Michael H/Stone via Getty Images

Air Lease Corporation (NYSE:AL) stock has gained 14.6%, or a 15.2% total return, since I discussed Air Lease Corporation Q3 2023 earnings in November last year. The broader markets returned 15.1%, so I would say that while the stock did quite well, it did not show the strong outperforming nature that we are looking for. In fact, since I turned bullish on AL stock in May 2022, share price development has failed to impress as its 12% return in stock price value fell short of the 22% that the broader markets gained. Also, amongst Seeking Alpha analysts, there seems to be no strong consensus. In a recent report, Greathouse Research marked the stock as a strong sell while analyst Diesel has a buy rating in the stock. Back in November 2023, I marked the shares a buy while analyst Seeking Profits rated Air Lease Corporation stock a Hold.

So, as I said, there is no strong consensus among Seeking Alpha analysts. In this report, I will be discussing analyst expectations for the fourth quarter, provide a discussion of risks and opportunities and update my rating if need be.

Air Lease Corporation Q4 2023 Earnings: What Are Analysts Expecting?

For the fourth quarter 2023 earnings for Air Lease Corporation, analysts are expecting $660.2 million to $688.05 million with a $674.18 million median target projecting 12% revenue growth year-over-year. Earnings per share vary between $0.97 and $1.50 indicating flat EPS from the $1.12 midpoint estimate. So, in some sense the projected earnings do not quite look favorable as revenue growth is not translating to growth in earnings per share.

Over the past three months, estimates for Q4 2023 earnings for Air Lease also came down. Two analysts revised their earnings estimates up while four analysts revised downward. For revenues, one analyst has increased the revenue estimate while four analysts have revised it downward.

When Will Air Lease Corporation Announce Fourth Quarter 2023 Earnings?

Air Lease Corporation will be announcing its fourth-quarter results on the 15th of February before the opening bell. It will of course be interesting to see what the results will look like, but I am more interested in comments from management regarding the current supply and demand environment because the current market provides a rich mix of opportunities as well as big pressures.

The Risks and Opportunities For Air Lease Corporation and the Aircraft Leasing Industry

As there are various pressures and opportunities, each with their own dynamics it is very important to provide a meticulous assessment of risks and opportunities. I will be discussing the risks and opportunities in one section as a fading risk provides an opportunity and a fading opportunity can be considered a risk. Broadly speaking there are risks on supply side that are most pronounced I would say, while demand-side pressures are there to a lesser extent. Furthermore, there is some risk regarding financing costs.

Aircraft Manufacturers Cannot Build Planes Fast Enough

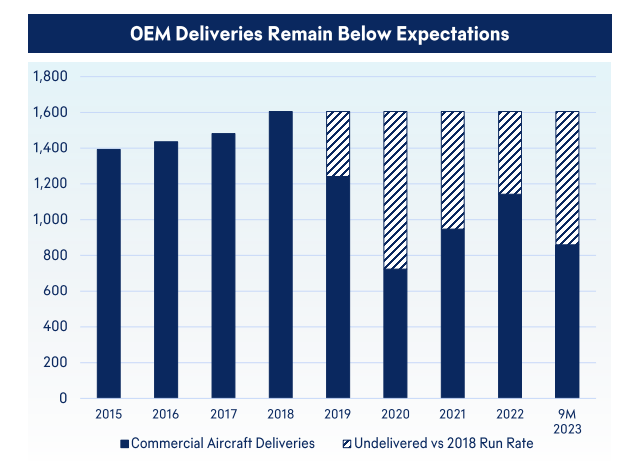

AerCap

The graph above is borrowed from AerCap’s Q3 2023 earnings slide deck and it provides an overview of the annual shortfall in deliveries from airplane manufacturers, most notably Boeing and Airbus. When the pandemic started in 2020, demand for airplanes tumbled. Airlines phased out airplanes that in the post-pandemic era needed to be replaced to capture the long-term growth trend. Most airplanes that were phased out were older wide-body airplanes in a relative sense. 16% of the wide-body jets were scheduled to be removed while for single-aisle airplanes this was only 8.6%. It does make sense that more wide-body jets were scheduled to be removed from service as most of these airplanes had been kept in service way longer than anticipated on the back of delays in wide-body development programs years ago. Those developments would provide a replacement for these jets and on top of that international traffic enabling long-haul operations was last in line to recover.

So, to some extent, the removals during the pandemic drive demand for airplanes as most jets do not return to service after they have been removed. Some jets eventually did return, such as the Airbus A380 which had a stronger-than-expected comeback but that is also driven by the fact that the pandemic resulted in further delays in airplane development and production. Parallel with demand imploding, jet makers reduced airplane production rates and along the entire aerospace supply chain efficiency and proficiency to build airplanes were lost. As demand has rebounded strongly, we have seen that jet makers have not been able to supply airplanes in line with demand and that is a continued pressure that is expected to remain there for several years.

Airbus delivered 11% more airplanes year-on-year, but its deliveries were essentially in line with what the jet maker had hoped to deliver in 2022. So, you are looking at a one year delay, and in 2023 we saw Safran hinting at Airbus bringing down its requested shipping, and in my discussion of Hexcel’s Q4 2023 earnings I also pointed out that the composite specialist saw softer demand for single-aisle programs in the second half of the year. The shortfall in deliveries is to a major extent driven by Boeing. The company had the Boeing 737 MAX crisis in 2019 that saw deliveries paused until December 2020. Last year, deliveries were halted as well to address a manufacturing defect in the supply chain leading to Boeing reducing its delivery forecast by 25 to 50 airplanes. Deliveries of the Boeing 787 have also been halted various times and the last halt in Dreamliner deliveries was in February last year. Furthermore, Boeing has only recently been able to somewhat stabilize its production on the Boeing 737 program, which pushed out increases in production, and it got worse for the jet maker. Boeing intended to raise production of the Boeing 737 MAX in February this year to 42 airplanes per month in its effort to reach a production of 50 to 57 airplanes per month by 2025-2026. Due to the problems with the Boeing 737 MAX 9, the FAA has barred Boeing from increasing production on the Boeing 737 MAX program. So, I would almost say that, instead of the outlook for new jet deliveries getting better, it got worse. That is not to say that I believe 2024 will see less deliveries, but we will still be in an environment that is more constrained from supply side than initially expected. The shortage is further exacerbated by the grounding of Geared Turbofan powered A320neo airplanes. On average, through 2026 there will be 350 airplanes grounded for 250 to 300 days taking additional capacity out of the market.

What does this mean for Air Lease Corporation? Their revenue growth is limited by the lack of supply of new jets. On the other hand, the company is able to book higher gains on the sale of new jets and can place airplanes coming off lease at a higher lease rate as the lower supply increases the market value of those airplanes. However, virtually all airplanes coming off lease are previous generation airplanes which are less fuel efficient or in other words have a lower value proposition than current generation airplanes. Simultaneously, besides passing through higher financing costs, the lessor is not able to pass through any increase in market value for current-generation airplanes and values for those jets have been recovering from the lows seen in the pandemic. Even in the current environment, lease rates for current-generation airplanes are 3 to 4 times that of older airplanes. In my view, there are simply not enough airplanes coming off lease to cover the shortfall in new airplane deliveries.

Airline Bankruptcies and Operating Costs

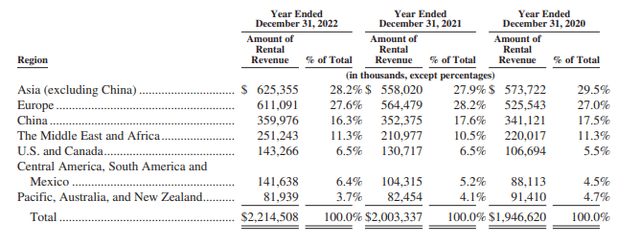

Generally, I don’t view airline bankruptcies as a major risk to lessors. Whatever fleet becomes available to lessors due to a bankruptcy can easily be placed on lease with other airlines and there aren’t that many airline bankruptcies. Gol (OTCPK:GOLLQ) recently entered Chapter 11, so it is not the case that there are very few bankruptcies. However, I believe that due to a combination of inflation and currency fluctuations, the Latin American market is more challenging as the traveling public in South America is more susceptible to events that increase cost of living eroding disposable income that could be used to fly.

Air Lease Corporation has not listed Gol as one of their customers, so they do not have the risk of having an airplane coming off lease and not generating revenues for a prolonged time as the airplane is being prepared to enter service with a new lessee. Generally, I don’t see major risk either as only 6.5% of the rental revenues is generated in Latin America and the airline has 200 customers across 70 countries.

However, what we should keep in mind is that many airlines are seeing elevated costs as labor costs have increased, and up to now, they have been able to successfully pass those costs to the consumer. However, one can wonder whether that is something that will last as it is unlikely that consumers can indefinitely carry rising costs of travel. Softening in demand is unlikely to result in lower revenues as existing lease contracts need to be honored and future placements with airlines are agreed on years in advance for multi-year periods. Short-term placements are not what lessors earn their money with, so I see little risk there. But we should keep an eye out either way as softening in demand could erode the ability to extend leases or place older aircraft with new operators at elevated lease rates. Softening demand would also reduce the margins booked on sales.

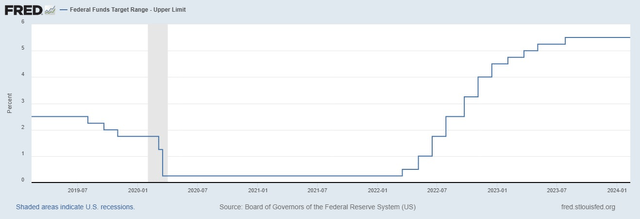

Cost Of Financing

In 2022, in an effort to reduce inflation, the Fed started increasing the interest rates and they now stand at 5.5%, which obviously makes borrowing money more expensive. The leasing business is a capital expensive business as each airplane roughly costs between $50 million and $150 million. So, a significant portion is financed with debt. As a result, Air Lease Corporation saw its composite interest rate increase from 3.07% to 3.42%

|

Q3 2023 |

Q3 2022 |

|

|

Assets held for operating lease |

$ 25,867.39 |

$ 24,142.50 |

|

Basic Lease Rent |

$ 604.03 |

$ 541.40 |

|

Interest Expense |

$ 161.77 |

$ 122.35 |

|

Depreciation and amortization |

$ 267.39 |

$ 242.50 |

|

Net Spread |

$ 174.87 |

$ 176.55 |

|

Annualized net spread |

2.70% |

2.93% |

Annualized net spread which measures how much a company generates after subtracting interest expenses and depreciation and amortization from the revenues relative to its assets held for operating lease. Year-over-year, Air Lease Corporation had lower debt but higher interest expenses due to higher debt and depreciation of flight equipment as its flight equipment asset pool grew. However, what we do see is that relative to its asset value the net spread did not compare favorably year-over-year. So, we do see quite clearly that the value extraction from the assets is subdued at present.

So, clearly higher interest rates are a risk because on existing leases Air Lease Corporation cannot factor in any escalation in interest rates. Interest rates escalators do exist, but that is to correct agreed upon leasing contracts prior to the start of the lease and not on existing lease contracts.

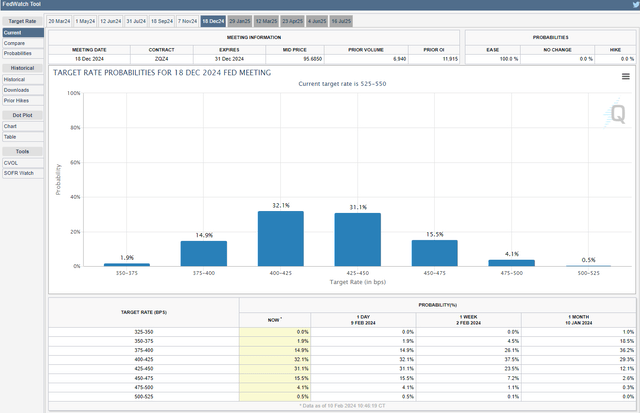

Fed rates are expected to remain relatively high, but by year end, the expectation is that the interest rates will be in the 400-425 bps region and 350-375 bps by July 2025. So, it is likely that we will pressure on net spread margins for some time. Additionally, if we consider the shortage of supply also driving up market values of new and older airplanes in combination with higher cost of financing and lower net spread margins, we can also find a reasonable explanation why lessors are less inclined to purchase airplanes in large quantities at this point in time.

Is a higher interest rate only bad? Somewhat counterintuitively, the answer is no. Generally, lessors have lower cost of financing than airlines, and as airlines came out of the pandemic loaded with debt, there already was a big role for lessors to provide airlines with the airplanes they needed without the high capital cost burden. A higher interest rate is only pushing more airlines to engage in long-term commitments with lessors for commercial airplanes.

What Is Air Lease Corporation Stock Worth?

|

Valuation Air Lease Corporation |

|

|

Common shareholder’s equity in $ millions |

$ 6,111.05 |

|

Common shares outstanding in millions |

111.03 |

|

Book value per share |

$ 55.04 |

|

Implied share price (5-year price-to-book) |

$ 39.20 |

|

Upside |

5% |

|

Implied share price (5-year price-to-book (pre-pandemic)) |

$ 52.32 |

|

Upside |

40% |

Airplanes are assets with strong value retention, so a price-to-book method to value Air Lease Corporation does make a lot of sense. The book value of Air Lease Corporation stock is $55.04 which provides a 30% upside. Using the five-year average price-to-book ratio, the upside would be limited to 5% with a $39.20 target. However, given that this five-year ratio includes the pressures of the pandemic, in my view it makes more sense to use a pre-pandemic price-to-book ratio which would bring the price target to $52.32, representing a 40% upside matching with the $53 average price target that Wall Street analysts have for Air Lease Corporation.

Conclusion: Air Lease Corporation Is Still A Buy

We’ve weighed the pros and cons of various risks and opportunities for Air Lease Corporation, looking carefully at where certain risks also provide opportunities and vice versa. I do believe that the biggest risk to the business currently is the pressure on single-aisle airplane delivery rates. However, even with that in mind, the assets already on the books provide a significant upside despite pressure on net spread margins. As a result, I am maintaining my buy rating for Air Lease Corporation stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment