Sundry Photography

SentinelOne (NYSE:S) is a leading cybersecurity company that secures some of the world’s biggest brands. Its customers include Samsung, EA, Aston Martin, Autodesk, Norwegian Airlines, and many more. SentinelOne has reported strong financial results for the third quarter of the fiscal year 2023. The company beat both revenue and earnings estimates, as it continues to execute on its strategy well. In this post, I’m going to break down the company’s business model, financials, and valuation. Let’s dive in.

Business Model Recap

In my previous post on SentinelOne, I covered its business model in massive detail. Here is a quick recap. SentinelOne is a Gartner Magic Quadrant leader in “endpoint” security. The term “endpoint” basically means the devices at the “edge” of an IT network such as your desktop PC, laptop, cell phone, tablet etc.

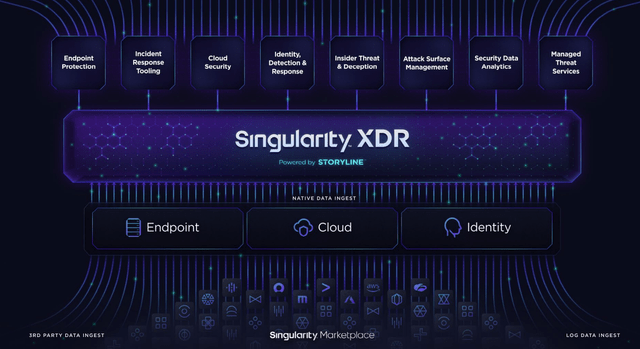

Its main platform is called the “Singularity XDR” which stands for Extended Threat Detection and Response. The platform gives cybersecurity teams a single viewpoint into the security of their IT network across endpoints, the Cloud, and identity security.

The Singularity platform uses advanced Artificial Intelligence to map the “security posture” of each endpoint device and then look for anomalies in this security posture. For example, if employee A normally accesses X application from Los Angeles, California but suddenly it shows access from Russia, then that could be a potential red flag.

Growing Financials

SentinelOne reported strong financial results for the third quarter of fiscal year 2023. Revenue was $115.32 million which increased by a blistering 106% year over year and beat analyst estimates by 3.89%. Annualized recurring revenue [ARR] also increased by 106% year over year to $487.4 million.

The top-line financial results were driven by strong customer growth which increased by 55% year over year to 9,250 customers. The company’s latest strategy has been to focus on winning the “whales” and moving “upmarket” to target larger accounts of Fortune 500 and Global 2000 enterprises. This strategy has been going well so far as customers with ARR over $100,000 increased by 100% year over year to 827. Customers with ARR over $1 million also increased by 100% year over year. Notable customer wins in the quarter included a large media brand that chose SentinelOne as the solution for endpoint, cloud, and data security. The cybersecurity industry was categorized for many years by a series of single-point solutions. However, the issue with this is it requires more management overhead to manage licenses, patching etc. Therefore. it was no surprise that in the third quarter a global consumer brand consolidated its security tech stack, which consisted of several legacy solutions with SentinelOne’s platform. The company has also continued to win three new federal agencies after a partnership with the Cybersecurity and Infrastructure Security Agency (CISA).

SentinelOne’s Cloud security solution was its fastest-growing solution. This was no surprise given some studies indicate that 82% of IT leaders are adopting a hybrid cloud solution.

SentinelOne has also executed its “land and expand” strategy well as the business has grown the contract value for existing customers. For instance, SentinelOne reported a net dollar retention rate of 134%, which means customers are staying with the platform and spending more.

These positive results were despite FX headwinds from its international markets, in addition to longer cycles which impacted the timing of some new deals. The business also “enables” Managed Security Service Partners [MSSP] which work with SMBs that are facing pressure on budgets due to macroeconomic issues.

Profitability and Expenses

SentinelOne reported a gross margin of 71.5% which increased by 5% year over year and nearly 20% since the beginning of 2021, which is outstanding.

The main growth in gross margin has been driven by the “land and expand” strategy, in addition to improved platform economics as the business has scaled.

The business also improved its operating margin by 26%, although it is still negative 43%. Earnings per share [EPS] on a GAAP basis were negative $0.16 which beat analyst expectations by a solid 27%, according to Google Finance data. Its EBIT margin also beat management guidance by 14%.

SentinelOne has a robust balance sheet with $1.2 billion in cash, cash equivalents, and short-term investments with virtually no debt. This means the company is in a strong position to weather any economic storm.

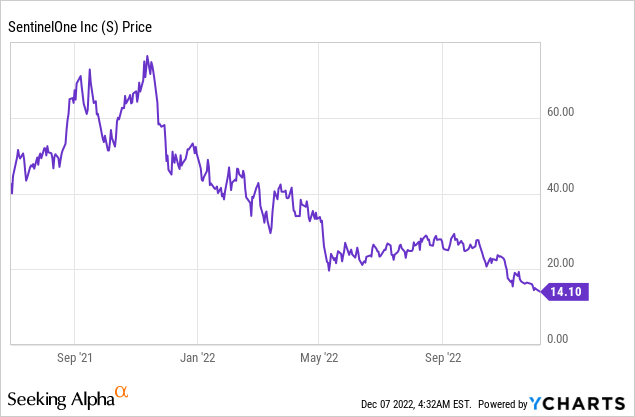

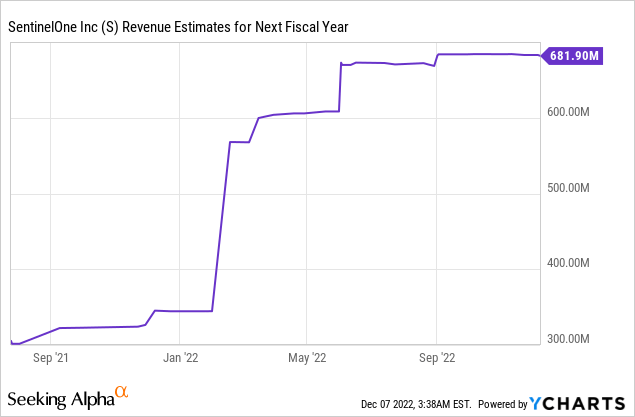

Moving forward, management has forecasted 90% year-over-year growth for Q4 FY22 to $125 million. However, for FY24, the company is expecting ARR of 50%, which is substantially slower than the 106% reported this year and mainly driven by macroeconomic factors.

Advanced Valuation

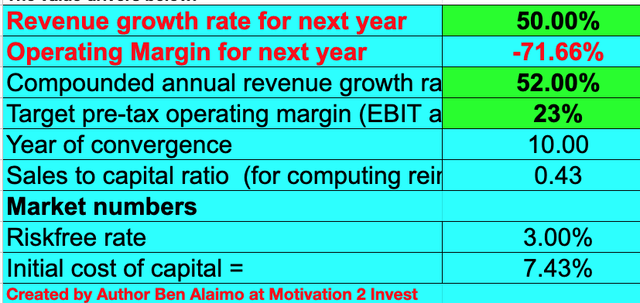

In order to value SentinelOne, I have plugged the latest financials into my discounted cash flow model. I have forecasted a conservative 50% revenue growth for next year and 52% revenue growth per year over the next 2 to 5 years. This is based upon management guidance, with slower growth forecasted next year due to the macroeconomic conditions. However, I have forecasted the growth rate to improve in years 2 to 5, as economic conditions are likely to improve.

SentinelOne stock valuation 1 (created by author Ben at Motivation 2 Invest)

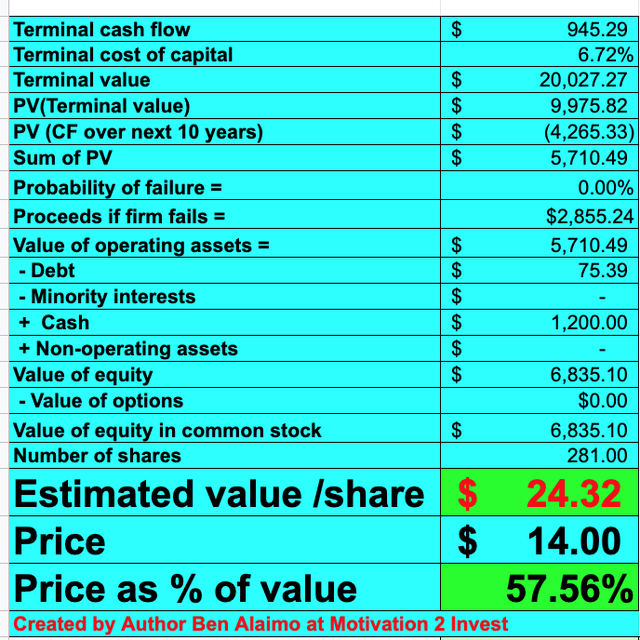

To improve the accuracy of the valuation, I have capitalized R&D expenses which has lifted net income. In addition, I have forecasted the operating margin to improve to 23% over the next 10 years. I forecast this to be driven by the continual scaling of the platform and improved operating leverage over time.

SentinelOne stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $24 per share. The stock is trading at $14 per share at the time of writing and is ~42% undervalued.

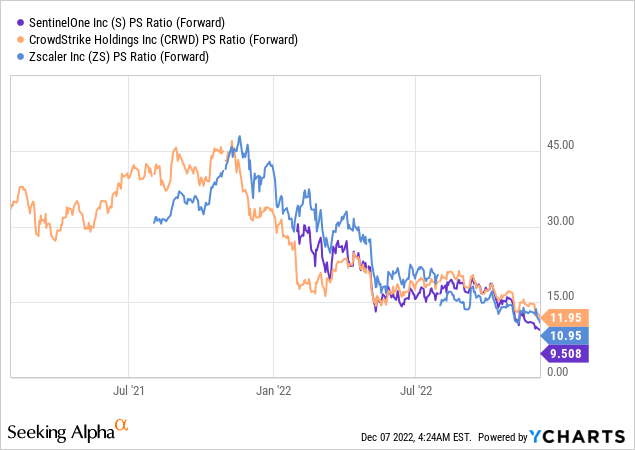

As an extra data point, SentinelOne trades at a Price to Sales ratio = 9.5. This is slightly cheaper than competitors CrowdStrike (CRWD), which trades at a P/S ratio = 11.95, and Zscaler (ZS) which trades at a P/S ratio = 10.95.

Risks

Longer Sales Cycles/Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Already management has seen “elongated” deal cycles and “budget adjustments” from its prospective customers. Therefore, this could impact growth in the short term.

Final Thoughts

SentinelOne is a tremendous company that is spearheading the cybersecurity industry with its single-platform solution. The company is executing its strategies well and continues to benefit from security tech stack consolidation and growth in the cloud. At the time of writing, the stock is undervalued assuming the business can grow its operating margin sufficiently over the next 10 years.

Be the first to comment