KuntalSaha

Published on the Value Lab 6/10/22

Safran (OTCPK:SAFRF)(OTCPK:SAFRY) is becoming a bit of a cash printer now thanks to its aftermarket sales. Free cash flow yields are above 5% this year, and FCF to EBITDA conversion is great as they service a large installed base. New engine deliveries are still pretty slow, but we believe some latent demand is still building as we will eventually emerge from a ‘wait and see’ approach by plane makers, and this will contribute to negative margin effects when that surge comes in. The aftermarket focus has been the thing to create very good EBITDA to FCF conversion and margins. Also, China has been a bit of a drag on results this year, and that market will eventually recover in terms of flight hours to further support aftermarket sales. We’re still not buyers since we’re worried about macro now that COVID-19 is increasingly in the rear-view, and the effects of even worse demand destruction from higher ticket prices on flight hours. Overall, interesting but still a pass.

H1 Note

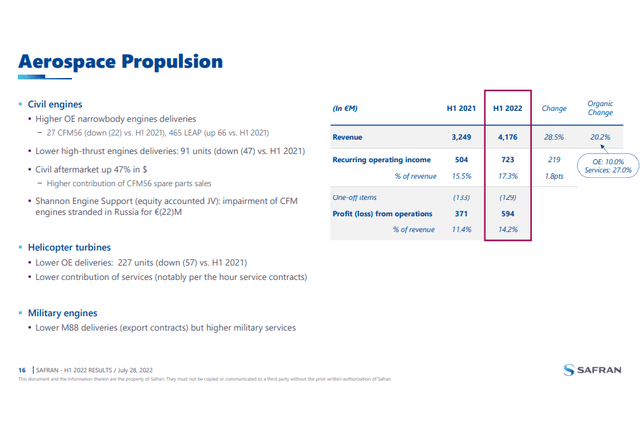

Let’s discuss briefly the results. In the aerospace and propulsion segment, which is the one that sells engines for both military purposes with the Rafale but also to Airbus (OTCPK:EADSF) and Boeing (BA) platforms, Revenues were up 20% and operating income up almost 50% thanks to margin expansion. This is driven mostly by higher aftermarket sales in the mix, and slower deliveries of engines which are actually at negative margin. The propulsion segment includes a lot of aftermarket revenue now, and this is what has been driving the growth of the segment thanks to growth of about 47%, and certainly all the margin expansion.

Segment Highlights (H1 2022 Pres)

Deliveries of new engines were showing mixed results. CFM56 deliveries which go in BA platforms were down about 50%, while LEAP engines were up about 15% which go into a more successful set of Airbus platforms. Again, aftermarket is where it counts, even for the CFM engine, which has an installed base of over 24k engines that are seeing very slow retirement rates as airliners operating aircraft take a wait and see approach. Some of the slowdown in deliveries is going to be driven by supply chain issues that the company reported, but again, the slow retirements show that the delivery growth we are seeing are for new planes, and actually growing the installed base – this is good for now.

Retirements of second-generation CFM56 powered aircraft remain low at a similar pace compared to 2020 and 2021 with 60 aircraft powered by CFM56 second-generation engine retired in the first 6 months.

Olivier Andries – CEO of Safran

The slow replacement rates are great for aftermarket and Safran margins, as these ageing engines are supporting large amounts of aftermarket growth in tandem with a sharp recovery in flight hours despite relatively high ticket prices these days. Flight cycles of CFM engines are apparently above 60% of the 2019 levels thanks to revenge travel, even in China which has been in intermittent lockdown, and in Europe there is a recovery to about 87% of 2019 levels. This recovery in commercial aviation is pretty impressive in the context of some lingering COVID-19 headache, but most importantly the demand destruction that was expected from high fuel prices. A recovery to pre-pandemic levels is close to being complete in the major European market.

When replacements eventually come, it’ll be a margin hit and not grow the installed base. Newer engines will also need less aftermarket service. The current situation is ideal in terms of cash printing. While not a bad thing to deliver new engines to grow the base, delivering them for replacement is not the best part of the Safran earnings cycle at all.

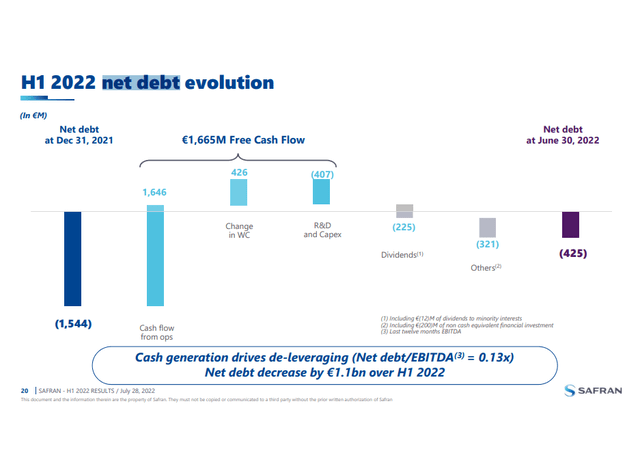

The M88 engines for the Rafale seem to have delivered reasonably well thanks to massive orders coming in from Dassault Aviation (OTCPK:DUAVF). Those advance payments have helped all but nix the net debt too. Ideal given rate trajectories.

