Aslan Alphan/iStock via Getty Images

By Somya Sharma

Summary

The retail sector has been under immense pressure this year. Between the Russia-Ukraine war, disruption in the supply chain, and an increase in energy prices, retail businesses have been struggling. Moreover, inflation and rising interest rates have added fuel to the fire. After all, many retailers have not faced significant inflation headwinds in a very long time.

VanEck Retail ETF (NASDAQ:RTH) is the largest market cap-based ETF, and is built quite differently than other ETFs that focus on the Retail sector.

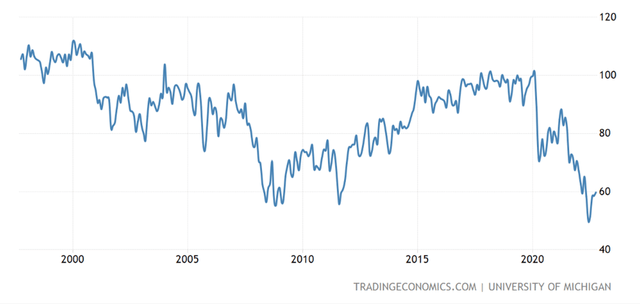

We rate RTH as a hold. Consumer sentiment recently ticked up slightly, after a historically-high drop in 2022. That so-called “green shoot” (a potential early sign of a bottom) may provide hope that the retail sector is on a path to recovery.

Strategy

VanEck Retail ETF invests in a wide variety of sub-segments of the retail industry. It tracks the performance of the MVIS US listed Retail 25 Index. This index tracks the performance of the 25 largest US exchange-listed companies. It includes companies that earn most of their revenue from retail distribution, online retail, wholesale, online retail, direct mail retail, and all other retail sectors.

It charges a modest 0.35% expense ratio and trades an average of about $1-2 million of volume per day. So, it’s liquid enough for an individual to invest. However, large advisory firms and institutional investors should be aware that trading RTH could require a bit more effort to avoid price slippage through wider trading spreads when executing trades.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Industries

-

Sub-Segment: Retail

-

Correlation (vs. S&P 500): High

-

Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

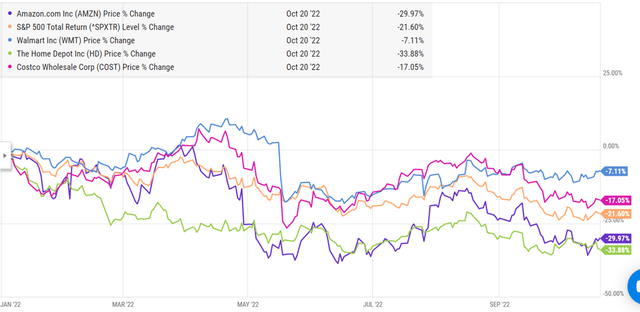

RTH weighs its stocks on a Market Capitalization basis. Thus, it is highly-concentrated in four big U.S.-based retail stocks. Amazon (AMZN) alone accounts for about 20% of the fund, and Home Depot (HD), Walmart (WMT), and Costco (COST) each account for 7-10% of total assets.

Retail companies tend to be classified as either cyclical (discretionary spending) or defensive (staples, i.e., things we need regardless of the economy). The fund allocates over 50% of its funds to the consumer cyclical sector, which makes it sensitive to economic conditions. This sector exposes the ETF to fluctuations in consumer spending. Investment in consumer cyclical provides profitability when the economy flourishes.

To balance this out, the fund invests about 40% of its assets in the consumer defensive sector, including essential products and services less affected by market fluctuations.

Strengths

This retail sector ETF comprises the four largest firms in the industry, and these companies are responsible for the lion’s share of the retail industry’s revenue. RTH represents a way to gain exposure to these firms without having to pick individual stocks.

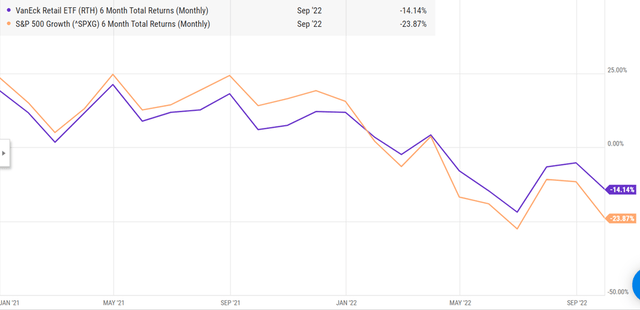

Through mid-October of 2022, RTH has been a decent defensive equity investment, beating the broader market by about 9% in just over 9 months.

6 months total returns(Monthly) comparison of RTH and SPY (YCharts)

Weaknesses

This high concentration in a few stocks can produce periods of high volatility, both up and down, depending on how that “big four” behaves. RTH offers less diversification than a broadly diversified ETF. But to be clear, as a firm, we prefer less diversification in an industry ETF, since it allows us to better-understand what we own.

This lack of diversification can create investment risk if one or more of the underlying companies perform poorly. The large Amazon position could be negatively impacted if so-called FAANG stocks fall hard in a bear market. Earnings season can be particularly volatile for industries like retail.

This ETF is focused on U.S. equities. That helps when the U.S. consumer is dominant, but a dramatic change in that trend can work the other way.

Dividend Yield-seekers will be disappointed by RTH, as retail companies in this index tend to use most of their profits to reinvest in the business, not to pay out to shareholders as dividends. In fact, RTH only pays a dividend annually, and its current 12-month trailing yield is a mere 0.97%.

Opportunities

Performance Analysis of RTH top holdings (YCharts)

In 2022, three out of RTH’s four biggest holdings have fallen by more than 17%. In particular, should Amazon and Home Depot reverse their 2022 lagging performance, RTH could be an excellent opportunity to participate in that rebound, but with the cushion of having a total basket of 25 companies in one security. A strong holiday season could boost the earnings of these retail giants.

Threats

At a time when consumer sentiment is low, heavy exposure to the cyclical sector could turn out to be a negative impact on RTH. If consumers have less disposable income, they are less willing to buy luxury and other non-essential products and services.

Inflation is rising worldwide, and several nations are seeing the worst price increases in a very long time. The prices of many goods are rising, but wages are not keeping pace. As a result, consumers are cutting back on their spending, causing retail companies to struggle.

The consumer price index has recently been seen at its lowest level in years as rising inflation, war, supply chain issues, and rising interest rates have shaken consumers’ confidence. It all adds up to resistance to spending. That is a clear threat to retail stocks, and, thus, to RTH.

The US Index of Consumer Sentiment (University of Michigan| Tradingeconomics.com)

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

We like RTH for what it is: a focused, “big four” oriented way to access the performance of U.S. retail stocks. We like its limited number of holdings, the focus on mega-cap, high-quality, sustainable businesses, and its sufficient asset size for retail investors.

ETF Investment Opinion

Our hold rating for the next few months and our longer-term sell rating are a reflection of two things: we think RTH can outperform the S&P 500 Index for a while, as it has done so far this year. However, the further we go in the future, inflation and stock market pressure in general, and on retailers in particular, make this as vulnerable as most of the stock market is likely to be.

Be the first to comment