SergeyChayko

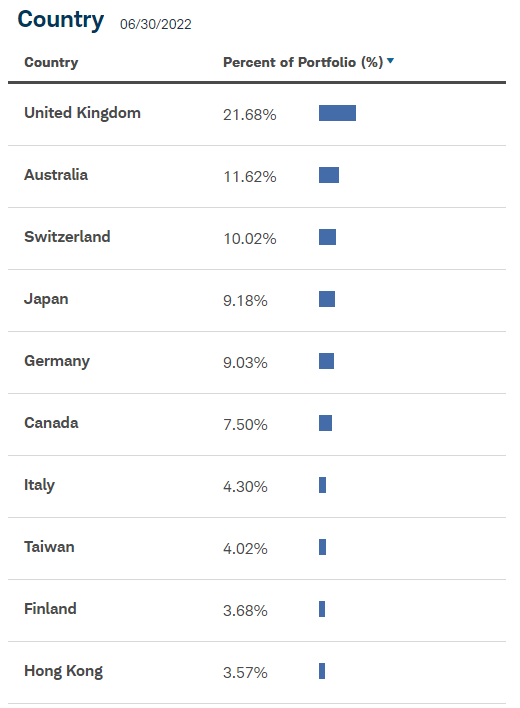

In my quest for portfolio diversification in light of a higher probability of the U.S, economy suffering from a recession within the next twelve months, I recently covered the BlackRock International Growth & Income Trust (NYSE:BGY), a closed-end fund (“CEF”) which provides high dividends and with an above 27% exposure to the U.K. For this thesis, I cover the Schwab International Dividend Equity ETF (NYSEARCA:SCHY) whose holdings as shown in the table below is also considerably skewed towards U.K assets, at 21.7%.

Country Exposure (www.schwabassetmanagement.com)

Now, with another 27% of its assets dedicated to European countries, namely, Switzerland, Germany, Italy, and Finland, the overall performance of the Schwab ETF is determined mostly by the macroeconomic conditions prevailing in the old continent. Additionally, that 11.6% exposure to natural resource-rich Australia remains significant.

Thus, for those who want diversification after traditional portfolio protection mechanisms provided through precious metals are not working as before, the aim of this thesis is to provide geographical diversification through SCHY. I will also elaborate on sector exposure as well as on some of its holdings.

I start with the macroeconomic picture in Europe paying particular attention to the U.K.

The Bleak European Picture

After weeks of market turmoil following British Prime Minister Liz Truss’ controversial tax cut budget, her hastily appointed replacement chancellor. Jeremy Hunt has scrapped her entire growth plan.

Adopting a more realistic posture, Mr. Hunt thinks that in order to promote, the prerequisite remains investors’ confidence and financial stability and acknowledges that the government will therefore make all the difficult decisions that are necessary.

His immediate actions included putting in the drawer the £32billion in tax cuts announced by the government last month as well as bringing cuts to the energy price support package in a bid to reassure markets that Britain’s finances could return to a stable footing.

The initial market reaction to Hunt’s statement was positive with the pound rallying against the dollar immediately after Hunt’s statement and Gilts, which are bonds issued by the UK government extending their upside. This translates into lower yields implying that the cost of domestic borrowing goes down as the trust level among fixed-income investors rises again.

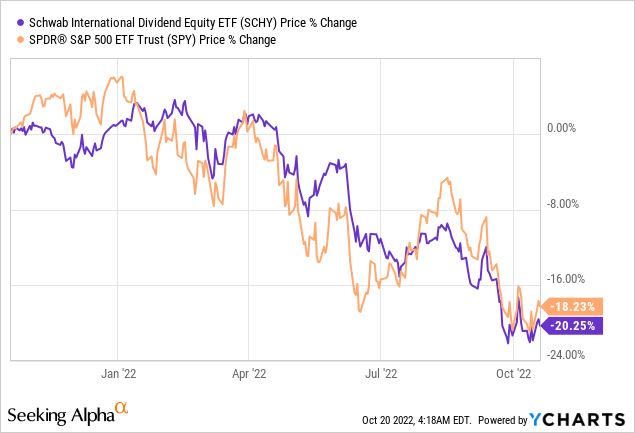

As a result, as shown by the blue chart below, SCHY’s share price has recovered some of the losses it started incurring as of the end of September. A comparison with the SPDR S&P 500 ETF Trust (SPY) helps to highlight the recovery.

