Dilok Klaisataporn

High dividend and dividend growth stocks are outperforming in the current environment of higher inflation. Inflation is here to stay. It will probably cool, but we believe it will remain the coming years at a level above the 2% FED-target. De-globalization, de-carbonisation and demographics are pushing inflation figures higher than we were used to in the past decade.

This backdrop favours dividend growth stocks. Our favourite dividend growth ETF is the SPDR S&P Dividend ETF (NYSEARCA:SDY).

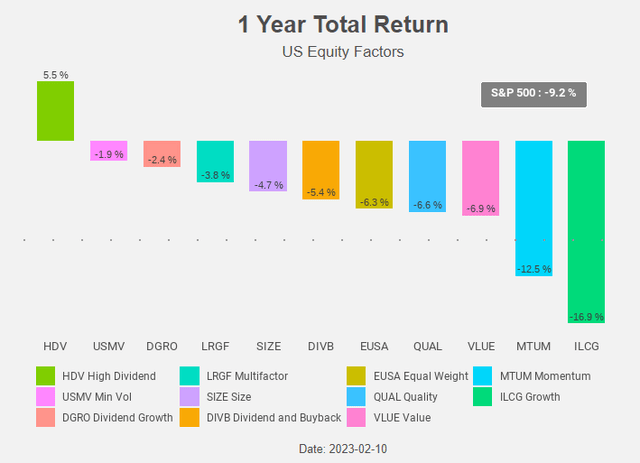

Factor performance

The past year was not good for equities. The same can of course be said of most equity factors. The two of the three best performing equity factors are high dividend and dividend growers.

Dividends always play an important role in the total returns of investment portfolios. This is even more the case when the price appreciation of equities is low, as was the was the case the past 12 months.

Figure 1: Total return chart (Yahoo! Finance, Author)

The worst equity factor was growth. Those “long duration” growth equities were heavily hit by the rising interest rates. Dividend stocks sit on the other end of the duration spectrum and hence less impacted by the higher rates. Dividend growth stocks are more “growth” and have a higher duration than high dividend stocks. This can be an explanation why high div outperformed dividend growth.

Companies that are able to consistently pay out dividends are also considered more mature, with stronger cash flows. And this helps both high dividend and dividend growth stocks when stock markets decline.

Figure 1 compared iShares equity factors ETFs. The iShares Core Dividend Growth ETF (DGRO) isn’t however the best performing dividend growth ETF.

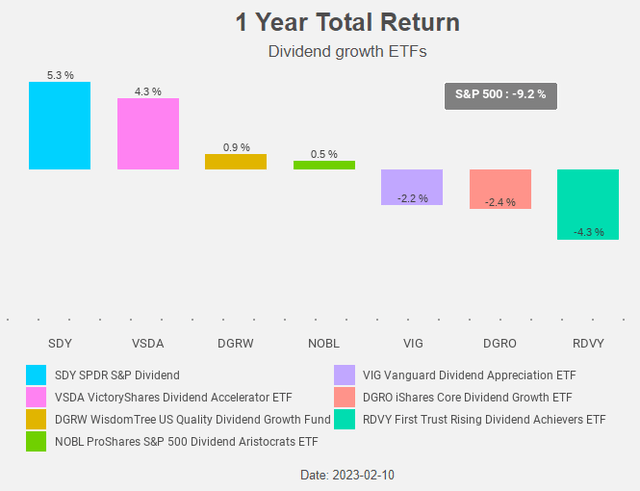

Figure 2: Total return chart (Yahoo! Finance, Author)

Other dividend growth ETFs like SDY and the VictoryShares Dividend Accelerator ETF (VSDA) were, unlike DGRO, able to book a positive total return over the past 12 months.

