Justin Sullivan/Getty Images News

Investment Thesis

Salesforce, Inc. (NYSE:CRM) guidance wasn’t the problem. The problem is that investors are becoming increasingly frustrated with their own GAAP EPS figures.

Approximately 8 weeks ago, I wrote an article about Salesforce called Going Nowhere Fast. When I wrote that article, the stock was $150.

Author’s work

Since that time, tech stocks have been ripping hard. And yet, notwithstanding all these capital flows, CRM at the time of writing is still $151 per share.

So, was there anything in this Q3 earnings report that you didn’t know 8 weeks ago? Yes and no. When I wrote “Going Nowhere Fast,” I implied just that, that Salesforce is going nowhere fast.

That being said, there are still a few noteworthy items to discuss. So, let’s get to it.

What About This For Context?

It’s all Go-Go in techland. Once again. Animal spirits are being felt on the Street. And yet, if you’ll permit me, I’m going to take a step back, so we can together take a step forward.

If we rewind the clock 4 years to this day, the CRM share price was very approximately $143. For the fiscal year 2019 (note, fiscal 2019 ended in January 2019), Salesforce ended that year with $13 billion in revenues.

And today, as we look ahead to this full fiscal year (ending January 2023), Salesforce is expected to end the year with more than $31 billion of revenues.

That’s more than twice the revenues in 4 years, or approximately 24% CAGR. Truly astonishing figures. We should ask Michael Mauboussin to stick that in his Base Rate book (page 22, ~3.2% chance of Salesforce’s performance).

But are shareholders any better off?

Revenue Growth Rates Fizzling Out

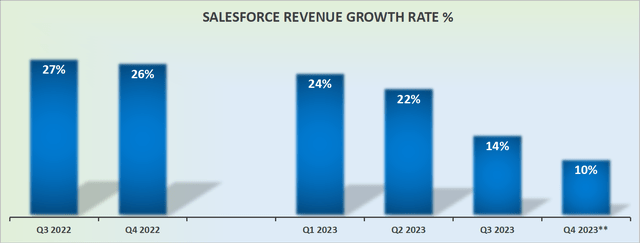

The figures above are as reported revenues. A lot of investors have clung to FX-adjusted revenues. But the irony is that when FX-rates were a tailwind last year, investors and companies alike barely made a peep about that.

But now that FX rates are a headwind, companies and analysts are making so much noise about this.

From where I stand, all I see is that Salesforce’s growth rates are slowing and the company is maturing. If a company is growing in the low teens, what sort of multiple does the company get?

Before answering this question, investors charge that these are not normal revenues. These are SaaS (Software as a Service) revenues. And SaaS revenues are stable, consistent, and predictable, which portends visibility. They are not cyclical commodities like revenues.

And on that note, I look back at the graphic above. Consider this, up until last quarter, Salesforce was growing at +20% CAGR. Now, it’s growing at low teens CAGR. If these revenues are not significantly exposed to the macro environment, what’s going on?

This is my point: SaaS companies are highly rated because they are supposed to guide stable growth rates. But it now appears that there’s a tremendous amount of cyclicality and macro exposure, even amongst the tech names.

Let’s now discuss Salesforce’s backlog.

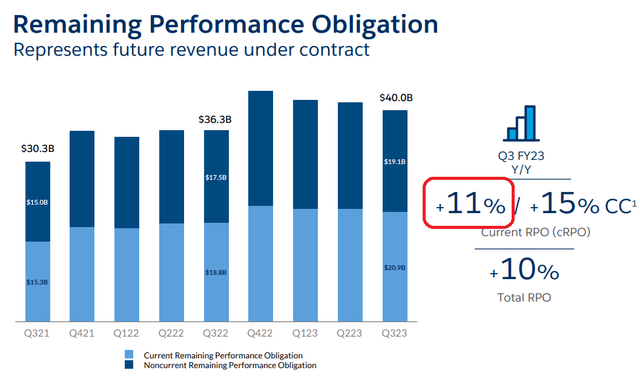

What you see above are Salesforce’s current remaining performance obligations. That means orders that have been recorded but not yet recognized as revenues.

Put simply, for a growth company, you want to see cRPO high. The higher the better. And ideally, the cRPO figure should be higher revenue growth rates. If that’s not the case, that means that future revenue growth rates could slow down. As it now appears to be the case for Salesforce.

Topic Du Jour, Mind the GAAP

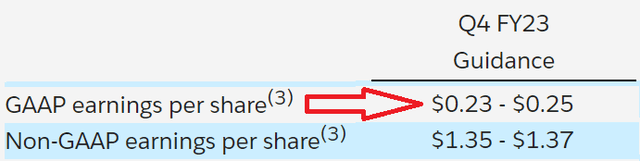

As we look at the guidance for next quarter, Salesforce is pointing its non-GAAP EPS to $1.37 at the high end.

Essentially saying, the company is going to make $1.37. And of this figure, approximately 20% goes to shareholders, as in $0.25 of EPS.

And shareholders understandably are pushing back. What makes me say so? Because analysts were only expecting $1.35 for Q4. So Salesforce is clearly able to print some impressive EPS figures, $1.37 in Q4 apparently. The only problem is that investors are not really getting all these benefits.

With that in mind, consider this:

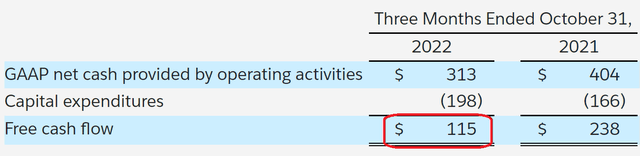

Above we see that free cash flows were down 52% y/y. And of that $115 million of free cash flow, do you care to know how much was stock-based compensation (“SBC”)? $843 million is the figure, up 3.8% compared with the same period a year ago.

CRM Stock Valuation — How Do We Value CRM?

At the most superficial level, CRM stock is priced at 27x next year’s fiscal 2024 non-GAAP earnings. Even if we were to pretend that management works for free and that non-GAAP is reflective of actual earnings per share, the fact remains that there are heroic assumption needed for next year if Salesforce’s EPS is to substantially outgrow its revenue line.

And I’m not going to say that’s impossible. What I will say is that in a high inflation environment, with interest rates staying at close to 4.0%, there’s going to be a lot of cost pressures, which will dampen profit margins.

Growing its EPS at 18% CAGR? I very much doubt that.

The Bottom Line

In the past few days, we are seeing the last few companies of this earnings season report.

I believe that if we look at it dispassionately there’s a significant discrepancy between what the Street wants, with stocks soaring higher day after day, and companies’ guidance.

For their part, companies are remarking that the macro environment is hard. Companies are actively telling investors that their customers are in a “challenging environment” and looking to “reduce costs.”

And we know this, from Snowflake (SNOW) to CrowdStrike (CRWD). The message is abundantly clear, customers are pushing back and sales cycles are elongating.

And in that environment companies should not get a premium valuation. SaaS companies or not. Everyone wants to stick with the winners of the past decade. But as we stand right now, Salesforce’s stock hasn’t gone anywhere in 4 years.

Be the first to comment