iambuff

Thesis highlight

I recommend going long on ScanSource, Inc. (NASDAQ:NASDAQ:SCSC) ($28.92 as of this writing). The company is a leading player in the industry it operates in, and it is led by a management team that has proven over the past few years to transition the business away from its legacy model.

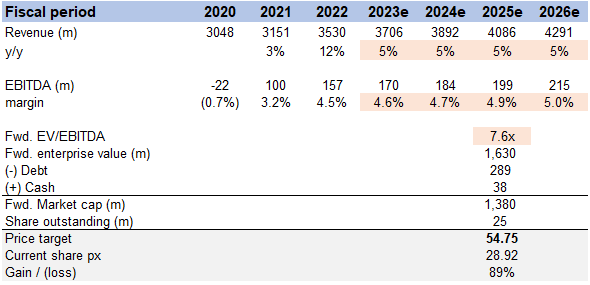

As SCSC executes its growth initiatives, I expect it to generate $215 million of EBITDA in FY26, with a 7.6x forward EBITDA multiple in FY25, resulting in an equity value of $54.75/share (implying an 89% potential upside).

Company overview

SCSC is a top hybrid distributor that links devices to the cloud while fostering partners’ business growth in the hardware, SaaS, connectivity, and cloud sectors. SCSC enables partners to provide their clients with solutions to deal with evolving end-user purchasing and consumption trends. SCS distributes hardware, SaaS, connectivity, and cloud service options from the top technology vendors through a variety of specialized routes to market. For mobility, barcode, POS, payments, physical security, networking, unified communications, collaboration (UCaaS, CCaaS), connection, and cloud services, SCSC provides technology solutions and services from more than 500 top vendors.

Customers of SCSC include companies of all sizes that sell to end-users in numerous industries. Important GTM channels include value-added resellers (VARs), sales partners or agents, independent sales organizations (ISOs), and independent software vendors (ISVs). Multiple paths to market are made available to SCSC via these customer channels.

SCSC has two operating segments as of FY22: Specialty Technology Solutions (59% of revenue) which consists of sales to customers in the U.S. and Brazil, and Modern Communications & Cloud (41% of revenue) which consists of sales to customers in the U.S., Brazil, Europe, and UK. In terms of geography, the company mainly operates in the U.S. (90% of revenues) while the remaining 10% of revenues come from its operations in Canada, Europe, Brazil and the U.K.

Investments merits

Growth and margin should inflect as higher-margin business grows to become a bigger part of the mix

Intelisys

SCSC’s business quality and profitability changed significantly following the Intelisys acquisition back in 2016. With Intelisys onboard, SCSC became the biggest worldwide master agent specializing in the sale of connectivity and cloud communications solutions (given the additional go-to-market channel).

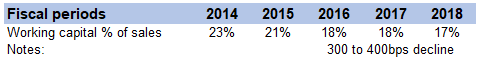

The economic model of Intelisys is very different from that of SCSC’s legacy businesses. Through its agency model, Intelisys enters into agreements with cloud service providers like RingCentral (RNG) and charges a recurring take rate on commissions billed throughout the duration of the contract. This agency model benefits SCSC greatly as it provides the company with a growing recurring source of revenue with a 35% EBITDA margin that doesn’t lock up capital in inventory or receivables. This effectively unlocks SCSC’s working capital for reinvestment into the business, and this can be seen from SCSC’s working capital as a percentage of sales.

Image created by author using data from SCSC’s filings and own estimates

It’s crucial to keep in mind that, although not distributing a product, Intelisys manages a critical component of the entire value chain-customer relationships. Intelisys brings onboard 200+ strong supplier contracts and choice, which reinforces and gels well with SCSC’s legacy business model of being a distributor.

Acquisitions of POS Portal and intY

The acquisitions of POS Portal in 2017 and intY in 2019 have increased SCSC’s services and its capacity for digital distribution, significantly enhancing its business offerings.

- Leading payment device distributor POS Portal improved the SCSC hardware-plus approach by offering hardware-related services including lifecycle management on behalf of ISVs and pre-configuring devices to operate when supplied.

- intY improves the SCSC cloud services sales model (compliments Intelisys’ pure agency model) through its CASCADE cloud services distribution platform, which links to vendors like Microsoft and allows agents and VARs to setup, price, sell, bill, and renew subscription software services.

Margins to inflect as high-margin recurring revenue represents a bigger portion of the business

Before the acquisition of Intelisys, SCSC was a mid-single digit growth business (4% CAGR from FY12 to FY16) and its gross margin was constant at around 10%. Intelisys’ revenue though highlights a stark difference as it carries very high gross margins, of nearly 100%.

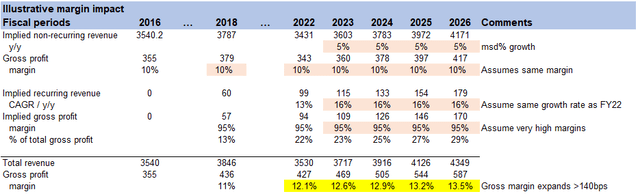

This is a typical instance of a rapidly expanding, high-margin business being concealed by an older, lower-margin segment. As Intelisys (majority of SCSC’s recurring revenue) takes up a larger portion of the revenue, margins will increase. Although SCSC doesn’t reveal recurring revenue, according to my calculation, the company could increase its gross margin by 140 basis points over the next two years. This additional gross profit carries a near 100% incremental margin as it flows down to SCSC’s bottom line (profit before taxes).

Image created by author using data from SCSC’s filings and own estimates

Strong value proposition

At its core, what makes SCSC valuable is its strong value proposition to both sides of the network: suppliers and sales partners. The sheer scale that SCSC has created through years of operation has further strengthened its barriers of entry, enhancing its competitive advantage. Today, SCSC is often the #1 or #2 channel partner for its key suppliers.

- Value proposition to suppliers: through a cost-effective variable approach, SCSC offers scale, access to clients through numerous channels to market, and reach into segments like small- and mid-sized businesses they cannot effectively target.

- Value proposition to sales partners: through training, marketing, and technical support, SCSC provides sales partners with access to various suppliers, more comprehensive solutions, and deep technical understanding while lowering working capital requirements and offering flexible financing alternatives.

Underneath the proposition to both sides of the network is SCSC’s position as a pure channel player – where it does not compete with suppliers and sales partners. This is extremely important as the company builds trust, which, in my opinion, is a competitive advantage that is underestimated. To illustrate this qualitatively, imagine the scenario where a start-up wants to replicate the SCSC business model and scale. It would take years of effort to convince each supplier and sales partner to be onboard, simply because the start-up is not known to be reliable.

The importance of trust is further emphasized as SCSC deals with leading technology suppliers such as Zebra and Verifone. These organizations would not want to be associated with “new” brands as it risks damaging their own brand reputation.

Digital and hybrid transformation improve scalability

SCSC has reorganized its operations to focus on the markets where it has sufficient scale for hybrid distribution. To do so, the company has implemented a new enterprise resource planning (ERP) system, merged five technology-focused business units into a solutions-focused structure, and sold off businesses outside the United States, Canada, and Brazil.

This is the right move to make as it positions SCSC to scale easily in the coming years when it is deploying more cloud solutions. It would be incredibly complex to deal with millions of data points across multiple databases as the company scales. As such, this benefits SCSC from an operational standpoint. With SCSC’s scalable platforms and infrastructure, it would be able to offer business partners dedicated solutions that better fit their needs. All in all, this move further increases SCSC’s value proposition.

The ability to provide cloud communications, connectivity, and infrastructure as well as software and security/SD-WAN as a service targets markets worth several hundred billion dollars. SCSC’s hybrid strategy opens up significant new markets for sales partners and growth possibilities. In Modern Communications and Cloud, where the fall in conventional on-premise communications (now accounting for 15% of sector revenue) has been a multiyear weight, the new TAM would significantly enhance the growth and profit potential.

Moving forward, I expect that there will be a continuous shift in the hardware mix to higher-value solutions in the Specialty Technology segment. As such, SCSC will enjoy growth via an increasing mix of higher-margin recurring revenue (as analyzed above). To put more meat into how value accretive the recurring revenue segment is, the gross end-user billings for Intelisys grew 20% to $2.25 billion in FY2022 (up threefold since the acquisition). This $2.25 billion has near 100% margin and, if realized today, will be five times FY21 gross profits.

SCSC Valuation

Price target

My model suggests a price target of ~$55 or ~90% upside from the current share price of $28.92. This is on the basis of mid-single digit revenue growth from FY22 to FY26E, an exit EBITDA margin of 5% in FY26, and a forward EV/EBITDA multiple of 7.6x. See the table below for my calculations.

Image created by author using data from SCSC’s filings and own estimates

Revenue growth and EBITDA margin

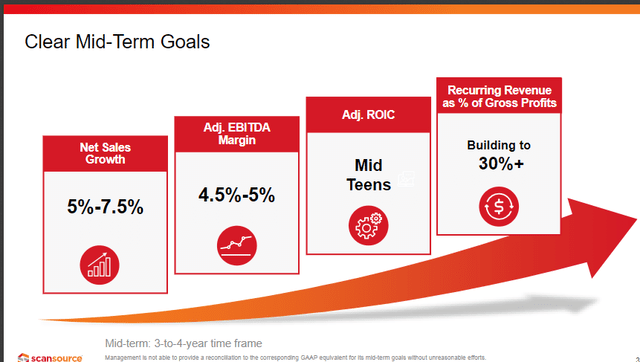

SCSC sells a variety of products and offerings to multiple end markets, so estimating the exact growth rate is hard. However, based on the investment thesis outlined above, I believe that SCSC can hit management guidance in terms of revenue and EBITDA margin.

- For revenue: I remain conservative on management guidance by forecasting it to grow at the lower end of the guided range.

- For EBITDA margin: I believe it is likely that SCSC can hit the higher end of the guided range (5%), given that gross margin has expanded by 25bps a year since 2016, and the recurring revenue segment is going to form a larger part of the business.

SCSC Sep’22 Investor Presentation

Valuation multiple

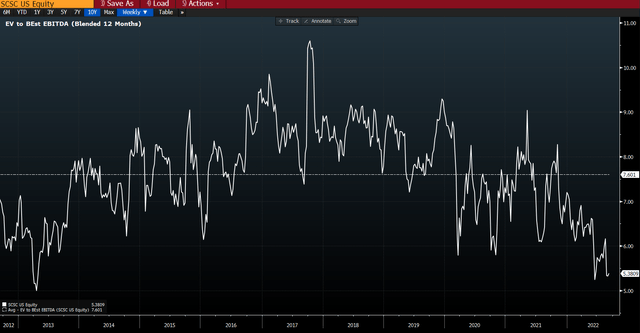

The reason for using a 7x multiple is that SCSC has historically traded at that valuation and, given the improved business quality (more recurring revenue in 4 years than today), deserves to trade back to historical levels.

Risks

Mis-execution

A large part of the SCSC thesis lies in its ability to improve the recurring revenue business that carries a higher margin. Although SCSC has been operating Intelisys for 5 years, they do not have experience in operating a large recurring revenue business (which I believe Intelisys will be in the future). This poses a risk in execution.

Accelerated slowdown of hardware business

While this is a known fact, if the slowdown accelerates thereby impacting overall financial performance, it may not look good optically. The narrative on the stock could easily flip from the current “transition story” to “mis-execution”, hence hurting the stock in the short term.

Thoughts on 4Q22 results

SCSC posted its 4Q22 results on 24 August 2022 with the following highlights:

- Revenue grew 12% to $962 million ($852 million in 4Q21)

- Gross margin expanded by 28bps to 11.51% (11.23% in 4Q21)

- GAAP EPS declined by 2.5% to $0.78 ($0.80 in 4Q21)

Overall, I think the results were alright. Revenue grew faster than I expected, likely due to certain billings being pulled forward, but the key thing to note here is gross margin expansion which shows that SCSC’s recurring revenue segment is becoming a larger mix of the business. While I think the results were alright, the market seems to have sold off following the results due to it missing consensus estimates. Personally, I have no idea how the stock price would react in each quarter, but as I have written above, if SCSC hit management guidance, the upside is significant.

Conclusion

SCSC is a leading player in the industry it operates in. Its competitive advantage lies in its compelling value proposition to both sides of its network, which increases as SCSC scales. As management executes to transition the company away from its legacy model, growth and margin should inflect as the higher-margin business grows to occupy a bigger part of the mix.

Looking ahead, the catalyst to reaching my price target would be SCSC successfully executing on its growth strategies and hitting management guidance.

Be the first to comment