Net Debt (H1 2022 Pres)

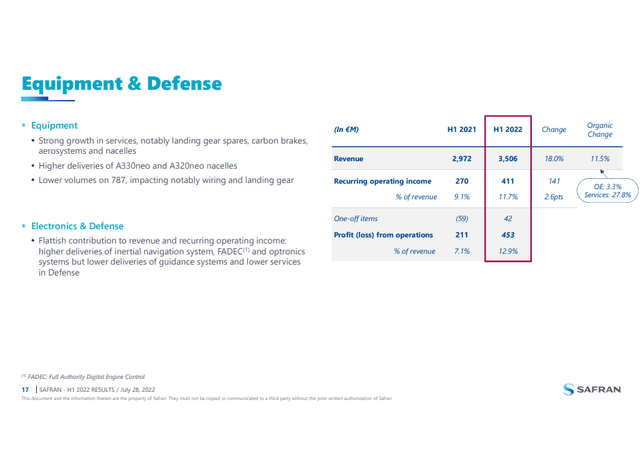

In equipment and defense, mix effects drove some margin expansion, and simply a good performance despite weaker BA platforms meant a decent operating income contribution from the segment.

Segment Highlights (H1 2022 Pres)

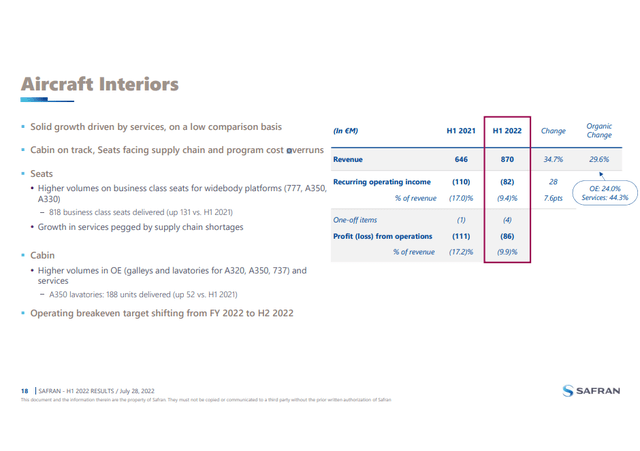

While airlines are preserving old engines in their fleet to have all options open in servicing the travel recovery, they are also finally getting new planes from manufacturers with the investment cycle by leasing companies obviously seeing some recovery. With 2021 being a year full engulfed by COVID-19 uncertainty, it provided a weak comp that allowed for pretty meaningful revenue growth and loss contraction in the aircraft interior business. Service revenues were still the ones driving this segment however, despite an initial recovery in new order volumes. Supply chain issues have apparently hampered growth here as well, and breakeven in H2 will depend on those.

Segment Highlights (H1 2022 Pres)

Remarks

There were some impairments with stranded assets in Russia, and the supply chain is a bit of a concern. Safran still gets its titanium substantially from Russia, but it is exploring other sources as well and managed to guarantee some of those in case the Russian supply is stopped. Besides titanium specifically, there are general issues of rehiring in the US and labor market tightness seems to be the primary bottleneck in the delivery slowdowns particularly in propulsion.

While supply chain issues have been a headwind, spare part stocking and even the stocking of whole spare engines has begun to become a theme among aircraft owners and operators. While the full effects of this higher velocity of demand is yet to be seen in deliveries because of supply chain issues it is one source of latent demand and learning economies on engine building. Currently engine deliveries are negative margin contributors. The point of the deliveries is to grow the installed base and make money in aftermarket. Learning economies slightly reduce this penalty. Supply chain issues actually improve the Safran margin surprisingly. Also we mentioned that a lot of the installed CFM engines are ageing, and this could mean a replacement wave. We think this will happen at the end of the rate cycle, when new CAPEX will be cheaper and the macro-economy more certain. This would be deliveries of engines, and therefore margin hit, while also not growing the installed base. Moreover, newer engines will be less valuable for the Safran aftermarket business. Prolonged periods of slow replacement indicate a bit of a peak for Safran, although flight hours have yet to recover fully, which will offset some of those effects once flying is back to pre-pandemic levels. But with geopolitical issues driving demand destruction and potentially also recessionary declines in consumer activity, those flight hours may not come in clutch, although these conditions will likely mean delays still in the replacement wave.

The point is we believe Safran is currently in a peaking position, and while not a catastrophe, a recession will negatively affect this business a fair bit, and the next peak in aftermarket activity and money printing will be a while off from then with a series of factors coming in to mitigate total margin recovery. Overall, a pass for now.

Be the first to comment