teppakorn tongboonto/iStock via Getty Images

I’m a bit of a coward. I also don’t like losing. In fact, I feel many times worse about a loss of “X” than I feel good about a gain of the same amount. Given all of this, I want to write about Union Pacific Corporation (NYSE:UNP) this morning. I’ve demonstrated that I don’t think the Class 1 railroads are worth an infinite amount in spite of their unassailable moats. I was cautious about the stock in March, and the shares are down about 10.5% since then. I finally turned bullish in the middle of June, and the shares are up about 16% since, against a gain of about 14.7% for the S&P 500. Given that this can be a “good” or “bad” investment depending on the price paid, it’s time to review this position. Additionally, some of my short puts are going to expire today, and so I need to work out whether or not it makes sense to enter a new options trade here. I’ll decide whether to buy more, hold, or sell by reviewing the current valuation and comparing that to what’s going on with traffic at the company.

Each of my articles comes with a (hopefully) pithy summary of my arguments in a single, easily digestible paragraph. I write this paragraph for a few different audiences. One audience consists of those people who want more than the title and bullet points, but less than the entire article. Another audience is that group of people who ignore the title and bullet points and who start reading the article at the 201st word for some reason. The largest group of people who favor these “thesis statement” paragraphs is that group that wants my investment ideas but can do without the bad jokes, bragging, and self-aggrandizement. So, to all of you who want to limit your exposure to the “Doyle mojo”, I present to you the thesis. Traffic in 2022 is only barely greater than it was in 2021 and is down materially from the pre-pandemic period. In spite of this, the shares are priced much more richly now than they were in 2018, for example. The shares may continue to rise in price from here, but I am of the view that they’re running on fumes at the moment. Given that losses are more painful than gains are pleasurable, I think the prudent course is to take chips off the table. Finally, I’ve done well on both the puts that are about to expire and those that expire in January 2023. This result highlights the risk-reducing, yield-enhancing potential of these instruments. Although I don’t recommend selling puts at the moment, I do recommend learning about these if you’re not yet familiar with them.

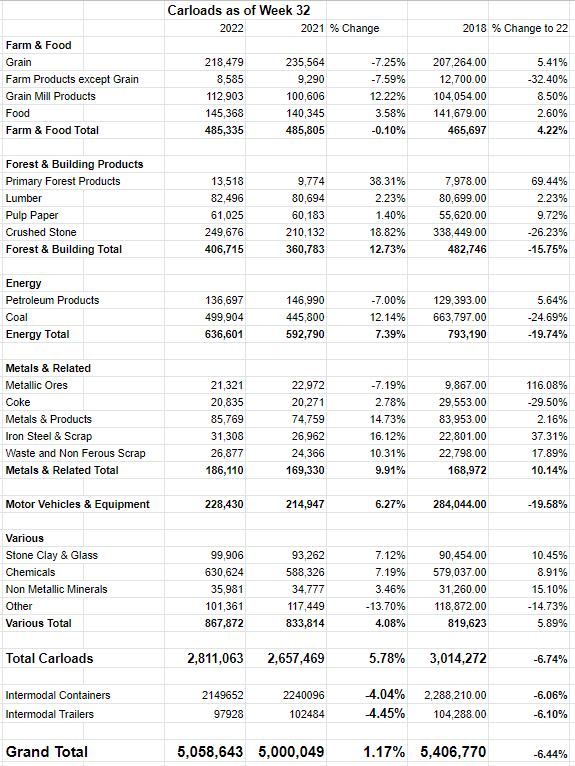

Rail Traffic for Week 32

The following table presents the traffic volume for various commodities for the first 32 weeks of the year. A quick review of this table suggests that traffic for the first 32 weeks of this year is about 1.17% greater than it was in 2021. Although there’s relative softness in the intermodal business (down by about 4%), overall traffic improved slightly relative to 2021, with primary forest products, crushed stone, and iron steel and scrap showing the strongest improvements relative to the same period in 2021. So far, so good.

There’s a problem with making comparisons of this sort, though. It may be the case that either last year or this year are outliers. Maybe economic growth was particularly robust last year, which would make comparisons to that period “unfair.” Or, it might be the case that the world was troubled in 2021, so we might have the opposite problem. It may be the case that traffic in 2021 was well below trend, and so any comparison to that year looks artificially rosy. It turns out that’s the case here. You may recall that the global economy was impacted by this pandemic, and that had a nasty impact on demand. A way to overcome this bias is to review the current year and compare it to other, pre-pandemic years. I assumed you’d be interested in that analysis, so that’s the analysis I performed. I did this because I’m absolutely obsessed with making your reading experiences as pleasurable as possible.

When we compare the most recent period to the same period in 2018, the current traffic figure looks quite soft, actually. Specifically, traffic for the first 32 weeks of 2022 is about 6.4% lower than it was in 2018. “Farm Products except grain” is a standout here, down over 32% in 2022 relative to 2018. “Crushed stone”, “Coal”, “Coke” and “Motor Vehicles & Equipment” are also down significantly, off by 26.25%, 24.7%, 29.5%, and 19.5% respectively.

When compared to 2019, the results aren’t as stark but are similar. So far in 2022, traffic is down just over 3% compared to 2019.

Thus, I conclude that traffic in 2022 is barely better than it was during the tail end of the pandemic, and it’s much worse than it was in the pre-pandemic era. Given that this is a company that earns revenue by hauling stuff, the fact that they haven’t returned to pre-pandemic traffic levels is troubling in my estimation. I’d like to see the fact that we’re still below normal reflected in the stock price.

Traffic Data By Year 2018, 2021, 2022 (Union Pacific investor relations, AAR carload reports)

The Stock

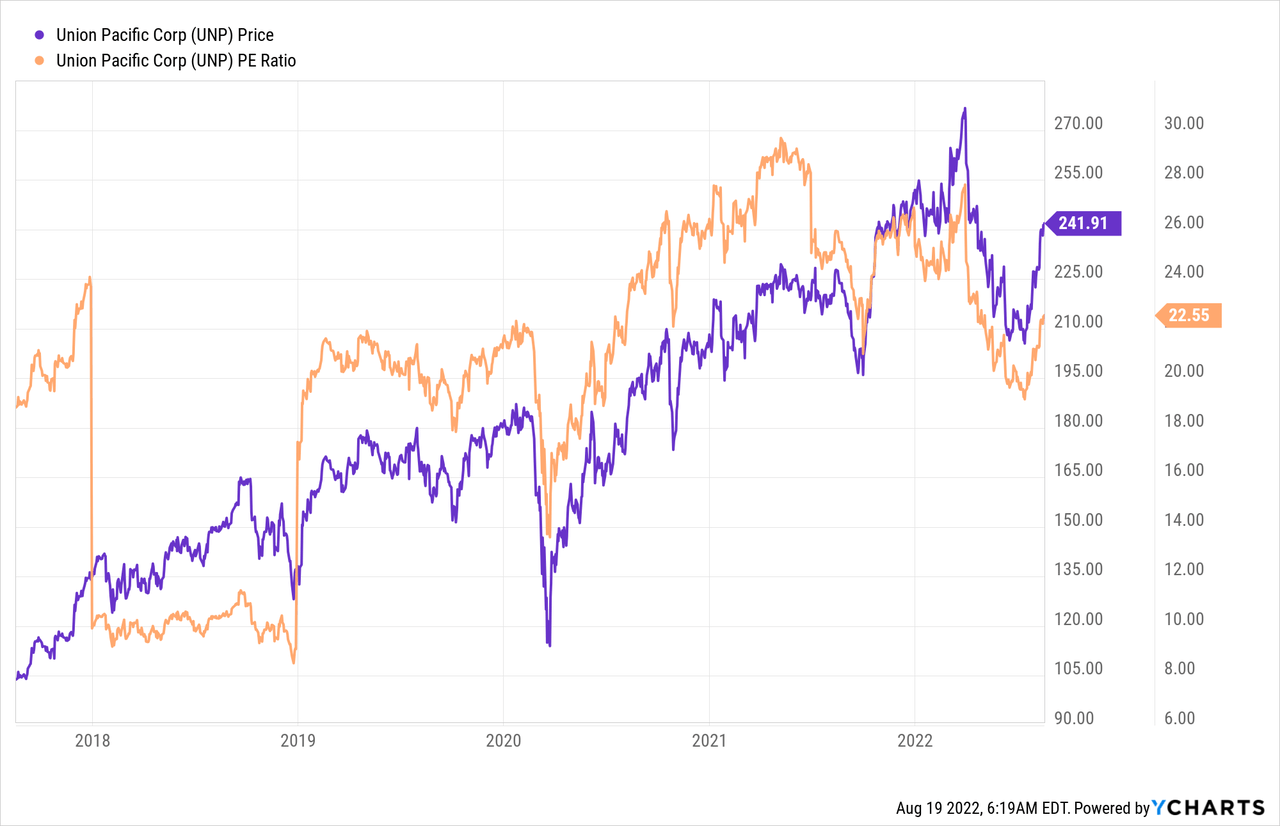

Given the above, I’d want to see the stock trading at a relative discount to the pre-pandemic period, when traffic was much more robust. When I look at valuations, though, I’m reminded of a cruel fact: you can’t want things ’til you’re blue in the face, but that means nothing.

In spite of a fairly sizable drop-off in traffic, the shares are trading higher on a P/E basis than they were for most of 2019, and are significantly more pricey than they were throughout 2018.

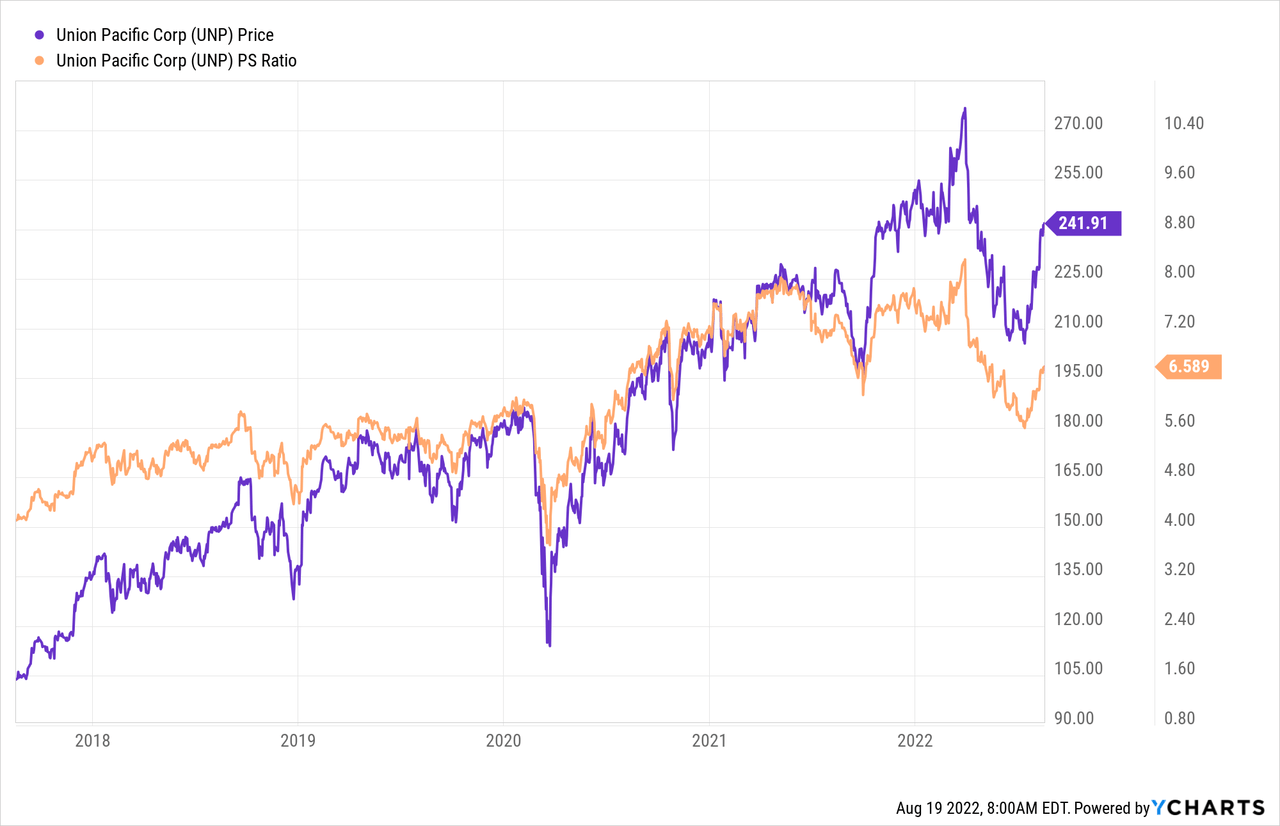

Additionally, in spite of the slowdown in traffic, investors are paying about 40% more for $1 of sales than they did back in 2018-2019.

I know I’m a coward, and I’m probably anchoring too heavily on the pre-pandemic era, but I’m not comfortable with this combination of richer valuations on top of a slowdown in the business. I’m selling my shares today.

Options Update

January 2023 puts with a strike of $175 are currently priced at $1.55-$1.70, which is fairly good as I sold them for $5.85 each. I don’t plan to do anything with these, as I’d be comfortable with either potential outcome. If the shares fall below $175, I’ll be comfortable buying at an adjusted $169.15. If the shares remain above $175, I’d be comfortable simply pocketing the premium. Additionally, the August puts with the same strike price that I sold for $.87 back in March are about to expire unless the shares fall about 28% today. Once again, this trade highlights the power of short put options. If you sell deep out of the money puts on companies that you’d be comfortable to own, you enter a “win-win” trade. Either the puts expire worthless, which is great because you collect the premium, or you’re obliged to buy a company you like at a price you really like.

While I like to repeat success when I can, I can’t recommend selling puts at this point. The premia on offer for reasonable strike prices isn’t sufficiently high in my estimation. For that reason, I’ve got to simply hang back and wait for what I consider to be an inevitable correction at this point. If the shares fall in price, I’m certainly going to re-enter this trade, but for now, I see a need to preserve capital. For that reason, I’m taking my gains here and running like the coward that I am.

Be the first to comment