Dividend growers

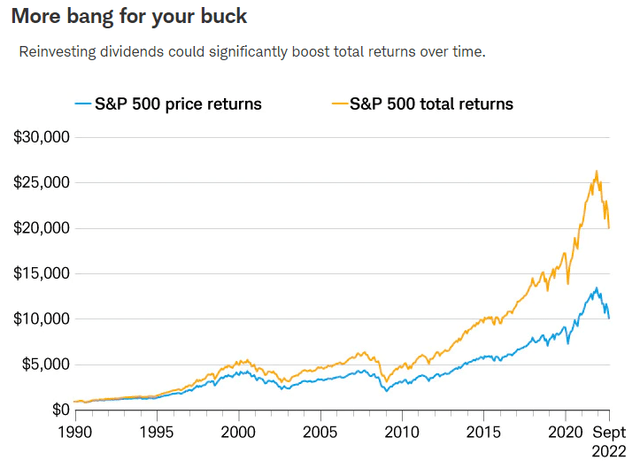

A chart comparing the price return of an equity index with the total return (including reinvested dividends) of that same index shows that it’s actually always a good idea to buy dividend growth stocks.

Figure 3: Price vs total return (Charles Schwab)

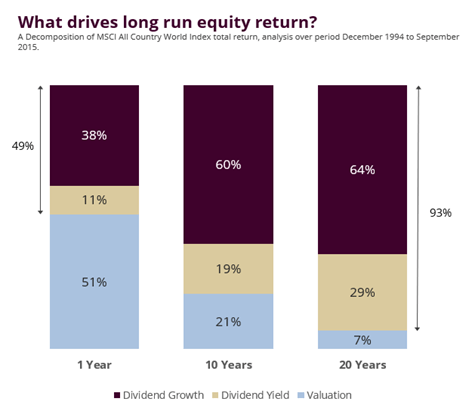

A 2016 MSCI study of long-term equity returns by MSCI on behalf of the Norwegian ministry of finance clearly showed that as the investment horizon increases, dividend yield and dividend growth become the dominant sources of equity performance.

Figure 4: Equity returns (MSCI)

Together they explain more than 90% of total equity returns over 20 years.

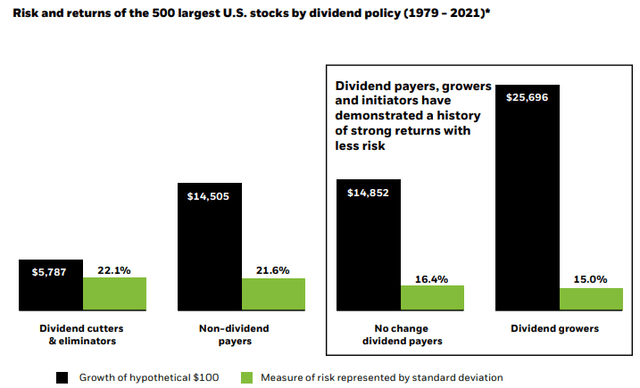

Dividend-oriented stocks have offered lower volatility and reduced downside risk relative to other equity strategies. The consistent and growing dividend payments can help to reduce the volatility of an investment portfolio.

Figure 5: Risk and return (Blackrock)

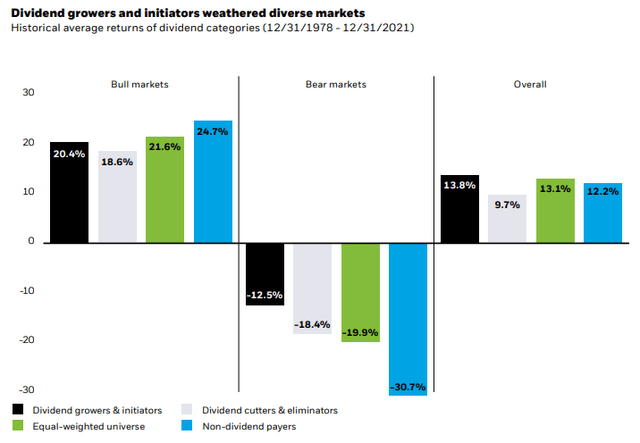

Dividend growers are a low-beta investment. In bull markets they perform well, but underperform the broader market. In down markets they have a negative return, but the outperformance is so outspoken that overall they come out on top.

These companies have a strong track record of generating consistent cash flow, which allows them to pay dividends even during challenging economic times.

