andreswd

SEI Investments Company (NASDAQ:SEIC) is struggling to sustain growth due to inflation. But it continues to hedge the impact while bracing itself for recessionary headwinds. Although near-term growth is out of the question, its viability makes it a durable company. It has solid and intact financial positioning, allowing it to sustain its operations. With that, it can adapt to changes and bounce back once market volatility cools down. Indeed, it is a secure and valuable stock despite the relatively lower dividend yields. These attributes will justify the impressive rebound of the stock price.

Company Performance

In the face of economic disruptions, SEI Investments Company faces various challenges in its operations. Growth has been hammered after years of impeccable growth. Overall, revenues are down as the capital market weakens. Investor pessimism and downturns across industries are leading to a bearish performance. And SEI is not spared from the unfavorable impact. Nevertheless, long-term growth prospects remain enticing. The acceleration of digital transformation is one of its core drivers.

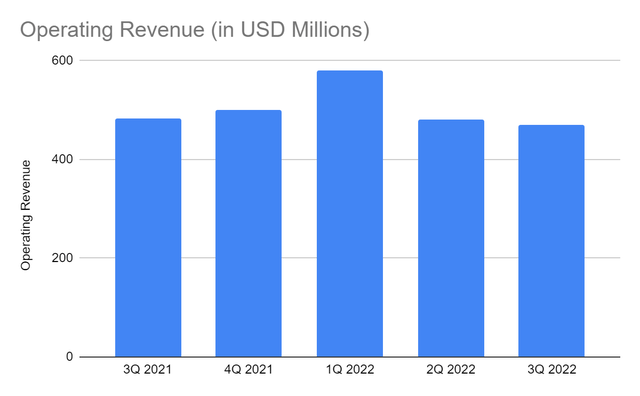

Its recent operating revenue amounted to $470 million. It has mixed results from its components, but the YoY decrease is more prominent at 3%. Despite this, its recent performance reflected some advantages of its investment solutions and acquisitions. Its capitalization on information processing and software servicing raised new client conversions. Its SEI Novus acquisition also contributed to it. These can be seen in its investment managers and new business investment segments. Even more, increased market adoption led to some improvements that partially offset the downtrend. Given this, SEI exceeded analyst estimates by 2.5%, proving it could withstand external pressures. If we check the overall trend from 3Q 2021, revenues still appear stable. So while all its business segments face massive changes, its engagement in the market remains high. Thanks to its continued innovation, investment in new assets, and prudent portfolio diversification. Indeed, there are opportunities for a rebound. It is logical since its fusion of wealth management and technology makes it a staple in the capital market. It may take more time, but it has a high probability of 2020-2021 levels.

Operating Revenue (MarketWatch)

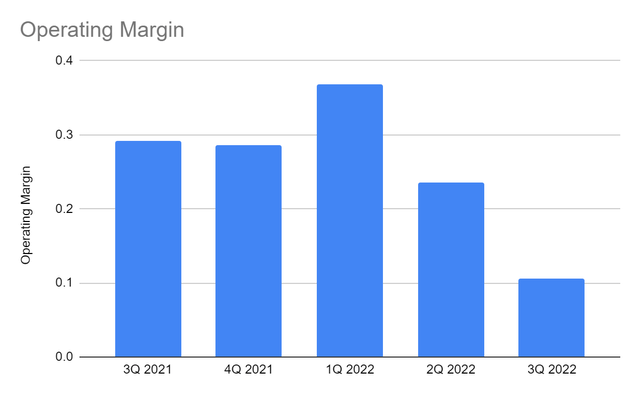

On the other hand, operating expenses had a substantial uptrend during 3Q 2022. It was primarily driven by the 51% increase in labor-related expenses. Inflation continues to put upward pressure on labor as the Great Resignation persists. We can also observe that business growth from recent acquisitions is another primary driver. In other words, higher personnel costs were driven by rising prices and business expansion. While it appears overwhelming, it is a testament to its dedication to human capital. Also, it remains viable with an operating margin of 11% despite the substantial year-over-year decrease. It shows that it can sustain its larger operating capacity amidst recessionary headwinds. Although growth may be flat in the short run, it may still be stable. It may bounce back by 2024 once the economy becomes more manageable.

Operating Margin (MarketWatch)

How It May Weather Market Risks And Bounce Back

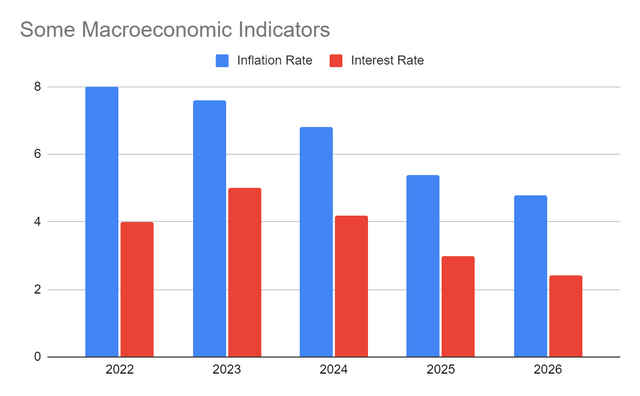

Inflation is one of the biggest hurdles on SEI’s path to sustainable growth and expansion. Although it has been in a lull recently, its current rate of 7.7% remains elevated. Fortunately, it does not seem to fire up again as sales across many companies cool down. I expect its maximum at 8-8.4%, which is reasonable, given the current market performance and monetary policies. In the next few years, it may decline further to 5%. In response, interest rates are skyrocketing and may go as high as 4.5-5%. But I expect its increment to slow down in the second half of next year due to more stable inflation. In 2024-2026, it may recede to 3% or lower. The capital market quickly responds, as shown by its bearish performance.

Inflation Rate And Interest Rate (Author Estimation)

The impact extends to financial service and technology providers, such as SEI Investments Company. We already saw how its expenses rose in 3Q, affecting its viability. Even so, the stable revenues show it can weather market disruptions. In addition, market opportunities are evident, allowing it to stay afloat. One example is the preference for cashless transactions, making fintech an industry staple. In the US, cash transactions dropped to 22%. As digital transformation peaks, productivity increases, which may pay off in the long run. Thankfully, its continued investment in data and technology is in line with these market changes. SEI can adapt to the trend and become more durable.

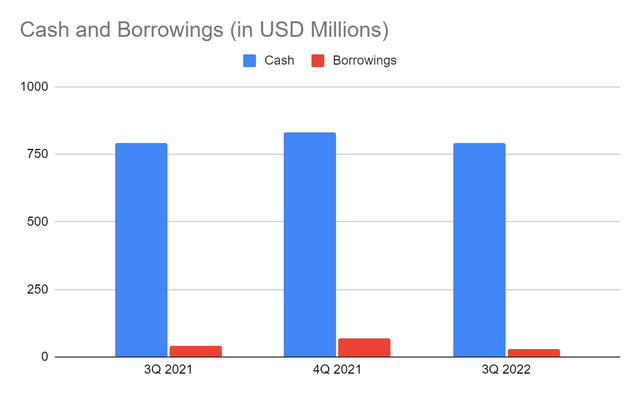

What makes it a sustainable company is its stellar Balance Sheet. Its excellent liquidity position is one of its cornerstones. Cash levels are stable, while borrowings are less than half their value in 2021. It is nice to see it repay borrowings that will help cushion the impact of interest rate hikes. Also, even if it continues to invest in newer technologies, its adequate cash levels can cover it. Cash alone can cover all of its borrowings, even the whole liabilities. At $790 million, it comprises 35% of the total assets, making it a liquid company. So it can use its cash to sustain its operations if its performance slows down. It will not have to dispose of non-cash assets or increase its financial leverage. It has adequate reserves to withstand recessionary headwinds while preparing for a rebound.

Cash And Cash Equivalents And Borrowings (MarketWatch)

Moreover, it can be considered debt-free since borrowings are so low, leading to only a 19% Debt/Equity Ratio. As a company in the financial services sector, it is relatively lower, making a safe investment. It also generates an ideal ROIC of 7%, making it a viable investment.

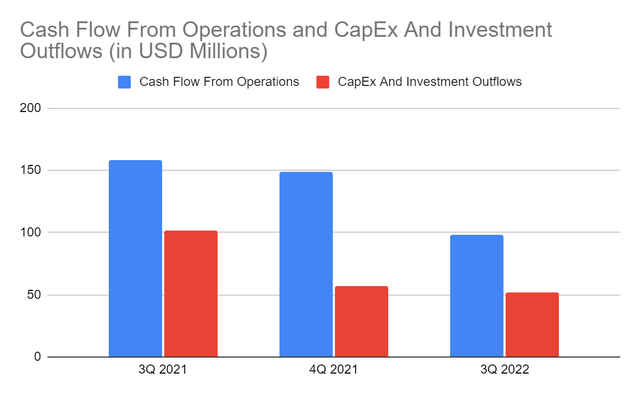

Its stable cash inflows can prove it. Although the value is way lower than in 2021, inflows can cover CapEx and investment purchases. SEI can continue investing in new and more performing assets and replenish PPEs. It has an FCF of $80 million, which is more than enough to cover all borrowings and dividends in a single payment. Indeed, it has a sustainable business with solid and intact fundamentals in a stormy market landscape. Its FCF/Sales Ratio of 17% shows a reasonable capacity to turn its operating revenue into cash. It maintains its impeccable positioning by spending on what matters to the business.

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price Assessment

After the continued plunge, the stock price of SEI Investments Company had a sharp uptrend in the last two months. It is regardless of the fact that earnings missed estimates by 36%. At $63.16, it has already exceeded the starting price by 4%. Yet, it appears reasonable as it trades at a price-earnings multiple of 17x. It is way better than its five-year average of 18x and the market average of 24x. Its Price/Cash Flow multiple of 14x is also ideal. Meanwhile, it appears to be less enticing when we check its PB Ratio of 4x. But it is way better than the five-year average of 5.2x, making it more reasonable.

With regards to dividends, payouts have been consistent since their continuation in 2013. Its dividend yield of 1.27% is also better than the NASDAQ and S&P 400 components, with 1.16% and 1.24%. But substantial insider selling in recent months must be considered since they can affect the actual value. Also, there are better alternatives when discussing dividend yields. To assess the stock price better, we can use the DCF Model.

FCFF $445,000,000

Cash $790,000,000

Borrowings $30,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 134,816,000

Stock Price $63.16

Derived Value $70.36

The derived value adheres to our supposition of its affordability. Despite the pessimistic estimation of EPS, its intrinsic value is still enticing. There may be a 12% upside in the next 18 months, which I believe is consistent with its potential rebound.

Bottom line

SEI Investments Company faces challenges that may hamper its growth. But it can navigate the market landscape with its solid and intact fundamentals. Stable cash levels allow it to cover its borrowings and investments. Its stock price appears affordable, with potential gains and consistent dividends, but yields are low. As we weigh its potential risks and returns, the recommendation is that SEI Investments Company is a buy.

Be the first to comment