Dimitrios Kambouris

Thesis

Tesla’s (NASDAQ:TSLA) CEO Elon Musk is currently on trial in Delaware to defend his $50 billion compensation package against shareholders who felt that Musk enriched himself at their expense (which I think is ridiculous – just as a side note). But the trial revealed highly interesting – and material – information about Musk’s ambition to continue to lead the EV maker as Chief Executive. According to Tesla director James Murdoch, Musk has voiced plants to find a successor for his role as CEO.

Among investors, it has long been debated if Musk is Tesla’s greatest asset or biggest liability/risk. Personally, I strongly believe that the former is the case. And if Musk would step-down as CEO, then Tesla shares are likely to sell off sharply.

Seeking Alpha

Background – Musk’s $50 Billion Payday

In 2018, Musk has received an incentive package that allowed him to potentially claim more than 100 million stock options on Tesla shares, if the EV-marker hits certain performance goals. After Tesla met the required milestones, and Tesla stock more than 10xed over less than five years, Musk cashed in on the options and became the world’s richest man.

Seeking Alpha

Although early investors – those who held Tesla equity back in 2018 when Musk’s stock options were awarded – profited richly from Tesla’s share price appreciation, a group of shareholders have different thoughts on this.

Shareholders’ concern regarding Musk’s role as Tesla’s CEO became even more pronounced after the world’s richest man acquired Twitter (TWTR) in a deal valued at approximately $44 billion. Some investors fear that Musk would spread out his time to broadly – now being the Chief Executive officer of Tesla, Spacex, Twitter, The Boring Company and Neuralink.

In that context, Musk even commented that his commitment toward Tesla should deserve less time:

If I over-allocate time to Tesla . . . I am not sure that would serve the greater good.

Interestingly, Musk is not the only one working at Tesla whose commitment is diluted. Only recently, he invited about 50 Tesla engineers to Twitter headquarters to improve various algorithms on the social media platform. But Musk implied that the commitment was non-material to Tesla’s business operations: (emphasis added)

This was an after hours — just if you’re interested in evaluating, helping me evaluate Twitter engineering … that’d be nice. I think it lasted for a few days and it was over.

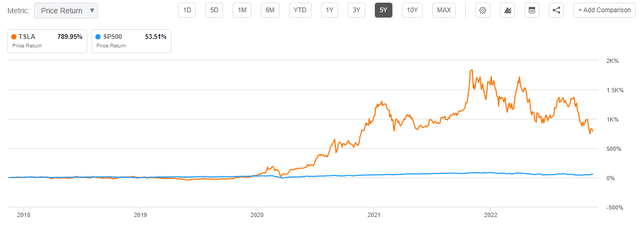

Nevertheless, Tesla’s valuation took note: The EV-marker’s stock has lost about 30% of market capitalization (approximately $175 billion) since Musk took the CEO office at Twitter, vs. a gain of about 5% for the S&P 500 (SPY).

Will Musk Musk Step Down As Tesla’s CEO?

Reflecting on Musk’s multiple CEO commitments it’s only reasonable to ask if he will hand off some responsibility. Testifying during the Delaware trial, Musk has said that he plans to reduce his time commitment to Twitter.

I expect to reduce my time at Twitter and find somebody else to run Twitter over time.

But apparently, Musk also voiced ambitions to find a successor for his role at Tesla – as Tesla director James Murdoch has testified. But there are two important things to note: First, only because Musk has identified a successor, this doesn’t mean that somebody else will actually take over. Second, even if somebody else would take on the CEO role at Tesla, Musk will likely to remain “technoking” and the key driving force for the EV maker’s future ambitions – as Musk arguably views the CEO title more “pro-forma.”

At SpaceX it’s really that I’m responsible for the engineering of the rockets and Tesla for the technology in the car that makes it successful …

… So, CEO is often viewed as somewhat of a business-focused role but in reality, my role is much more that of an engineer developing technology and making sure that we develop breakthrough technologies and that we have a team of incredible engineers who can achieve those goals.

in that context, Musk also added that:

I tried not to be CEO of Tesla, but I had to or it would die. I rather hate being a boss. I’m an engineer …

… It’s my experience that great engineers will only work for a great engineer. That is my first duty, not that of CEO.

Assuming Musk would hand over the CEO title, who could claim it? In my opinion, there are two likely candidates: Ex Volkswagen CEO Herbert Diess and Tesla’s current CFO Zach Kirkhorn. Interestingly, Herbert Diess has voiced appreciation for Tesla cars and Musk multiple times during his stay at Volkswagen, while he quite successfully spearheaded the German carmaker’s EV transformation. And Diess reportedly also cultivated a friendly relationship with Musk.

Musk Is Doing A Great Job

With all the news surrounding concerns regarding Musk’s role as Tesla’s CEO, investors should not forget that Musk is doing an excellent job as the carmaker’s chief executive. He received the $50 billion options-package because he managed to deliver on milestones that the market thought impossible.

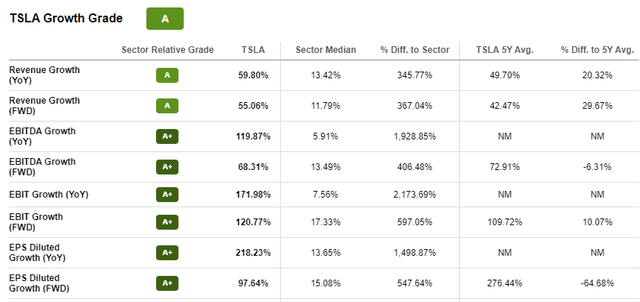

Moreover, Musk is doing an excellent job balancing Tesla’s growth potential with industry-leading profitability.

Seeking Alpha

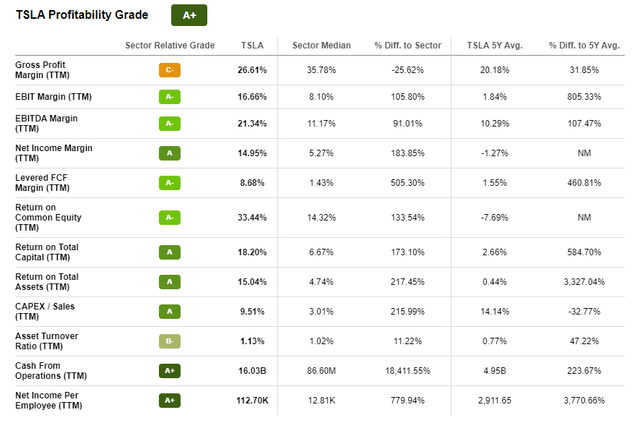

For the trailing twelve months, Tesla has managed to claim an operating income margin (EBIT reference) of 16.6%, which implies a premium to the sector median of more than 100%.

Tesla also is very capital efficient. For the trailing twelve months, the world’s leading EV-maker managed to generate a 18.2% return on total capital employed, which compares to 6.7% for the sector median. Moreover, Tesla generates about $112.7 thousand of net income per employee, vs. $12.8 thousand for the automotive sector median, respectively.

Seeking Alpha

Investor Takeaway

In the past few months, TSLA shareholders have become increasingly disenchanted with Musk as the carmaker’s CEO: The $50 billion options package awarded in 2018 has turned into a legal dispute, and the recent acquisition of Twitter adds concerns over Musk’s multiple CEO commitments.

But investors should not forget that Musk’s visionary ambitions are a key cornerstone for Tesla’s rich valuation. Moreover, there are few reasons to doubt that Musk is not doing an excellent job as the EV-makers Chief Executive. And in my opinon, Tesla needs Musk to remain CEO – because the world’s leading EV-maker still has lots of “visionary potential.” And arguably, the company is not yet ready for an executive with focus on financial engineering.

Personally, I believe that Tesla shares could drop sharply on Musk’s resignation as CEO. But since I view this as an unlikely outcome, I remain “Buy” rated and continue to believe that Tesla’s fair implied value per share should be around $367.

Be the first to comment