Mongkol Onnuan

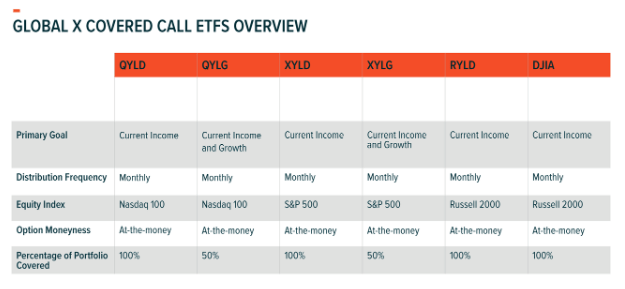

There are many different Covered-Call and hybrid Covered-Call ETFs, but the Covered-Call ETFs from Global X, which include the Global X Nasdaq 100 Covered Call ETF (QYLD), Global X S&P 500 Covered Call ETF (XYLD), and the Global X Russell 2000 Covered Call ETF (NYSEARCA:RYLD) remain three of the most popular. We no longer live in a yield-starved environment as 1-year CDs and treasuries can exceed 4%, but many income investors are attracted to the double-digit yields that covered-call ETFs can offer. RYLD, XYLD, and QYLD all track their respective indexes by replicating their portfolios and selling covered-calls against their positions to generate additional distributable income, which is paid to their investors monthly.

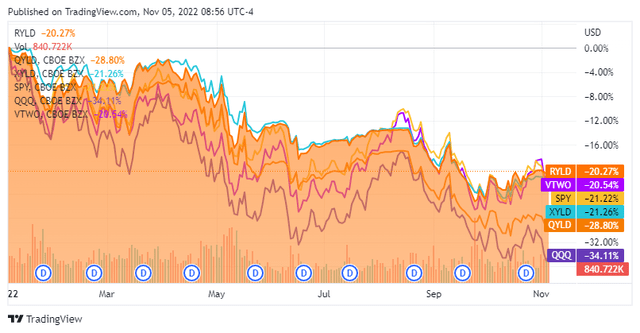

The respective indexes tracked by the SPDR S&P 500 Trust (SPY), Invesco QQQ ETF (QQQ), and the Vanguard Russell 2000 ETF (VTWO) have all fallen back into technical bear markets as their YTD performance ranges from -20.54% to -34.11%. While capital appreciation for the Global X Covered Call ETFs isn’t part of the discussion for 2022, these ETFs were designed for income, and many commenters in my previous articles have speculated that when a true bear market occurs, these investments will decline significantly further than their respective indexes. This bear thesis continues to be disproven as monthly income has still been generated, and the mechanics haven’t created an outsized deviation from their underlying assets. I have updated all of my tables, and taking the monthly distributions into account, RYLD has generated a larger return on investment (ROI) compared to XYLD and QYLD when looking at these investments from the beginning of 2021, and throughout 2022 as a standalone year. I am invested in RYLD, QYLD, and XYLD, but after reviewing the data, I wish that I was more heavily allocated to RYLD rather than QYLD. As an income investor, I am still accumulating more of these ETFs, and the data indicates RYLD has been a better steward of capital than its peers.

Comparing RYLD, QYLD, and XYLD since the beginning of 2021

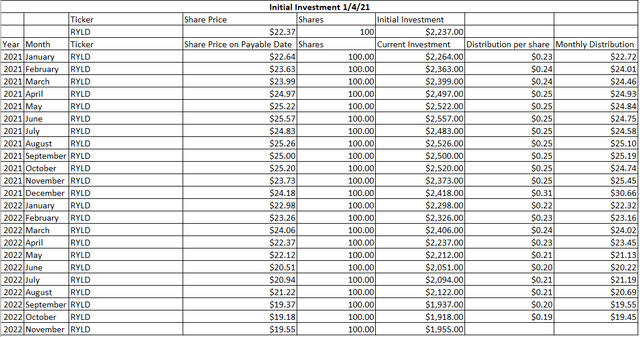

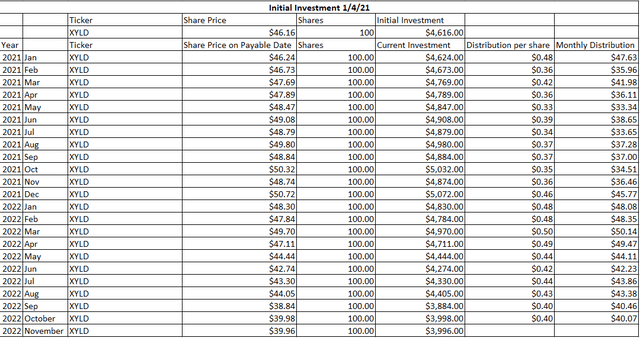

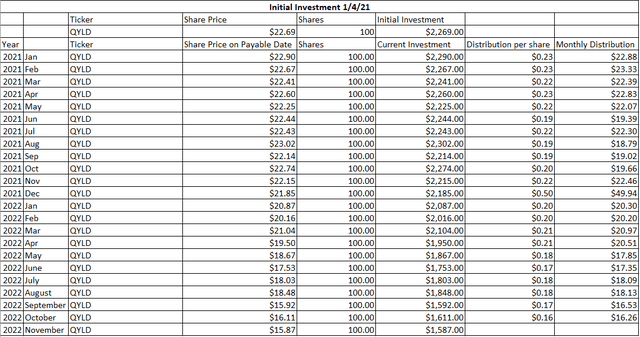

I have used the data from the Global X website regarding distribution amounts and distribution dates and Seeking Alpha for the share price on the distribution dates to build the tables in this section. I used a 100-share block purchased on 1/4/21 for RYLD, QYLD, and XYLD as the starting point and calculated the amount of distribution income generated, if there was a total profit, and what the total ROI was for each of these funds.

On 1/4/21, RYLD traded at $22.37, so an initial purchase of 100 shares cost $2,237. RYLD currently trades at $19.55, so the current value of the initial investment would be $1,955, which is a decline of -$282. The initial investment has a -12.61% ROI. RYLD has paid $516.61 in monthly distributions since the beginning of 2021, which is a 23.09% yield on investment. After the distribution income is netted against the capital appreciation loss, RYLD has generated $234.61 in total profit for an ROI of 10.49%.

Steven Fiorillo, Seeking Alpha, Global X

On 1/4/21, XYLD traded at $46.16, so an initial purchase of 100 shares cost $4,616. XYLD currently trades at $39.96, so the current value of the initial investment would be $3,996, which is a decline of -$620. The initial investment has a -13.43% ROI. XYLD has paid $908.50 in monthly distributions since the beginning of 2021, which is a 19.68% yield on investment. After the distribution income is netted against the capital appreciation loss, XYLD has generated $288.50 in total profit for an ROI of 6.25%.

Steven Fiorillo, Seeking Alpha, Global X

On 1/4/21, QYLD traded at $22.69, so an initial purchase of 100 shares cost $2,269. QYLD currently trades at $15.87, so the current value of the initial investment would be $1,587, which is a decline of -$677. The initial investment has a -29.84% ROI. QYLD has paid $471.25 in monthly distributions since the beginning of 2021, which is a 20.77% yield on investment. After the distribution income is netted against the capital appreciation loss, QYLD has generated -$205.75 in total profit for an ROI of -9.07%.

Steven Fiorillo, Seeking Alpha, Global X

Looking at these investments since the beginning of 2021, RYLD has generated the largest ROI at 10.49% after the total investment profit and distributions paid are netted against each other. RYLD also has the largest yield on investment at 23.09%, as it has paid $516.61 in distributions from the initial investment of $2,237.

Looking at RYLD, XYLD, and QYLD since the beginning of 2022 and seeing how they have been impacted during the downturn

In this section, I will use the same statistics, but the 100-share investment block would have been purchased on 1/3/22.

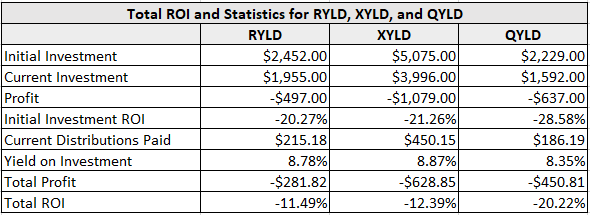

On 1/3/22, RYLD traded at $24.52, and an initial investment of 100 shares would have cost $2,452. RYLD recently closed at $19.55, causing the initial investment to decline -$497 to $1,955. This is an ROI of -20.27%. RYLD generated $215.18 in distributions YTD creating a yield on investment of 8.78%. After the capital depreciation and distributions are netted against each other, RYLD is in the red by -$281.82 for a total ROI of -11.49%.

On 1/3/22, XYLD traded at $50.75, and an initial investment of 100 shares would have cost $5,075. XYLD recently closed at $39.96, causing the initial investment to decline -$1,079 to $3,996. This is an ROI of -21.26%. XYLD generated $450.15 in distributions YTD creating a yield on investment of 8.87%. After the capital depreciation and distributions are netted against each other, XYLD is in the red by -$628.85 for a total ROI of -12.39%.

On 1/3/22, QYLD traded at $22.29, and an initial investment of 100 shares would have cost $2,229. QYLD recently closed at $15.92, causing the initial investment to decline -$637 to $1,592. This is an ROI of -28.58%. QYLD generated $186.19 in distributions YTD creating a yield on investment of 8.34%. After the capital depreciation and distributions are netted against each other, QYLD is in the red by -$450.81 for a total ROI of -20.22%.

Steven Fiorillo, Seeking Alpha, Global X

2022 hasn’t been a great year by any stretch for investing, but covered-call ETFs didn’t implode and simply followed their respective indexes. RYLD has been the least volatile to YTD and, after factoring in the distributions, has been the better investment when compared to XYLD and QYLD.

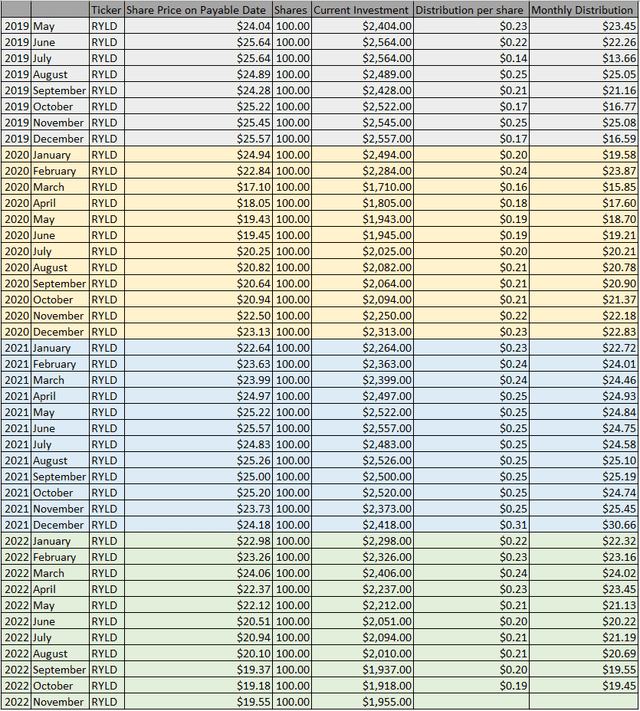

Looking at RYLD as a standalone investment and looking at how it would have played out since its inception if you had reinvested the distributions or taken the monthly distributions as income

RYLD went public on 4/17/19 for $25 per share. Since then, RYLD has paid 42 consecutive distributions without missing a single month. RYLD has established a long track record of distributing income from its Covered-Call strategy to investors. Since May of 2019, RYLD has paid $9.24 per share in distributions, which is an investment yield of 36.95% on its initial $25 share price. RYLD utilizes a buy-write where it buys exposure to the stocks in the Russell 2000 Index and writes or sells corresponding call options on the same index. The options are written at the money on a monthly basis and the premiums collected are used to fund its monthly distributions to shareholders.

Global X

If you had purchased 100 shares of RYLD at inception, it would have cost $2,500, and today you would have seen a -$545 decline as the initial investment is now worth $1,955. This is a -21.80% ROI on the initial investment. Since inception RYLD has paid $9.24 per share in distributions, so the investment would have generated $923.72 in distributable income. This is a 36.95% yield on investment. When the distributions are netted against the capital depreciation, this investment has generated $378.72 in profit for an ROI of 15.15%. RYLD has paid $2.71 per share in distributions over the TTM, which would place its forward projected income at $271.29, which is a forward yield of 10.85% on the initial investment.

Steven Fiorillo, Seeking Alpha, Global X

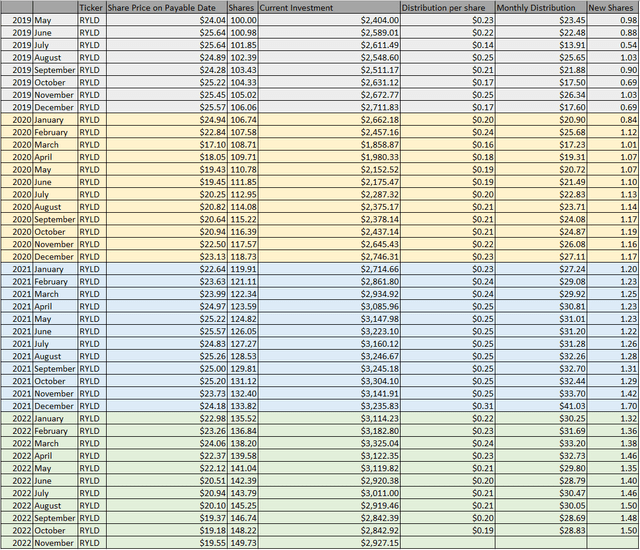

The numbers change when the monthly distributions are reinvested back into RYLD. By reinvesting the distributions, RYLD would have paid $1,129.97 in distributions which is a 45.20% yield on investment. The initial share count would have increased by 49.73 shares, causing the forward projected income to increase to $394.04, which is a forward yield of 15.76% on the initial investment based on the $2.71 TTM distribution. The current investment would be worth $2,927.15 for an ROI of 17.09%.

Steven Fiorillo, Seeking Alpha, Global X

So, is it better to take the distributions or reinvest them? That is a question that each investor needs to answer for themselves. The data indicates that since inception, regardless if you had taken the distributions or reinvested them, when they are netted against the share price decline, both circumstances would have generated a positive ROI. On the one hand, monthly income is being generated, and the asset base is still generating a projected double-digit yield, while on the other, a larger amount of distributions have been paid, and the forward distributions grew due to the number of shares increasing. I don’t believe there is a wrong answer because investors invest in RYLD for different reasons, and it’s effective in both cases. For investors with time on their hands, RYLD has proven to substantially increase the forward yield on the initial investment over time, and for investors who need immediate income, RYLD has generated 36.95% of its initial investment in monthly distributions.

Conclusion

I am bullish on the covered-call ETFs from Global X, but after conducting the research, RYLD has been the better investment since the beginning of 2021. The covered-call ETFs have proven they can withstand a bear market as they have followed their respective indexes while generating monthly distributions through their mechanics of writing monthly covered calls. RYLD has been an interesting fund as its generated 36.95% of its initial share price in distributions over the previous 42 months. I plan on adding to my position in RYLD and am looking forward to seeing how it finishes in 2022 compared to XYLD and QYLD.

Be the first to comment