Scharfsinn86/iStock via Getty Images

Note: I have covered Ballard Power Systems (NASDAQ:BLDP) previously, so investors should view this as an update to my earlier articles on the company.

Last week, leading Canadian fuel cell systems developer Ballard Power Systems (“Ballard” or “Ballard Power”) announced plans to deepen its global manufacturing footprint in Europe, the United States and China “to support global market demand growth through 2030“.

As part of this new “local for local” strategy, the company has entered into an investment agreement with the Government of Anting in Shanghai’s Jiading District to establish its new China headquarters, membrane electrode assembly (“MEA”) manufacturing facility and R&D center at a site strategically located at the Jiading Hydrogen Port, located in one of China’s leading automotive industry clusters.

Over the next three years, Ballard plans to invest approximately $130 million with the target of establishing large-scale MEA production capacity sufficient for 20,000 fuel cell engines, which would be more than double the recently expanded capacity of its Vancouver facility:

With the new MEA capacity coming online in China, Ballard now expects its global MEA capacity to support total demand requirements through the second half of the decade.

This investment is expected to reduce MEA manufacturing costs, align with China’s fuel cell value chain localization policy, and position Ballard more strongly in the hydrogen fuel cell demonstration cluster regions and for the post-subsidy market.

Please note that this latest move is already Ballard’s fourth attempt to gain traction in the Chinese market but in contrast to its previous strategy of protecting core IP by supplying MEAs solely from its Vancouver facility, the company will soon manufacture its core product in China which apparently bears the risk of Ballard actively contributing to its future obsolescence in the Chinese market.

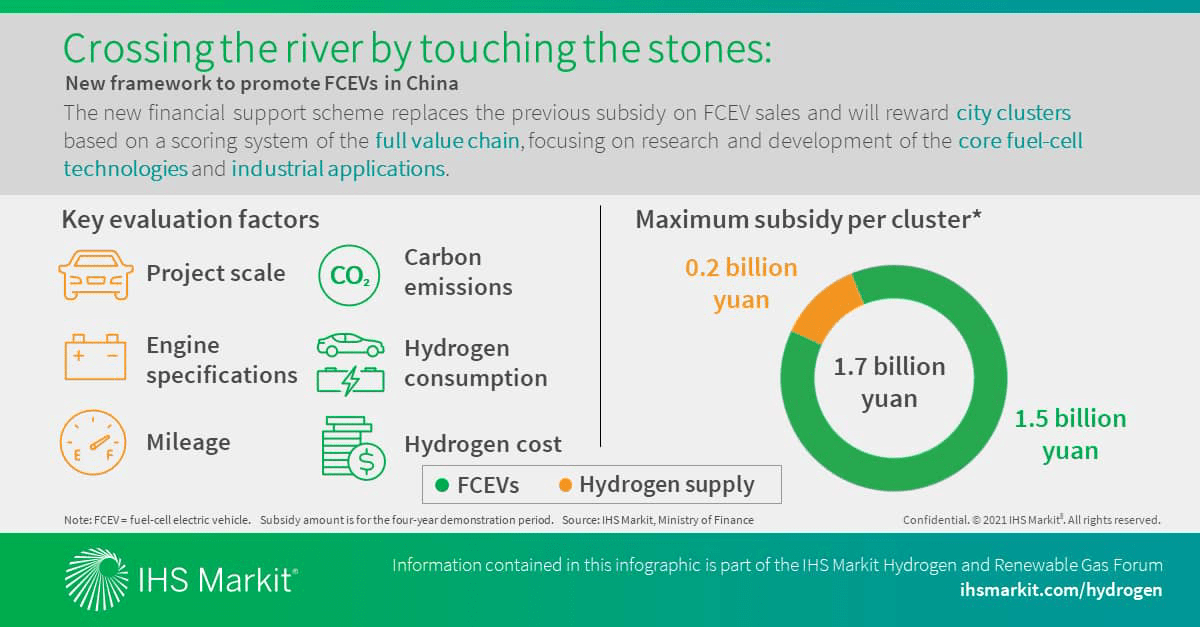

In fact, this is what the Chinese government’s most recent subsidy policy framework is all about as it replaced the previous direct subsidy scheme on fuel-cell electric vehicle (“FCEV”) sales to reward eligible city clusters for the development of a more comprehensive FCEV value chain over a multi-year demonstration period.

IHS Markit

Since the subsidy scheme on vehicle sales has not produced significant results, the government shifted its approach to incentivizing breakthroughs in key core technologies and industrialization of basic materials to improve economics across the FCEV entire value chain.

Clearly, Ballard didn’t have much of a choice anymore as the company’s much-touted joint venture with Weichai Power has largely failed to produce tangible results partially due to the fact that it is located in Shandong, a province that has not been selected for the first batch of hydrogen city clusters.

But even with Ballard Power now apparently willing to share its core IP with Chinese partners, the new facility is not expected to commence operations before 2025 as the Chinese fuel cell market remains in its infancy.

Moreover, with the new subsidy approach apparently directed towards establishing a complete domestic fuel cell technology and hydrogen supply chain over time, any near-term impact on FCEV adoption is likely to remain limited.

Keep in mind that Ballard’s recently expanded Vancouver facility remains underutilized, so increasing total production capacity by more than 200% looks aggressive even when assuming the Chinese FCEV market gaining traction over time.

In addition, at the current sales pace, the joint venture with Weichai Power won’t have to order additional MEAs from the company for another three years.

Bottom Line

Ballard Power has been caught between a rock and a hard place in China with the government’s latest subsidy framework more or less requiring the company to establish domestic manufacturing operations for its core MEA product with the apparent risk of being crowded out of the Chinese market over the long term by domestic competitors after successfully accessing the company’s IP.

In addition, there won’t be any short- and medium-term benefits to Ballard’s top- and bottom line. In fact, the required $130 million investment will consume approximately 15% of the company’s cash balance and increase operating expenses quite meaningfully.

But even when assuming the project to increase the company’s annual cash burn rate to approximately $250 million, Ballard Power’s liquidity of close to $1 billion should still carry the company well into 2026.

Quite frankly, only the company’s large cash balance of approximately $3.35 per common share is keeping me from downgrading shares to “Sell” on this latest headscratcher.

Be the first to comment