Leila Melhado

Another Excellent quarter

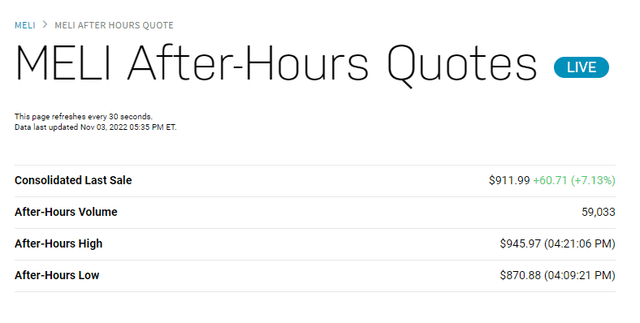

MercadoLibre (NASDAQ:MELI) just posted another stellar earnings report amidst this ongoing bear market, where many growth stocks disappointed shareholders greatly. The stock is up 7% after-hours. In September, I wrote a comparative article between MercadoLibre and Amazon (AMZN) and why I prefer MELI. Let’s check how the aspects I pointed out outperformed in this earnings report.

Throughout this article, I’ll refer to MercadoLibre as its ticker MELI.

MELI after hours after releasing Q3 earnings (Nasdaq )

Refreshing up on MELI’s KPIs

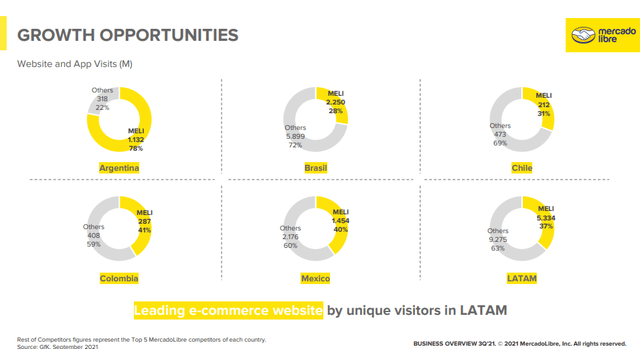

MercadoLibre is a Latin American (LATAM) e-Commerce, logistics and fintech company with a dominant market position in most of its segments, especially in its home country Argentina. The main points I want to address are:

- 3P Marketplace (Take Rate, GMV)

- Payments (Take Rate, TPV)

- Credit

MELI Market shares (MELI investor presentation 2021)

In line with analyst expectations

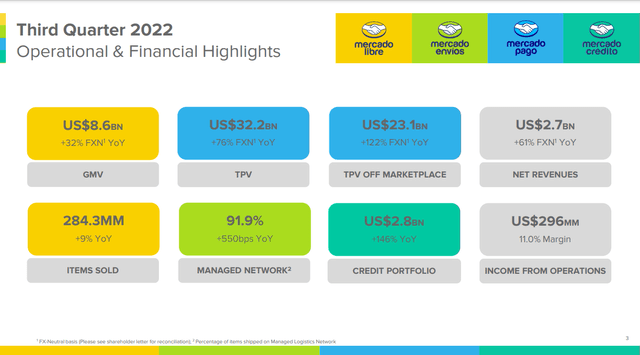

MercadoLibre once again delivered excellent results across the board. Revenues increased 61% to $2.7 billion in the quarter, missing analyst expectations by $5 million. According to Seeking Alpha’s earnings page, EPS of $2.56 was a $0.07 beat. MELI doesn’t give guidance and I’d always look at analyst expectations with a grain of salt. In the last eight quarters, MELI beat EPS 4 times and revenues six times out of eight.

MercadoLibre (e-Commerce)

Gross Merchandise Volume (GMV, the dollar amount transacted on the MercadoLibre platform) increased 32%, accelerating from 26% last quarter and in line with the prior quarters to reach $8.6 billion in the quarter. GMV is one of the most important metrics to track because the MELI ecosystem’s value is derived from the services they sell to customers and merchants alike. I went deeper into the ecosystem in my first article if you want to check that out. MELI shared a new piece of information in this release (I haven’t seen it in any prior release, at least, please let me know if I’m wrong in the comments): Ad penetration over GMV, so ad revenues relative to GMV.

We are progressing our strategy to increase monetization with our Ads business reaching 1.3% penetration over gross merchandise volume, a small but steady increase on previous quarters.

Pedro Arnt, CFO MercadoLibre Q3 22

This implies an ad revenue of $111.8 million in the quarter at an EBIT margin of 77-83, with around $86 to $93 million operating profit. This small segment is expected to grow fast over a multiyear period in all of MELI’s geographies and will significantly contribute to profits.

Generally, commerce saw a strong quarter with over 10% total unique buyer growth and a steady purchased item per buyer rate of 6.7 items.

Mercado Envios (logistics) continued its trend and reached 92% managed network penetration, up five percentage points YoY, led by Mexico with 96%, up from 90% a year ago and with 55% delivered within 48 hours.

