Phiwath Jittamas

Note: This article is focused on the investment opportunity in the bonds of Sachem Capital and is not intended to analyze the common stock or its potential. The analysis below will be a credit analysis, which necessarily looks at downside and stress scenarios, even if such scenarios may be unlikely. As part of DIA’s due diligence, Chief Investment and Credit Officer Bill Haydon was interviewed.

Introduction

Sachem Capital (NYSE:SACH), structured as a REIT, was founded in 2010 and completed its IPO in 2017. Sachem provides secured short-term loans, typically 1-3 years, to real estate owners and investors to fund their acquisition, renovation, development, rehabilitation or improvement of properties; these loans are also known as “hard money” loans. The company’s focus has been in the northeast, primarily in its home base of Connecticut (45% of total portfolio), then Florida (19%), New York (15%) and eleven other states (21%).

Properties by total mortgage loan amount are residential (52%), commercial (32%), land (9%) and mixed use (7%). There has been a recent shift into more commercial properties as a diversification from the residential market. In October 2022, Sachem purchased a real estate development and construction company for $1.1 million in stock, intended to help with the outcome of properties in the construction phase, particularly if stressed.

Sachem underwrites its loans to a 70% loan-to-value ratio (LTV) and obtains personal guarantees by the principals of the borrowers in nearly all cases, building in a strong layer of extra protection. According to Haydon, the Company has not yet needed to access the personal guarantee to realize repayments or loan recoveries. Haydon explained that underwriting standards tightened already in early 2022 with the expectation that there would be stress in the real estate market.

For example, the Company has been assuming since early 2022 a 10%-20% lower value for real estate versus the borrower’s assertion in its underwriting models and to support its diligence Sachem obtains 2 or 3 separate appraisals for each property. Haydon added that recent market stress has led to greater market opportunities (similarly confirmed by CEO John Villano in the recent earnings call) since smaller lenders have been more affected by market stress so there is less competition. Sachem has thus been able to be more selective in how it deploys new capital. According to Haydon, new loan pricing has moved up a bit from the low-11% range roughly to 12%, but more importantly, the Company has been able to do so while tightening its underwriting standards and offering fewer concessions to borrowers.

Sachem Bonds

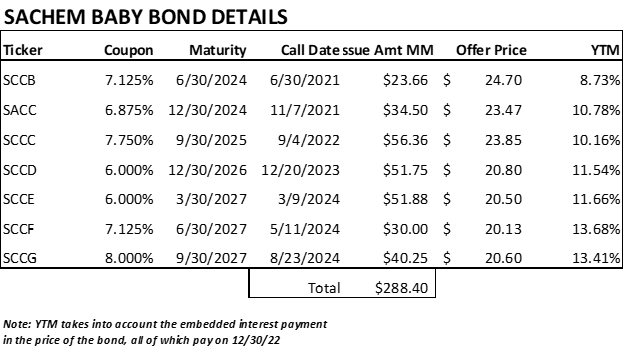

The chart below summarizes the 7 separate issued of unrated exchange trade bonds (also known as “baby bonds”) issued by the Company and the investment opportunity available to investors. Sachem has been a prolific issuer of baby bonds as its primary tool of capital raising in the past two years. Investors should be aware that liquidity in these issues can be thin, bid/ask spreads wide, so watch pricing closely and always use limit orders when buying or selling. Daily price fluctuations and bid/ask spreads on these bonds can mean as much as a 0.50% point difference in yield. There is often mispricing between the various bond issues and there can be opportunities for swaps between the issues to optimize yield.

Prepared by Downtown Investment Advisory

Yields by issue move higher based on maturity date, with a significant jump for the 2027 issues into the mid-13% yield range. SCCB is yielding 8.7%, a much lower yield due to the fact that this is the first bond due to be repaid, thereby arguably less risky. We don’t see the benefit of taking a much lower yield here, as the key risks to the Company in our opinion occur in the next two years (and perhaps mainly in the next 6 months) – before SCCB’s maturity date in June 2024 – so there is no real risk reduction in buying this bond over the others.

If interested in going shorter term for other portfolio reasons, SACC is clearly the best choice. Otherwise, our view is that SCCF and SCCG and their mid-13% yields offer the best risk/rewards at this time. Call dates are shown but don’t expect any issue to be called in the near to medium term.

Sachem’s Loan Portfolio

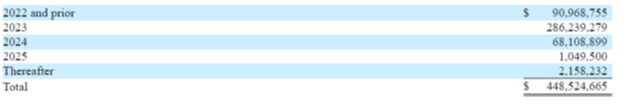

The company holds a $448.5 million real estate loan portfolio as of September 30, 2022, comprised of 503 separate loans. The chart below shows the maturity schedule of the loan portfolio – $377 million or 84% of the total portfolio is due in the next 15 months. There is little duration risk to this portfolio.

Sachem 10-Q

The company expanded its activity significantly in the first 9 months of 2022, raising $122 million of debt capital (from three separate issuances of baby bonds) and $37.6 million from common stock issuances. This capital was used to fund new loans in a net amount, after loan repayments, of $158 million.

