imaginima

Rubis (OTCPK:RBSFY) owns a retail distribution network of LPG, gas and other crude related products, as well as agrifood and oil terminals and finally even refineries in tax havens as well as supply and trade of oil. They are extremely resilient. COVID-19 did nothing to them despite tourism exposure thanks to backstops in other areas like bitumen, and recessionary pressures continue to do nothing to stop their decent gross profit growth. With reopening supporting the brunt of their businesses, our main concern was with the SARA segment, which has logistics, trading and supply of oil within it. Even the more exposed segments are standing firm. Rubis remains a very solid and cheap buy for the current environment.

Q3 Breakdown

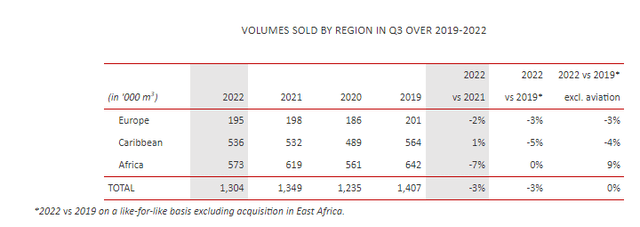

The retail and marketing segment is up 16% in gross profit, which is better growth sequentially, driven primarily by falling oil prices and room to breathe on unit margins. The driving forces were primarily the Caribbean holding volumes, but also Africa. The Caribbean division benefited from the restoration of tourism activity and aviation fuel volumes, offsetting some of the negative pressures from security issues in Haiti dissuading travel there. Volumes were decent there.

Volumes R&M (Q3 2022 PR)

The Africa division benefited from organic operational improvements coming from service station optimisation, but bitumen suffered there and the gross profit picture was flattish. Bitumen mainly suffered due to a slowdown in infrastructure projects in West Africa due to the rainy season. Declines in oil prices helped things as well because it increased access to oil in emerging markets, and kept Rubis from getting crimped by price caps that may have been instituted if gas prices stayed at unsustainable levels for locals. As a utility, Rubis might have had to take the GM hit for price caps instituted by emerging market governments, as Madagascar did. The Europe division benefited from good LPG volumes and was stable on a gross profit basis.

The support and services division, which includes the SARA division and the supply and logistics business, also managed to improve. They benefit from commodity volatility in their trading business and they benefit from logistic demand for oil products. Logistics and charters have been under a lot of pressure broadly speaking, but that division together with trading is eking out flat gross margin evolutions. The SARA refinery is totally fixed margin and regulated infrastructure, so its contribution has not changed. This was the part of EBIT we were worried might be at risk, so the lack of negative developments is taken as a positive.

Bottom Line

The retreat and rationalisation of oil prices have been a good thing for Rubis to get breathing room, but generally the story of Rubis is that its gross margins are improving on positive volume developments. This quarter was under a little idiosyncratic pressure from Haiti, which saw double-digit volume declines that stopped the segment’s overall growth, and was saved by improved margin, but next quarter is likely to see broader improvements on sustained margins and further strides in volumes improvement also as African infrastructure resumes.

There is also the terminal business which is seeing single-digit growth from demand in agrifood and biofuel but also petrochemicals more broadly.

Overall, Rubis infrastructure is indeed that: infrastructure. The economics that go with that are stable and utility-like. Yet the company trades at a P/E of 7.4, despite the super resilient earnings, even in the face of COVID-19 which specifically decimated travel and mobility upon which Rubis relies. The continued downtrend in price has opened an 8% dividend opportunity, and remains irrational. Rubis is a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment