janiecbros/E+ via Getty Images

Green shoots from a company out West

The cannabis sector has been an exciting space for investors and promises to continue to be for the foreseeable future. It’s still like the Wild West in many respects, but since taking off three years ago the industry is starting to take shape. The major players have settled on a strategy of rapid expansion into new states and maximizing business in current states. They want to get big, and establish their brands in new and existing markets. And why not? With size comes financial muscle, operational and marketing synergies, and more recognition by the investor universe. Some companies have even declared that their goal is to become the biggest in the industry. It’s a popular strategy, but it’s not the only one. Investors owe it to themselves to be open to other potentially lucrative strategies, especially before success is recognized by the investing public. This article will introduce a relatively unknown company, Schwazze (OTCQX:SHWZ) that is similar to the more familiar names but also different in some interesting and important ways.

The company

The company now known as Schwazze (pronounced SCHwaZZ) was incorporated in 2014 and went public in 2016 as Medicine Man Technologies. NOTE: Medicine Man will continue to be the legal name but the company has done a corporate rebrand as Schwazze.) Their business was consulting on medical and recreational cannabis cultivation, marketing and distribution, mostly in Colorado. They also provided equipment and nutrients to cannabis cultivators, and had a small retail presence. In 2019 changes in Colorado law allowed non-Colorado resident and publicly traded investment into “plant-touching” cannabis companies (Medicine Men was incorporated in Nevada). With the arrival of Dye Capital in the same year they began acquiring dispensaries, manufacturing facilities and growers with the goal to become one of the largest seed to sale cannabis businesses in Colorado. The full company history can be found on page iv of the 2021 Annual Report.

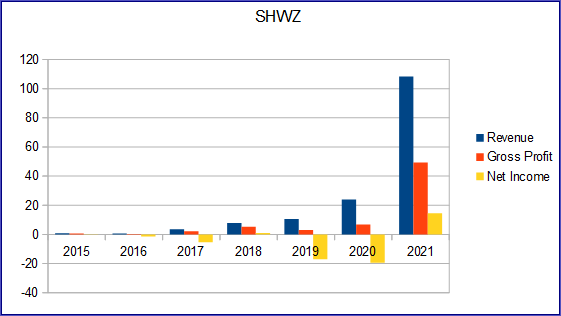

In April 2020 the company acquired its first plant-touching business: four dispensaries and one manufacturing facility under the name Purplebees. As of April 2022, they have 23 retail locations under various names in Colorado, 10 locations in New Mexico, and significant manufacturing and cultivation capabilities. More acquisitions are pending. The dramatic increase in revenue, gross profit and net income in the table below shows the impact of the 2019 strategic redirection.

Schwazze revenue, gross margin, net income (10-K reports)

Justin Dye and Dye Capital

Medicine Man/Schwazze is being transformed from a small, unknown Colorado player into a growth powerhouse. The transformation is the work of Justin Dye, CEO and Chairman. He is the key to the bull case for Schwazze, and it’s important to understand what he brings to the company. Dye is chairman of eponymous Dye Capital & Company, a private equity firm. His company brought the first major new capital to Schwazze, $18.575 million for shares and warrants in 2019. Dye Capital then purchased a Schwazze $5 million convertible note, arranged a placement of $52 million in preferred stock, and then a private placement of $95 million in notes to 31 accredited investors.

Dye Capital believes that hands-on operational involvement is the key to the success of their equity investments. The operational skills and experience that Justin Dye brings to Schwazze as CEO and Chairman are unsurpassed, and the company’s greatest asset. Over 28 years he has worked at top firms like Arthur Andersen, Cerberus Capital, and PJ Solomon, and was an integral part of a number of new and existing companies. For 11 years he held executive positions (including Chief Strategy Officer and Chief Operating Officer) at rocery behemoth Albertsons during that company’s turnaround. When he began there, Albertsons was a huge money-losing collection of retail brands that had lost its way and was losing to competitors across the country. By 2017 the company sales had risen from $10 billion to $60 billion and consistent profitability. Following the turnaround Albertsons went public again in 2020. Since then, shares have risen 133%.

Why Colorado, and why now?

A more complete outline of Justin Dye’s distinguished career is at his LinkedIn profile and on the Schwazze website. There is also an excellent interview by Jesse Redmond on Seeking Alpha. In cannabis he saw an outstanding opportunity to continue his success in private and public equity and growing businesses through operational excellence. Looking at the cannabis landscape he decided that the state with the most potential for his investing and operational team is Colorado. At first glance this may seem like an odd choice. Colorado is a relatively saturated market, highly fragmented, and the major cannabis companies are mostly absent. But looking deeper, it looks like the right fit. Less than two years ago Colorado law changed to allow participation by out of state entities, and now larger amounts of capital can be put to use there. By rolling up small businesses in the state into one larger business, the many benefits of scale can be put to use. Driving operational excellence, as Dye did for Albertsons, will maximize efficiency and profitability. For Justin Dye, with proven expertise in evaluating, investing in, growing and transforming businesses, Colorado looks like a smart choice.

New Mexico expansion

New Mexico has had legal medical cannabis since 2008, and adult use (aka recreational) sales began on April 1, 2022. They are in the “sweet spot” where a state transitions from medical to recreational. The current $220 million market there is projected to grow to $800-900 million. The exciting potential (partly because of Texas customers!), is clear in this report on the first week of adult use sales. Schwazze entered NM by purchasing Greenleaf, which has ten dispensaries, four cultivation facilities, and one manufacturing facility. In part, Schwazze will recreate the Colorado playbook by bringing new capital and expertise to a fragmented market ripe for consolidation due to changes in cannabis laws.

Schwazze business performance

The following table shows the impact of Justin Dye and Dye Capital coming to Medicine Man Technologies, now Schwazze, in 2019.

| (million $) | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Revenues | 0.8 | 0.6 | 3.5 | 7.9 | 10.6 | 24.0 | 108.4 |

| Cost Of Revenues | 0.2 | 0.5 | 1.3 | 2.6 | 7.6 | 17.2 | 59.1 |

| Gross Profit | 0.6 | 0.2 | 2.2 | 5.3 | 3.0 | 6.8 | 49.4 |

| Operating Income | 0.1 | (1.2) | (5.1) | 0.5 | (13.6) | (22.9) | 10.4 |

| Earnings From Continuing Operations | 0.1 | (1.5) | (5.4) | 0.9 | (17.0) | (19.4) | 14.5 |

| Net Income | 0.1 | (1.5) | (5.4) | 0.9 | (17.0) | (19.4) | 14.5 |

| Basic EPS | $0.01 | ($0.14) | ($0.23) | $0.04 | ($0.50) | ($0.47) | $0.17 |

| Diluted Weighted Shares Outst. | 9.9 | 10.2 | 23.0 | 27.8 | 33.7 | 41.2 | 101.4 |

| Normalized Diluted EPS | $0.01 | ($0.08) | ($0.14) | $0.01 | ($0.33) | ($0.33) | $0.11 |

| EBITDA | 0.1 | (1.1) | (5.0) | 0.5 | (13.6) | (22.4) | 19.0 |

Source: Seeking Alpha

Large positive changes in 2020 accelerated in 2021, and are set to continue. As of January 1, Schwazze has $106 million in cash, which it has said it plans to use for more acquisitions. Dye said in February that he expects a run rate of $220-230 million by the end of the year, which is double the rate of Q4 2021.

The growth will come entirely from Colorado and New Mexico. The big cannabis names are in a modern day land rush, trying to expand their geographic footprint as rapidly as possible and in the most populous states. This is not the Schwazze approach. Their strategy is to operate in a few states with special situations matched to their particular expertise. In Colorado and New Mexico they will consolidate, drive market share, produce excellent products, and run superior retail operations. Acquisitions will be accretive, have positive cash flow, and have management aligned with Schwazze’s philosophy. As it says on their home page:

As a verb, Schwazze is a cultivation technique that prunes a living organism to create more growth.

It’s the perfect metaphor for Schwazze’s strategy.

Investment landscape

Schwazze stock price history (Seeking Alpha)

Over the past five years, Schwazze is that rare cannabis company that has had a substantial price gain. In the latest 12 months, it has declined about 17%, which is outstanding when the big cannabis names have declined 50% or more. Since February 1, while the big names have continued their decline Schwazze stock has gone up from $1.54 to $2.09, or 36%. Perhaps investors are starting to take notice of this small, new company.

Justin Dye had a lot to say in the February interview when asked about the stock price. As expected, he feels the stock is very underpriced. Currently at 5x next year’s EBITDA, he believes it should be at 15x. The issue of generating investor interest is a challenge for any small, new company. At a share price of $2 the average daily dollar volume is only $100-200 thousand. The solution is to get bigger, be successful, and work for more analyst coverage. The fundamentals are in place for more outperformance, which will be an important step. Dye’s plan is to continue to underpromise and overdeliver. As one of very few profitable cannabis companies Schwazze will attract money from investors for which this is important. In his opinion, the profitability, positive cash flow, large cash level and management credentials make Schwazze one of the safest investments in the cannabis. After the sector’s performance over the past year many investors have a heightened appreciation for safety.

In addition, there is a certain class of cannabis investor who is always on the lookout for the small company that will become a big company. Schwazze is a prime candidate, and will become more so as its profile increases.

Another clue about the future comes from the nature of the private equity business that Justin Dye and Dye Capital come from. Private equity is most often interested in developing companies for future sale at substantial profit, not owning a company forever. Although this is not the stated plan for Schwazze, it’s very possible that it’s part of the long-term strategy and would be a very positive outcome. The possibility of a buyout is never a sufficient reason to invest in a company, but in this case is certainly part of the bull case. It is interesting to note that the warrants issued in the first big capital raise two years ago have an exercise price of $3.50.

Risks

There are risks related to the current turmoil in general economic conditions. Schwazze can be adversely affected by recession, supply chain problems, labor shortages, material shortages, and of course inflation. They have previously mentioned the pandemic reducing the number of customers and causing staffing shortages.

There are also risks related to the cannabis industry as a whole. The fortunes of every cannabis operation depend on the suitability of regulations in the jurisdictions where they operate. We have already seen how impactful this can be when the federal government cracked down on vaping and when the FDA declined to issue a positive recommendation on CBD. In addition, Schwazze is not immune to changes in sector investor sentiment that can suppress prices for an extended period.

There are also risks related to Schwazze in particular. Success depends on both continued high growth and positive financial performance; without those there will be less investor interest. There is also the possibility that management will not be able to repeat their past success with other companies. Coming from private equity the lack of experience operating as a public reporting company may be detrimental.

To be sure, there is risk in putting money in a small company in an emerging growth industry. Each industry and company has its own set of risks. Part of the investment process is determining which companies are most capable of meeting the inevitable challenges.

Investment recommendation

Schwazze is a buy at the current price of $2.00 per share. The stock is at an EV/EBITDA of 5x for 2022 and 1.4x for 2023. The PE was 11.1x in 2021 and is projected to be 7.4x for 2022 and 3.2x for 2023. They are cashed up for growth.

As Seeking Alpha says in its introduction to the CEO Interviews series, quality of leadership is a decisive factor in stock performance. In Colorado and New Mexico, which have been largely ignored by big cannabis, management is taking a stake in two states with unique environments they believe are particularly well-suited to their skills and experience. They know retail, product development, distribution, how to grow cannabis and how to grow a business. They are distinctive enough to offer an opportunity for diversification in a portfolio made up of the more well-known cannabis names without going too far out on the risk spectrum. As a small, rapidly growing, well-capitalized company with a discrete and solid growth strategy it merits serious consideration by cannabis investors.

Be the first to comment