PixelsEffect/E+ via Getty Images

Published on the Value Lab 17/6/22

Saratoga Investment (NYSE:SAR) is a lender to mid-market US companies. While they are diversified, risks are now systemic, with nowhere really to hide in the asset markets. Mid-market lending is more risky, and while solvency isn’t a concern, credit quality should be if employment were to fall due to the double pressure of rates and some immutable inflation factors. On the other hand, they are well positioned from an NII perspective for rate increases. While yields are high and multiples low, we pass on Saratoga categorically due to risks of capital impairment.

Q4 Note

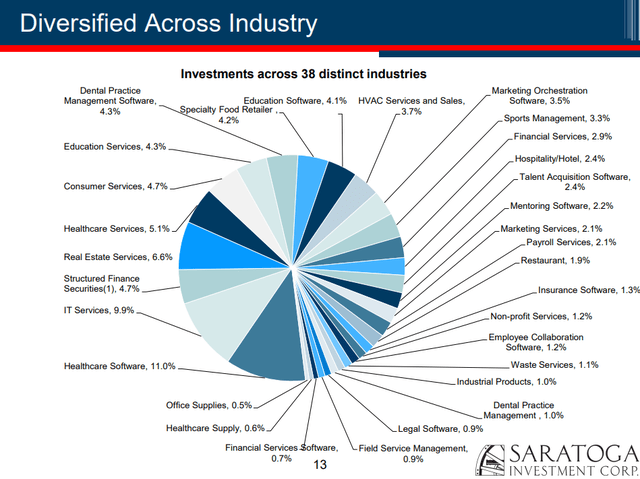

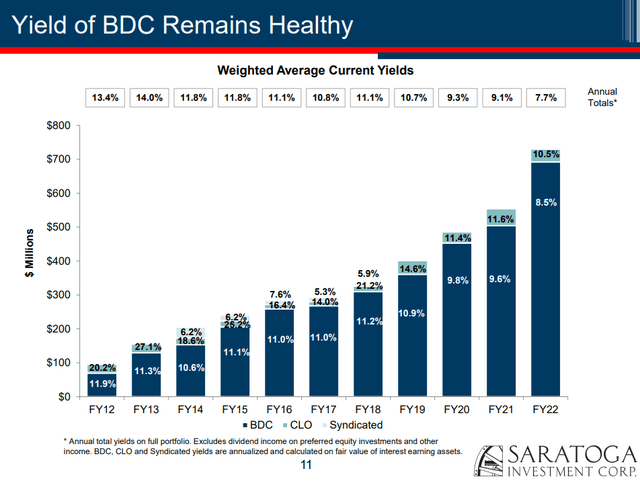

The Q4 demonstrates well the company profile. There is a high rate of origination and these loans carry nice yields. The companies are mid-market, between $2 million – $50 million in EBITDA, so really small companies, and with a decently large proportion of borrowers in IT. Origination is driving NII growth, while typical of the previously low-rate environment, spreads had tightened throughout the year.

Industries (Q4 2022 Pres) Yields (Q4 2022 Pres)

The company is well diversified geographically as well, but the issue is that the interest rate hiking environment poses a systemic problem for debt as an asset class. While the company doesn’t have a spread risk, as basically all of its assets are variable rate with debt being primarily fixed rate and long-term, it does have a credit risk.

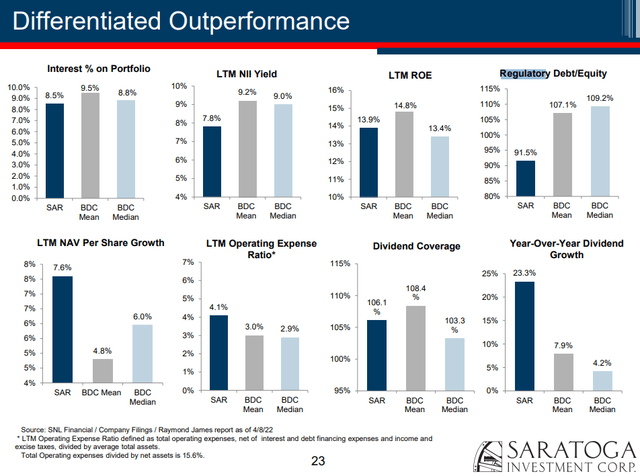

The leverage ratios are pretty low due to the profile of the company, with Saratoga having lower rates than peers, but impairment to assets would mean a lot of pain for potential equity holders.

Taking Inventory

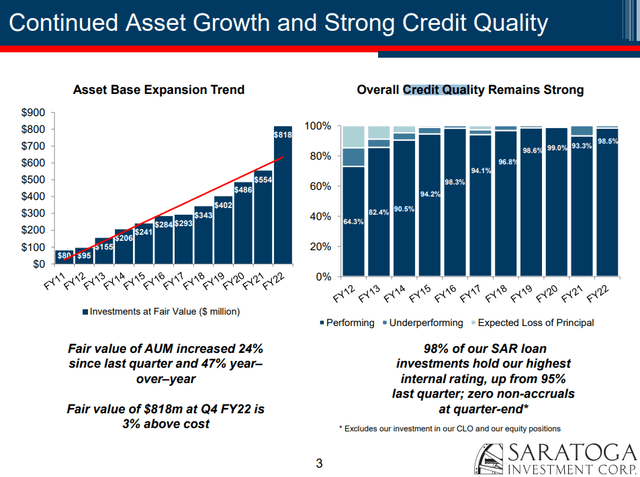

Consider the following chart. Due to accounting closure dates, the FY 2021 contains the COVID-19 impact.

Loans Could Undeperform (Q4 2022 Pres)

FY 2022 doesn’t represent an accurate representation of fundamental performance, as the rate environment and the spending boom would have saved most companies. With origination rates being high, causing a 50% increase in AUM, lending has been happening in a buoyant environment and occupies a third of the portfolio. Need to expand dry-powder to safe deals will mean concessions in credit terms.

Moreover, Saratoga invests in client equity as well sometimes in conjunction with debt, so a bit of PE style. While mark-to-market is tough with equities, declines in the equity market of more than 10% these last couple of days means that the value of these relatively risky assets are falling too.

Conclusion

The PE is low at 5.6x and the yield is almost 10% with good history of dividend growth. Ultimately, Saratoga is pretty safe from solvency issues, but for equity holders capital impairment risks exist. There is no more Fed put on US small businesses, and the market needs to acknowledge this newfound issue. The stock could decline much more as these equity risks become more of a concern with inflation and rate fueled demand destruction and employment level risks, and with other stocks trading at similar multiples but with much safer end-markets and assets, we are passing on stocks like these.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment