Henrique NDR Martins/iStock Unreleased via Getty Images

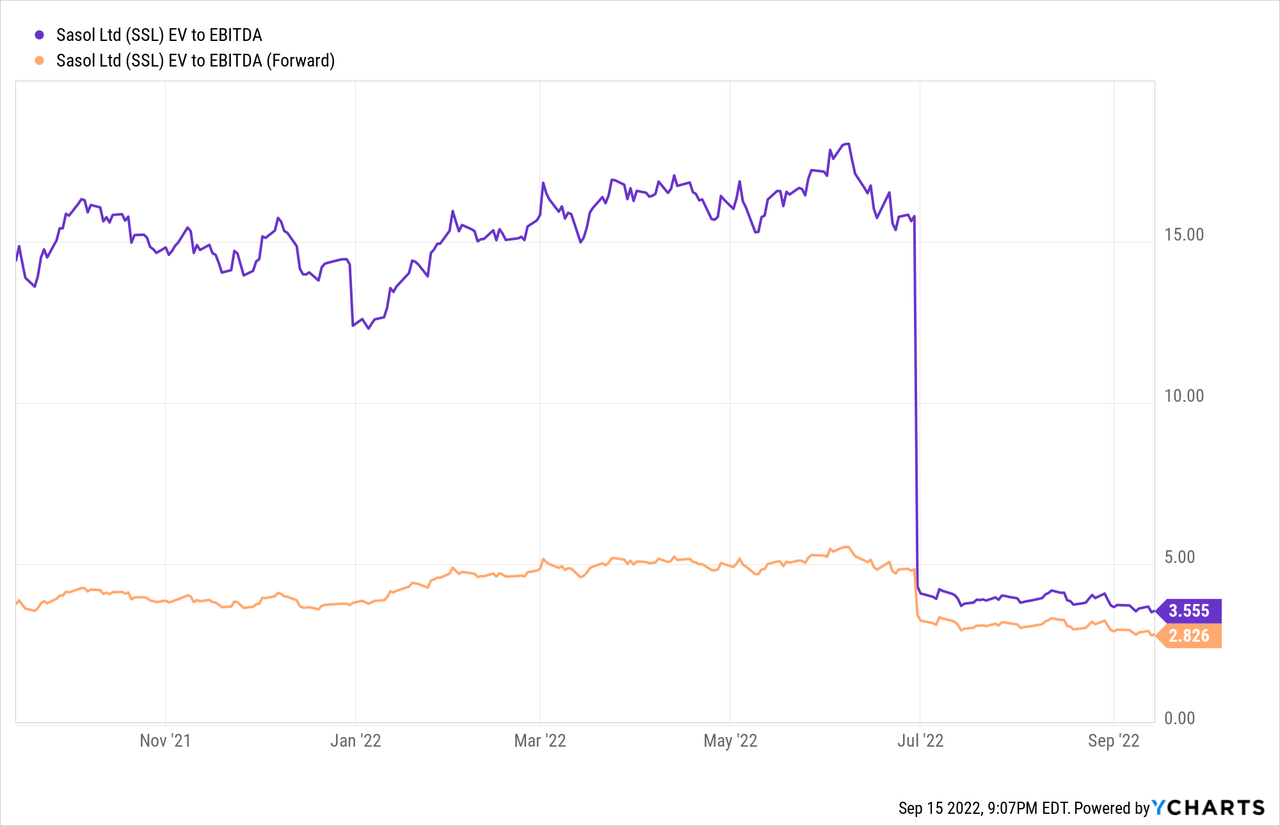

Sasol’s (NYSE:SSL) full-year result update validated investor bullishness heading into the print, with robust operational performance supported by a strong energy and chemical pricing backdrop. The balance sheet was another strong point, seeing significant de-levering to a net debt/EBITDA of <1x from better-than-expected organic cash flow generation and asset disposals. The strong performance has culminated in Sasol restarting dividends at a solid ~14.70/share, with ample room for upside if the recent performance sustains. Beyond 2022, the successful ramp-up of the Lake Charles Chemicals Project and the ongoing streamlining of its business operations will be key in removing any lingering overhang from balance sheet concerns. In the long run, risks from climate change issues remain; yet, at >3x fwd EV/EBITDA, investors get more than enough buffer, making the stock a great play on the oil price upcycle.

FY22 Surpasses Expectations as Dividend Moves Higher

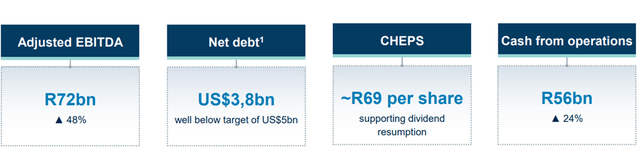

Sasol’s latest full-year trading statement saw a significantly improved financial performance, supported by a cyclical upswing in oil prices, refining margins, and chemical prices. These tailwinds culminated in a YoY margin increase, as Sasol’s revenue outperformance was complemented by strong cost and capex management. There were minor drawbacks, though, as strong pricing in energy and chemicals was partially outweighed by operational and mining productivity challenges. Still, H2 2022 EBITDA at ZAR40bn (+34% YoY) and ZAR72bn (+48% YoY) was impressive, even with lower chemicals sales volumes and realized oil hedging losses.

Similarly, core headline EPS for FY22 rose to 68.54/share (at the midpoint of the ZAR65.21-70.76/share guidance for the year), while basic EPS for FY22 was up ~100% to ZAR62.34. Of note, the headline earnings number was weighed down by the recognition of ~ZAR5.2bn of unrealized losses on financial instruments and derivative contracts. This was more than offset, though, by a net gain of ~ZAR9.9bn on re-measurement items, comprising a ~ZAR4.9bn gain on the realization of foreign currency translation reserves related to Sasol Canada’s shale gas asset divestment, ~ZAR2.9bn on the European Wax business divestment, as well as ~ZAR1.4bn from an impairment reversal in the chemicals business. The strong cash flow was funneled into de-levering the balance sheet, driving gearing down to 41.8% (from 61.5% in 2021), while net debt to EBITDA also decreased to 0.8x (from 1.5x in 2021). As a result, Sasol re-instated its dividend at ZAR14.7/share – equivalent to a peer-leading annualized dividend yield of ~9%.

Near-Term Guidance Buoyed by Industry-Wide Tailwinds

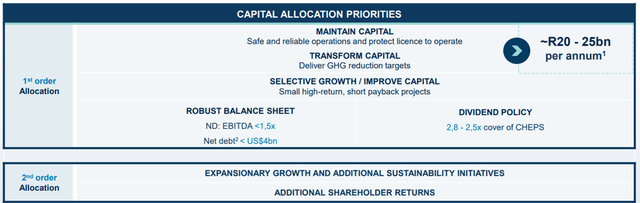

Heading into FY23, Sasol has updated its capex expectations at a very reasonable ZAR27-28bn, with cash fixed costs also in line with inflation for the full year. By division, the volume outlook for the energy business stands out, with mining productivity targeted to improve to 1000-1100 t/cm/s (up from 984 t/cm/s in 2022). Of note, Mozambique gas production is guided to hit around 109-112bscf, while liquid fuels sales are closer to 53-56mmbbls, and the ORYX GTL average utilization is targeted at 83-88%. Sasol has also hedged 29m barrels with a floor at $63/bbl and a cap of $97/bbl for the year. The chemicals business will see similarly strong tailwinds, with Africa sales volumes leading the way at +6-12%, followed by America at +5-10%, and Eurasia at +0-5% relative to FY22 levels.

Sasol has also maintained its dividend payout policy as well as its net debt/EBITDA target. Given Sasol’s balance sheet is already well within its leverage target and with higher energy prices supporting cash flow generation, expect further dividend upside in the coming year.

ESG Challenges Remain

While its core financial outlook appears bright, Sasol’s carbon issues remain the key headwind. Per management on the recent carbon pricing rate hike implications:

In South Africa, the recently proposed $20 carbon pricing rate by 2026, if implemented, will have an adverse financial impact for Sasol. This increase is still subject to consultation. In a conservative scenario, assuming all allowances fall away and the increase in price is applied, Sasol would need to consider tradeoffs to balance the people, planet, and profit agenda. At this stage, there is still uncertainty on what rate, trajectory, and allowance reduction rates will be applied. For this reason, the full analysis has not been incorporated into our decision-making approach.

At first glance, a $20/ton charge is a concern, particularly without offsets. Using Sasol’s 2022 EBITDA of 4.7bn as a starting point, this would imply a massive >$1bn in carbon taxes. Addressing this will require tradeoffs, in my view, and Sasol’s Secunda plant, the largest spot CO2 emitter, will likely be the key focus going forward. Potential options include shutting down the plant entirely and/or accelerating the transition to green hydrogen. Any ‘green’ transition will be costly, though, and comes with major execution risk, so some ESG overhang is justified at this juncture.

An Undervalued Play on the Oil Price Upcycle

Sasol’s core EPS and FCF numbers were all strong in FY22, but the key highlight was the dividend, which came well above expectations at ~14.70/share (annualized dividend yield of ~9%). While balance sheet concerns had long plagued the stock, the confluence of energy and chemical price tailwinds have allowed the company to de-lever and significantly improve its liquidity and cash flow position. In the likely scenario that Brent prices remain constructive amid the large demand/supply imbalance, I see prices sustaining at elevated levels through the next year or two, paving the way for further dividend hikes. The valuation is an added bonus at an undemanding <3x fwd EV/EBITDA. While the secular ESG headwind is a valid risk, the ample margin of safety at these levels makes the stock a compelling play on a sustained oil price upcycle.

Be the first to comment