Mercado Pago (Fintech)

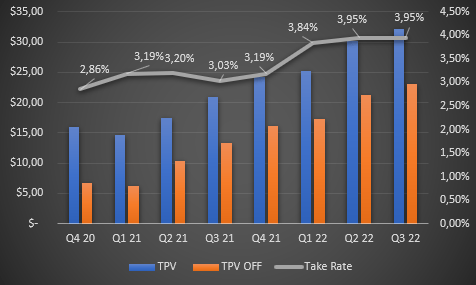

The most important metric to watch for the fintech business is the Total Payment Volume (TPV, similar to GMV but for payments), which saw another strong quarter. Total TPV saw a substantial 76% growth to $32.2 billion in the quarter and TPV OFF Marketplace saw the third sequential quarter above 100% growth. TPV OFF Marketplace is especially important because it increases the size of MELI’s reach outside of its marketplace. TPV OFF is already the larger business at 72% of total TPV. Total transactions grew 66% while the take rate increased 92 bps to 3.95%; the flywheel keeps turning.

MELI TPV (Authors model)

Pedro Arnt mentioned something interesting with their MELI Places business (reverse logistics operations), where the company noticed that these places are now being used as a cash-in cash-out network, besides the intended purpose to elevate the logistics network, which could rival ATMs in the future. If successful, this will increase the moat with small store owners, who can leverage this service as incremental revenue for themselves.

Then on places and functions — so it’s interesting. I think we’ve always said that places had potentially a very important role in adding nodes to our logistics network, so for pickup, delivery and returns. Returns continued to grow in terms of percentage. But more importantly, the customer satisfaction that, that drives and ideally also better conversions. But if you look, for example, at Argentina, we began to see the other piece of the places thesis, which is the creation of a cash-in and a cash-out network that has the potential to rival ATM machines.

So these small store owners can make incremental revenue and drive incremental foot traffic by serving as cash-in and cash-out points, and we’re seeing strong execution on that front in Argentina, and it’s something that we would look to mirror across all of the geographic footprint.

Mercado Credito (Credit business)

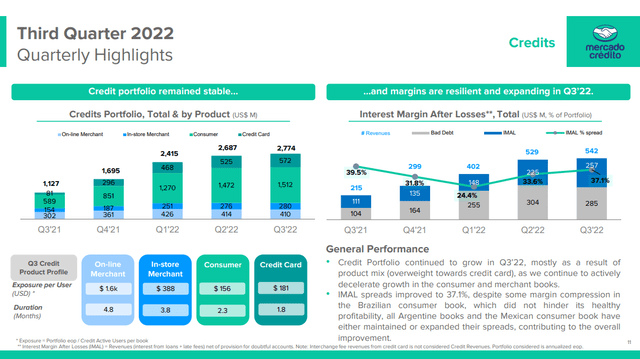

In my September article on MELI, I mentioned that the credit portfolio increases the risk due to many consumer credits and that MELI will learn incrementally from operating in this relatively new segment.

Osvaldo Giménez, President Mercado Pago (Fintech segment), mentioned that they started to group users into segments to increase their ability to assess the risk per user. With these steps, the company reduced its level of bad debt by 5% sequentially after it tripled in the prior nine months to $304 million. The credit business still needs to be observed (especially the rising amount of 90-day past dues). Still, MELI is taking the proper steps and learning incrementally how to operate this business ideally.

So Geoffrey, what we did during the last end of the second quarter and during the third quarter, basically, we have scored users in 12 segments. And those that were lower ranking, we stopped offering them both personal loans and buy now pay later. Those that were a little bit better ranked but still not so high up, we stopped offering them personal loans. And we — but we continue to offering them buy now pay later. The good news that we saw is that we believe in hindsight that we took the right decision.

Mercado Credito Q3 (MELI Q3 presentation)

A compelling valuation

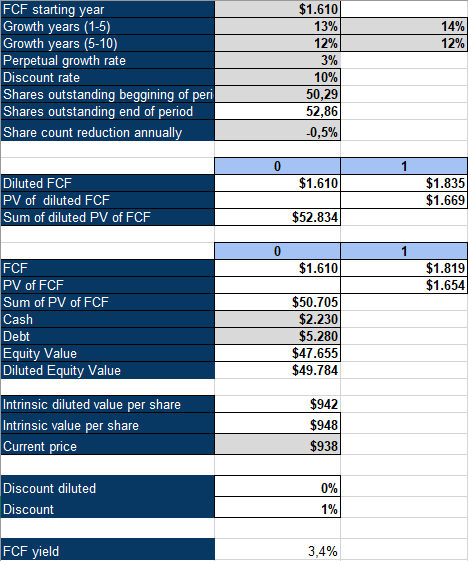

MELI finally realizes higher profitability from its scale and the growth of high-margin businesses like the ads business. Operating margins (EBIT) increased by 500 bps to 11%, resulting in $296 million of EBIT for the quarter, almost doubling YoY. The company expects to further increase EBIT margins incrementally over the upcoming period. Free Cash Flow now stands at $1.6 billion LTM. According to my inverse DCF analysis with a 10% discount rate (required rate of return), a 3% perpetual growth rate and a 0.5% annual dilution, MELI currently is priced for 12-14% FCF growth, a very reasonable growth rate, considering the runway of growth and operating leverage still ahead.

MELI inverse DCF (Authors Model)

I’m a buyer

MercadoLibre continues to deliver strong results, especially toward profitability. Management is doing a great job at figuring out the Credito business with incremental improvements each quarter, and the advertising model is spewing cash now. MercadoLibre is a core position in my portfolio at 5%, and I remain very optimistic about this founder-led company.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment