alvarez/E+ via Getty Images

Scorpio Tankers (NYSE:STNG) is based in Monaco, where it oversees its operations in oil transportation of refined petroleum. Strategically placed on the coast of the Mediterranean, the company has divided its operations into four different segments, each according to the type of vessels being managed. These include the Handymax segment and the Medium Range segment (MR), which is involved in medium-range (MR) transportation. Panamax and Aframax are responsible for long-range transportation together. The company manages approximately 128 vessels, each with a different capacity, as well tankers the company owns through leases.

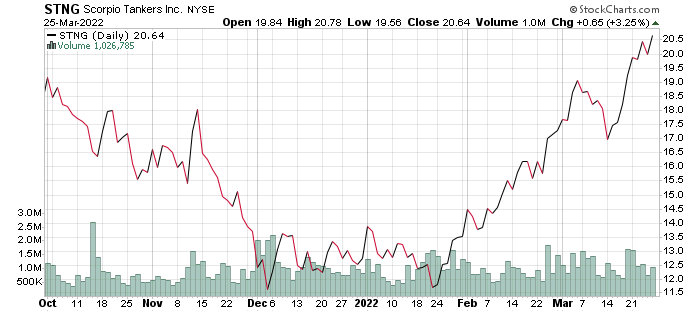

stockcharts.com

Despite the losses reported and the volatility of both markets Scorpio is involved in, shipping and oil, there is reason to be optimistic about the company’s future. We will look into the pros and cons of the business and go through why what may seem to be red flags against the company’s profitability turn out to be false flags.

Market Risks

The nature of the industry is much like the waters it depends on for transport. A combination of both volatility and the cyclical nature of oil demands can massively affect a company’s earnings on a yearly basis. Scorpio has experienced such volatility, reflected best in the company’s annual revenue, and is as sensitive as any company in the industry to geopolitical turmoil that often threatens markets. More company-specific issues involve a dependency on sport-oriented pools and charters, which could experience a drop in prices and further add to the company’s volatility.

If anything, the shipping crisis the world has seen due to pandemic restrictions has highlighted the industry’s value, which comes as a double-edged sword. While these companies have experienced massive growth during the crisis, there is no foreseeable substitute for global bulk shipments. In the case of oil tankers, they will continue to survive as long as oil is in production. On the other hand, this may lead to an over-supply of capacity, reducing prices that could massively affect earnings. The issue of the oil industry cannot be brushed aside, and while it is undeniable going to be phased out in favor of clean and renewable energy, it will by no means be sudden death. A slow and manageable decline is expected over the next few years. The industry will possibly survive at a substantial size for one or two more decades, giving companies enough time to manage their assets and project future transitions. Assuming no future variant of COVID-19 will cause the same lockdowns and subsequent bottleneck of vessel ships, the industry is expected to get back on track.

Recent Performance

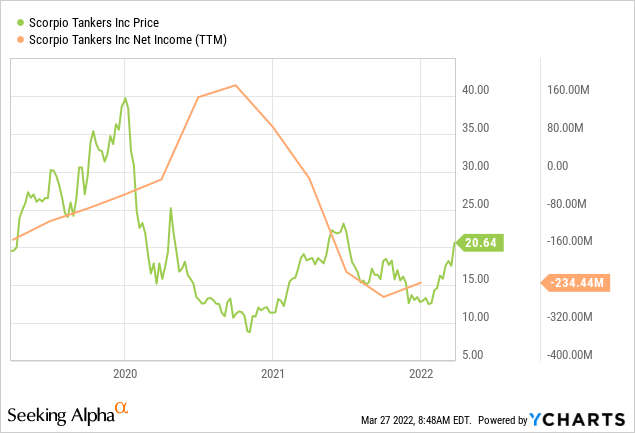

ycharts.com

Scorpio registered losses in 2021, despite seeing phenomenal numbers in 2020 when a rise in transportation costs resulted in a rapid rise in costs. It was also the only year in the past four years that saw positive net income, with a total of $94.124 million reported at the end of 2020, compared to a $234.4 million loss last year. This represented a $4.28 diluted loss per share by the end of the fiscal year. The final quarter ended with losses, reporting a $0.79 diluted loss per share or a corresponding loss of $43.7 million during the final three months of the year. This may not look good, but it is an improvement from the final quarter of 2020, which saw a net loss of $56.6 million, despite the gains made that year. While it may seem that the normalization of transportation costs comes at a loss for the company, which was directly reflected in the income statement due to prices dropping, it can also be easy to forget that the business was profitable prior to the pandemic.

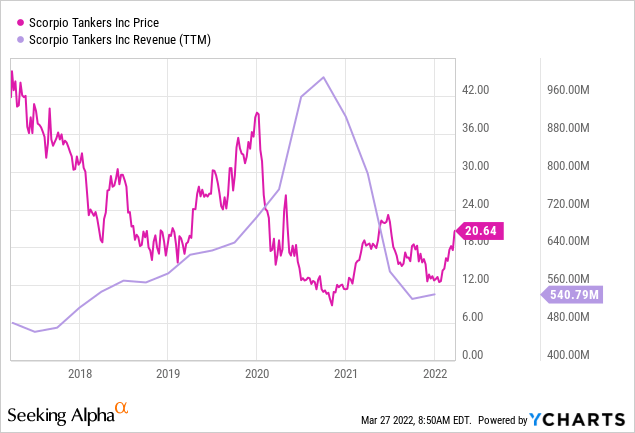

ycharts.com

Overall, revenue was spread out among the vessels, with the MR bringing in total revenue of $262.7 million in 2021, followed by the LR2. This doesn’t compare to the $347.9 million the same vessel reported by the end of 2020. The bulk of that loss came from an imbalance in vessel revenue against the costs involved in shipping, accounting for a total loss of $234.4 million, compared to the $94.1 million gains reported in 2020. The company will seek increased numbers of shipments to make up for the losses. Scorpio could not have project earning what it did in 2020 for very long, with the company making re-adjustment to resume activity, to capitalize on the gains made from an industry boom. Even prior to the pandemic, difficulties were always there, as evidenced by the $48.49 million loss reported in 2019.

Moving forward, Scorpio has a chance to manage its financials better and seem to look to cut losses by selling the vessel, which the company announced earlier this year. The company also announced an additional 12 LR1 vessels in a deal expected to raise $189 million in additional liquidity. If the company wants to keep growing, they need to go smaller sometimes, making additional cuts that could save on costs and result in positive revenue for the company.

