matdesign24

Introduction

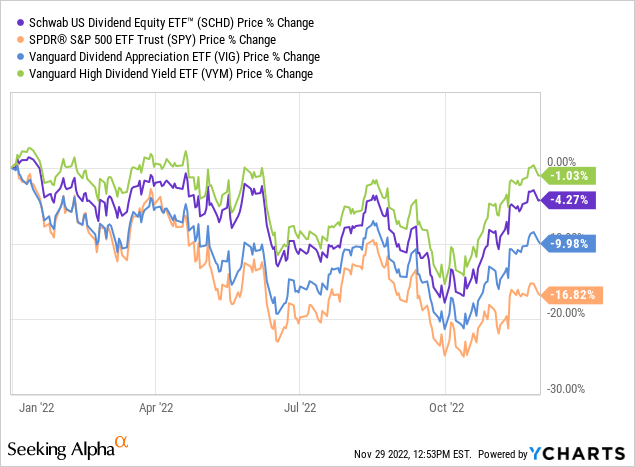

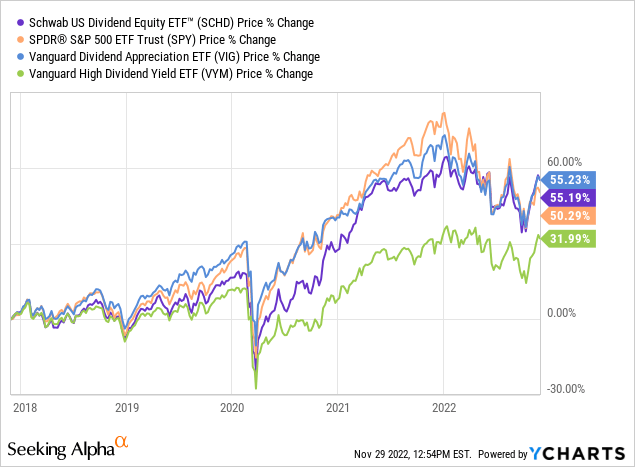

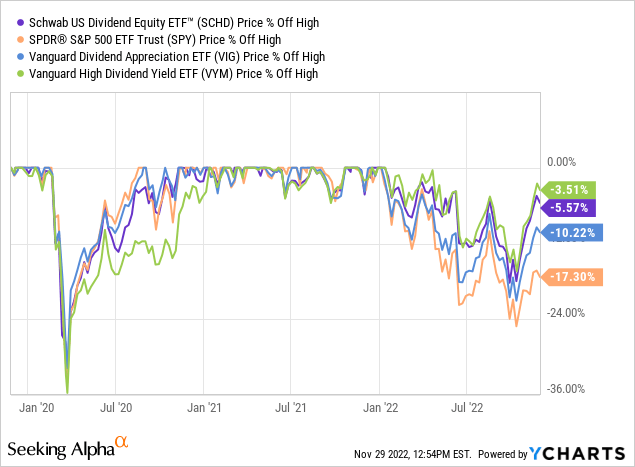

The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) has consistently performed well vs peers. Year-to-date, the exchange-traded fund (“ETF”) is only down around 4% before dividends compared to -10% for the Vanguard Dividend Appreciation ETF (VIG), -1% for the Vanguard High Dividend Yield ETF (VYM) and -17% for the SPDR S&P 500 ETF (SPY). On a longer 5-year term, SCHD along with VIG have outperformed SPY.

While this isn’t particularly surprising given the quality of holdings in a fund like SCHD, what has been somewhat unanticipated has been SCHD’s performance in the face of rising interest rates. I mentioned this as the key risk to this ETF in my previous article.

Portfolio Construction and Holdings

SCHD holds inflation-resistant, mature, well-established, dominant companies. SCHD’s mandate is to hold a basket of market-cap-weighted high-quality stocks that have a 10-year track record of paying dividends. Its portfolio is rebalanced quarterly, and the fund caps individual holdings at 4% and individual sectors at 25%.

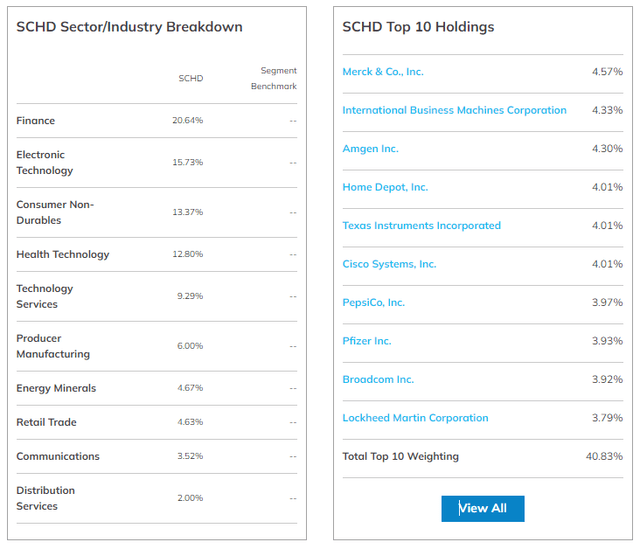

SCHD Sectors and Holdings (ETF.com)

Currently, the portfolio’s largest sector is financials at just over 20% of holdings. This is interesting as none of the top 10 individual stocks, making up 41% of the entire fund, are financial companies. Second is electronic technology (essentially tech), and third is consumer non-durables. Health tech and tech services round out the top 5 sectors.

The fund’s largest individual holding is the medical company Merck & Co (MRK). International Business Machines (IBM) is second, while another medical/biotech company, Amgen (AMGN), comes in at third. The remaining top 10 include a nice mix of consumer-facing companies like Pepsi (PEP), and Home Depot (HD), along with a few semiconductors like Broadcom (AVGO) and Texas Instruments (TXN), and even a defensive name like Lockheed Martin (LMT). Overall, I think it’s a solid mix of recession- and inflation-resistant names.

Interest Rates: Still A Risk?

Given the nature of SCHD being somewhat of a dividend-focused ETF, I do believe interest rates remain a key risk here. Since my last article, the ETF has performed well despite 2 and 10-year U.S. government bond yields rising from around 3% to around 4%.

US Government Bond Yields (Koyfin)

SCHD’s dividend yield is only around 3.2%, meaning it is now lower than U.S. government bonds. Of course, this comes with the possibility of business increasing earnings and dividends over time (unlike bonds), but were rates to climb further, I do think it’s possible we would see SCHD could come under a bit more pressure.

Financials being the fund’s largest sector is perhaps a counter-argument here, as financial companies such as banks should benefit from higher interest rates.

Conclusion

SCHD is a great ETF that has consistently put up performance to back such a statement up. The ETF charges just an expense ratio of just 0.06%. SCHD holds recession- and inflation-resistant companies, although their valuations may be susceptible to increasing interest rates. Nonetheless, I think it’s more likely than not that the SCHD ETF continues to outperform peers and the S&P 500.

Be the first to comment