claffra

On Wednesday, OPEC+ announced a 2 million barrel/day reduction in its production limit in an effort to support oil prices, which had fallen over the past few months amid a strong dollar and growing recession fears. With OPEC working to keep a floor under oil prices, the rebound in drilling activity that has been occurring in the US and other non-OPEC nations is poised to continue as higher prices all else equal, encourage more production. Given the potential for further Russian disruptions, the outlook is even brighter.

Considering this backdrop, it is not surprising that Schlumberger (NYSE:SLB), the world’s largest drilling services company has performed well, up 36% over the past year. However, these gains have only helped to claw back some of the losses of the past five years. While increased productivity gains have meant exploration & production companies will likely never need to buy as many services to get a barrel of oil out of the ground that they did several years ago, capex budgets are rising and will likely continue to do so. So even though SLB is unlikely to reach its past heights when shares passed $100, at $42, I think there is further upside.

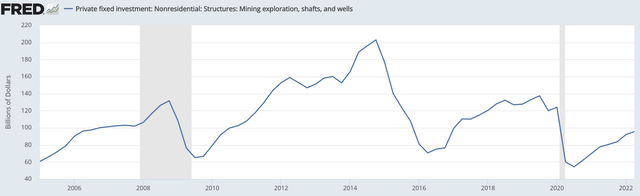

First, as you can see below, investment in exploration and wells (the GDP category under which oil & gas capex falls) plummeted when COVID hit. Since then, it has been steadily rising and reached $95 billion last quarter. This though is still well below 2019 levels and just half the level during the boom in 2014. Now, US oil producers have become far more conservative; eight years ago, production growth was the primary focus. Today, companies like Devon (DVN) and Pioneer Natural Resources (PXD) are prioritizing free cash flow and single-digit production growth.

Given this changing mindset and the productivity gains technology developed by firms like Schlumberger have produced, getting to $200 billion in spending is unlikely. However, with E&Ps still targeting production growth, the moderate growth in capital spending is likely to continue, which creates more opportunities for Schlumberger to generate revenue.

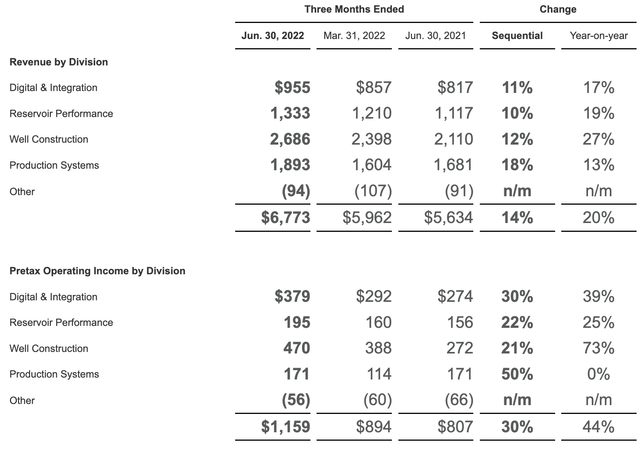

Indeed in this moderate capex cycle we are experiencing, SLB is generating solid gains. During the company’s second quarter, revenue rose by 14% to $6.8 billion. This revenue growth was broad-based, up 12% overseas (where it gets 80% of its revenue) and 20% in North America. SLB is showing tremendous operating leverage off of this revenue growth with adjusted EBITDA margins expanding 132bp to 22.6%. Adjusted EPS rose 47% to $0.50.

As you can see below, revenue growth was double digits across all segments, from segments involved in new drilling to those managing existing production. Each segment also reported faster profit growth than revenue growth. Given there is a fair degree of cost in maintaining their technology platforms, this operating leverage makes sense, and further revenue growth should continue to flow down to the bottom line.

Citing a “multiyear upcycle” in drilling activity, Schlumberger raised full year guidance. Management now expects over $27 billion in revenue. Given H1 revenue of $12.7 billion in revenue, H2 revenue will be at least $14.3 billion, representing an 8% increase from Q2’s level. With that level of revenue, the company should be able to generate $0.55-$0.57 in quarterly EPS. At a $2.20 run rate, that represents a 19x P/E multiple.

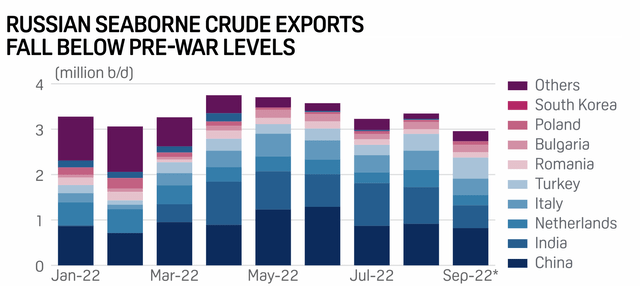

Importantly, I expect to see revenue and profit growth continue in 2023 and beyond. Here, I also think SLB’s skew to international operations is helpful. While US production is rising, and Schlumberger’s US business will benefit from this, there will be the need to raise production globally, especially to feed Europe’s demand. A remaining question mark is what will happen later this year as Russian oil faces an EU embargo. Already, we are seeing Russian exports fall as a result of technology bans that are making its fields less productive. While China and India have been increasing their purchases of Russian oil, they have not offset declines elsewhere.

With no end to the Ukraine war in sight, we need to contemplate the possibility of Russian oil and gas being more permanently closed off from much of the world’s market. To replace that production, there will need to be significant medium-term production growth elsewhere, requiring a major upswing in global E&P spending, where Schlumberger’s global footprint will be a major asset. We have seen Russia weaponize its gas exports, and the same could happen in the oil market.

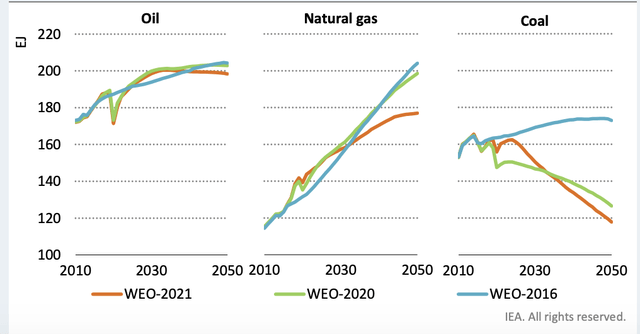

It is also important to emphasize that even with the push to decarbonize economies to address climate change, oil and gas will continue to be critical sources of energy. The IEA doesn’t expect oil demand to peak for ten years, and it barely declines by 2050. Natural gas demand is expected to rise for 30 years, albeit at a slower pace than once thought. There will need to be significant capex to support this demand for years, and the gains will need to be even higher outside of Russia to offset what may be structurally lower production. This is already causing countries to shift policies in ways once unthinkable. For instance, the United Kingdom is lifting a ban on gas fracking.

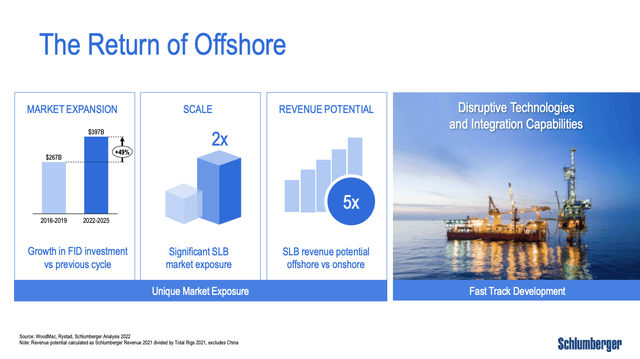

Additionally, the Inflation Reduction Act requires the Biden Administration to hold auctions for offshore oil and gas leases, a specific concession to Senator Joe Manchin. Back in June before the IRA was announced, Schlumberger CEO Olivier Le Peuch was touting the opportunity for growth in this segment, given SLB’s large footprint and industry-leading technology. This opportunity looks even bigger now. While selling leases is just the first step in the process, this is an added tailwind that will support medium-term growth.

Replacing Russian production and loosening restrictions for offshore production are factors that can turn what has been a cyclical upswing into a multiyear secular upswing for Schlumberger’s business. Over the next two years, I believe SLB can get back to the $32-33 billion revenue run-rate it had in 2018-2019, which assuming another 100bp of margin expansion would translate to $2.70-$2.85 earnings power.

That leaves SLB with just a 15x go-forward multiple. Given the potential for further secular gains as US offshore production returns and nations scramble to replace Russian barrels, this represents an attractive entry point. This is especially true given the strong free cash flow the business generates. The business is on track to generate over $2.8 billion in free cash flow this year, assuming flat working capital and over $3.1 billion next year. As a consequence, I would expect shareholder returns to accelerate. We are already seeing this. In May, Schlumberger increased its dividend by 40% to $0.18, though it remains well below its pre-COVID $0.50 level, so I would expect further double-digit increases in coming years.

Poised to benefit from a multiyear cycle, I would be a buyer up to at least 20x next year’s free cash flow, or about $48, which would be about 17x forward earnings. Schlumberger is a good way for investors to play the need for increased oil and gas production without having direct exposure to each $1 move in prices. I would be a buyer at current levels and look to add aggressively on any weaknesses.

Be the first to comment