This recovery was also due to a technical rebound after several consecutive sessions of decline partly due to fears of an escalation of the conflict in Ukraine, concerns about economic downturns, turmoil in the U.K. bond market, and expectations of further monetary tightening by the major central banks. There was also some contagion from the world’s first-largest economy on the other side of the Atlantic following disappointing PPI (producer price index) data and CPI (consumer price data) being higher than expected, implying that the Federal Reserve would have to maintain its hawkish stance.

However, contrary to bond prices which have little way but to go down when rates rise, SCHY’s holdings are made up of stocks, which come from different sectors of the economy, with some faring better than others. Thus, I look at the sector’s strengths and weaknesses.

Sector Strength and Weakness

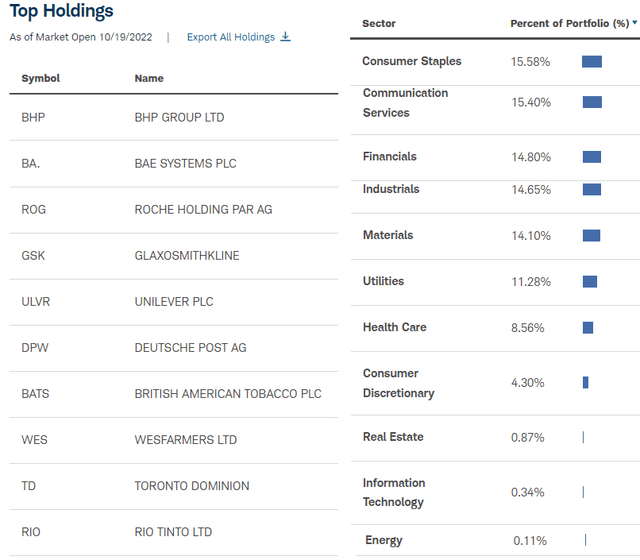

As shown below, Consumer Stables make up for 15.58% of the underlying fund. Now, this sector includes companies that produce and supply essential products like foods and beverages, and hygiene products used daily by consumers. Therefore even if inflation eats into a family’s disposable income, it is not likely that its members will stop spending on these items.

This means that companies like Unilever (UL) [ULVR] will continue to obtain more revenues as they adjust their pricing to account for higher input costs for commodities, as well as higher production expenses like labor and energy.

Top Holdings and Sector Exposure (www.schwabassetmanagement.com)

However, in practice, it is not so simple as there is competition and Consumer Staples stocks cannot just pass all the cost to customers. Moreover, with the Ukrainian conflict continuing, it is unlikely for energy or agricultural commodity prices to come down rapidly.

On the other hand, exposure to the Materials sector at 14% is a positive as underlying stocks like Rio Tinto (RIO) and BHP Group (BHP) own and control physical (mining) assets which they sell as commodity-based products. While the strong dollar has mostly weighed on the prices of industrial and precious metals, these have the potential to make a comeback as traditional hedges against high inflation. On top, BHP exploits natural gases which accounts for its higher revenue growth.

Another sector whose underlying stocks tend to be correlated with rising inflation is energy, but, SCHY provides negligible exposure to this sector.

Discussing the Effects of Inflation on SCHY

Next, coming to the communications services sector which forms a hefty 15.4% of SCHY, rising inflation can increment energy-related expenses for telco’s network operations, but they can pass on the costs to consumers as higher inflation eats into their profits.

Pursuing further, with U.K. inflation at its highest levels in more than 40 years, many investors simply do not know what a prolonged period of rising prices looks like and the effect it may have on financial markets – and, their portfolios. In addition supply chains have been disrupted and while there have been some improvements, there appears no end in sight with the Chinese government being adamant about its Zero Covid policy.

In these conditions, as shown by the performance of the S&P 500, the U.S. market has resisted better than its developed counterparts in Europe, Asia, or North America, helped by the strong dollar mitigating against the effect of high inflation. America also has ample energy supplies. However, possessing many of the world’s largest financial markets, there are questions as to the effects the Federal Reserve tightening liquidity both through hiking rates and tightening its balance sheet can have on markets.

In these circumstances, opting for SCHY provides for non-US diversification of your portfolio while staying in the developed world, where countries have more elaborate tax collection systems to insulate themselves against the undesirable effects of severe recessions. Consequently, there is a lower probability that they will resort to an IMF aid package.