Shipping Outlook and Competitors

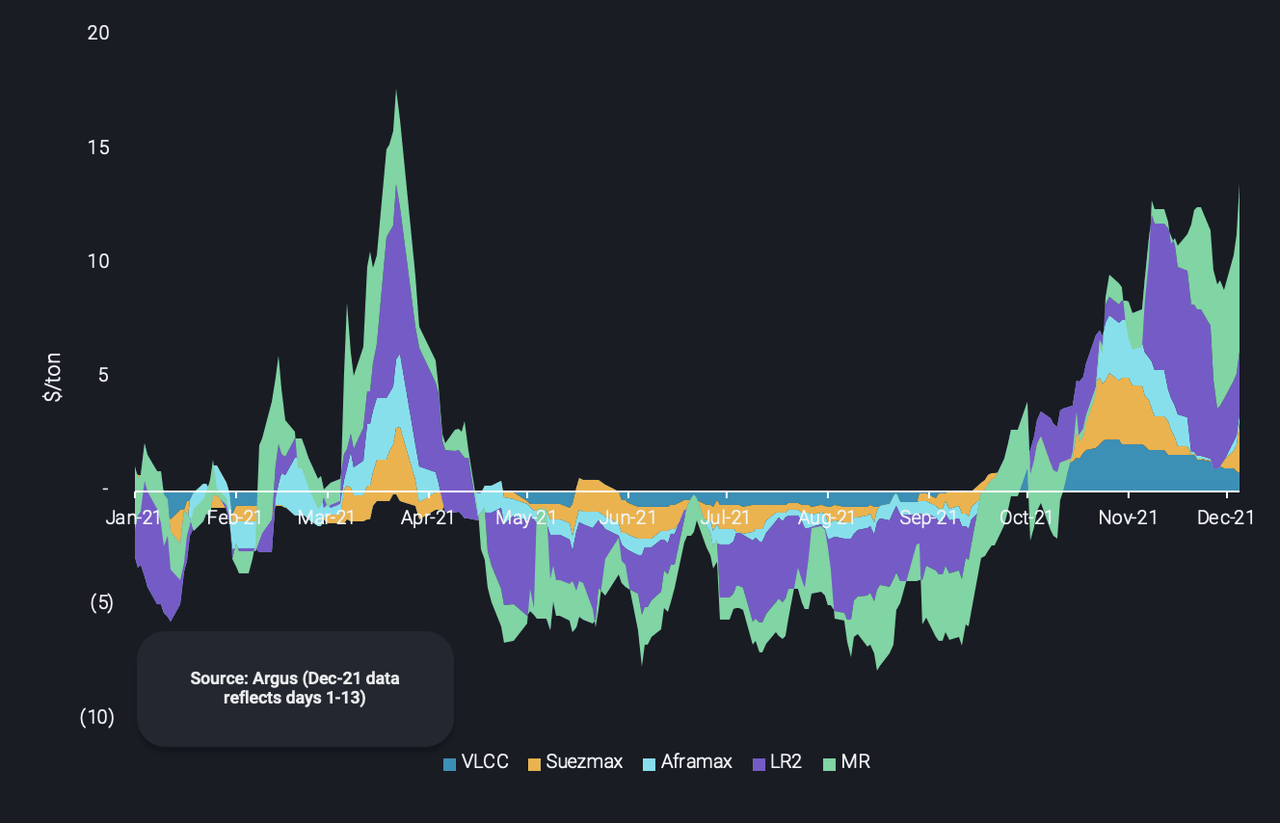

breakwaveadvisors.com

The industry suffered some of its lowest number in 2021, with the price of freight rate dropping, after riding on a wave of high prices in the previous 12 months. However, the demand for oil did increase throughout the year, with an increase in OPEC+ volumes from recovering economies. The industry’s growth was still very positive, at an estimated 4.8%, and is expected to grow an additional 2-3% in 2022. Prices will continue to drop throughout the year, with current estimates expecting up to 40% in price reduction, assuming current trends continue. Of course, the market’s volatility could go either way. Therein lies the opportunity for Scorpio to make a profit by reducing expenses and capitalizing on either high prices or frequent shipments. Scorpio’s losses are also by no means a sign of the company’s inability to manage its portfolio. A total of 11 tanker companies saw losses above $400 million in the third quarter of the year alone, with the first three quarters surpassing $1 billion in losses. While Covid-related impacts are slowly reducing, the industry is faced with new challenges involving geopolitical conflicts with Russia and Ukraine, affecting the prices of oil dramatically.

News

Scorpio announced that it repaid a $17.2 million outstanding balance related to one of its vessels in an AVIC arrangement. The company made further debt payments to multiple institutions due to the multiple vessel sales finalized by the first quarter of the year. These debt payments totaled $117.8 million in quarter one. The company announced another sale of a vessel for approximately $26.5 million, expected to be finalized by the second quarter of the year. This will help the company in its effort to continually raise liquidity. As per March, it is estimated that the company’s first quarter will register losses of $5.3 million, again seeming alarming, except when analyzing the trend that is progressively heading towards positive net income.

If the company continues getting rid of unnecessary assets, they could manage a low season of prices by ensuring the vessels they own can make a profit. Scorpio announced that it would pay a quarterly cash dividend of $0.10 per share. Bullish investors can expect returns to increase soon for a strong company like Scorpio Tankers that should stay afloat for a while.

Be the first to comment