Peach_iStock

Written by Nick Ackerman, co-produced by Stanford Chemist. A version of this article was posted to members of the CEF/ETF Income Laboratory on September 19th, 2022.

Cohen & Steers Quality Income Realty Fund (NYSE:RQI) is one of my go-to closed-end fund investments for gaining a broad swath of REIT exposure. In fact, it is the largest exposure I have when combining the position that I have spread between two accounts (a taxable account and a nontaxable one.)

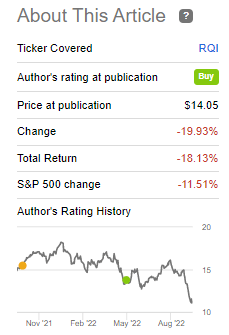

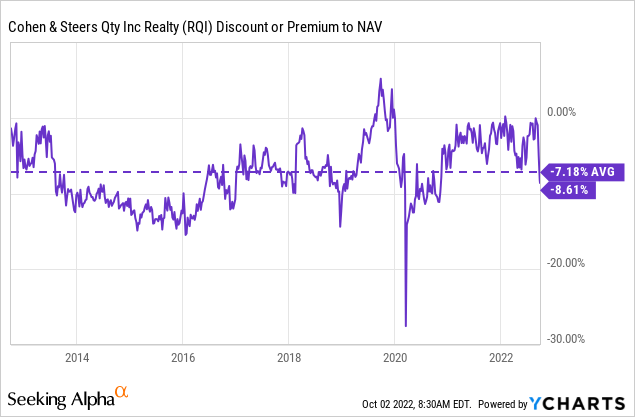

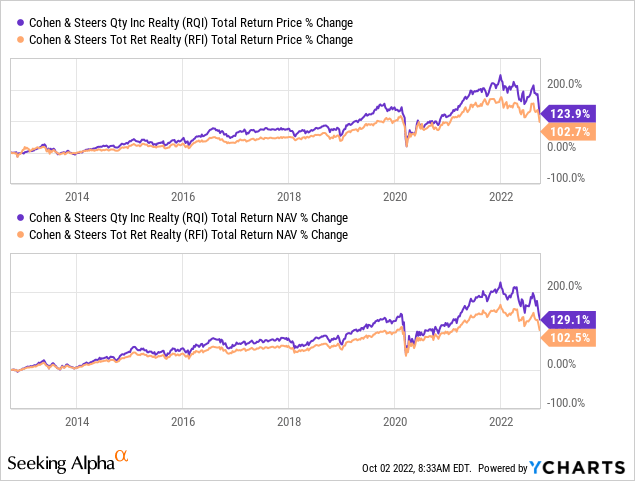

Since our last update, we have seen the fund’s discount widen. This happened primarily as the overall market came crashing down. However, that results in the share price performance being weaker than compared to the NAV. Meaning that the portfolio has held up a bit better than what the actual share price performance would suggest. It still makes it an attractive option to gain REIT exposure, in my opinion.

RQI Performance Since Previous Update (Seeking Alpha)