Moreover, with a trailing distributions yield of 3.15%, this is not necessarily a high dividend ETF when compared to BGY whose trust managers use the covered call mechanism for the purpose. On the other hand, SCHY charges much less with an expense ratio of only 0.14% compared to BlackRock’s 1.09%.

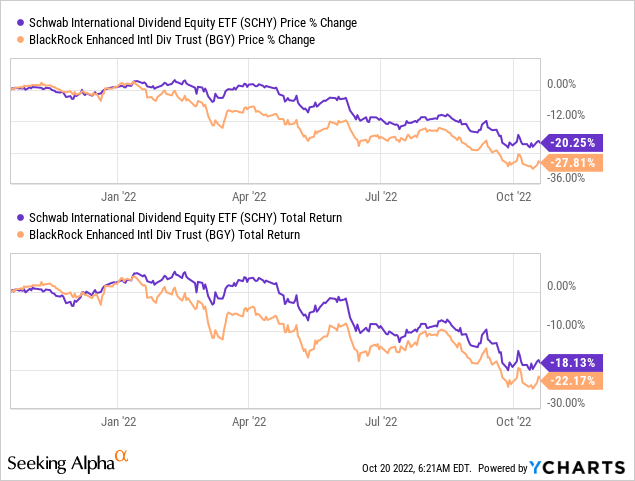

I also like the fact that SCHY selects stocks that have consistently paid dividends over at least 20 years. This ensures quality, an important attribute for current highly uncertain times when financial strength is important to navigate in turbulent waters. In this respect, the portfolio strength becomes evident when comparing performance with BGY in the orange chart below. It basically shows that SCHY in the blue chart has resisted market turmoil better, by underperforming by less than 7%.

In addition, the total return charts above, which include dividend payments in case these are reinvested in the fund, show that despite BGY paying yields of 8.69% (through its covered call strategy), it is SCHY that has managed to provide better mitigation against the market downturn for the past year. For this purpose, it has been less volatile compared to BGY by around 4% in terms of total returns.

Therefore, SCHY is relatively balanced in terms of sectors but, with energy prices still being high, its holdings could suffer from further downside. This downside should be mitigated to a certain extent by the fund managers being choosy in their asset allocation.

Conclusion

Coming back to the U.K, with Mr. Hunt firmly in control, it is unlikely that the country will again implement a fiscal policy that will undermine its very economy or the financial stability of its bond markets and induce contagion to the continent only a few miles away.

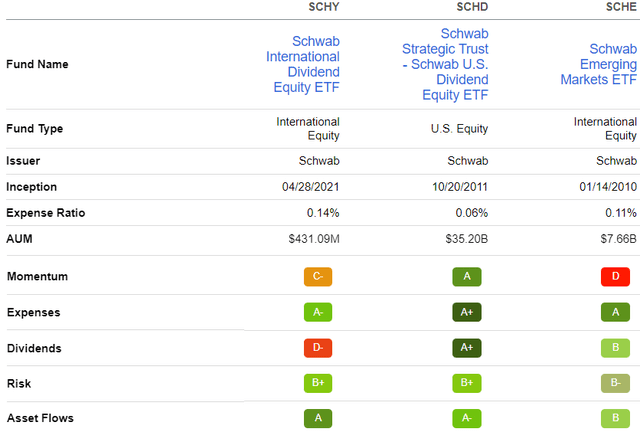

However, with a recession looming in King Charles III’s kingdom and other European countries also facing high energy costs, there is no lack of news to adversely impact the markets. Still, as shown in the table below, compared to its U.S. and emerging market peers, SCHY is benefiting from better asset flows as evidenced by its “A” score. In fact, its AUM or Assets Under Management has increased by 62.26% over the past six months whereas the median for all other ETFs has suffered from a reduction of 16.08%.

Peer Comparison (www.seekingalpha.com)

More importantly, for the last month which has been an exceptionally high volatile period for equities and bonds, its AUM has regressed by only 1% compared to -10.94% for the sector median.

Hence, investors seem to be trusting SCHY more in current circumstances, possibly because they think that the worst may be behind for equities in those parts of the world. Thus, you may want to put in some money, but, do not forget that uncertainty reigns and there are risks of the market going lower.

Finally, with Mrs. Liz Truss departing as Prime Minister and the pound rising, the positive momentum seen in U.K. stocks this week could continue and SCHY, after having lost 20% in the last six months alone, could climb back to the $22 level.

Be the first to comment