Panama7

In August, Sanofi (NASDAQ:SNY) (OTCPK:SNYNF) declined by almost 16% which represented approximately €13 billion of its entire market value. What happened? All were due to potential liability for Zantac. Here below, we report a paragraph from our previous publication:

Having checked Zantac product development, there are four enterprises that have been involved in ownership rights over time. In 2017, the drug was transferred to Sanofi; however, already in October 2019, the French company voluntarily withdrew its over-the-counter drug from the US. According to med research, Zantac can cause cancer, especially in the presence of specific foods.

Speaking of numbers, today there are less than 2,000 claims, but this might increase as the litigation moves forward. If we are looking at past drug settlements, we are ranging from $30k to $270k per person. If liabilities were cumulatively split over time, GSK would have been the major company impacted with almost 80% of the claims, while the other OTC manufacturers with the remaining 20% to be paid. Given the limited number of claims, Sanofi’s latest stage in the OTC drug, and its voluntary withdrawal, we are not assuming any liabilities in our Sanofi estimates.

Source: Sanofi – What Has Happened?

It’s important to emphasize how we were not assuming any liabilities in our Sanofi future estimates. As already mentioned, the company’s top management was cautious and also confident in the Zantac matter. We concluded our analysis by reiterating our buy rating target at €110 per share and doubling down our investment. Last week, we were not surprised to see a positive stock reaction (the company was up by more than 6%) thanks to a favorable court order that dismiss almost 2.500 lawsuits alleging links between cancer and heartburn medication. We really hope you get on board with us, but in case you missed the opportunity, we still believe in Sanofi’s long-term potential. In detail, the company is still trading behind the Zantac inquiry. At that time, Sanofi was at €97 per share with stands out half-year results. Here at the Lab, we also commented on the company’s Q3 results which were impressive. As a memo, Sanofi is targeting a 16% EPS growth.

Aside from Zantac’s positive outcome, on the 29th of November, Horizon Therapeutics, a US specialty biopharma company, announced a potential takeover offer from Sanofi, Amgen, and JNJ. The latter already dropped out, but Sanofi is still in the game. Being Horizon Therapeutics an Irish entity, under their rules, any parties involved need to make an offer by mid-January.

There’s a strong rationale behind this transaction. Horizon and Sanofi might be well matched given their respective portfolio in immunology and rare diseases. Sanofi already confirmed that any offer for Horizon Therapeutics, if made, will be in cash.

According to our estimates, we assess the following:

- €250 million in SG&A savings;

- €250 million in R&D savings;

- Sanofi’s presence ex-US could boast Horizon’s top-line sales, so we forecast a 4% revenue synergy;

- We forecast €1.5 billion in integration costs;

- Assuming a cash deal transaction founded by debt with an interest rate expense of 4% and considering a premium value of 40%, the deal should be equal to approximately $26 billion. We ended up with Sanofi’s net debt/EBITDA of 1.7x from the current 0.6x.

Based on our internal model and on a Pro-forma combination, the deal is already accretive in Year 1 by more than 5% and this number should increase and be at double-digit in Year 4.

Conclusion and Valuation

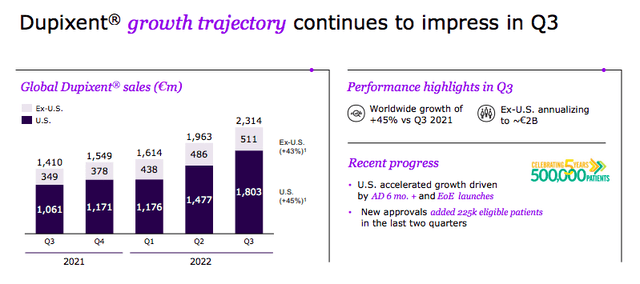

Our Sanofi buy case is still valid. Sanofi is a European dividend aristocrat with a strong pipeline and a positive track record in COGS improvement (ex-Euroapi spin-off). The company is currently trading at a 35% discount on a P/E basis compared to its closest peers. In detail, on our 2023 P/E estimates, the French pharmaceutical giant is priced at a P/E of almost 10x compared to an average EU peer of 13x. As a comparison, we include Roche, Novartis, Lonza, and Grifols (all companies which are covered by our team). We believe that this discount is not justified and our buy rating is then confirmed. Aside from the typical pharmaceutical industry risk that might affect our target price we also include: R&D failure, management ambitious to earning growth forecast, and increased Dupixent competition, a drug that accounts for almost 20% of Sanofi’s top-line sales and is a direct link to its BOI margin improvements.

Source: Sanofi Q3 results presentation

Be the first to comment