bunhill

My last article about Sea Limited (NYSE:SE) was published in February 2022 when the stock was trading around $140, and I rated the stock as a hold. Since then, the stock declined more than 35% (and was trading even lower in the meantime) and as Sea Limited was already declining before my last article it is now trading about 75% below its all-time high the stock reached in the fall of 2021.

The quarterly earnings results are a good opportunity to take a closer look at Sea Limited again and ask the question if the stock is now cheap enough and a good investment. We start by looking at the quarterly results.

Quarterly Results

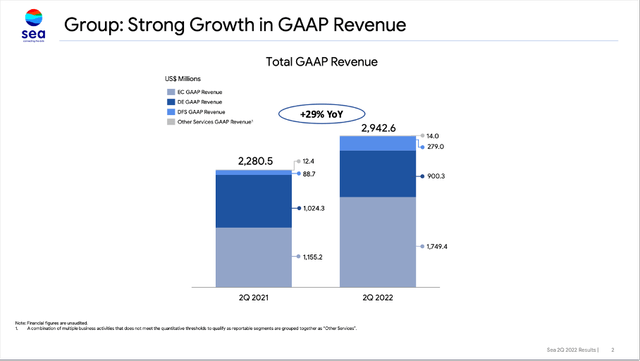

On Tuesday, Sea Limited reported second quarter results for fiscal 2022. And while the company could slightly beat earnings per share estimates, it slightly missed revenue expectations. When turning away from analysts’ estimates and look at the hard numbers we can see sales increasing 29.0% year-over-year from $2,281 million in the same quarter last year to $2,943 million this quarter. The rather negative point of view might be growth slowing down over the last few quarters as revenue growth was 64% one quarter ago and 106% two quarters earlier. However, we must keep the macro-economic environment in mind and several other technology companies have troubles growing at all these days.

Sea Limited Q2/22 Presentation

When looking at the three different segments we see extremely mixed results. Revenue for “Digital Entertainment” declined from $1,024 million in the same quarter last year to $900 million this quarter – resulting in 12.1% year-over-year decline. And “sales of goods” could increase revenue from $257 million in Q2/21 to $287 million in Q2/22 – resulting in 11.7% YoY growth. The biggest part of growth (in absolute and relative numbers) stemmed from “E-commerce and other services” which could grow 75.6% year-over-year from $1,000 million in Q2/21 to $1,756 million in Q2/22.

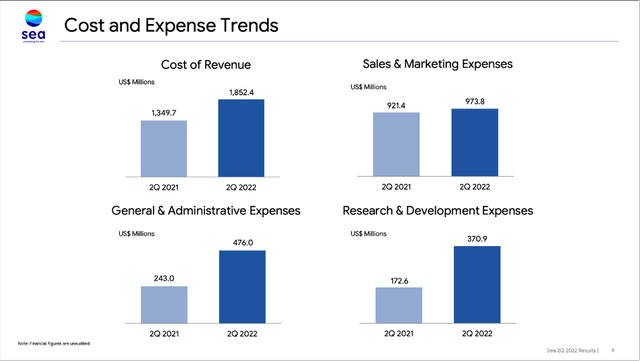

Sea Limited Q2/22 Presentation

While Sea Limited is still able to grow its top line with a solid pace, the increasing costs have a huge negative impact on the operating income (or rather: operating loss) as well as the bottom line. Expenses for sales and marketing were more or less the same (compared to the same quarter last year) but costs of revenue increased with a higher pace than revenue. And especially general & administrative expenses (+96% YoY) as well as research and development expenses (+115% YoY) increased quite a lot.

As a result, operating loss increased from a loss of $334 million in the same quarter last year to $837 million this quarter and net losses per share increased from $0.61 in Q2/21 to $1.03 in Q2/22.

And finally, Sea Limited also suspended its e-commerce guidance and although there seems to be a logical explanation, I would see this move as a rather bad sign. In its earnings release, the company is stating:

In our efforts to adapt to increasing macro uncertainties, we are proactively shifting our strategies to further focus on efficiency and optimization for the long-term strength and profitability of the e-commerce business. Given this strategic shift, we will be suspending e-commerce GAAP revenue guidance for the full year 2022.

Light and Shadow

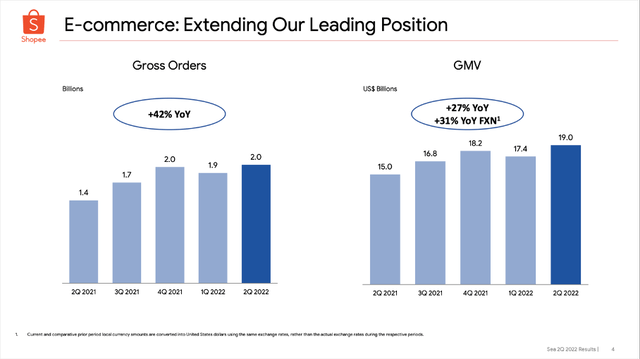

When looking at the e-commerce segment we see solid growth rates for Sea Limited. Year-over-year the number of gross orders increased 42% to 2.0 billion and gross merchandise volume also increased in the same timeframe, but only 27%.

Sea Limited Q2/22 Presentation

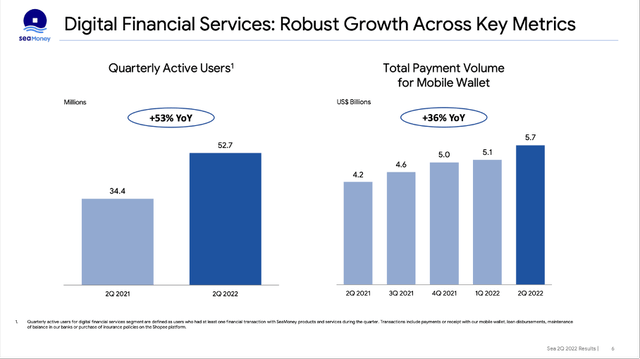

Aside from e-commerce, digital financial services are also growing. Quarterly active users are growing 53% year-over-year to 52.7 million and the total payment volume for mobile wallet was increasing 36% year-over-year to $5.7 billion.

Sea Limited Q2/22 Presentation

In both cases we are seeing solid growth rates, but the number of orders and quarterly active users is growing with a higher pace than gross merchandise/payment volume and this could be interpreted as small warning sign. Active customers are obviously spending less money. This could have several different reasons but could be a first hint for the economy slowing down.

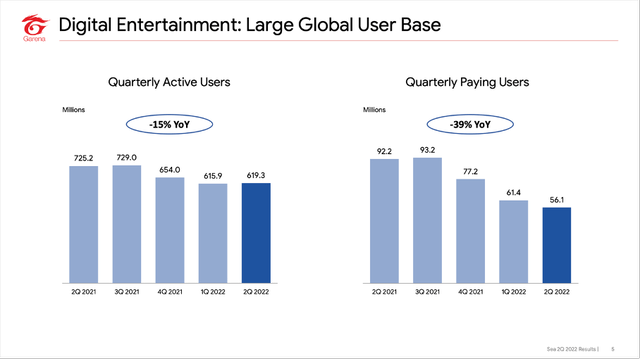

And when looking at digital entertainment, the picture is becoming murkier. While digital entertainment certainly has a large global user base, we cannot ignore the negative trends over the last few quarters. Not only are quarterly active users declining from 725.2 million one year ago to 619.3 million right now (15% YoY decline), but quarterly paying users declined even 39% YoY from 92.2 million in Q2/21 to 56.1 million in Q2/22.

Sea Limited Q2/22 Presentation

Sea Limited is explaining the decrease in revenue due to the softening of bookings post-COVID. However, the increase of quarterly paying users between Q2/20 and Q2/21 was almost completely erased. Quarterly paying users increased only with a CAGR of 6% in the last two years – from 49.9 million in Q2/20 to 56.1 million in Q2/22. And so far, digital entertainment is the only segment for Sea Limited which is profitable and with sales and operating income declining this is especially problematic as Sea Limited is using the cash to fund its other business segments.

