Drew Angerer

Looking for exposure to infrastructure assets? With the US set to invest more heavily in its infrastructure over the next several years, this may be a good place to be.

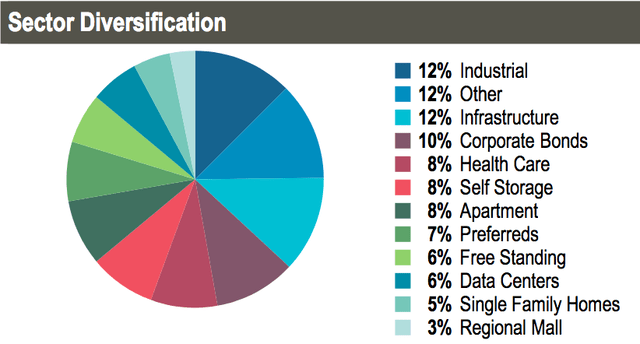

The Cohen & Steers Quality Income Realty Fund (NYSE:RQI) invests in a variety of real estate assets, such as infrastructure, industrial, data centers, and healthcare, among others:

But won’t rising rates hurt real estate investments? No one knows how long the rate hikes will last, but one thing is certain, they’ll eventually stop. In fact, many investors are now thinking that they’ll reverse in 2023:

“Wall Street investors are betting that officials will raise interest rates aggressively through the end of the year – and then turn around and start cutting them in six months.” (WSJ)

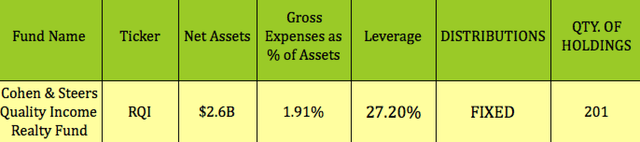

Profile:

RQI is a closed-ended equity mutual fund which invests in stocks of companies operating in the real estate sector, including REITs. It primarily invests in growth stocks of companies across all market capitalizations.

RQI has $2.6B in assets, with 201 holdings. Management uses 27.2% leverage to increase the fund’s returns, with a gross expense ratio of 1.91%.

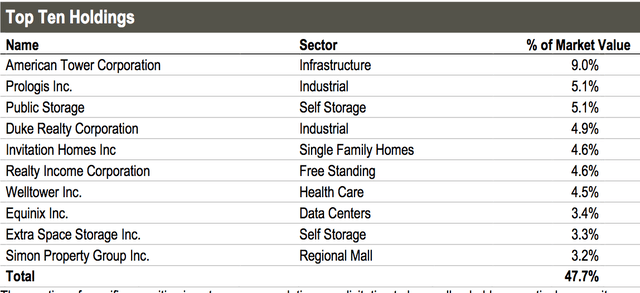

Holdings:

RQI’s top 10 investments span a variety of sectors, with cell tower owner American Tower topping the list, at 9%. The biggest industrial warehouse REIT, Prologis, self-storage REIT Public Storage, and industrial REIT, Duke Realty, each form ~5% of RQI’s holdings.

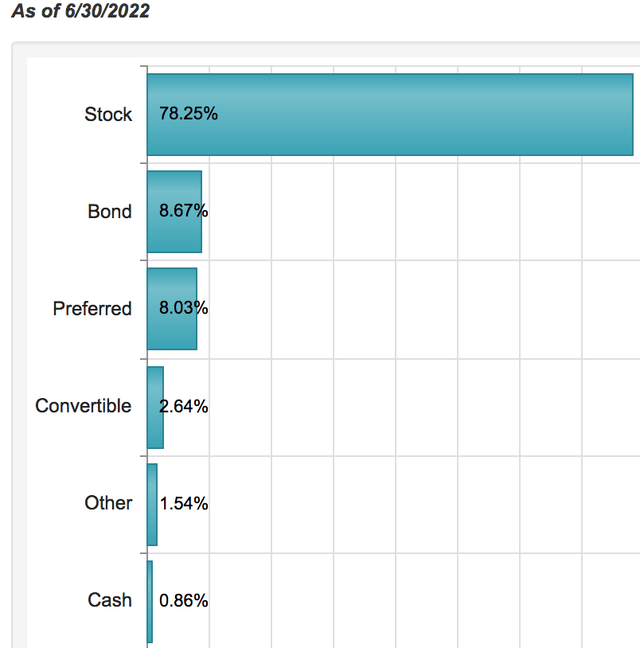

As of 6/30/22, ~78% of RQI’s portfolio was in stocks, with Corporate Bonds at 8.7%, preferreds at 8%, and Convertibles at 2.6%:

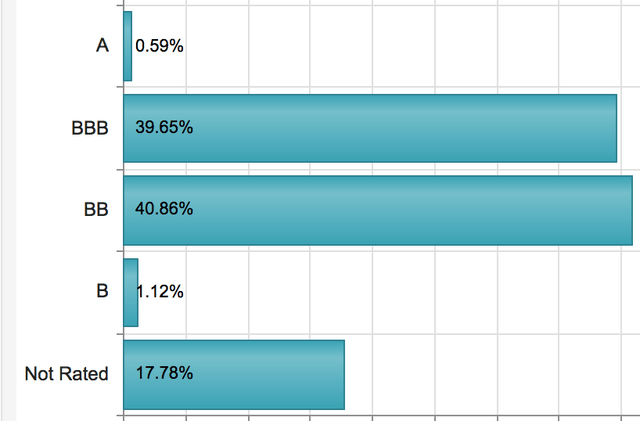

The credit quality is skewed toward lower investment grade, 39.65%, and upper non-investment grade holdings, at 40.86%, with 17.78% not rated:

Dividends:

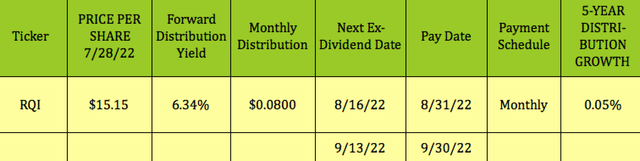

RQI pays monthly, usually going ex-dividend in mid-month, and paying at the end of the month. Management pre-announces the ex-dividend and pay dates for each quarter.

At $15.15, RQI yields 6.34%. It pays a fixed/managed $.08 monthly distribution, hence the low distribution growth.

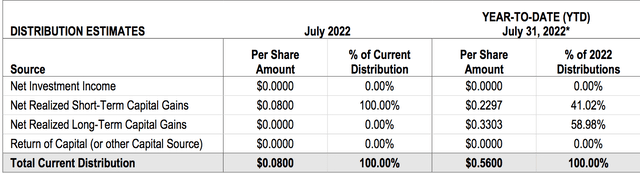

Management estimates that 41% of 2022 distributions have come from short-term capital gains, with 59% coming from long-term gains:

NAV Pricing:

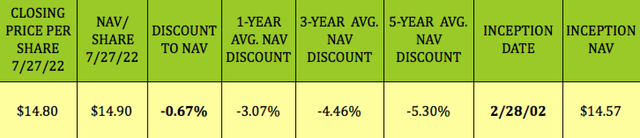

A useful strategy when buying CEFs is to try to buy them at deeper discounts or lower premiums than their historical averages. With its lower -0.67% NAV discount, RQI is currently trading at a lower discount than its 1-, 3-, and 5-year average discounts to NAV/Share.

RQI’s inception NAV in 2002 was $14.57 and is now $14.90. That may look like poor NAV growth, but keep in mind that RQI has paid nearly $26.00/Share in distributions to shareholders since its 2002 inception.

Performance:

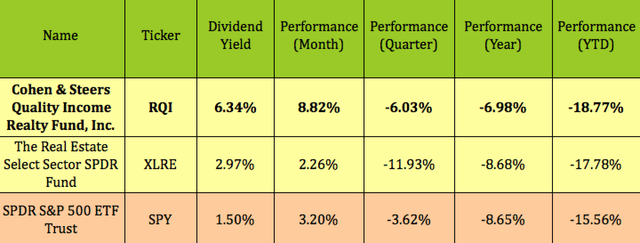

Unsurprisingly, in this rising rate environment, RQI has trailed the market so far in 2022. It has outperformed the market and the broad real estate sector over the past month while holding up better than them both over the past quarter and past year.

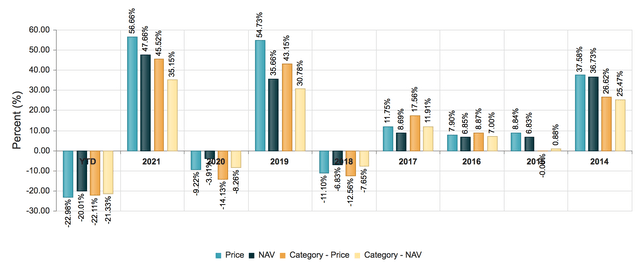

RQI’s calendar year performance outperformed the Morningstar US CEF Real Estate category on a price and NAV basis in 2019-2021:

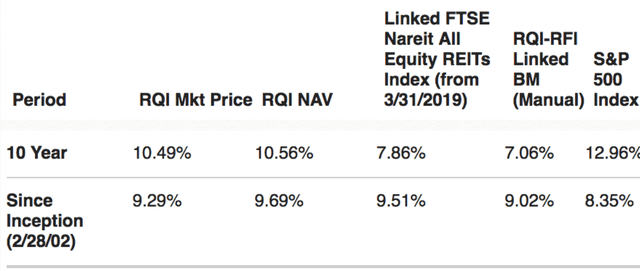

Looking back further shows RQI outperforming the FTSE REIT Index over a 10-year period, and outperforming the S&P 500 since its 2002 inception:

Parting Thoughts:

This is a good candidate for your income investment watch list. It’s currently not a “bargain” due to its lower-than-average NAV discount, but there should be dips in the future that you can take advantage of.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment