jasonbennee

It’s been a rough year for Sandstorm Gold (NYSE:SAND) despite coming off a record quarter, with the stock underperforming its peer group. While this lagging performance vs. peers is partially justified due to the period of underperformance we often see for suitors following major deals (exacerbated by additional share dilution), Sandstorm’s current valuation makes little sense and is among the most attractive it’s been in years. So much so that its CEO Nolan Watson has been aggressively buying shares, purchasing ~$275,000 worth of shares in the open market at higher prices than current levels, in addition to the exercise of options and ~$688,000 spent acquiring shares in the recent financing.

The aggressive insider buying by the CEO is not surprising when Sandstorm is trading at a nearly 40% discount to its historical cash flow multiple vs. FY2023 cash flow estimates and a significant discount to its net asset value. In fact, Sandstorm is now trading at a producer-like valuation despite having a lower-risk business model, superior margins, and a growth profile that is among the best in the sector currently among all companies and the best growth among its royalty/streaming peers. So, while it’s easy to be negative about the recent share dilution, I think it makes sense to take advantage of this negativity since it is one of the best ways to make money in this sector as long as one is buying cash-flowing businesses with a relatively low-risk business model.

Recent Financing

Given that the financing is the subject of significant criticism, and some authors have noted that the company “lacks long-term goals” and has diluted significantly to which I would argue that I don’t know how else a company of its size completes ~$1.0+ billion in transactions outside of having a printing press like the Federal Reserve or drowning in debt, we will tackle this first and move on to look at the New Sandstorm later in the article.

Sandstorm announced an $80 million financing in September (which was increased to $92 million), and the deal caught many investors (including myself) by surprise. Not surprisingly, many investors were frustrated with the news, given that dilution is never ideal. Some investors noted that the whole point of owning royalty/streaming companies is to avoid significant share dilution. Others pointed out that Franco-Nevada (FNV) would never do something so ludicrous, and some pointed out that it makes zero sense to buy back shares above $6.00 only to sell them at $5.10.

These are undoubtedly fair points, and there’s no question that Sandstorm bit off a little more than it could chew by making two major acquisitions in a rising-rate environment, which suddenly turned into a rising-rate and falling commodity-price environment, further impacting its short-term cash flow. However, this was not a case where Sandstorm massively overpaid in the upper portion of a cycle. Instead, this was a case of Sandstorm acquiring at favorable prices in a period of extreme pessimism and getting an excellent price for Nomad/Basecore. I think this was a brilliant move for the company that transformed its portfolio, providing potential for a significant re-rating once new world-class assets start to come online (Greenstone, Platreef, Robertson, Hod Maden).

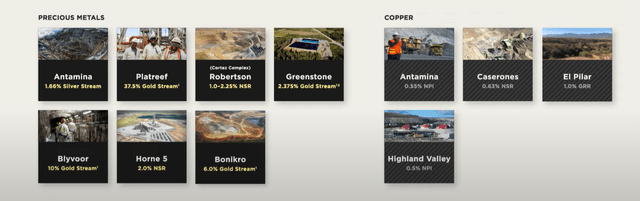

Key Assets Added to Sandstorm Portfolio In Past Year (Company Presentation )

I also think it’s important to make the following points:

- Sandstorm’s surprising bought deal financing has been criticized severely, but it’s actually relatively insignificant compared to the level of criticism the deal has received. I would argue that the deal has received more attention than companies in the development/construction phase who diluted in the lower portion of their multi-year range but with 70% plus share dilution, such as deals completed to finance Magino and Valentine were much worse and have led to irreparable share dilution. Hence, while no dilution is welcome, I don’t see the incremental ~6% share dilution as being that meaningful to the investment thesis or a deal-breaker by any means.

- Although Sandstorm previously repurchased shares at much higher prices than it diluted, the company shouldn’t be judged for not having a crystal ball. Given the inflationary environment, repurchasing shares below $6.50 made sense previously, with most believing that precious metals would respond more favorably to the macro backdrop, which they briefly did in 2020. Sandstorm also didn’t likely anticipate it would have the opportunity to acquire an established royalty/streaming company with a path to ~50,000 GEOs per annum for less than 1.0x P/NAV when it was buying back shares over a year ago. Hence, it didn’t have a more accretive use for its cash. Given the ability to look into the future with the hindsight knowledge that gold would head to $1,625/oz briefly with 8.0% inflation, the company might have been more patient with buybacks.

- Finally, while it’s true that Franco Nevada would likely never do a bought deal today for 5% plus share dilution, comparing Franco Nevada today to Sandstorm today is an apples-to-oranges comparison. The reason is that Franco Nevada’s scale, considerable cash flow generation, and available liquidity allow it to grow without dilution outside of its occasional ATM use. However, when Franco Nevada was a much smaller royalty/streaming company, it regularly raised capital and saw share dilution, and many of these deals had warrants attached. In fact, Franco Nevada saw heavy dilution in its high-growth phase, going from 90 million shares in Q1 2008 to 146 million shares by the end of 2012, translating to 60% share dilution. An example of some of these transactions is below:

- February 22, 2008 – Franco-Nevada Corporation (“Franco-Nevada”) announced today that it has entered into an agreement with a syndicate of underwriters led by BMO Capital Markets and UBS Securities Canada Inc., under which the underwriters have agreed to buy 10,000,000 units (the “Units”), from Franco-Nevada, and sell to the public at a price of C$23.25 per Unit, representing an aggregate amount ofC$232,500,000. Each Unit consists of one Common Share and ½ of one Common Share Purchase Warrant (the “Warrant”). Each whole Warrant entitles the holder to purchase one Common Share at a price of C$32.00 on or before the date, which is four years following the closing of the offering. In addition, the underwriters will also have an option exercisable for a period of 30 days after the closing of the offering, to purchase up to an additional 1,500,000 Units.

- May 27, 2009 – Franco-Nevada Corporation (the “Company”) announces that it has entered into an agreement with a syndicate of underwriters, co-led by BMO Capital Markets, GMP Securities L.P., and CIBC World Markets Inc., which have agreed to purchase, on a bought deal basis, 10.0 million Units of the Company at a price of $32.20 per Unit for aggregate gross proceeds of $322 million. Each Unit will be comprised of one Common Share and one-half of one common share purchase warrant (“Warrant”) of the Company. The underwriters will also have the option, exercisable in whole or in part at any time up to 30 days after the closing of the offering, to purchase up to an additional 1.5 million Units. In the event that the option is exercised in its entirety, the aggregate gross proceeds of the offering will be $370.3 million.

- Nov. 22, 2011 – Franco-Nevada Corporation (the “Company”) is pleased to announce that it has entered into an agreement with a syndicate of underwriters, led by BMO Capital Markets, which has agreed to purchase, on a bought deal basis, 8,000,000 common shares (“Offered Shares”) of the Company at a price of C$42.50 per share, for aggregate gross proceeds of C$340,000,000 (the “Offering”). The underwriters will also have the option, exercisable in whole or in part at any time for a period of 30 days following the closing of the Offering, to purchase up to an additional 1,200,000 common shares to cover over-allotments, if any. In the event that the option is exercised in its entirety, the aggregate gross proceeds of the offering will be C$391,000,000.

In summary, I certainly would have preferred not to see the dilution, but I am willing to give Sandstorm a pass here if this is the last of the dilution, and I believe it’s opened up an incredible opportunity to accumulate the stock.

The Current Setup

There’s no question that it’s been a busy year for Sandstorm and certainly a painful one from a dilution standpoint, with Sandstorm’s share count increasing materially to ~299 million shares outstanding. However, this wasn’t for naught, with Sandstorm adding royalties/streams on multiple world-class assets to its portfolio, including the monstrous future Platreef Mine which could deliver ~12,000 GEOs per annum by the end of 2028, the Caserones Mine in Chile, which provides exposure to copper from a long-life asset, the Robertson Mine which will be operated by the two largest gold producers (Nevada Gold Mines LLC), Antamina, which is a top-5 copper mine globally with a silver stream, and a sizeable stream on Greenstone, one of Canada’s largest future gold mines which will start contributing in 2024 (~400,000 ounces per annum).

Platreef PGM Mine (Ivanhoe Presentation)

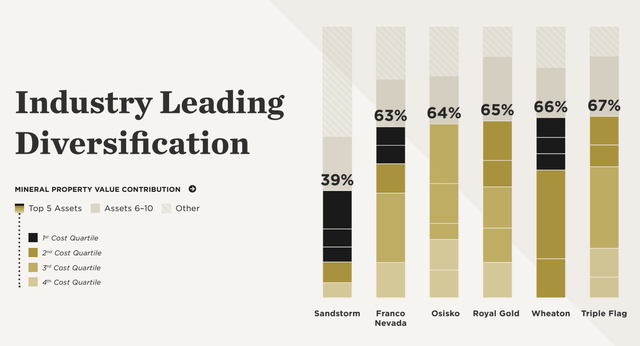

After the recent share dilution left a bad taste in investors’ mouths, many are laser-focused on the negative without the ability to look at the positives more calmly, and these positives couldn’t be more significant. Sandstorm has truly transformed its royalty/streaming portfolio to one with lowest-quartile mines even when stacked up against its largest peers, industry-leading diversification, and a growth profile (+80,000 GEOs over the next five years) that some junior royalty/streaming companies would kill to have. Most importantly, the bad news is now in the rear-view mirror; the company is up against easier year-over-year comps as it laps a period of weak gold, silver, and copper prices, and it’s secured this growth at an attractive price in a competitive market where securing this in the future won’t be as easy.

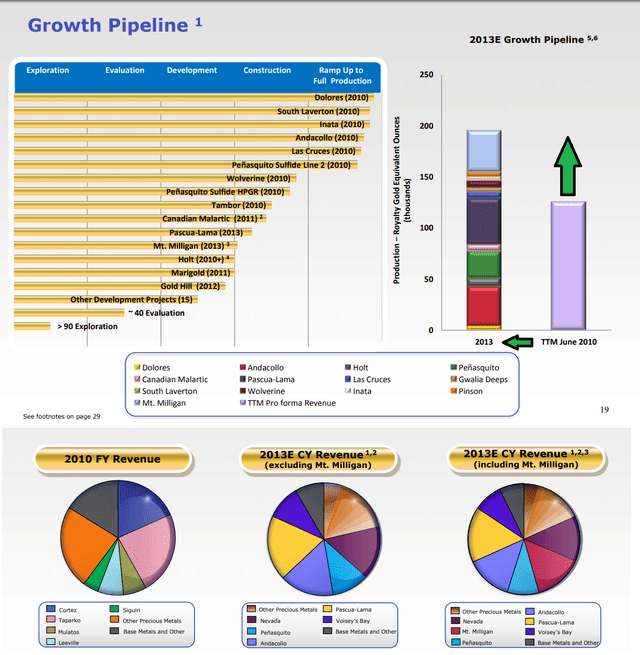

The result is that Sandstorm has an industry-leading growth profile with the potential to increase production by 85% over the next three years. Plus, it will see a significant improvement from a diversification standpoint, with the majority of its attributable GEOs coming from six assets (those contributing 1,000+ GEOs per quarter) to eight assets currently and twelve assets by 2025 (Greenstone, Blyvoor, Platreef, Robertson, Hod Maden, and Aurizona) and with much stronger partners, offset by Relief Canyon and Mercedes which will be winding down. So, I see this setup as quite similar to where Royal Gold was over a decade ago, having just completed three major deals and one smaller deal, including a stream on Mt. Milligan, the plan of arrangement with IRC (acquired for cash and shares), a gold royalty on Andacollo, and an added royalty on Pascua Lama.

Royal Gold 2010 Presentation – Assets & Future Growth (Royal Gold Presentation)

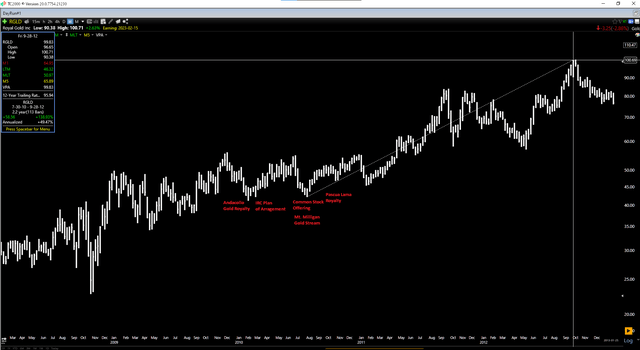

The chart above highlights how Royal Gold looked at the time (2010) and that it was seeing a significant improvement in revenue diversification over the next three years, just like Sandstorm Gold Royalties will (2022 —> 2025), already had a solid portfolio of operating assets, and would enjoy 50%+ growth in attributable GEOs over the next three years based on its estimates. Not surprisingly, the company also saw share dilution related to this growth, selling ~6.0 million shares in a public offering, seeing ~3.0% share dilution for its Andacollo transaction, and offering additional shares plus cash in its deal to acquire International Royalty Corporation. For investors willing to buy into this transition period that saw elevated share dilution ahead of future growth, they were handsomely rewarded, with the stock going on to rally 130% over the next two years.