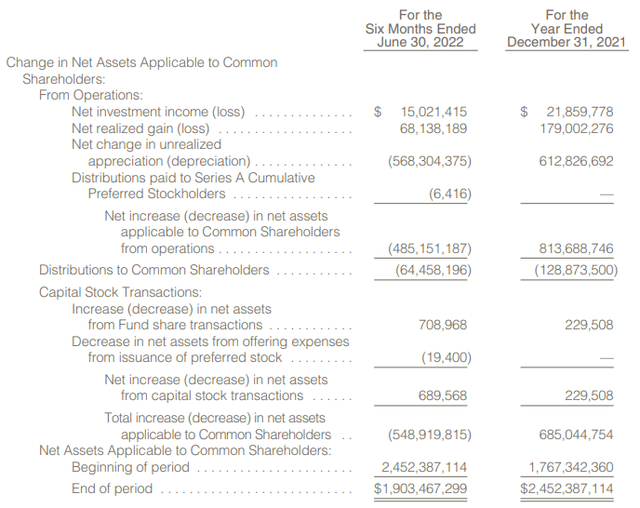

Additionally, since the last time we took a look at this fund, there has been a new semi-annual report that has been posted. In the latest report, we’ve seen a meaningful jump in the net investment income the portfolio is generating. That is both year-over-year and if we annualized the current amount to compare with the prior fiscal year-end amount. NII can be more predictable than capital gains in continuing to fund the distribution, which becomes incredibly important to consider during these times of volatility.

The Basics

- 1-Year Z-score: -2.62

- Discount: -8.61%

- Distribution Yield: 8.53%

- Expense Ratio: 1.29%

- Leverage: 26.68%

- Managed Assets: $2.7 billion

- Structure: Perpetual

RQI’s investment objective is to provide a “high current income.” They also have a secondary investment objective of “capital appreciation.” They will invest in “real estate securities including common stocks, preferred stocks and other equity securities of any market capitalization issued by real estate companies, including real estate investment trusts (REITs) and similar REIT-like entities.”

The fund’s expense ratio comes to 1.29%; when including interest expenses, this comes to 1.89%. Thanks to being a fairly large fund, this is actually quite low for a closed-end fund.

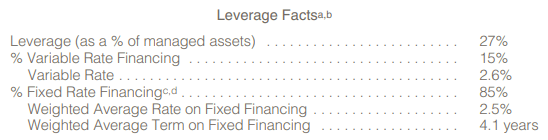

Additionally, this fund isn’t as exposed to higher interest rates at this time. They’ve been hedged against higher rates for quite some time through interest rate swaps and fixed-rate financing. It saw around 85% of the leverage at a bit higher of a cost previously, but it is now benefiting the fund.

RQI Leverage Stats (Cohen & Steers)

We can see that the variable rate portion has now topped the fixed-rate amount. This was for the period ending June 30th, 2022. From that point, rates have only increased further. At the end of December 2021, the variable rate leverage was costing them 0.9%.

That being said, the fixed-rate financing also ticked up from 2.1% to 2.5%. The change would have resulted in the fixed-rate borrowing portion. While that was an increase, it was a relatively smaller leap higher. Meaning they’ve now avoided a meaningful amount of those higher costs by fixing most of their leverage.

Of course, any leverage is going to make a fund more potentially volatile. Therefore, leverage might not be appropriate for risk-averse investors as it can result in compounding losses.

Performance – Narrowing Discount

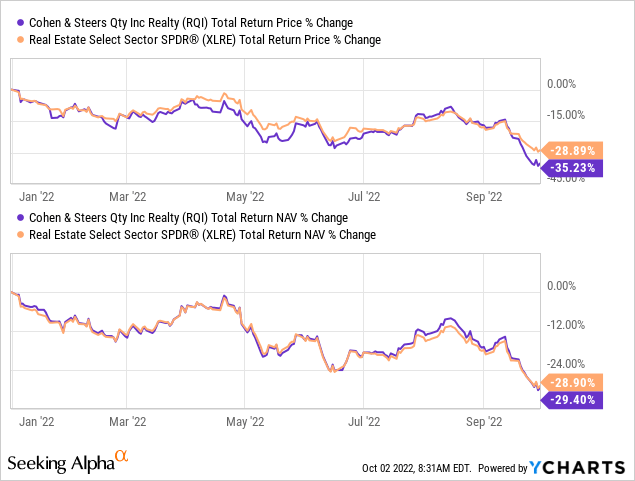

The fund hasn’t been performing very well, which is something we noted previously. However, it seems to be more related to the overall market and, specifically, the real estate sector performing terribly. Despite that leverage, RQI on a total NAV return basis has performed very similarly to the Real Estate Select Sector SPDR (XLRE).

On a total share price return basis, it had performed more meaningfully weaker as the fund went from trading near parity with its share price entering this year. Now, the fund has sunk to a discount to an attractive discount.

Looking back historically, the fund is trading at a wider discount than its longer-running average discount. Within just the last week, this discount widened sharply. That could provide further upside whenever the market recovers if the discount narrows once again.

If one is looking to avoid leverage, the Cohen & Steers Total Return Realty Fund (RFI) could be worth consideration. The fund trades at a fairly persistent premium, even longer-term, the fund has traded at premiums more than a discount.

Of course, avoiding leverage in the last decade meant that you would have given up some upside. An investor might be okay with that if they think the next decade will be more challenging.

Distribution – Attractive 8.5%+

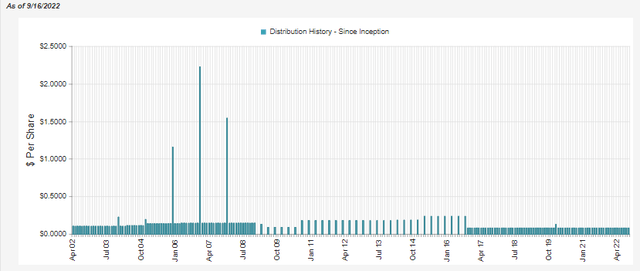

At this time, RQI is sporting a 8.53% distribution rate, and it works out to a reasonable 7.89% on a NAV basis. The only time they’ve cut their distribution was in 2008/09 – though it was quite an extreme cut as they went from monthly to quarterly.

RQI Distribution History (CEFConnect)

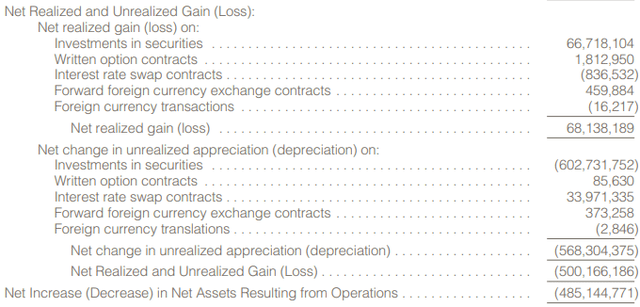

Supporting that distribution are capital gains that the fund can generate. However, it isn’t all just underlying position changes that can contribute to capital gains. The fund operates with various derivatives, too, including written options and currency exchange contracts. Both of which contributed positively to the latest report. Interest rate swaps and foreign currency transactions had taken away from the gains.

You might also note that despite the unrealized depreciation, the fund had realized a significant amount of gains during the period.

RQI Semi-Annual Report (Cohen & Steers)

In realized gains alone, the fund had covered its distribution for the last six months. The NII was just gravy on top.

RQI Semi-Annual Report (Cohen & Steers)

Which, one might notice that NII had actually increased quite substantially. If we annualized this latest figure compared to the prior fiscal year, it would have been an increase of 27.23%. Year-over-year, it was a similar increase of 27.43% from the $11,787,713 reported on June 30th, 2021. That’s a positive trend, especially as we can see capital gains should become a bit more difficult to come by with the sizeable unrealized depreciation in the fund.

The NII distribution coverage comes in at around 23.30%, which means a sizeable shortfall in covering the payout from NII alone. Still, the actual distribution yield being below 7% means we are at a reasonable level.

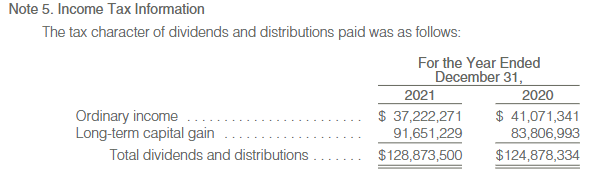

The tax character of the fund’s distributions is important to look at. They generally come in around what the underlying earnings of the fund are. However, that isn’t always the case. For RQI, while the fund’s ordinary income is the smaller sleeve of the classification, it really comes in different from the NII we often see the fund generating.

RQI Annual Report (Cohen & Steers)

A good reminder to always give it a double-check if you are unsure or in a situation where small changes in tax classifications can matter to you.

RQI’s Portfolio

A turnover rate of 16% in the last six months would indicate that the management hasn’t made too many significant changes. This would be on the lower end of what we’ve seen in the prior few years, too. Last year they reported a turnover rate of 38% and then 54% and 51% in 2020 and 2021, respectively.

That being said, there aren’t too many surprises regarding what this fund is holding. The sector weightings stay generally consistent, and the top ten holdings also stay fairly stable.

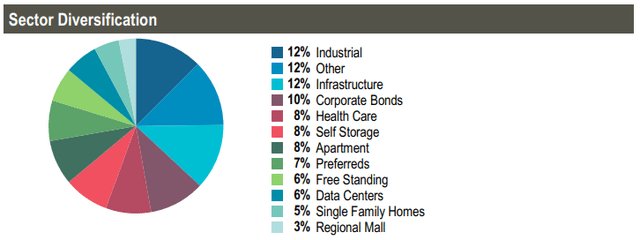

With sector allocations, the fund remains fairly diversified. That can be another strength heading into a period of uncertainty as some sectors will be hit harder than others, or there will be those that stay relatively unscathed. The data below is as of June 30th, 2022, from the latest quarterly fact sheet.

RQI Sector Diversification (Cohen & Steers)

Previously, “other” was listed at 15% weighting, and infrastructure was at 13%. Industrial has maintained its same 12% weighting, but due to the other sector exposures coming down a touch, it was brought up to the top allocation. I don’t see anything here that really would have a meaningful change in the fund’s outlook.

Bonds inched up to a 10% allocation from the 8% previously and preferred stayed at the same 7%. So they haven’t been pushing into any more defensive positioning in a material way, which is probably a good thing as bonds are set to continue to get hit while rates are rising.

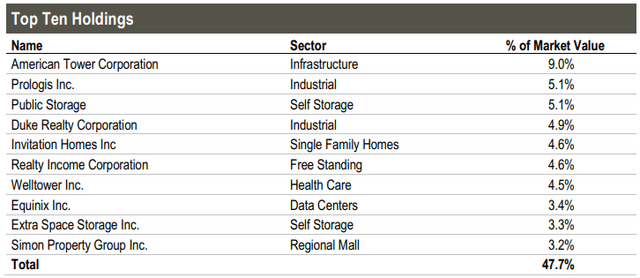

The top ten still have American Tower Corporation (AMT) firmly in the top spot at the same 9% weighting. Prologis (PLD) has moved up one spot to overtake Public Storage (PSA).

Duke Realty Corp. (DRE) and Equinix (EQIX) are another two REITs that have always caught my attention, along with PLD and AMT. I’ve considered adding them to my portfolio as individual holdings, but holding such a substantial weighting in RQI means I’m still indirectly gaining exposure here.

It is also nice to see Realty Income (O) come in at such a large weighting of 4.6%. O has been a position in the fund but has now popped up to a more significant weighting. At the end of 2021, they held 713,226 shares, which increased to 1,752,313 at the end of June 2022. A meaningful increase likely contributed to that more regular income the portfolio is now generating. At least one piece of the puzzle on the increased NII we saw.

Conclusion

RQI’s discount has widened out further since we last looked at the fund. The price has also come down too, with the market and real estate space. REITs continued to be pressured through 2022, but they continue to provide regular and growing income despite what the price actions have suggested. If we are only looking at a mild recession being expected, I believe we won’t see substantial dividend reductions. Thus, what should support a rebound in the REIT space over the following years. All this explains why I’m not worried about holding onto shares of RQI or even why I’d consider adding to the position.

Be the first to comment