Dilok Klaisataporn

Golub Capital BDC (NASDAQ:GBDC) recently increased its regular dividend by 10% to a new quarterly dividend of $0.33 per share, resulting in a forward stock yield of 9.7% at the current share price of $13.67.

The company provides passive income investors with a well-managed high-quality debt investment portfolio with a moderate amount of non-accruals and a strong concentration in secure First Liens. To know more, please visit- Golub Capital: I Am Buying This 8.6% Yielding BDC Hand Over Fist

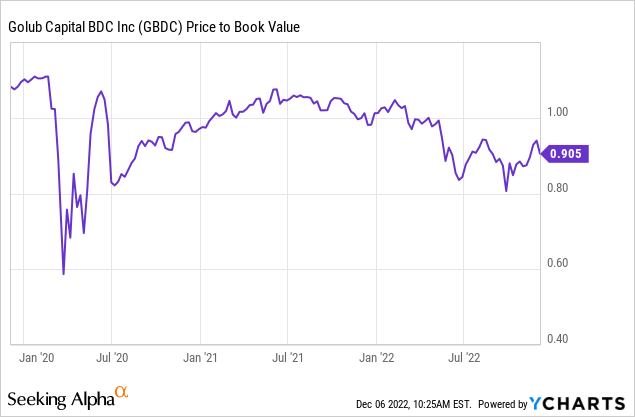

Golub Capital’s stock is trading at an 8% discount to net asset value, giving investors an extra margin of safety.

Portfolio Exposure, First-Lien Focus, Moderate Non-Accruals

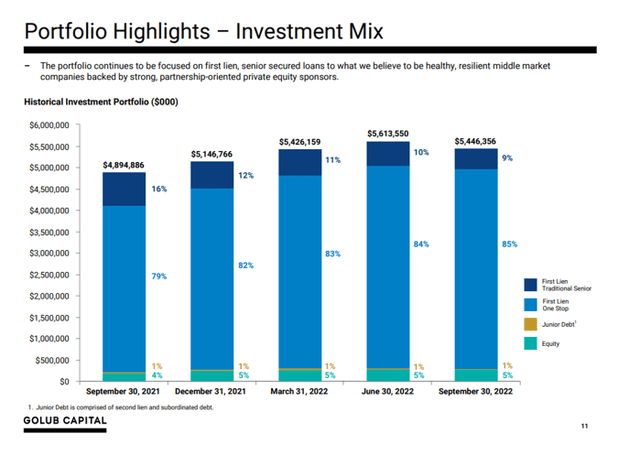

Golub Capital put 94% of its money into First Liens, the safest type of debt for investors. Furthermore, as of September 30, 2022, the business development company had invested 1% in junior debt and 5% in equity.

In my opinion, the small proportions of higher risk debt and equity do not pose a significant risk to the portfolio, and Golub Capital, given the high percentage of investments in First Liens, is a BDC with a high-quality investment portfolio.

Investment Mix (Golub Capital BDC)

In the September quarter, the portfolio remained well-diversified. The majority of Golub Capital’s loans have gone to the software and healthcare sectors, both of which are defensive sectors (representing 34% of all investments) and are not likely to experience major corrections if the economy contracts.

As of September 30, 2022, the top ten investments accounted for only 16% of total portfolio investments, indicating that Golub Capital is a well-diversified business development firm.

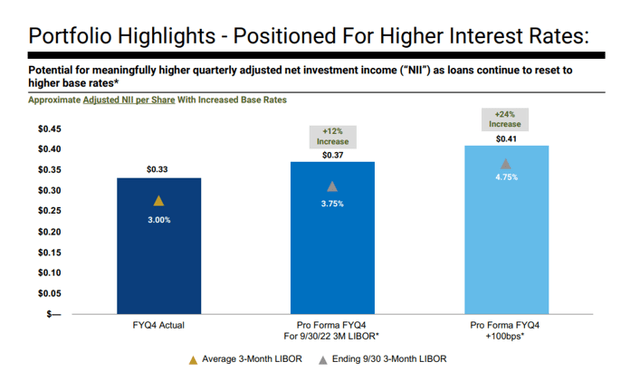

A nice feature of Golub Capital is that 100% of its loans have floating rates, which means that the central bank’s continued aggressive stance on interest rates will boost the BDC’s net investment income in the future and may result in the payment of a special dividend.

Poised For Higher Interest Rates (Golub Capital BDC)

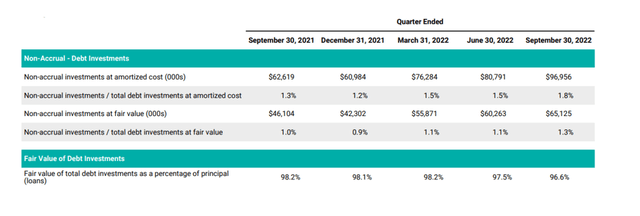

Non-accrual status at Golub Capital slightly worsened QoQ, from 1.1% in the June quarter to 1.3% in the September quarter. Eight investments were non-accrual, which was the same as the previous quarter on a net basis. The total investment value at risk increased to $65.1 million from $60.3 million in the previous quarter.

At the end of September, Oaktree Specialty Lending Corporation (OCSL), one of my favorites in the BDC sector, had no non-accruals in its portfolio.

Non-Accruals (Golub Capital BDC)

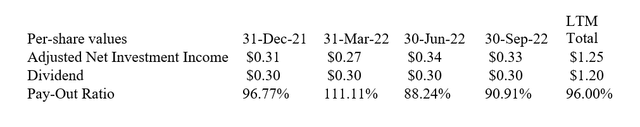

10% Dividend Raise, Dividend Covered By Adjusted NII

Golub Capital earned $0.33 cents per share in adjusted net investment income in the September quarter, more than covering the $0.30 per share dividend payout.

In the September quarter, the dividing pay-out ratio was 91%, which was slightly higher than the twelve-month dividend pay-out ratio of 96%.

Furthermore, Golub Capital increased its dividend pay-out by 10% QoQ to a new dividend of $0.33 per share per quarter, owing to strong portfolio performance and overall good credit quality.

GBDC stock has a dividend yield of 9.7% based on the new dividend payment.

Dividend (Author Created Table Using Trust Information)

10% Discount To Net Asset Value

Golub Capital’s net asset value as of September 30, 2022 was $14.89, implying that the BDC’s stock can be purchased for a small but reasonable 10% discount to book value.

Given that the BDC has a large and diverse debt portfolio and recently increased its dividend by 10%, I believe the valuation is compelling.

Why Golub Capital Could See A Lower Valuation

Golub Capital primarily provides passive income investors with a high quality First-Lien focused debt portfolio with an almost double-digit dividend yield.

The BDC’s non-accrual ratio remained well under control in the third quarter, but that doesn’t mean non-accruals can’t rise if economic conditions change and loan defaults rise. Increased non-accruals and a decline in asset valuations, in my opinion, are two potential headwinds for Golub Capital that could result in net asset value losses if the economy enters a recession.

My Conclusion

Golub Capital should be considered by passive income investors and yield seekers who value near double-digit dividend yields from a well-managed business development company with high portfolio quality.

The 10% increase in the regular dividend rate to $0.33 per share per quarter, I believe, strengthens the BDC’s position in the high-yield investor community.

Net investment income covers the 9.7% yield, and floating rate exposure could improve Golub Capital’s dividend coverage in the future.

Be the first to comment