André Muller

Published on the Value Lab 11/9/22

Rubis (OTCPK:RBSFY)(OTCPK:RUBSF) is one of our main infrastructural picks in the portfolio. It was one of the few things we decided to add to quite heavily in June on the basis that its infrastructure economics would be unfazed by macro headwinds, and that reopening trends and weak comps would overcome any potential headwinds. Ultimately, we were right, and the company is performing swimmingly. Unit profit and volumes are growing driven by reopening in the retail segment, and the others are also holding the fort. The dividend and low PE multiple are supported by the promise of growth and resilience, demonstrated yet again in this quarter.

H1 Results

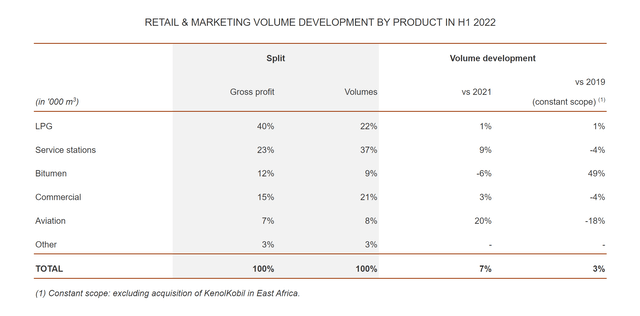

While oil prices rose and raised questions of demand destruction some months ago, the Rubis performance demonstrates that oil still needs to flow, especially in service of a revenge season of tourism that the Caribbean in particular is experiencing. Volumes are growing substantially in the retail marketing segment, which drives 70% of EBIT. Aviation volumes are coming off depressed levels by growing 20% since H1 2021, but are still below pre-COVID levels by about 18%.

Commodity Breakdown (PR H1 2022)

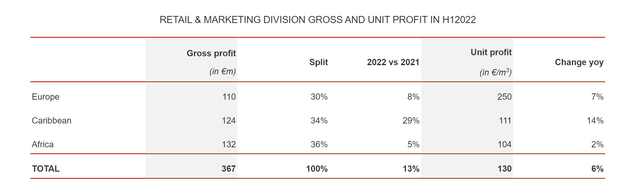

The Caribbean which accounts for almost half of the retail and marketing segment grew by 14% driving overall retail and marketing volumes by 7% thanks to greater Caribbean activity as tourist populations again rise. Unit profits grew by 6%, further supporting gross profit growth in the segment. Caribbean EBIT grew by 29% YoY, with less improvement in other segments, especially Africa where price controls in Madagascar limit unit margin growth. Overall growth was 13%.

Geographic Split (PR H1 2022)

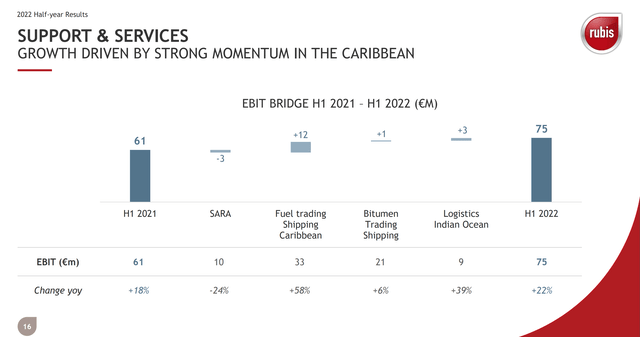

The support and services division which is supported by logistics and oil price volatility performed well, although logistics growth seems to be peaking.

EBIT Evolution Logistics and Trading (H1 2022 Pres)

YoY change was still 22% thanks to trading profits on fuel.

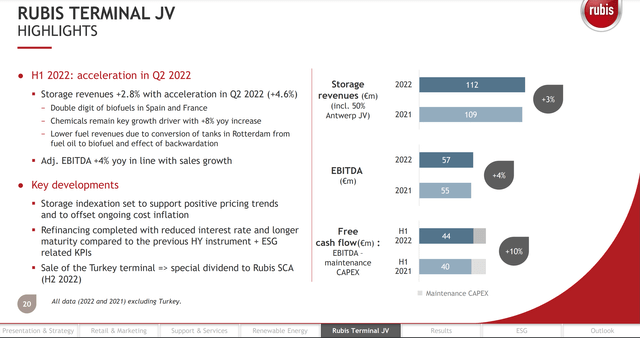

The terminal business provided solid all-around performance consistent with an infrastructure profile.

Rubis Terminal EBIT (H1 2022 Pres)

Exposure to non-fuel sources only rises, and growth in product like biofuel supports results.

The Photosol acquisition has been consolidated for the first time. Their pace of asset development is promising, and their EBIT contribution is about 3% of overall Rubis EBIT now. Capacity and production growth in the high teens will support growth of that bottom line.

Conclusions

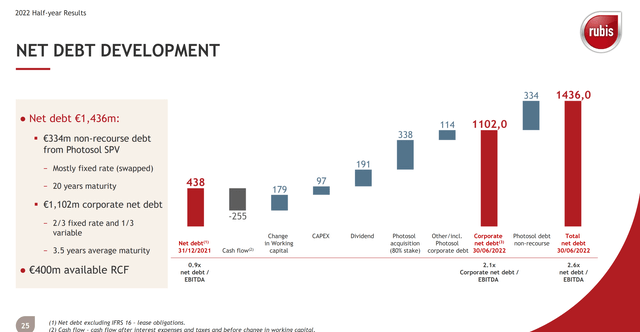

The Photosol acquisition added a fair bit of net debt to the balance sheet, as did working capital effects associated with growing unit price of oil, and not due to a slowdown in the cash cycle’s velocity.

Net Debt (H1 2022 Pres)

What is essential is that the majority of this debt is fixed rate, which places Rubis rather well with respect to rate hikes despite growing leverage. Across the profile, approximately 66% is fixed rate debt.

We think that Rubis should continue to accomplish resilience. 63% of product volumes in retail and marketing come from LPG and service stations, primarily in regions of the world where electrification plans are slow. These are highly resilient product segments. Bitumen represents 12% of the gross profit split in retail and marketing, and it is being supported by excellent trends in basic infrastructure in eastern Africa, and has managed to limit declines despite the awesome 2021 infrastructure comp, where volume development is still 49% above pre-COVID levels.

Trading and logistics could be more affected by an oncoming downturn, and we think that comprehensively no more than 12-15% of Rubis EBIT is at risk from a downturn in the cycle for logistics and trading EBIT.

The terminal and Photosol business should stay entirely resilient.

On a run rate basis, the current PE looks to be around 7.7x, which is extraordinarily low for an infra play. While it likely earns a discount because of its emerging market exposures, infra is infra, and the emerging market risks only really materialised in Madagascar with price controls. The 13% earnings yield is superb, and runs almost twice ahead of the dividend yield, meaning 2x coverage. There is even still scope for aviation recovery, which is still very depressed compared to pre-COVID levels in terms of volumes. All other segments are the picture of resilience. Overall, a clear buy.

Be the first to comment