Marina113

After recently ending a lot of covid restrictions, the cruise line sector has seen a surge in demand. Royal Caribbean Cruises (NYSE:RCL) remains underappreciated, with the stock trading closer to the covid lows as to the 2021 rebound highs of nearly $100. My investment thesis remains ultra-Bullish on the cruise lines, with covid officially being declared over by President Joe Biden.

End Of Covid

On the CBC program 60 minutes that aired on Sunday, President Biden claimed the unofficial end of the covid pandemic. A lot of areas of the country were already operating with limited covid restrictions, but the cruise lines were one notable area where CDC guidelines and internal acceptance by management allowed the industry to have covid restrictions far beyond the general travel industry.

Back at the start of August, the cruise lines generally removed a ton of restrictions that helped improve bookings dramatically. The main restriction removed effective September 5 was the requirement for a vaccine in order to board a cruise ship. The cruise lines were regularly reporting extended bookings into the next year at strong levels, but the close in travel was typically restricted due to requirements for vaccines and tests turning off passengers.

A lot of data points are highlighting a big boost to bookings since the relaxation of covid restrictions. Based on talks with travel agency executives, Truist forecast a 30% increase in bookings for the month ending the first week of September versus 2019.

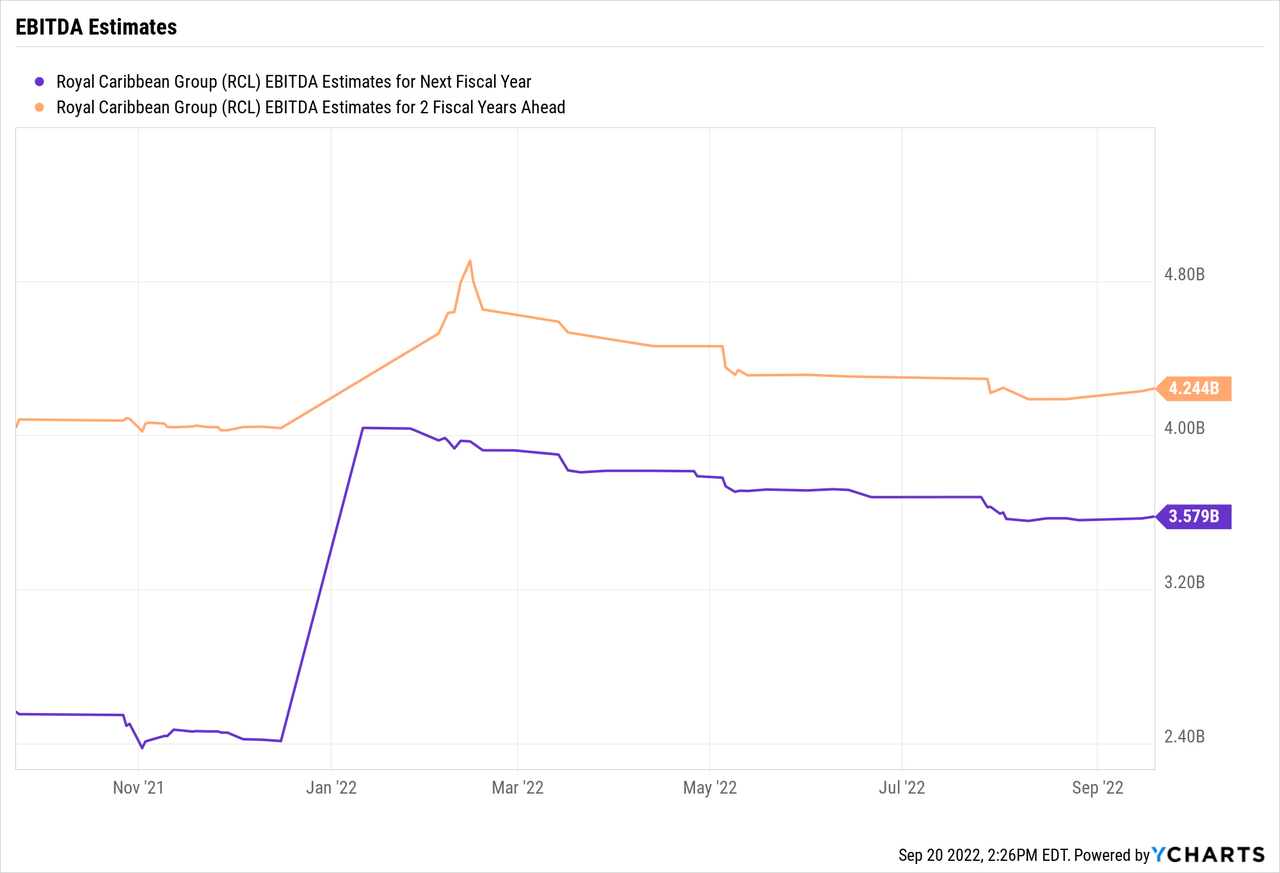

The prior day, Stifel had raised 2023/24 EBITDA targets for Royal Caribbean based on confidence in bookings trends since the removal of most covid restrictions. Analyst Steven Wieczynski sees demand matching 2019 levels without China operating, providing for considerable upside to historical trends once the communist country finally moves on from covid shutdowns.

The one negative for Royal Caribbean is that some indications have the luxury bookings up 40% compared to 2019 favoring Norwegian Cruise Line Holdings (NCLH) over Royal Caribbean and Carnival Corp. (CCL) on the lower end. Macro issues are limiting the upside on all cruises, but the non-luxury market is still seeing upside.

The one minor problem for Royal Caribbean is that some covid restrictions still exist. In the US, the cruise line still requires a negative covid test for unvaccinated people 3 days prior to boarding a ship. Other regions, such as China, still have general restrictions on any travel and Canada requires a vaccine to make a stop in the country, including the departures from Vancouver.

Even New York City has lifted some covid restrictions, including the end of private employer and school activities vaccine mandates. The city still has restrictions on healthcare workers and the groups.

Focus On Growth

With covid over, an investor can now focus on a complete recovery of the cruise business. In the case of Royal Caribbean, investors can return to focusing on a growth in bookings after a 3-year period of pent-up demand:

Back on the Q2’22 earnings call, CEO Jason Liberty highlighted what was already a positive bookings environment prior to the end of more covid restrictions in August:

During the second quarter, we saw a strong demand for close in sailings, which contributed to better-than-expected load factors. Bookings for 2022 sailings averaged about 30% above 2019 levels throughout the second quarter and more recently have been up to 35%. The second half of 2022 is booked below historical ranges, but at higher prices than 2019 with and without future cruise ship credits.

Cancellations are at pre-COVID levels. In addition, we are now seeing the booking window starting to extend back out, providing further confidence in forward-looking business as our guests thoughtfully planned for the future. As a result, all four quarters of 2023 are booked within historical ranges at record prices with bookings accelerating every week. Our customer deposits are at record levels and over 90% of bookings made in the second quarter were new, while study FCC redemptions continued.

The stock only trades at 3x 2024 EBITDA targets of $4.3 billion. The consensus estimates for 2024 continue to rise with the removal of more covid restrictions after bottoming out during the Summer.

Based on the inflection point in bookings, Royal Caribbean could actually see the 2024 EBITDA targets reached next year. The consensus estimates once had 2023 EBITDA at ~$4.0 billion, and the expectations for next year could even be stronger now.

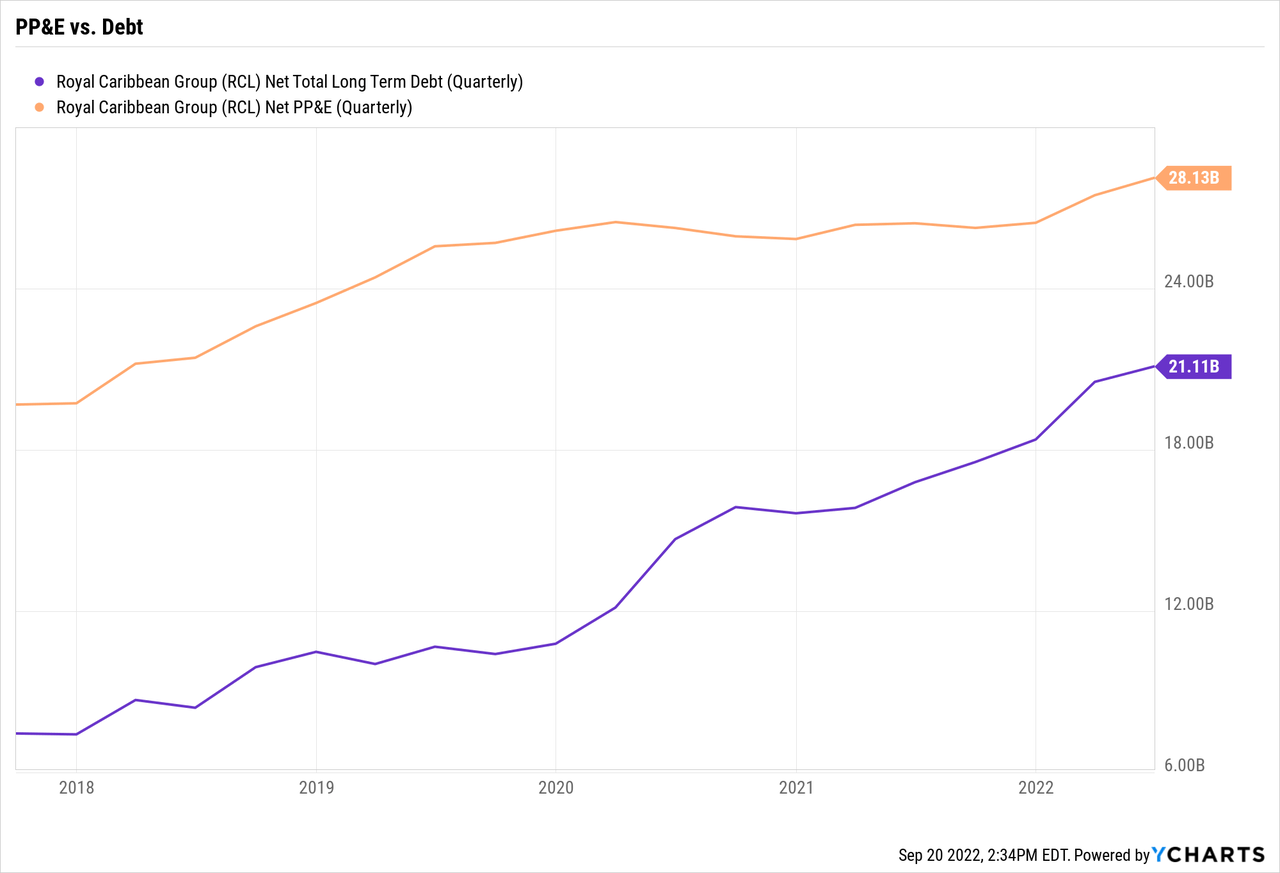

Of course, the company has net debt of $21.1 billion, making the EV/EBITDA target at close to 8x. The issue here is valuing a stock based on net debt while ignoring the net PP&E. All debt isn’t equal, and debt used to acquire assets (cruise ships in this case) shouldn’t just be counted in a similar manner, in my opinion. Royal Caribbean has net PP&E in excess of debt of $7.0 billion.

Takeaway

The key investor takeaway is that once investors start valuing the business based on 2024 consensus EPS estimates of nearly $7, the stock will likely rise. The market is currently lumping on all the negative aspects of higher fuel costs, debt and share dilution while not focusing on the actual facts discussed above.

Investors should use this weakness to load up on Royal Caribbean.

Be the first to comment