OlenaMykhaylova/iStock via Getty Images

Investment Thesis

The Seneca Foods Corporation (NASDAQ:SENEA) has been a top performer since my initial article on the company, outperforming the market by over 35 percentage points. You can read about the initial investment thesis here.

Since SENEA recently reported FY22 results, I believe it’s a good time to revisit the initial investment thesis. While the company continues to perform better than I have previously expected, some headwinds seem to emerge in the data. Firstly, as the cost of labor and commodities remains elevated, profitability is likely to become a bigger issue over the next months than it is today. Secondly, I believe the pace of share repurchases is going to decline over the next quarters as the company focuses on preserving liquidity. Both profitability and buybacks have been major contributors to the company’s excellent results over the last 24 months. In my opinion, a reversal in these factors would be detrimental at this point for the share price. As a result, I think that investors who bought SENEA back in January 2022 should consider selling in the $62-66 range.

Recent Developments

The firm published FY22 results on June 10th, 2022. Sales were $1,385 billion, a ~5.6% decline YoY. The drop in revenues was caused by (1) the sale of the prepared foods unit in FY21, and (2) declining sales volume of $93.0 million, which was slightly offset by higher selling prices of $82.6 million.

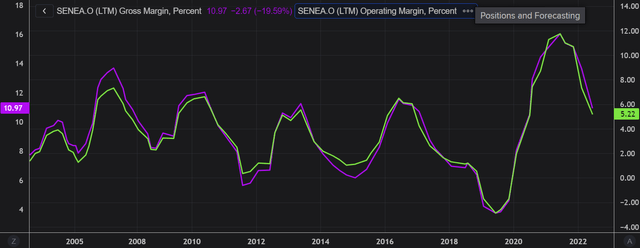

Over the last 12 months, SENEA generated $70.3 million in operating income, compared to $181.1 million in FY21. This is the direct result of a drop in operating margin from well above 10% to ~5% today. While many investors would see a 50% decline in profitability as alarming, it’s important to remember that SENEA is a cyclical business. It is typical to see profitability decrease by over 50% in the late stage of the cycle. Given the inflation dynamics and the geopolitical risks directly affecting food supplies, I believe we have seen peak margins in 2021, while subsequent periods will only show a deterioration in profitability. As a result, I wouldn’t be surprised to see SENEA reaching a 2% operating margin in the coming 18 months.

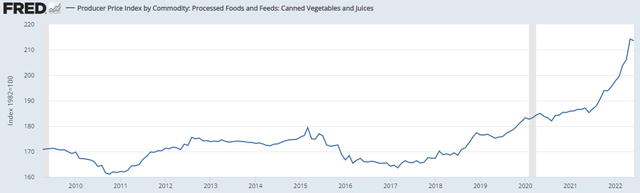

Talking about food inflation, the war between Russia and Ukraine is definitely not contributing to food price normalization. On the contrary, prices of agricultural commodities were rising at the fastest pace in over a decade until recently. Despite a decline in recent weeks, I believe it’s still hard to say if agricultural inflation has peaked. Inflation has proved to be a sticky issue and the unstable geopolitical situation in Eastern Europe could add further fuel to the fire.

While it seems that producer prices (“PPI”) in the sector are now catching a break, it remains unclear if the trend has reversed or not. In any case, I believe that Q1 FY23 profitability will remain impacted by higher PPI, while investors should expect to see an improvement from Q2 FY23 onwards only if food inflation remains under control.

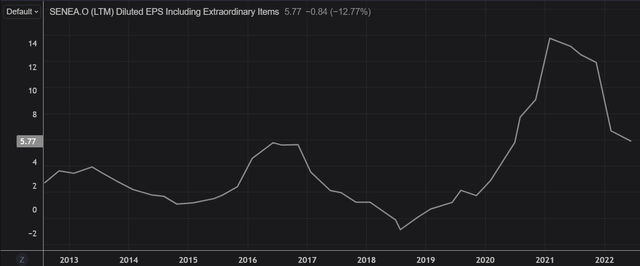

The last 24 months have been excellent for SENEA investors, with EPS reaching a decade high of ~$14 at some point. However, we are now seeing EPS normalization, where that figure is likely to revert to $3 to $4.5 per year.

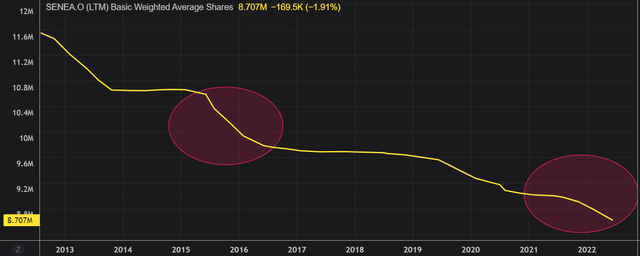

In the last months, buybacks have been a major tailwind for EPS growth. The company spent nearly $40 million in FY22 on share repurchases, representing ~10% of SENEA’s market capitalization. However, I don’t expect the recent pace of buybacks to continue. The company has a long history where management alternates periods of aggressive share repurchases with periods where there are no buybacks at all. Unfortunately, buybacks are price sensitive, and we can clearly see a preference to repurchase shares when EPS is at the high end of the historical range.

Company Valuation

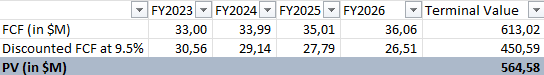

In my previous article, I concluded that SENEA was undervalued. Based on my previous DCF model, there was a ~18-20% upside to be unlocked for value investors. In any case, the stock did well since my first recommendation. SENEA is up ~18% since January 2022 vs a loss of ~15% for the S&P 500 index. In this part, I have updated my DCF model to reflect some of my latest assumptions:

- Estimated free cash flow for FY23 of $33 million – $3 million down to reflect a more conservative view of the business.

- 3% growth rate until FY25 – unchanged.

- A 2% terminal growth rate – unchanged.

- An 8% discount rate – unchanged.

Author’s DCF Model

Based on my updated model, the fair value of the stock is around $66 per share, which is in line with my previous estimate. However, the margin of safety is now lower since SENEA trades at $57 versus $54. I believe investors that initially bought the stock when I first published my article should look for an exit in the $62-66 range.

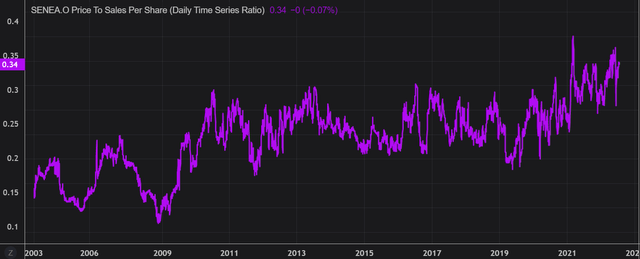

The price-sales ratio (“P/S”) is another helpful indicator for determining where we are in the cycle. SENEA trades at 0.34x sales, which is above the historical average of the last decade of 0.25x sales. As a result, I believe that it’s an interesting time to consider selling.

Key Takeaways

While the firm continues to outperform my expectations, several headwinds appear to be emerging in the data. To begin with, if the cost of labor and commodities continues to rise, profitability is likely to become a greater problem in the coming months than it is now. Second, as the firm concentrates on maintaining cash in the event of an economic downturn, I expect the pace of share repurchases to slow down in the coming quarters. Profitability and share buybacks have both contributed significantly to the company’s returns over the previous 24 months. A reversal in these variables could translate into disappointing returns in the share price. As a result, I believe investors who purchased SENEA in January 2022 should consider selling around the $62-66 level.

Be the first to comment