megaflopp/iStock via Getty Images

Investment summary

We continue to see selective opportunities within US medical devices as investors look to shift up the quality spectrum. One such name is Sanara MedTech Inc. (NASDAQ:SMTI), a differentiated offering with niche exposure to wound care. The primary value proposition lies within the Cellerate portfolio, however, there looks to be a gap in current fundamentals to forward expectations. This has created a pricing asymmetry to the upside where we see shares fairly valued at $39. Rate buy on these factors.

Q2 earnings comments

The company derives the bulk of revenue volume from sales of the CellerateRX surgical powder. This is a hydrolyzed collagen that is indicated for surgical and non-surgical wound care, burns included. Collagen actually plays an important role in tissue healing throughout all stages of repair. There are numerous studies corroborating its efficacy in these applications. Globally, the hydrolyzed collagen market was recently valued at US$1.09 billion and was forecast to climb at a CAGR of 7.8% by 2032 to a market value of US$2.34 billion.

CellerateRX is a long-term compounder with exciting economics tied into the mix by our estimation. By the end of Q2, it was being sold in ~590 hospitals and ambulatory centres in 27 states. It is approved to be sold in a total of 1,580 facilities. Management estimates the total addressable market for CellerateRX, measured in terms of hospitals and ambulatory centres, is ~12,000 facilities in the US.

Net quarterly revenues of $9.7 million (“mm”) grew 54% YoY and was comprised primarily of organic growth. For the six months to date, revenue was $17.5mm, meaning the bolus of revenue was generated in Q2. The increase in sales was underscored by continued adoption of the Cellerate portfolio throughout the quarter. The gain of 54% is well above market growth trends and suggests to us that SMTI captured additional market share during the quarter.

The Scendia Biologics acquisition was also completed and this adds an entire suite of complementary biologics products and tuck-ins to the Cellerate portfolio. In particular, the acquisition looks accretive to the company’s cellular and bone matrix offerings, Amplify and Allocyte. These are differentiated offerings in a complex segment of osteo-cartilaginous tissue repair, where treatment failure rates are high. Scendia clipped revenue of $8.3mm in FY21. SMTI’s goal is to expand Scendia into an additional 18 states and eventually reach all 50 states. We estimate the deal to show accretion to the bottom line as early as the next quarter.

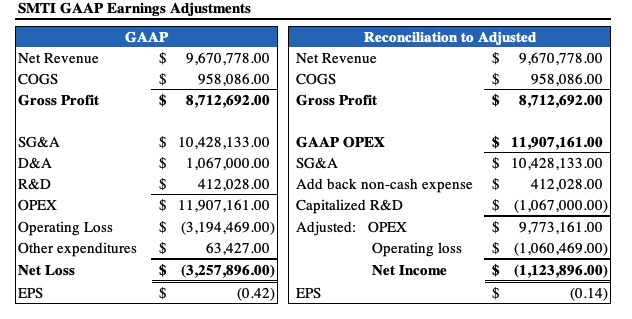

Reconciliations to GAAP earnings

Considering where SMTI allocated capital during the past 12 months and last quarter, several adjustments to GAAP earnings must be made in order to understand how much the company invested, where it allocated capital and the return on this investment.

As seen in Exhibit 1, we have capitalized 100% if the R&D investment and reconciled $412,000 in non-cash spend that was expensed on the income statement. This results in an improved operating loss and net loss to $1.06mm and $1.12mm respectively. In consequence, we estimate non-GAAP quarterly earnings to be at a negative $0.14 per share for the company. These adjustments also see a shift in shareholder equity up from $35.45mm to $35.86mm.

Exhibit 1. Reconciled earnings from GAAP accounting reveal narrower net-loss and improved EPS.

Data: SMTI 10-Q Q2 FY22

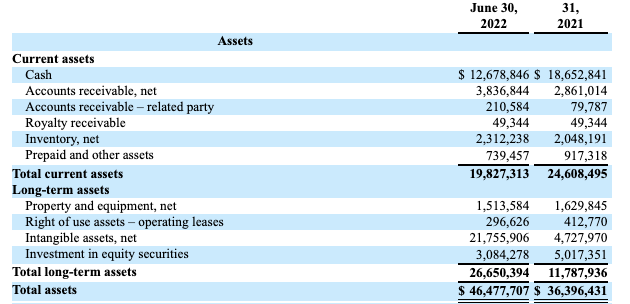

Factors to consider for valuation

Measures of value are where the risk/reward calculus begins to turn bullish for STMI in our estimation. As seen below in Exhibit 2, these are high quality assets we are buying into, with liabilities made up of accruals and operating leases. The absence of a goodwill ledger on the balance sheet presents a clean asset value. Pleasingly, inventory value only saw a marginal increase YoY whilst inventory turnover was flat at 2x. Following acquisitions made throughout the year, the company booked growth of 359% YoY in intangible asset value, lifting total assets and book value by more than $10mm.

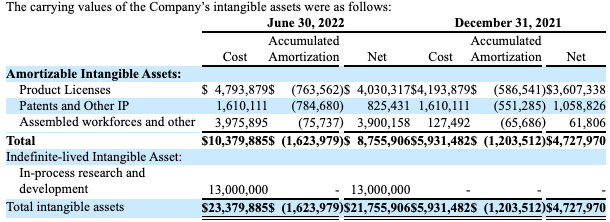

As seen in Exhibit 3, clarity is provided on the fair value of these investments. We are satisfied there is validity in the fair value of these investments, and note the $1.6mm amortization schedule on a straight line basis.

Exhibit 2. Note the absence of goodwill, despite recent acquisitions and increase to intangible asset value.

This is a ‘clean’ balance sheet that can continue to be put to effective use, by estimation.

Data: SMTI 10-Q Q2 FY22

Exhibit 3. SMTI intangibles are well-defined, and validate their presence on the balance sheet.

This is essential as oftentimes intangibles are booked precariously and do not warrant inclusion in measures of corporate value.

Data: SMTI 10-Q Q2 FY22

We note the company completed a $36.5mm capital spend with a NOPAT loss of $3.2mm, meaning ROIC was also -8.76%.

Valuation

Shares are priced at 7.9x TTM sales and around 7x book value. The market has also priced SMTI at 5.3x forward sales, a c.16% premium to the sector. This suggests investors expect the company to outpace the market again at the top line next year.

At 5.3x our FY22 sales estimates of $49mm shares are valued at $31.20. At this multiple to our FY3 estimates of $84mm and discounted back at 12.5%, SMTI is priced at $47.90. The arithmetic mean of both is $39.50, suggesting there is a pricing asymmetry to the upside yet to be realized in the name.

Based on the culmination of these factors we rate SMTI a buy. We have good clarity on what we’re buying, asset value is clean and clearly defined, whereas shares look to offer further upside capture in terms of valuation. Rate buy at price target $39.50.

Be the first to comment