Recession as Headwind

The looming recession was mentioned countless times in the last few months (by many analysts and contributors including myself). We are seeing growth rates slowing down for many businesses – recently I wrote about Meta Platforms (META) which had to report declining revenue for the first time ever – and Sea Limited is no exception (as we already saw above). And if the recession will hit the world, growth rates might slow down even more. Sea Limited is depending on entertainment, games as well as retail/e-commerce. And these are all segments that are usually affected by a recession. People usually purchase less goods in case of a recession as the disposable income will decline. Rising interest rates will also force people to choose more wisely where to spend money. And spendings for games as well as entertainment are probably not considered essential by most people and might be among the first victims when expenses must be cut.

Of course, Sea Limited is very active in the Southeast Asia region and while I am pretty sure the United States and many European countries will be in a recession in 2023, I don’t know enough about that region to make reasonable predictions. I am just assuming the next recession being a global and brutal one and therefore affecting most countries and companies around the world.

Problems: Lacking Profitability and Dilution

One problem I see with investing in Sea Limited right now is the lacking profitability of the business. I know Sea Limited is still a rather young company (founded 13 years ago) and it is not untypical for young companies to be not profitable yet – especially if management is still focused on growing with a high pace and sacrificing profitability for high revenue growth. And it seems to be working as Sea Limited is still growing with an extremely high pace compared to other competitors. And the balance sheet (we will get to this) is allowing Sea Limited to be not profitable yet and focus on growth while still burning cash for a few more years.

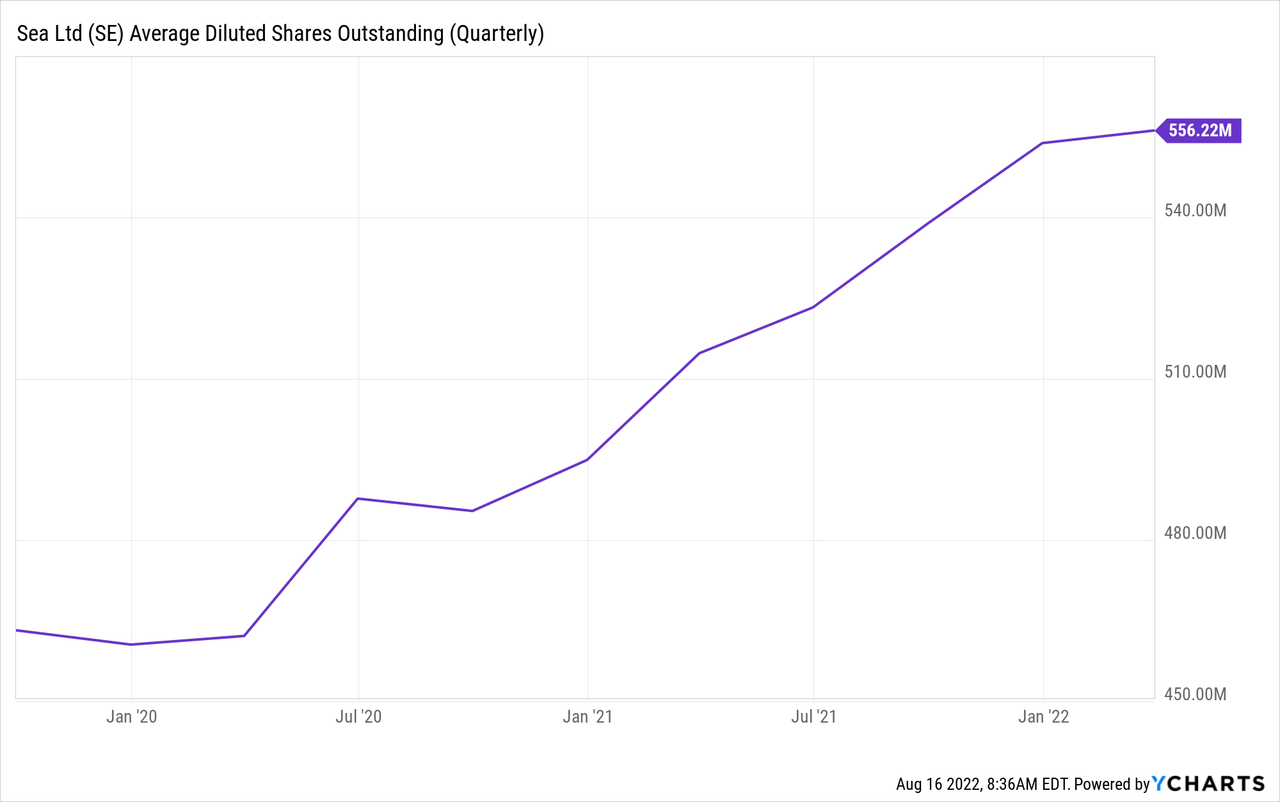

Sea Limited is also increasing the number of outstanding shares constantly – another aspect I don’t like to see as potential investors. I don’t want to see my stake in the company diluted over time. Nevertheless, Sea Limited is increasing the number of outstanding shares with a high pace in the last few quarters, and we must assume the business will continue to do so in the quarters to come.

Balance Sheet

Sea Limited is continuing to dilute is shares, which is not a good sign for investors as it is lowering the profit for each investor when the number of outstanding shares is continuously increasing. However, it is good to know that Sea Limited doesn’t have to issue additional shares to raise capital as the balance sheet is solid (when management is continuing to dilute it is happening for different reasons).

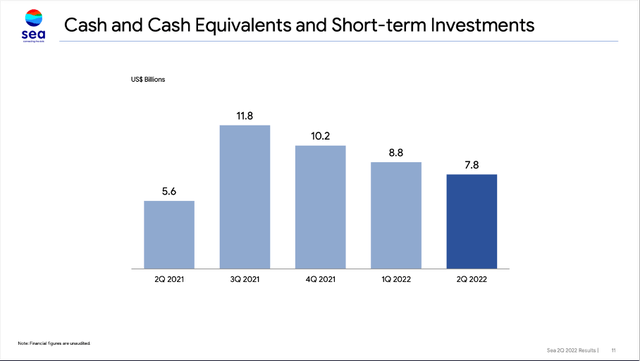

Sea Limited Q2/22 Presentation

In the last few quarters, cash and cash equivalents as well as short-term investments declined from $11.8 billion in the third quarter of fiscal 2021 to about $7.8 billion in the second quarter of fiscal 2022. Nevertheless, on June 30, 2022, the company still had $6,493 million in cash and cash equivalents and $1,288 million in short-term investments on its balance sheet and no short- or long-term debt. And as Sea Limited will probably not be profitable in the next few quarters (and most likely not generate free cash flow) it is good to know that the business won’t have to rely on additional cash.

Intrinsic Value Calculation

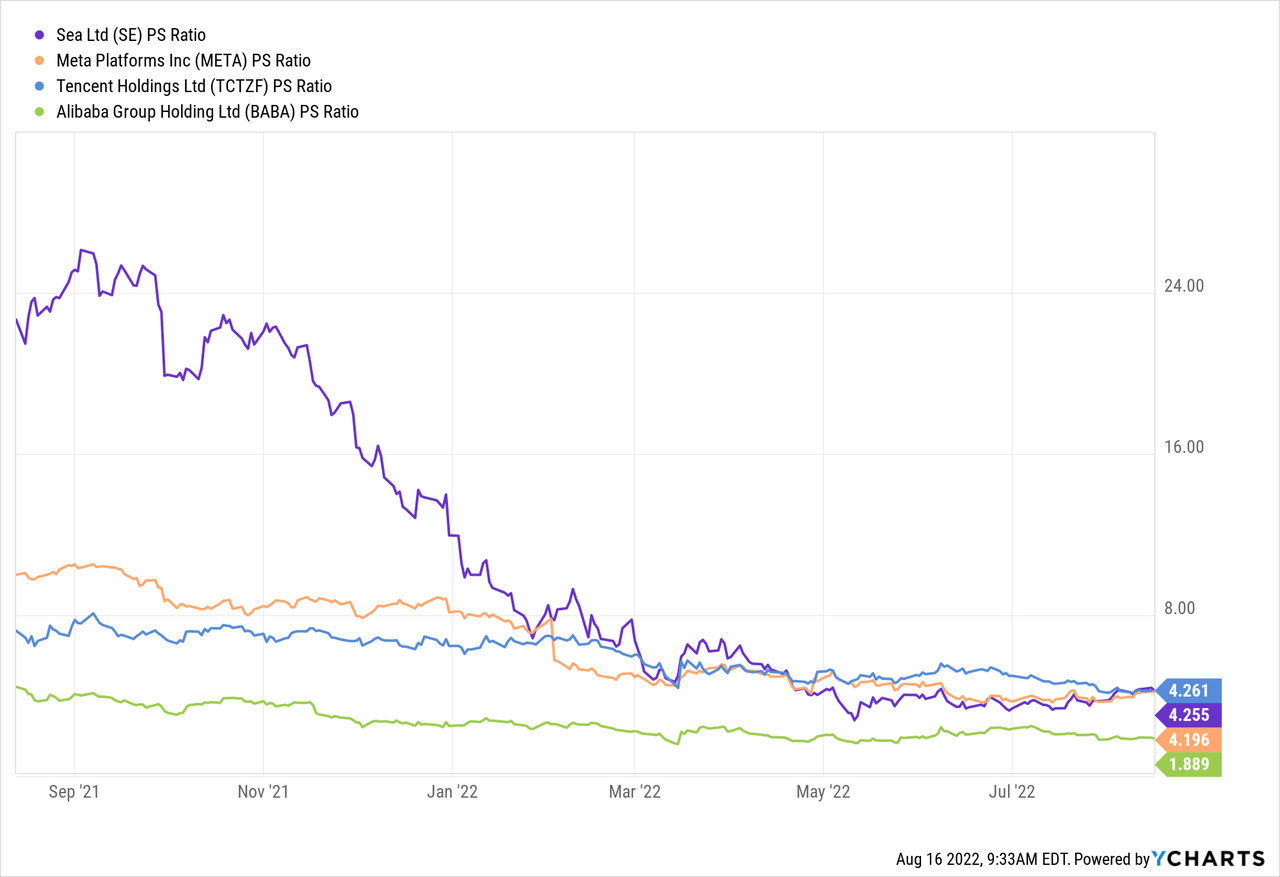

Sea Limited is still not profitable, which is making it rather difficult to look at simple valuation metrics – with free cash flow as well as earnings per share being negative in the last four quarters, we can’t neither calculate a P/FCF ratio nor a P/E ratio. Instead, we can look at the price-sales ratio and since my last article in February 2022, the price-sales ratio continued to decline further. Right now, Sea Limited is trading for 4.4 times sales.

And it might be helpful to offer some perspective to interpret that price-sales ratio. Of the four companies presented above, Sea Limited has the highest price-sales ratio, but aside from Alibaba (BABA), which is trading for only 1.9 times sales, the other three companies have almost similar P/S ratios. Tencent (OTCPK:TCEHY) is trading for 4.3 times sales and Meta Platforms is trading for 4.2 times sales.

And these three companies – Alibaba, Tencent and Meta Platforms – are all stocks I consider undervalued right now. The fact, that two of them are trading for a similar P/S ratio as Sea Limited although Sea Limited can grow at a much higher pace might imply that Sea Limited is rather cheap right now.

Of course, Sea Limited must become profitable in a similar way as these businesses to make P/S ratios comparable. And so far, Sea Limited is struggling to be profitable, but as we are talking about similar business models, I think Sea Limited can become profitable in a similar way. The company is trying to grow with a high pace and take market shares – like most of these technology companies did in the early days.

Conclusion

Following earnings, Sea Limited seems to be taking a big hit and as I am writing these lines in the early U.S. trading hours, the stock declined almost 15% as investors are obviously not satisfied with the news. And at $75 the stock might be worth a shot, and I would describe myself as slightly bullish. Ray Dalio and his hedge fund Bridgewater also invested recently in Sea Limited (and sold the stakes in the Chinese companies Alibaba and JD.com (JD)).

Although Sea Limited might be undervalued at this point, we should not ignore that a bear market and recession is most likely still upon us. I expect the next few years to be rather challenging for stocks and when the recession will hit the economy earnings per share will decline and many stocks will go much lower. Despite an already 75% decline for Sea Limited, the stock could go lower. When remembering the Dotcom bubble and stocks declining 90% or 95%, we get a feeling how low technology stocks could go.

Be the first to comment