Realized impairments to the portfolio are effectively zero, which is positive; however 44 loans at the end of Q3 were in the process of foreclosure or already for properties managed in-house, representing $21.4 million of unpaid principal and interest, representing 4.8% of the loan portfolio and 3.7% of total assets. According to the company, “the value of the collateral exceeds the outstanding balance on the loan plus accrued interest and borrower charges.” According to Haydon, the expectation in the vast majority, if not all of these cases, is that the full value of the outstanding amount owed will be realized, due to the conservative advance rates (70% of LTV) and personal guarantees, even if it takes some time to realize full repayment.

CEO John Villano explained on the recent earnings call that most of these foreclosed loans were made prior to COVID, but were not extended, as is often the case, since they do not meet current underwriting standards which have tightened this year. Management expects that these borrowers will refinance the loans elsewhere or sell the property to repay the Sachem loan. Villano added that property values are still typically higher today than when the loan was made pre-COVID, thus the expectation is for full recovery.

In addition to loans in foreclosure, an additional ~$24 million of loan balance was past maturity – often due to delays by the borrower in completing construction or a property sale. If we include these past due loans, total stressed loans represent ~10% of the total loan portfolio and ~8% of total assets.

There is no doubt that credit risk in the portfolio has increased (at the end of 2021 only $4.4 million of principal and interest was accrued but unpaid) but relative to the size of the portfolio the non-accrual rate <5% of assets is reasonable and does not materially stress asset coverage for the bonds. Our view is that these portfolio stresses are likely to continue and perhaps worsen, but the strong asset coverage and 70% LTV protection provides excellent cushion to manage through a potentially worse stress scenario.

Capital Structure

Sachem’s assets of $562 million compare to liabilities of $343 million, about 95% debt, for 164% asset coverage – a key metric for this credit analysis. Adjusting for cash balances, net assets and liabilities would be $492 million and $273 million, resulting in even higher asset coverage of 180% — excellent cushion which provides good protection to bondholders to withstand a downside case scenario.

The baby bonds, which are all pari passu, unsecured and subordinated issues, comprise the bulk of the debt structure of the Company. Secured credit lines comprise about $47.3 million and there are $15.6 million of other liabilities on the balance sheet. The low level of secured debt is a positive for baby bond holders.

The company has liberally used at-the-market stock offerings to raise capital, which is always a positive for bondholders. About $37 million was raised in this manner in the first 9 months of 2022 and $1.6 million more from this past Oct 1-Nov 9 period. While the pace of these offerings has slowed with the stock price down, this mechanism to raise capital can protect bondholders, as in a downside scenario the Company would likely raise cash via common stock issuance to shore up the balance sheet.

The capital structure also has a sizeable preferred stock tranche of $47.6 million of 7.75% Preferred Stock Series A, which is traded under ticker SACH/PRA (exact symbol varies by brokerage firm). The preferred stock sits below the bonds and is simply equity from the bond perspective. SACH/PRA is trading at $19.29 with a current yield of 10.0% and further potential upside if the price moves up. Our view is that the bonds present a far better risk/reward with five-year bonds offering a mid-13% yield-to-maturity with a date certain maturity. Interest must be paid on the bonds otherwise the company will default, while the preferred dividend can be cut with no such consequence.

At the current stock price the Company has a ~$145 million market cap and net book value of equity (after deducting the preferred stock) of $172 million, which means the stock is trading at about ~84% of book value, reflective of recent weakness in the stock price and the higher risk profile of the real estate and capital markets today.

Dividend policy has been solid but saw a bit of a reversal in the last announcement after a raise in Q2. The dividend stood at $0.12/share for about the last three years (no cuts during COVID in 2020) and was raised to $0.14 for July 2022, but perhaps a bit ahead of where income was going with the stress in the markets. After only one payment at this level management lowered the November 2022 dividend to $0.13 in what appeared to be a prudent measure to account for higher market risk. The new level is still 8% higher than the $0.12 from prior years. From the bondholder perspective these changes are not material. Of course, all interest must be paid to the bondholders first before any dividends can be paid.

Income & Cash Flow

Sachem has continued to grow revenue to record levels nearly every quarter since 2017, and Q3 2022 continued the upward trend with revenue reaching a high at $13.5 million and $4.1 million in net income. Interest coverage ratio comes to about 2.2x based on annualized Q3 2022 EBITDA of roughly $13 million (net income plus interest expense and certain non-cash expenses) versus $6 million of interest expense – solid coverage.

Sachem’s cash flow is predominantly determined by the level of new loans written and loan repayments. A strong positive aspect for bondholders is the fact that the loan portfolio is short term, with loans of 1-2 years mostly. Cash flow is always coming in – which means that if cash is necessary to improve the balance sheet or repay debt, it can be done by using repayments from loans to pay back corporate debt. In the first 9 months of 2022 Sachem took in cash from repayments of $95 million (and $90 million for the same period in 2021), more than offset by $252 million of new loans written in 2022. In Q3 alone the Company took in cash from repayments of $34 million but wrote $60 million of new loans.

Credit Strengths

- Solid Historical Performance – Management has grown the business steadily since 2017 reaching record levels in 2022. Portfolio performance from a credit quality standpoint has been solid, with negligible loan losses. Overall management performance is positive.

- Underwriting Standards Protect Against Losses – The 70% LTV underwriting standard, coupled with personal guarantees in each loan, protects against defaults and is a key factor in negligible loan losses to-date. According to management, these standards have been tightened in 2022. Combined with the diverse portfolio of 500 loans, risk of major loan loss appears low.

- Strong Asset Coverage – Perhaps the most important credit metric for bondholders, assets cover liabilities by 164%, or another way of looking at it, the aggregate asset value of the Company could decline by ~40% and assets would still match liabilities 1:1.

- High Cash Balances – The company carries $70 million of cash and liquid investments that further adds to the asset coverage cushion (to 180% assuming cash was all used to repay debt). While the Company has to maintain healthy cash balances to cover unfunded loan commitments which are over $100 million, this high liquidity protects against stress scenarios.

- High Cash Flow Generation – The nature of the Company’s business of short term lending means that cash flow from repayments is always coming in. Repayments were $95 million in 2022 and $34 million in Q3 alone. While the Company seeks to redeploy this capital to generate profits and shareholder value, in a downside scenario Sachem can simply stop redeploying this incoming cash flow to shore up the balance sheet or repay debt. Along with high cash balances, the constant liquidity source is a strong positive credit feature.

Risks & Mitigants

- Stressed Market Conditions – Concerns about mortgage rates, inflation and possible sharp drop in real estate prices, at least in the near term, hover over Sachem’s business. This is coupled with uncertainty on these same factors going into 2023. These risks are mitigated by the factors noted above, beginning first with the tight underwriting standards which should cushion falling real estate values (as well as personal guarantees) and the diverse portfolio. The fact that the Company has nearly all fixed rate debt raised in the past two years is another mitigating factor for rising market yields.

- Increasing Portfolio Stress – Q3 statistics show an increase in loans that are not being extended and on non–accrual status. However, the stress appears quite manageable, with non-accruals at about 4% of the portfolio, and adding in loans past maturity (which does not mean distress) at about 10%. The expectation is that loans past due and not extended will be repaid in full – even if not the case in some instances, these numbers are not significant in the context of 164% asset coverage. Our opinion is that some of these stresses may worsen in the next couple of quarters, but continue to remain manageable.

- Refinancing Risk of Bonds – Every company with debt outstanding today must face the prospect of refinancing at much higher rates. Sachem has 7 bond issues outstanding, but the good news for management is that it was able to raise significant capital at 6% rates in the past year. The first baby bond is due in June 2024 and then in steady tranches through 2027. Two key mitigants – first, by 2024 the markets will likely stabilize, thus even if Sachem has to refinance at a much higher rate, it should be able to do so. Second, cash is constantly coming in from loan repayments as a natural consequence of the Company’s business model. If the bond market is unavailable to Sachem for some reason, it could simply use loan repayments to repay the bonds instead of redeploying.

Conclusion

In our opinion as a fixed income investment manager, Sachem’s baby bonds offer an excellent risk/reward and appear to be mispriced relative to the credit risk. To be clear, investors should not confuse Sachem bonds with an investment grade bond, and investors should be aware that these bonds are certainly in the high yield category. An investment in Sachem bonds should only be considered as part of a diversified portfolio of fixed income investments.

We consider the asset coverage cushion to offer the key protection to bondholders against the elevated market risks the company faces, as well as our view that management appears to be prudently managing the business in the current market environment. We are encouraged by the solid Q3 numbers which showed increases in portfolio stress, but at modest and manageable levels. High cash balances and loan repayments steadily coming in means the Company has plenty of liquidity and is well positioned to manage through the market stress that is expected to continue.

Management does not need to worry about refinancing the first bond until 2024, and just one quarter’s worth of loan repayments would cover the full amount of the bond if for some reason a refinancing was difficult. Our view is that the Company could do well to buy back some of the notes now yielding 13% (which is higher than the rate at which loans are being written) on the open market, thereby locking in this yield for 5 years at lower risk than writing new loans, and improving the Company’s balance sheet. If the Company does not want to buy these bonds, you can.

Please be aware that Downtown Investment Advisory currently holds positions in some or all of the Sachem bonds noted in this article in client and personal accounts, and may have added/will add to positions at any time prior to or following the publication of this article. (The Seeking Alpha disclosure says “I” but in fact refers to both personal & client accounts). It is important to note that High Yield bonds and related fixed income investments such as many issues of preferred stock and baby bonds, such as Sachem bonds, are by definition not “investment grade” and are thus only appropriate for investors willing to accept a higher fixed income risk profile. Consider High Yield bonds and similar investments only as part of a broader investment portfolio allocation to various assets of all risk profiles. Please see the Downtown Investment Advisory profile page for important disclaimer language, which is an integral part of this article.

Be the first to comment