Figure 6: Bull and bear markets (Blackrock)

SPDR S&P Dividend ETF

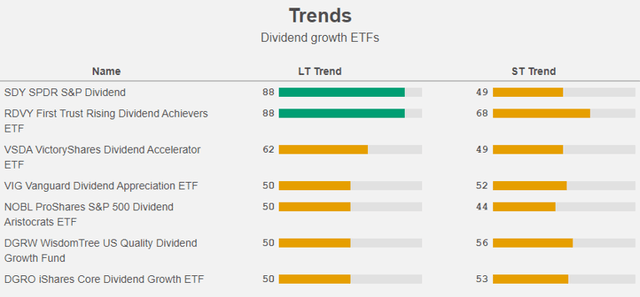

It will not surprise you that all the dividend growth ETFs outperformed the S&P 500 over the last 12 months.

The two best performing ETFs, SDY and VSDA, are also the only two dividend growth ETFs in a clear long term uptrend.

Figure 7: Trends (Yahoo! Finance, Author)

Our preferred dividend growth is SDY.

SDY is linked to the S&P High Yield Dividend Aristocrats Index, which offers exposure to dividend paying large-cap companies that exhibit value characteristics within the U.S. equity market. The S&P High Yield Dividend Aristocrats Index is designed to measure the performance of the highest dividend yielding S&P Composite 1500 Index constituents that have followed a managed-dividends policy of consistently increasing dividends every year for at least 20 consecutive years.

Normally a dividend aristocrat is a member of the S&P 500 index and has increased its dividend for at least 25 consecutive years. For the S&P High Yield Dividend Aristocrats Index the threshold is hence a little bit less strict: a history of increasing its dividends for 20 consecutive years or more is enough.

The Vanguard Dividend Appreciation ETF (VIG) and DGRO have a very low expense ratio (0.06% and 0.08%). SDY has an expense ratio of 0.35%, more or less in line with the other dividend growth ETFs. Despite the higher expense ratio, SDY managed to outperform both VIG and DGRO.

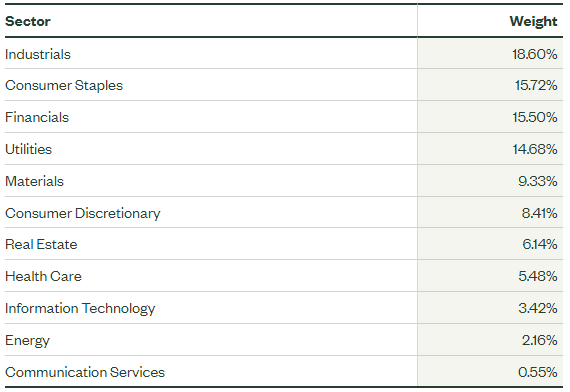

SDY has 122 holdings and the exposure is tilted most heavily towards Industrials, Consumer Staples Financials and Utilities.

Figure 8: Sector weightings (SPDR)

Stocks are weighted by yield and weight-adjusted each quarter.

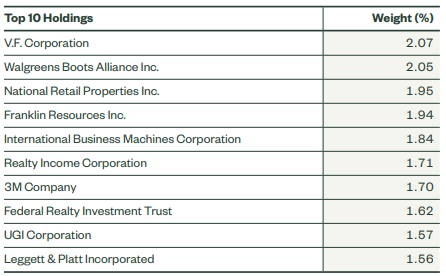

Figure 9: Top 10 holdings (SPDR)

Most dividend growth ETFs have a dividend yield around 2%. SDY has a dividend yield of 2.5%.

SDY has a P/E of 17.7 and a P/B of 2.9. On all these measures it’s cheaper than the S&P 500.

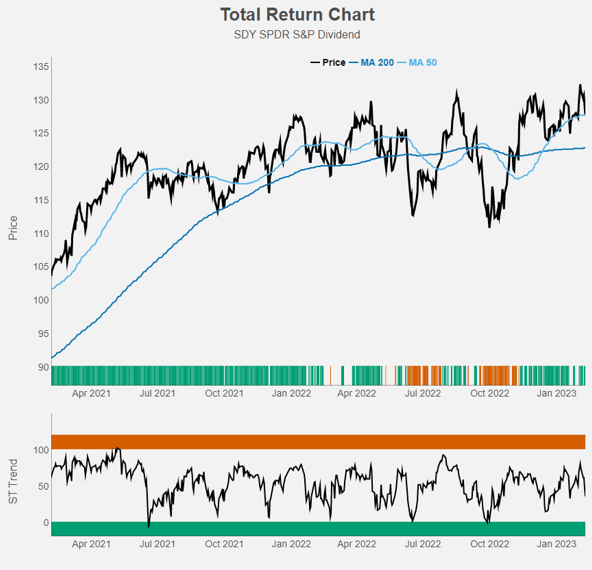

Figure 10 gives an overview of the evolution of both SDY’s short and long term trend over the past years.

Figure 10: Total return chart (Yahoo! Finance, Author)

When the LT trend is clearly up, we get a green light/colour. Vice versa, when the LT trend is clearly down, we see a red light/colour. In between the colour is orange.

The ribbon in the price-part of the chart shows the LT trend-colour, while the lower part of the chart shows the ST trend. We left out the orange colouring to avoid overloading the chart.

Dividend growers or …. bonds?

Thanks to or due to the higher inflation, interest rates are no longer very low and hence bonds might become more interesting for income-oriented investors.

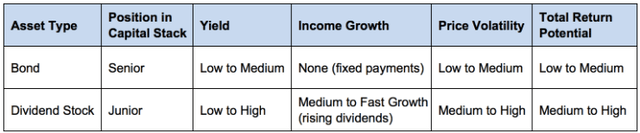

Unlike dividend stocks, fixed-rate bonds have no inflation protection. When inflation expectations rise, interest rates tend to rise with them as investors demand a higher yield to compensate them for higher expected inflation. As a result, bond prices fall. Dividend growth stocks, which often grow their dividends faster than inflation, do offer some inflation protection.

Figure 11: Bonds vs dividend stocks (Simply Safe Dividends)

Additionally, dividend growth stocks offer something bonds lack: income growth.

One can od course expect dividend growth stocks to be more volatile than bonds and to have greater drawdowns.

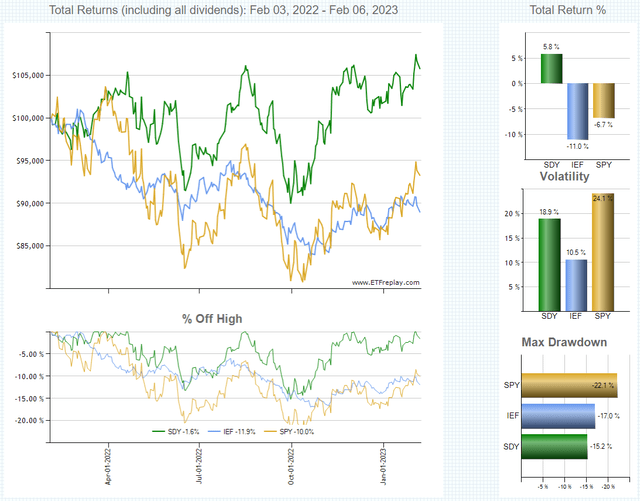

Figure 12: Dividend growers vs bonds (ETFreplay.com )

But then again, if we look at the past twelve months, which were quite volatile for stocks, dividend growth stocks had a lower drawdown than treasuries (and a much higher total return).

Investors shouldn’t in our view switch completely from dividend stocks to treasuries, simply because the latter have now a bigger yield.

Conclusion

High dividend and dividend growth are among the best performing equity factors. While it is always a good idea to invest in high dividend paying equities and dividend growers, this is even more the case in periods with low equity returns.

Our favourite dividend growth ETF is the SPDR S&P Dividend ETF. It has the best past performance, is in a long term uptrend and has a higher dividend yield than other dividend growth ETFs.

Be the first to comment