RiverRockPhotos

Investment Thesis

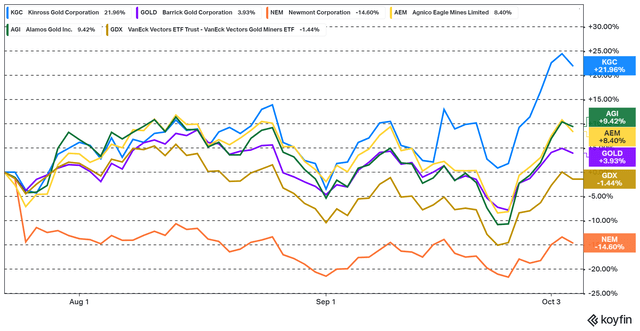

It has been a few months since I bought Kinross (NYSE:KGC) and wrote about it here on Seeking Alpha. The stock has performed well since the publication of that article, which is likely due to the very aggressive buyback strategy that was recently announced.

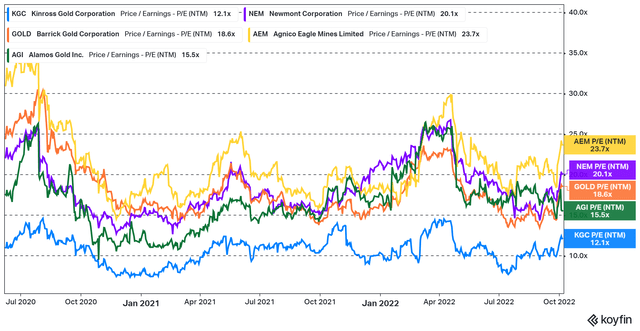

Kinross remains very cheap, both on an absolute level, and compared to many other gold mining companies. It is an excellent example of why valuations matter for companies with strong cash flows together with a good capital allocation strategy, which is why I think the strong performance is very likely to continue.

Buyback Strategy

At the end of September, Kinross announced an aggressive buyback strategy, with the commitment to buy back $300M worth of shares during the rest of 2022. The company will also use 75% of excess cash in 2023 and 2024 for buybacks, where excess cash is defined as free cash flow after paying interest and dividends.

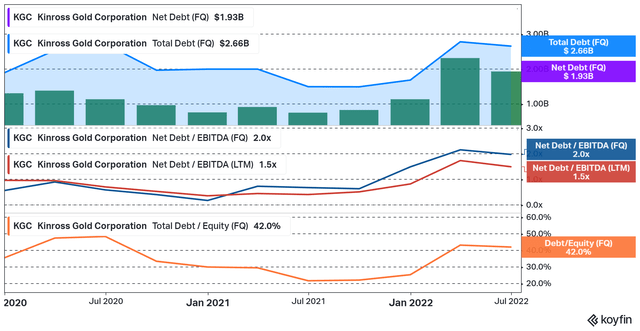

The buybacks in 2023 and 2024 will only take place if the net debt to last twelve months EBITDA is below 1.7. The buybacks might also be temporarily paused in the event of a ratings downgrade, major operational disruptions, or a significant drop in the gold price.

Note that the market cap of Kinross is only $5.1B today, which means the buybacks could decrease the number of shares by about 15-25% over the next few years, all depending on the price of the stock and the gold price over that period.

Q2 2022

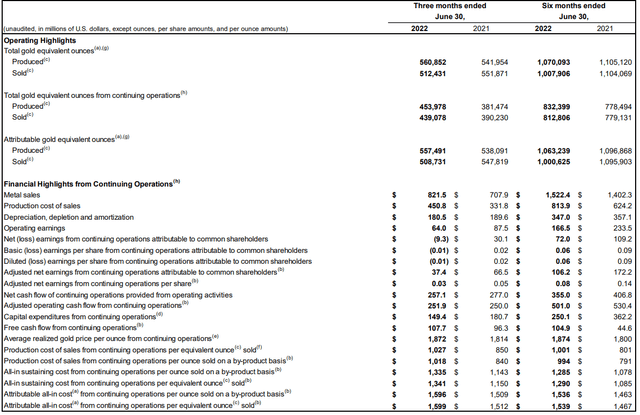

Figure 3 – Source: Q2-22 Earnings Release

Q2 2022 was weak for Kinross and came in below expectations, with an adjusted net earnings of $37.4M or $0.03 per share. Adjusted operating cash flow was $251.9M.

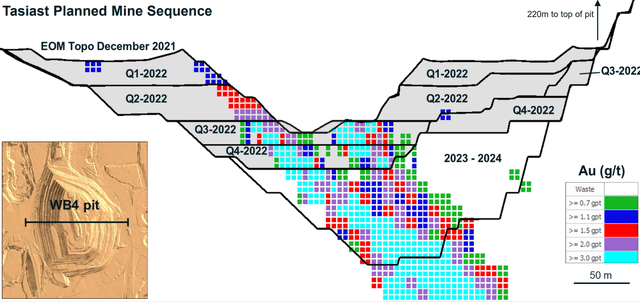

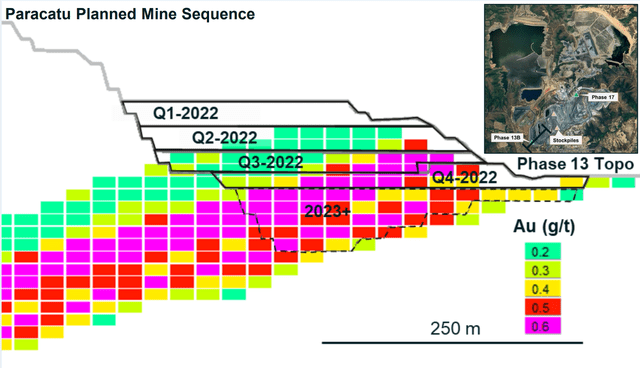

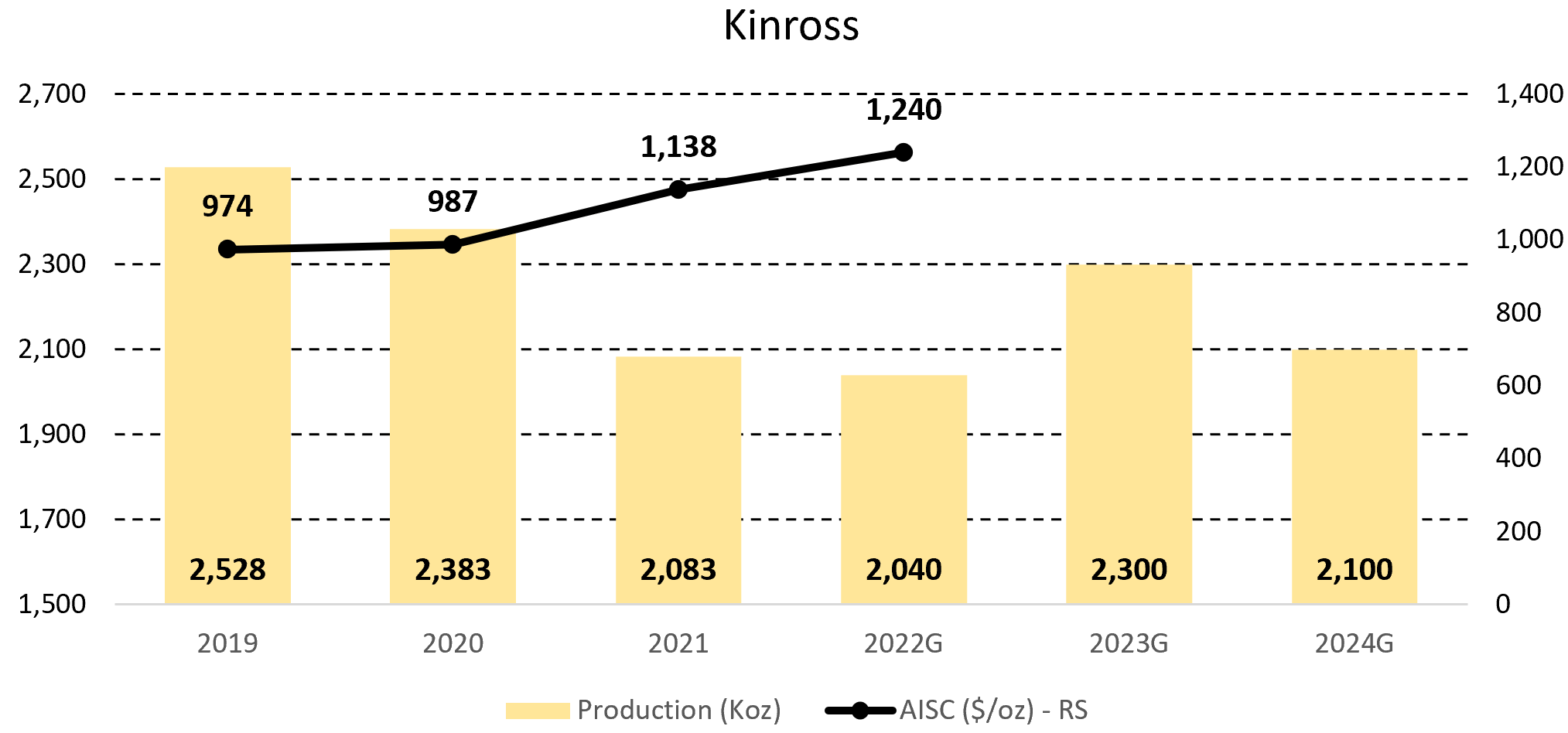

The company did in Q2 2022 have a gold equivalent production from continuing operations of 454Koz and an AISC of $1,341/oz. The high costs were due to a combination of cost inflation and mine sequencing where the first half of 2022 was expected to be weaker than the second half. Both Tasiast and Paracatu will start to mine higher grade material in the second half of the year, which will continue over the next few years.

Figure 4 – Source: Q2-22 Presentation Figure 5 – Source: Q2-22 Presentation

Kinross did however increase the AISC guidance in 2022 from $1,150/oz to $1,240/oz and communicate that production is expected to be at the lower end of the +-5% production guidance of 2.15Moz, which takes it to about 2.04Moz. This was apart from the inflationary pressures, primarily due to temporary delays in the mill ramp-up at La Coipa, which is now expected to reach full production in Q4 2022.

While revised guidance is never ideal, it is not a major concern to me. La Coipa has been making progress in Q3, and the company has not adjusted the production guidance for 2023 and 2024.

Impact from Higher Interest Rates

Over the last year we have seen interest rates climb substantially in most developed economies. While higher interest rates for longer is not my base case, in this section, I wanted to illustrate what the net effect would be for Kinross from a 5% increase in interest rates.

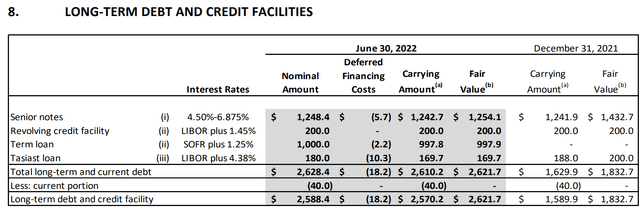

Figure 6 – Source: Kinross Q2-22 FS

Kinross has about $2.6B in total debt and $1.9B in net debt. Where about half of the total debt has a floating interest rate. A 5% increase in interest rates would cost Kinross an additional $69M in interest expense per year if we assume both LIBOR and SOFR would increase by an equal amount. That comes to 1.8% of last twelve months revenues and is a very manageable amount.

The company also has $500M of fixed rate debt that matures in 2024, which might indirectly be affected by higher interest rates at the time of the refinancing. I do however think it is reasonable to assume that if interest rates stay higher for longer, we would see Kinross deleverage some from today’s level.

Conclusion

While there have been some operational challenges in 2022, Kinross is still on track to grow production substantially in 2023. The company has yet to provide cost guidance for 2023 and it is difficult to know what the inflationary impacts will be. I do however think Kinross is likely to do well due to the improved mine sequencing from the largest mines and a greater amount of production coming from La Coipa going forward.

Figure 7 – Source: Kinross Quarterly Reports

Kinross has for quite a while been trading with a discounted valuation compared to many other gold mining companies. That probably made sense with a large portion of production and earnings coming from Russia. That is no longer the case, which is why Kinross is such an attractive stock at this level.

Normally, there is always a risk that the market fails to appreciate this discrepancy for quite a while. However, given the size of the buyback program and the cash flows Kinross will generate with this gold price, that is unlikely to be the case here. Unless Kinross experiences production disruptions, I think the stock will outperform over the next few years.

Be the first to comment