wdstock

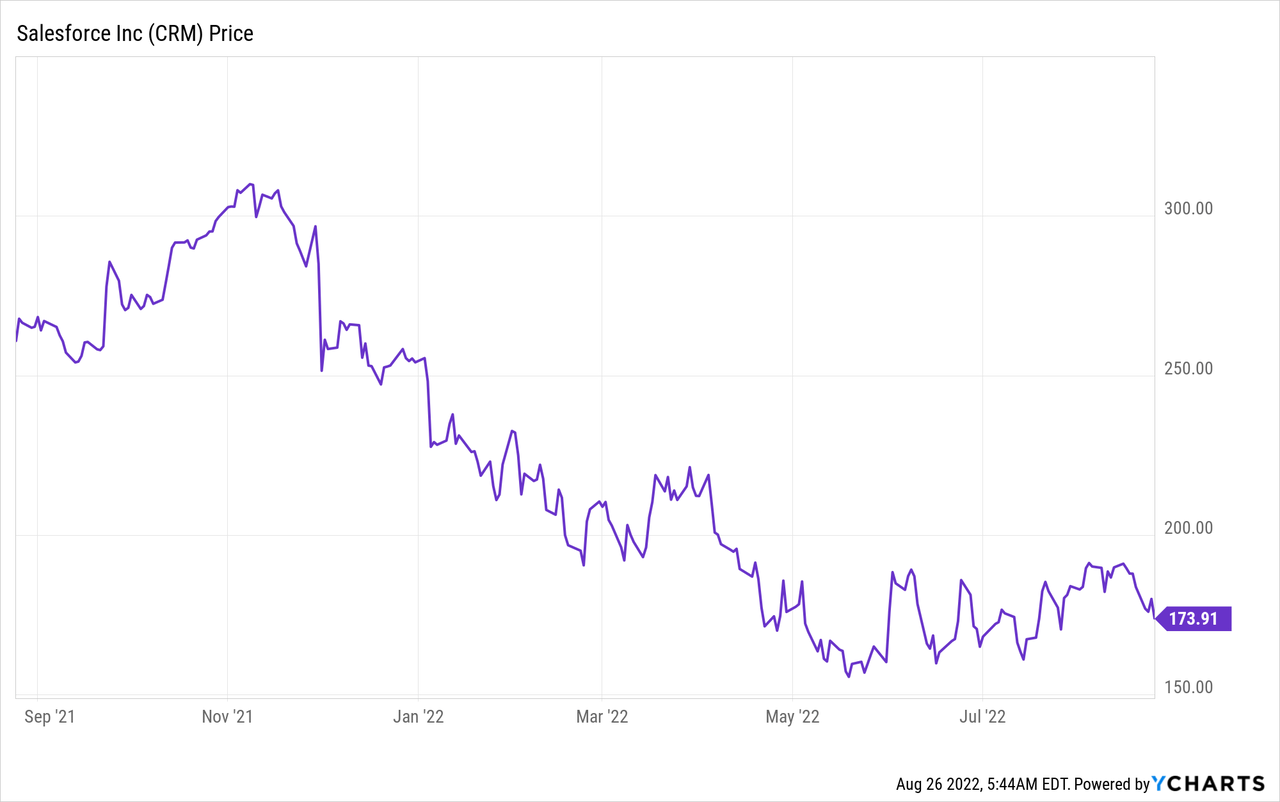

Salesforce, Inc. (NYSE:CRM) is a global software powerhouse which is most well known a pioneer in Customer Relationship Management [CRM] databases and the “Sales Cloud.” The company produced another solid quarter which surpassed analyst estimates for both revenue and earnings. Management even authorized the purchase of up to $10 billion worth of stock which is substantial. Given these factors the company is facing FX headwinds and the stock price is down 43% from all-time highs in November 2021. The good news is Salesforce is now undervalued relative to historic multiples and fairly valued intrinsically. In this post I’m going to break down the company’s most recent earnings report for Q2 and the valuation. Let’s dive in.

Salesforce’s Business Model Recap

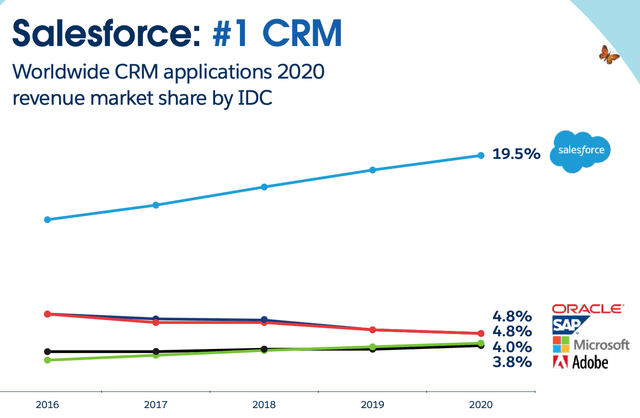

In my previous post on Salesforce, I outlined its business model and strategy in more detail. Here is a quick recap. Salesforce is the “Number One CRM” platform by revenue and is used by over 150,000 companies globally.

Salesforce CRM (Investor Presentation)

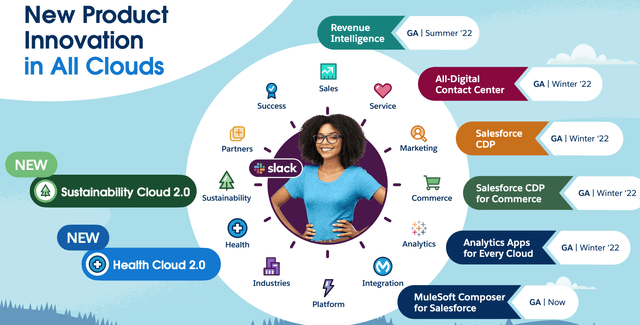

It is most famous for its “Sales Cloud,” which enables leads to be generated and assessed using advanced AI powered techniques such “lead scoring.” In addition, the company has a Marketing Cloud and Pardot which is a marketing automation platform for B2B. Salesforce also believes that the selling process doesn’t stop after purchase and provides a “Service” part of the business.

Product Platforms (Investor Presentation)

The company has historically adopted a growth by acquisition strategy and acquired platforms such as chat platform Slack, Data visualization platform Tableau and many more. Moving forward the company’s three pronged strategy for growth includes:

-

Land and Expand

-

Multi-Cloud Adoption

-

International Expansion.

Strong Financials

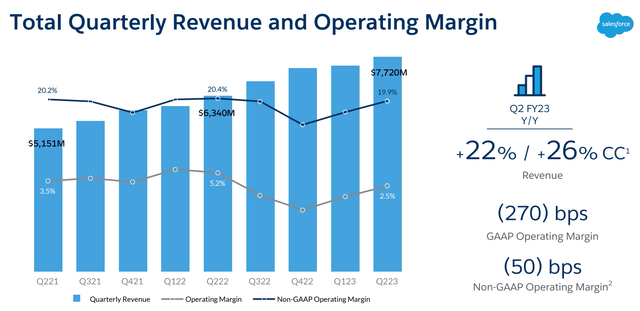

Salesforce generated strong financial results for the second quarter of fiscal year 2023. Revenue popped to $7.72 billion, up 22% year over year or 26% on a constant currency basis. It’s GAAP operating margin did decline by 270 bps year over year to 2.5% but this was higher than the past three quarters, as a trend towards margin recovery looks strong.

It’s Non-GAAP operating margin is a healthy 19.9%, which is only down 50 bps year over year and again has shown an upward trend over the past three quarters, which is a positive. However, keep in mind this does include $852 million for stock based compensation, which really is an expense but one could argue is a “non cash” expense. I provide more details on this in the “risks” section.

Revenue (Q2 earnings presentation)

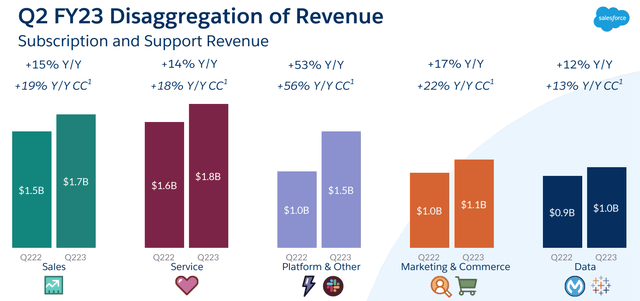

Breaking down the Revenue by segment. Subscription and support revenues were $7.14 billion, up 21% year over year. This is the core business of Salesforce and includes the product lines shown on the chart below. It’s flagship “Sales” app showed solid growth of 15% year over year or 19% on a constant currency basis. This is great to see given that platform was an industry pioneer and now faces much more competition in the industry (more on this in the risks section). It’s “Platform” product which allow enables teams to design and build customer applications was the fastest growing segment. Revenue for this product and other (Slack) popped by 53% year over year or a blistering 56% YoY on a constant currency basis to $1.5 billion. This is a disruptive product which enables the “low code” development of applications. The low code industry is expected to grow at a rapid 22.7% CAGR, reaching $86.92 billion by 2027. I believe this could be a key growth driver moving forward.

Revenue segments (Q2 Earnings Report)

The Salesforce Service revenue showed steady growth of 14% year over to $1.8 billion. While it’s Marketing & Commerce products jumped by 17% YoY to $1.1 billion, despite increasing industry competition. It’s Data platforms which includes the 2019 acquisition of Data visualization platform Tableau was only up by 12% year over year. I personally was expecting higher growth rates in this segment due to the proliferation of “big data” and the need to visualize this data.

Earnings per share [EPS] [GAAP] was $0.07 which beat analyst estimates by $0.08 which is fantastic. On a Non-GAAP, basis EPS was $1.19 which beat analyst estimates by $0.16.

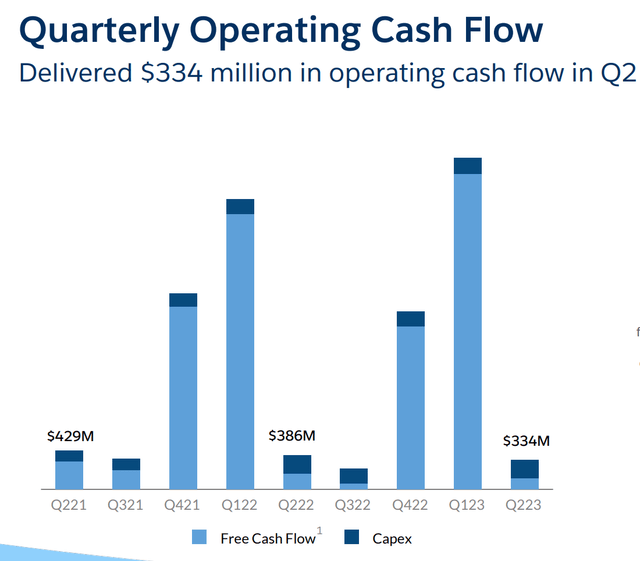

Operating cash flow for the second quarter was $0.33 billion, which was down by -13% year over year. With Free cash flow of $0.13 billion, down (24)% Y/Y. This decline was driven by an extra $10 million in capital expenditures and slightly lower operating cash flow. Although management is bullish on free cash flow growth of approximately 18% to 19% for the fiscal year, which is solid. From the below chart, you can see major spikes and dips in cash flow, at first this may cause alarm but when we dive under the hood we see the real reasons for this. Salesforce has a cyclical pattern of business in which its strongest quarter for new business is usually the fourth quarter and then the company invoices annually, hence the spikes in cash flow.

Cash Flow (Q2 earnings report)

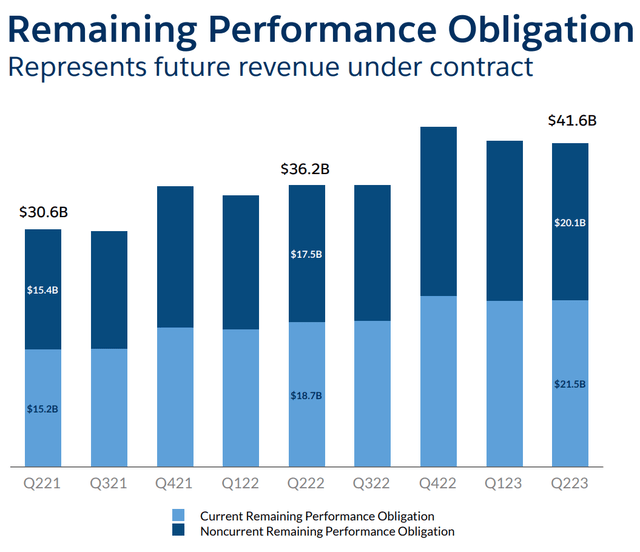

Remaining Performance Obligation [RPO] which represents the amount of future revenue under contract but not realized yet, gives an accurate foresight into future sales. RPO for the second quarter was $41.6 billion which increased by solid 15% year over year.

Remaining performance obligation (Q2 Earnings)

Solid Guidance

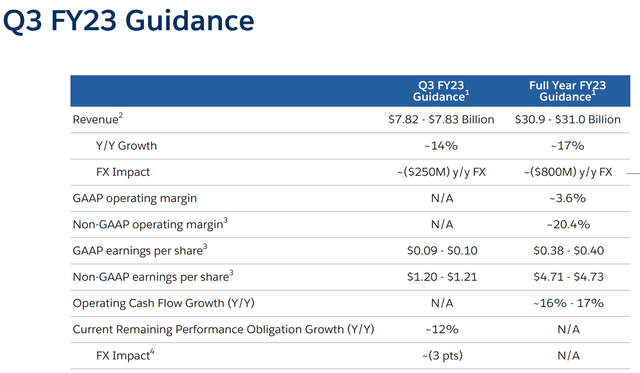

Management issued solid guidance, with third quarter FY23 of ~$7.82 billion up ~14% year over year or 18% on a constant currency basis. For the full year FY23, Revenue is expected to increase at a faster rate overall with ~17% YoY or 20% CC to $30.9 Billion and $30.1 Billion. Forex exchange headwinds seem the main issue for the company moving forward, as they make approximately 30% of their revenue from regions outside of the Americas.

Guidance (Q2 Earnings Presentation)

Salesforce has a fortress balance sheet with $13.5 billion in cash and marketable securities, up 40% year over year. In addition to total debt of $13.8 billion with “just” $1.2 billion being current debt (due within the next two years).

Advanced Valuation

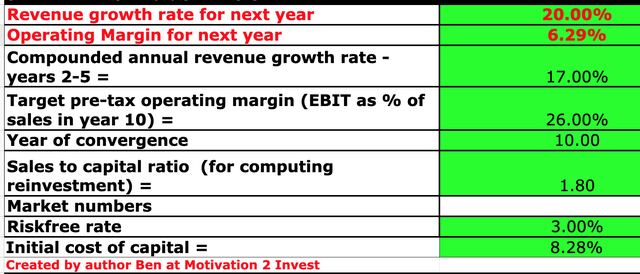

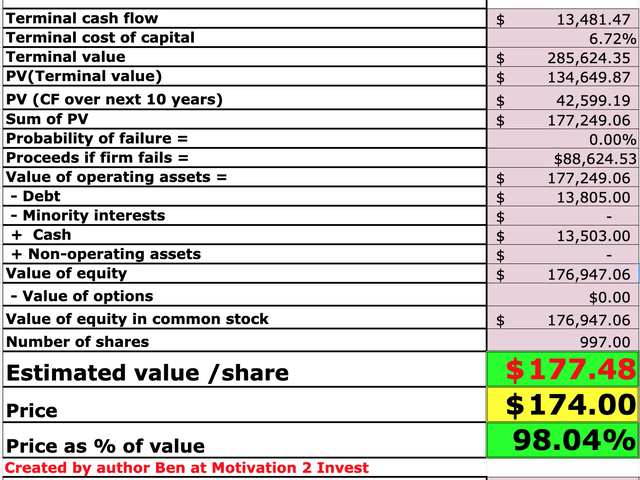

In order to value Salesforce I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 20% revenue growth for next year and a conservative 17% revenue growth for the next 2 to 5 years, which is not including any acquisitions.

Salesforce stock valuation (created by author Ben at Motivation 2 Invest)

I have also forecasted the company’s operating margin to increase to 26%, which is the average for the software industry as the company benefits from higher operating leverage and more upsells. I have also capitalized the company’s R&D expenses for extra accuracy.

Salesforce Stock Valuation 1 (Created by author Ben at www.Motivation2invest.com)

Given these inputs, I get a fair value of $177 per the share the stock is trading at ~$174/share at the time of writing and thus is “fairly valued” in my eyes.

As an extra data point, Salesforce is trading at a Price to Earnings [fwd] ratio = 37 which is 37% cheaper than its 5 year average.

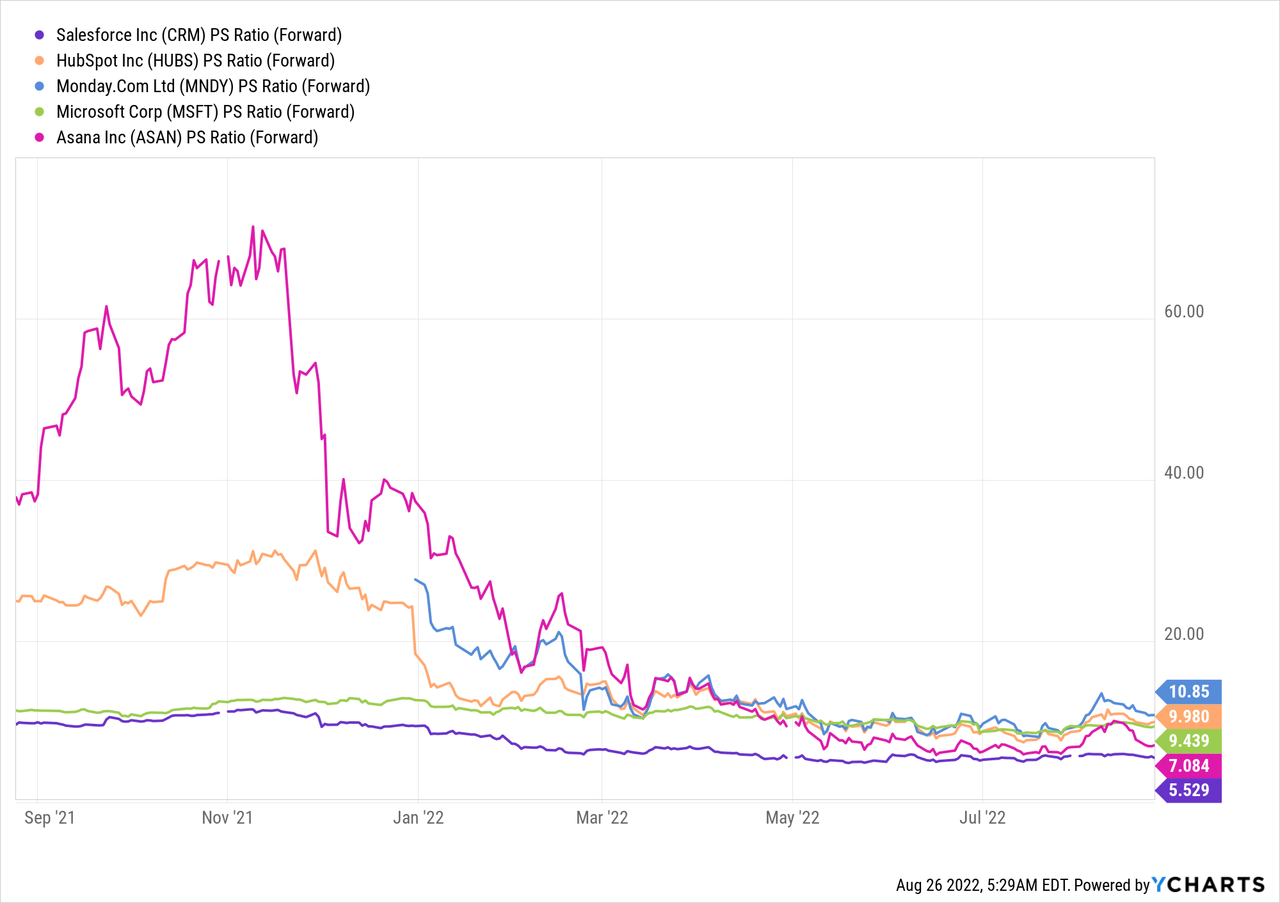

When I compare to other software companies, I see Salesforce is trading at the cheap end of the spectrum with a price to sales [forward] ratio = 5.5. Close competitor (but SMB focused) HubSpot (HUBS) trades at Price to Sales Ratio [forward] = 9.98

Risks

FX Headwinds

As mentioned previously, as the company makes nearly one third of its revenue from international regions, it is facing FX headwinds from a strong dollar. This is impacting revenue growth rate negatively. But the good news is that I believe this is only temporary, as exchange rates tend to move in cycles just like everything else.

Stock-Based Compensation

Salesforce paid out a staggering $852 million in stock-based compensation in the second quarter, which is the main reason we see a low operating margin on a GAAP basis. As someone who has worked for large tech companies, I understand that stock-based compensation helps to entice and retain the best talent and thus is necessary. But I do believe companies should have a long-term strategy in place to pay employees from earnings and also to be mindful of share dilution for the investor.

Competition

Salesforce was a pioneer in automated sales software and the CRM. However, these days there is plenty of cheaper competition which have effectively replicated many of Salesforce’s advanced features. For example, G2 reviews actually shows HubSpot to have a higher star rating of 4.4 out of 5, vs. Salesforce at 4.2 out of 5.

Final Thoughts

Salesforce is software powerhouse which enables enterprise teams all over the globe. The company’s growth-by-acquisition strategy has been working well over the past few years, and its “low code” platform is also showing strong growth. Salesforce is currently facing FX headwinds, and thus I do expect slower growth in the short term. However, I do believe the company could have another cheeky acquisition up its sleeve. The stock is “fairly valued” in my eyes and the platform has high “stickiness” which makes it a fairly “safe” bet for investors despite the competition.

Be the first to comment