Investment Thesis: The SEK/EUR will see further downside due to a combination of fears regarding COVID-19 and the possibility that the Riksbank may have to go back on their prior stance of raising rates due to weak domestic growth.

At the end of last month, I made the argument that the run-up we had been seeing in SEK/EUR had come to a standstill for now.

Initially, the Swedish krona had been rising due to the fact that the Riksbank (Sweden’s central bank) had indicated that interest rates would be rising – which was a contrary policy to make other central banks across the developed world. Indeed, the central bank did raise rates out of negative territory to 0.00% in December.

While this had initially pushed up the SEK/EUR, the currency had retreated due to the fact that the COVID-19 crisis had caused a flight to safety on the part of investors, and high beta currencies including the Swedish krona were no longer in vogue.

With this being said, we also observe that while the SEK/EUR took a hit at the end of the month, the currency pair has started to see an uptrend once again:

Source: investing.com

At the beginning of February, the Riksbank decided to keep rates at zero and indicated that there was no particular urgency to raise rates in the near future. Should inflation overshoot the bank’s target, then the central bank would tolerate this to a certain degree.

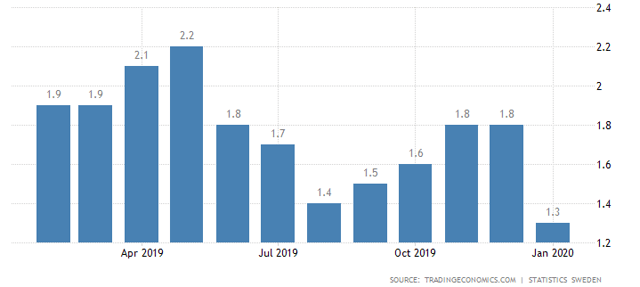

Interestingly, the inflation rate in Sweden has been dipping significantly, down to 1.3% in the last quarter:

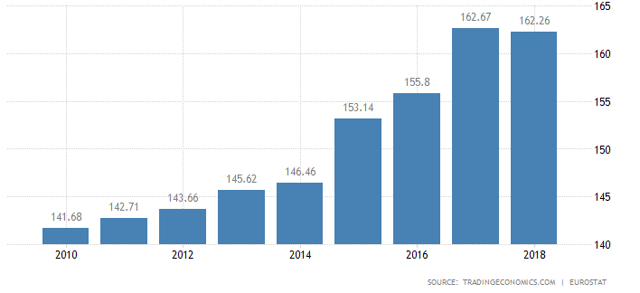

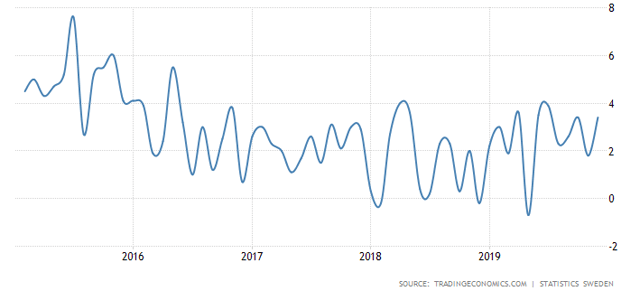

Sweden’s household debt to income is one of the highest in the world at 162.26 as of December 2018. Moreover, retail sales in Sweden have dipped significantly since 2016 and have remained on more or less a stationary path since then.

Household Debt to Income

Retail Sales YoY

Taking into account the above data, the Riksbank would understandably be reluctant to raise rates if doing so will not be accommodative to growth.

However, the Riksbank now faces somewhat of a credibility test, in that should Swedish growth continue to lag, then the Riksbank might be forced to cut rates into negative territory once again to stimulate the economy.

Under this scenario, the central bank would likely lose significant credibility for performing an “about-face” on its previous policy statements, and the Swedish krona would likely drop significantly against other currencies as a result.

Looking forward, there is a possibility of this happening if Swedish growth remains flat. According to the February 2020 Monetary Policy Report from the Riksbank, inflation has gone lower as a result of lower energy prices. However, from the end of 2020 the central bank expects inflation to rebound to the 2 percent target. Moreover, while the central bank is also forecasting growth in domestic demand from the end of 2020, they also allude to the fact that the potential for falling house prices would see domestic demand fall instead.

At the present time, I fail to see upside for the SEK/EUR due to a combination of fears over COVID-19 and concerns regarding the Swedish economy itself. Should we see an improvement in retail sales and general growth in Sweden, then the Riksbank may choose to continue with rate increases. I take the view that the SEK/EUR would appreciate significantly under such a scenario, but this is likely to be a longer-term possibility rather than an immediate one.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment