Justin Paget/DigitalVision via Getty Images

Due to the size of the economies in North America, especially the US, and factoring in the geographical size of the region, it should be no surprise to investors that a strong industry centered around transportation and logistics solutions would develop. Today, there exist a number of players in the space. And one of the most attractive, fundamentally, is Schneider National, Inc. (NYSE:SNDR). Recent performance by the company has been impressive. And when you factor in guidance provided by management, shares of the business look to be rather cheap. Though this may not be true relative to other players in the space, it is definitely true on an absolute basis. And while I do believe the easy money has been made, I believe that further upside potential for the company exists moving forward.

Positive developments

The last time I wrote an article about Schneider National was in September of 2021. At that time, I categorized the company as being fundamentally attractive and I said that, should financial performance revert back to what the company had experienced in prior years, the business would be, at worst, fairly valued. This created a favorable risk to reward prospect for investors to keep in mind. Ultimately, in that article, I rated the company a “buy.” Since then, shares have roared higher, generating a return for investors as of this writing of 17.9%. That compares to the 1.1% loss experienced by the S&P 500 over the same window of time.

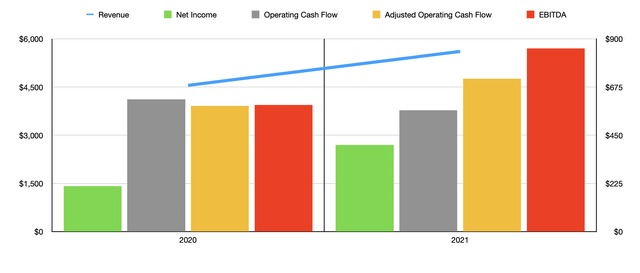

This increase in share price was not without cause. Fundamentally, the company ended the 2021 fiscal year on a high note. Revenue for the year came in at $5.61 billion. That represents an increase of 23.2% over the $4.55 billion the company reported in 2020. And it is the highest in sales the company achieved in at least the past five years. This sales increase was attributable to a variety of factors. $679.4 million of the increase in sales was associated with the Logistics segment to the company experiencing greater revenue per order and volume growth. The Intermodal segment of the business saw sales grow by $168.4 million as a result of higher revenue per order and higher volume despite certain supply chain constraints. $126.5 million of the increase in sales came from fuel surcharge revenue as the price per gallon of gasoline increased by 27%. And the company saw an increase in revenue of $83.9 million associated with its Truckload segment that was driven by higher revenue per truck per week but negatively impacted, to a modest degree, by lower volumes because of driver capacity constraints.

Revenue was not the only area where the company improved. Net income for the business nearly doubled, jumping from $211.7 million in 2020 to $405.4 million last year. Operating cash flow did decline, dropping from $618.2 million to $566.1 million. But if we adjust for changes in working capital, it would have actually risen to $714.5 million. Meanwhile, EBITDA for the company expanded, climbing from $591.4 million to $854.9 million.

For investors who might be worried, legitimately, about how long supply chain issues will have a positive impact on companies like Schneider National, the answer seems to be for the foreseeable future. For the 2022 fiscal year, for instance, management anticipates earnings per share of between $2.35 and $2.55. At the midpoint, this implies net profits of $435.3 million. To be fair, some of this will likely have been driven by an acquisition the company completed on January 4th of Midwest Logistics Systems in a deal that cost it $263 million and that should bring annualized revenue to it of $205 million. With an extra 990 trucks being added to the 4,240 that it already has, this will surely help the company fundamentally.

Besides net profits, the only area where management provided any guidance was on capital expenditures. They anticipate this figure coming in at about $450 million for the year. Start to get a proper estimate of the operating cash flow and EBITDA for the company for 2022, I merely applied the year over year growth rate for net profits to these metrics. Based on this methodology, the operating cash flow for the company for the current fiscal year should be around $767.2 million. And the EBITDA for it should be about $918 million.

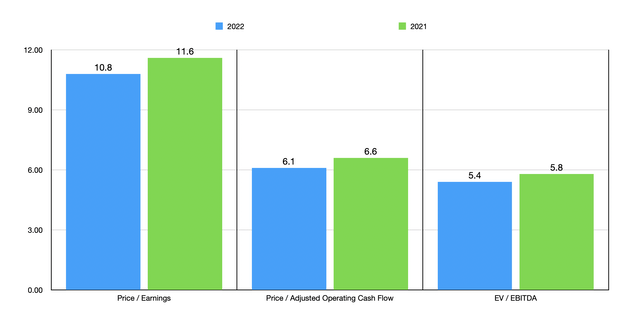

Taking these figures, we can effectively price the company. Using the 2021 figures reported by management, the company is trading at a price-to-earnings multiple of 11.6. The price to adjusted operating cash flow multiple is substantially lower at just 6.6. And the EV to EBITDA multiple of the firm should be 5.8. When I last wrote about the firm, the price to earnings multiple was 12.1. Meanwhile, the price to operating cash flow multiple I calculated was 4.2. So in one way, shares have gotten cheaper. And in another, they have gotten more expensive. I did not, at that time, perform an estimate based on the EV to EBITDA approach. Using instead, the 2022 estimates, the price to earnings multiple would be 10.8. The price to operating cash flow multiple would be 6.1. And the EV to EBITDA multiple would be 5.4.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, the companies ranged from a low of 6.5 to a high of 15.8. Using both the 2021 and 2022 estimates, I found that two of the five firms were cheaper than our prospect. I then did the same thing using the price to operating cash flow approach, resulting in a range from 2 to 40.7. Once again, in both scenarios, three of the five companies were cheaper than our prospect. And finally, I did the same thing with the EV to EBITDA approach, resulting in a range of 3.1 to 9.4. And three of those five firms were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Schneider National | 11.6 | 6.6 | 5.8 |

| TFI International (TFII) | 15.8 | 12.3 | 9.4 |

| Ryder System (R) | 8.4 | 2.0 | 4.0 |

| Covenant Logistics (CVLG) | 6.5 | 5.4 | 3.1 |

| Daseke (DSKE) | 15.0 | 5.3 | 6.0 |

| Yellow Corp (YELL) | N/A | 40.7 | 4.5 |

Takeaway

In recent months, Schneider National has exhibited a nice bit of upside, driven by strong fundamental performance to end the 2021 fiscal year and because of strong guidance for 2022. On top of this, the company has been active on the mergers and acquisitions front and shares are trading at levels that still look attractive on an absolute basis, even though the company might be fairly valued relative to similar firms. I do believe that the easy money has likely been made. But if management is accurate about the outlook for the current fiscal year, I would make the case that shares probably still do have some additional upside potential moving forward.

Be the first to comment