gorodenkoff/iStock via Getty Images

During the pandemic, aircraft manufacturers significantly reduced their production rates, and as demand for air travel is growing again, original equipment manufacturers are looking to rebuild the rates. That is being hampered by supply chain issues driven by staff shortages, infections and rebuilding efficiency into the system as well as fluctuations in demand. Layered on top of that are issues arising from the Ukraine-Russia conflict.

To get a clearer image of how the recovery is coming along, I take a deeper dive into the supply chain and analyze Safran’s (OTCPK:SAFRF) (OTCPK:SAFRY) Q1 results and comments. Safran is a key supplier in the commercial aircraft and defense industry and provides its products to Boeing (BA) as well as Airbus (OTCPK:EADSF) (OTCPK:EADSY). Some of its major programs include the CFM LEAP engines, Airbus A350 and Boeing 787 landing gears, nacelles for the Airbus A330neo and Airbus A320neo and business class seats.

Demand And Supply Side Pressures

The first thing that is important to address are the pressures seen on demand and supply side. On demand side, there are two pressures and the combination of both and a third OEM-related pressure. So, the first pressure is the zero-COVID policy in China, which results in rapid reductions in demand for air travel and that subsequently also reduces demand for new aircraft to be supplied to the Chinese market as well as services. By the end of March, cycles of the CFM turbofans in China used on the Airbus A320ceo and Boeing 737 were down 80%.

The second pressure is that demand for international travel is returning, but it is not yet fully recovered, so the demand there is still dim compared to pre-pandemic levels and that results in lower demand for new wide body aircraft as well as related services. The third pressure is related to Boeing. The US aircraft manufacturer is currently working on getting a green light on delivery resumption for the Boeing 787 and has around 115 Boeing 787 jets pending delivery. Until deliveries do not restart, production rates remain low and result in less demand for Boeing 787 parts.

On the supply side, there are also challenges, some of which have a more near-term impact and some of which could become an issue in the future if impacts are not mitigated. Safran is currently running 6-8 weeks behind with engine deliveries to Boeing and Airbus, but does expect to catch up by the end of the year. This without doubt puts pressure on the delivery targets that either jet maker is aiming for this year. Problems causing these delays can be found throughout the chain, where worker proficiency and COVID-19 infections play a role. In terms of material supply, currently the biggest threat over the longer term is the supply of titanium. Earlier this year I already discussed the pressures on titanium supply and many companies were looking into alternative sourcing as sanctions require them to decouple from the Russian titanium. Safran used to source 50% of its titanium from VSMPO in Russia. The good news is that the company has secured enough of the material as required for 2022 and is looking at alternative sources. However, with many companies looking into alternative sourcing, one can wonder whether titanium supply won’t become a bottleneck in 2023.

Another pressure on supply side includes inflation on material costs, logistics and energy costs resulting in an 80 basis-point pressure on margins, which is a significant overhang.

A Conflict With Impact

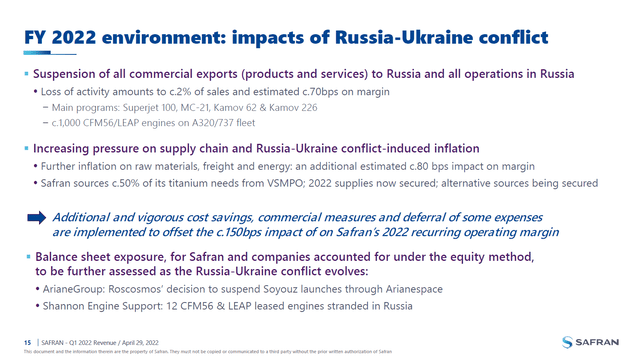

Safran impact Ukraine-Russia conflict (Safran)

The Ukraine-Russia conflict does not only affect the supply side and costs, but also the commercial environment in the air and space. Safran has around 1,000 CFM56 and LEAP engines on the Airbus A320 and Boeing 737 active in Russia and the sanctions against Russia disable Safran to collect services and parts revenues for those engines while participation in the Superjet 100 and MC-21 programs has been halted. This provides a 2% pressure on sales and a 0.7 points margin pressure. In space, ArianeGroup which is a 50:50 joint venture between Airbus and Safran decided to suspend launches using the Russian Soyuz.

All in all, there is a 2% impact on sales and margin erosion of 150 basis points due to elements that are directly or indirectly tied to the Ukraine-Russia conflict.

Results: Managing A Challenging Demand And Supply Environment

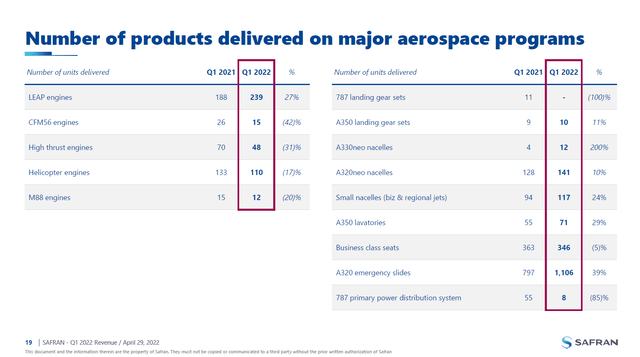

Safran major program contributions (Safran)

Looking at shipments on the major programs, we see that LEAP engines shipment rose nearly 30% primarily reflecting the increase of Boeing 737 MAX production supporting the ramp from low initial rate to 31 aircraft per month. CFM56 production is coming down as demand for that engine is coming down as successors are penetrating the market. Airbus A350 and Airbus A330 related shipments are up significantly, showing some improvement in the demand environment, but Boeing 787 related shipments remain poor due to the delivery stop and low production rates.

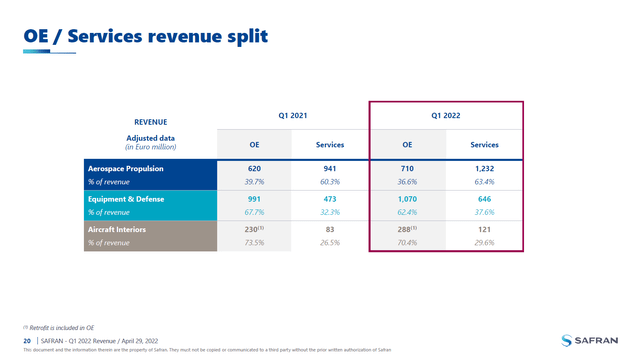

Safran OE/Services split (Safran)

Looking at the revenue splits across the 3 segments, it can be seen that in 2022 the services had a bigger share of the pie in each segment. There are two reasons for that. The first one is that increased flying led to an increase in demand for services as can also be seen in the absolute increase in revenues for services, and the second reason is that supply chain challenges provide a pressure on original equipment revenues, though also for original equipment the demand and ability to supply is improving. Year-over-year, revenues improved by 21.8% and 16.9% on a like-for-like basis and excluding currency impacts. So, we are seeing that even in a tough supply chain environment, things are improving year-over-year. However, it should be pointed out that sequentially services revenues were down nearly 20%, likely driven by a positive bump of aircraft being brought back to service in the previous quarter and some COVID-19 pressures in the first quarter this year.

Safran Outlook: Strong Upside In 2022

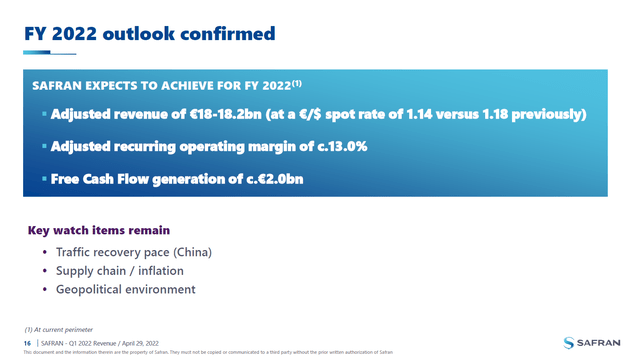

Safran FY 2022 Outlook (Safran)

Safran provides its earnings for the first half of the year as well as for the full year, but doesn’t provide earnings for Q1 and Q3. That makes it even more interesting to keep the 2022 outlook in mind. For the full year, the aerospace supplier expects €18-€18.2bn in revenues and margins of 13% or €2.34-€2.37bn in earnings with a free cash flow generation of €2bn. This implies a 19% increase in revenues, a 30% increase in profits and a 20% increase in free cash flow.

Conclusion

While there are significant pressures on the aerospace supply chain and Safran certainly cannot dodge them all, I do view Safran as an excellent investment due to its original equipment programs as well as associated services. As air travel does pick up, and it will definitely recover over the longer term, Safran is positioned extremely well to benefit. The company is already expecting significant improvement in its 2022 results and beyond that as the market further recovers and Safran hits break-even on production of the LEAP engines, there is significant potential for further margin expansion. As a result, I consider Safran to be one of the best investment opportunities in the supply chain, even amidst recession fears.

Be the first to comment