Royal Gold Weekly Chart (TC2000.com)

The key to this strategy working, though, is that this aggressive portfolio transformation is done in a period of pessimism when one can secure solid deals for new assets and augment one’s portfolio with as little share dilution or balance sheet weakness as possible. Importantly, this is precisely what Sandstorm has accomplished, striking while the iron was hot, with sentiment in the sector extremely pessimistic, especially for royalty/streaming companies which were being thrown out with the bathwater like Nomad despite these businesses being inflation-resistant and seeing minimal margin compression (unlike their producer peers). So, while it’s easy to pick on the company with the unplanned dilution being an unfortunate consequence, I see it as a small price to pay for the transformation we’ve seen in its portfolio.

Sandstorm – Industry-Leading Diversification (Company Presentation)

Valuation

Based on ~300 million shares outstanding and a share price of US$5.20, Sandstorm trades at a market cap of ~$1.56 billion, which compares very favorably to an estimated net asset value of ~$1.84 billion after factoring in net debt of ~$520 million and estimated corporate G&A of $60 million. This represents the most attractive P/NAV multiple in its peer group among $1.0+ billion companies (~0.85x P/NAV). Investors are getting this price for a company with industry-leading growth and diversification, plus multiple assets in the lowest-cost quartile. In my view, this is a huge valuation disconnect.

To put the valuation in perspective, Maverix (MMX) was just acquired for ~1.0x P/NAV with a much smaller scale (estimated ~50,000 GEOs in FY2025 for Sandstorm vs. ~150,000 for Sandstorm).

Using what I believe to be a fair multiple for Sandstorm of 1.60x P/NAV to reflect the company’s superior diversification and higher exposure to precious metals vs. most of its peers offset by slightly higher jurisdictional risk, I see a fair value for the stock of ~$2.94 billion. After dividing this by 300 million shares outstanding, this translates to a fair value for Sandstorm of US$9.80 – 88% upside from current levels. Meanwhile, even in what I would argue to be an ultra-conservative scenario with a lower multiple of 1.50x P/NAV, Sandstorm’s fair value would come in at US$9.25, still representing a 70% upside from current levels.

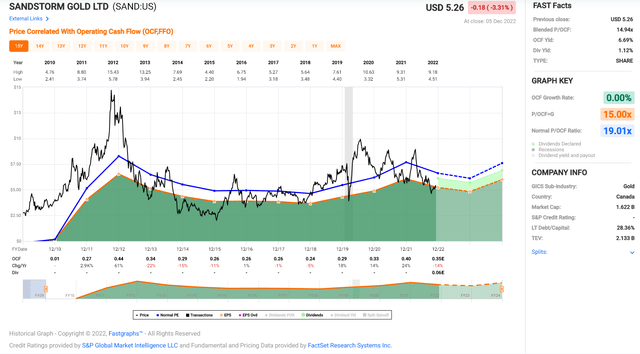

Sandstorm – Historical Cash Flow Multiple (FASTGraphs.com)

If we look at the stock from a cash flow standpoint, this confirms Sandstorm’s clear undervaluation, with the stock historically trading at ~19.0x cash flow (10-year average: ~17.2x cash flow) and currently trading at ~13.3x FY2023 cash flow per share estimates ($0.39). While this might not appear to be that much of a discount, I would argue that Sandstorm can easily command a multiple of 21.0x cash flow given that its portfolio looks the best it has in history with scale, diversification, and depth (lots of organic growth not currently modeled in future production estimates by the company). Notably, this cash flow estimate still pales compared to where Franco-Nevada trades at ~24.3x FY2023 cash flow per share estimates.

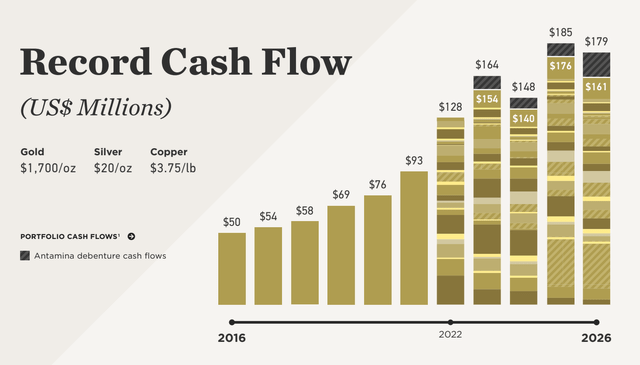

Future Cash Flow Projections (Company Presentation)

Even using a more conservative multiple of 20.0, which is only a 5% premium to its historical average (19.0x), Sandstorm’s fair value would come in at US$7.80. However, this doesn’t accurately capture the strength of this portfolio, with considerable growth expected between FY2023 and FY2025. If we look out longer-term and assume no new deals are completed and assume conservative metals prices, Sandstorm should generate over $195 million in cash flow in FY2025. Using a multiple of 21.0x cash flow to account for its larger scale (150,000+ GEOs) and assuming a flat share count translates to a fair value of US$13.65 (3-year price target). In summary, the current valuation could not be more attractive.

Summary

Royalty/streaming companies make for excellent additions to one’s portfolio, typically having lower beta and much lower risk (increased diversification, inflation-resistant), which is why they tend to outperform in precious metals bull and bear markets. Hence, I believe allocating capital to these stocks makes sense, with precious metals royalty/streaming companies helping to smooth out portfolio volatility and significantly reduce risk within the precious metals portion of one’s portfolio. The drawback that balances the pros of this strategy is that it can be difficult to justify owning these companies from a valuation standpoint when some consistently trade at an 80% or higher premium to net asset value.

However, Sandstorm today trades at a producer-like valuation at less than 0.85x P/NAV, which would be the equivalent of buying Franco-Nevada at below $65.00 per share, a level it hasn’t traded at since gold prices sat at $1,200/oz in 2018, and will likely never trade at again. Obviously, no two companies are the same; Franco Nevada is superior, given its scale, stronger balance sheet, and the fact that it has its tentacles in what seems to be nearly every world-class mid-scale and large-scale precious metals asset globally. Still, even if we use a much lower multiple than Franco Nevada commands to adjust for this, Sandstorm is significantly undervalued and reminiscent of Royal Gold in 2010, which outperformed the GDX by ~150% over the next two years.

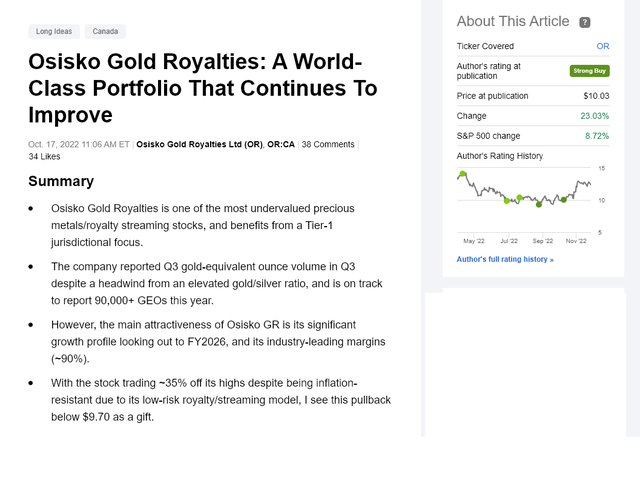

Osisko Gold Royalties October Article (Seeking Alpha Pro)

While it may not be popular, and one certainly has to find a way to ignore the noise, I see the current pullback in Sandstorm as a gift, with this being the best opportunity in the royalty/streaming space since Osisko Gold Royalties (OR) near $10.00 per share which I highlighted in October. Obviously, I could be wrong this time, and no two stories are the same even if they trade at similar valuations, but from a margin of safety standpoint, I see limited downside risk from current levels in SAND. For this reason, I recently more than doubled my position at US$4.80, and I would gladly accumulate the stock if we were to see further weakness.

Be the first to comment