Marina113

Royal Caribbean Cruises (NYSE:RCL) is a large cruise-line that has fallen almost 40% since its 52-week highs during the year. The company is the world’s second-largest cruise line operator after Carnival Cruises, with a market capitalization of just under $14 billion. As we’ll see throughout this article, we expect the company’s portfolio to recover, driving returns.

Volatility Without COVID-19

It’s worth noting that even without a global pandemic impacting the industry, cruising remains a volatile industry.

The industry is expensive, heavily susceptible to changing fuel prices, and easy to cut back on when customers are looking for somewhere to cut costs. There’s also a number of competitors in the industry, and while Royal Caribbean is well positioned, there’s numerous wealthy competitors that are continuing to invest in newer and larger ships.

We expect that volatility to continue and 2022 is a prime example of that where cruise companies have seen substantial pressure from crude pricing despite record volume recoveries.

3Q 2022 Financial Results

Financially, Royal Caribbean has continued to see its financials recover.

Royal Caribbean Investor Presentation

Source: Royal Caribbean Investor Presentation

The company has 11.6 million APCDs in the quarter (11.6 million available passenger cruise days). The company managed to earn an average of just $250 / day for $3 billion in total revenue in the quarter with a 96% load factor. The company managed to turn this into $742 million quarterly EBITDA and an annualized EPS of just over $1 / share.

That’s a P/E of roughly 50, however, it’s a respectable profit for a company continuing to improve its balance sheet and recover.

Driving Expanded Financials

The company is working to expand and improve its financials across its portfolio.

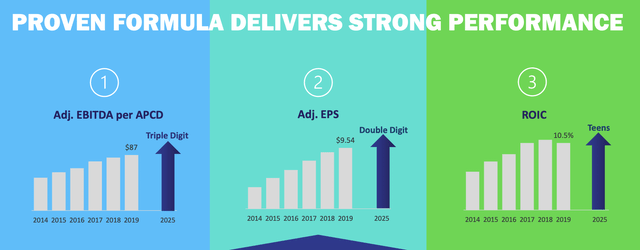

Royal Caribbean Investor Presentation

The company is working to hit triple digit adjusted EBITDA per available passenger cruise day with a double-digit adjusted EBITDA. Those are impressive targets for a company with a share price of just under $54/share. The company is aiming for a double-digit ROIC, and we expect it to continue its volume growth and strength.

The company is working on moderate capacity growth with continued strong cost control to support its portfolio. The company is adding several new ships per year which means 100s of thousands in annual APCDs driving triple figures of profits each.

New Opportunities

The company has substantial new opportunities worth paying close attention to drive future returns.

Royal Caribbean Investor Presentation

Source: Royal Caribbean World Cruise – Royal Caribbean

An example of this is the Royal Caribbean World Cruise, the longest world cruise, with a 9-month duration. It’s broken into 4 segments so customers can choose to sign up for an individual segment or the entire thing. It’s a major change for the company, and it could open up a new avenue for the company to drive revenue.

Cruisers are increasingly interested in experiences, especially younger ones, with expansion to remote destinations like Alaska. That could help the future growth potential.

Climate Change Headwinds

In many ways, cruise ships model the excess of humanity, as enormous floating hotels that can generate massive waste and emissions as they overcrowd the next stop on their tour. Cruise ships account for 0.2% of global CO2 emissions, which might sound small, however, a 7-day Antarctic cruise can equal the average annual emissions of a single European.

Regardless of your views on climate change, the political pressure is there, and unless cruise companies independently clean up their acts, there will likely be increased political pressure to do so, potentially resulting in restrictive regulations on the industry. LNG ships, which are now 52% of the order book, represent a strong step forward with a 30% emission reduction and a higher reduction of more polluting fuels.

Importantly for the industry, LNG ships represent a technological advancement that’ll reduce costs. However, this is a potential headwind that if nothing else, will require cruise companies to continue spending money on finding innovative solutions.

Guidance and Potential

The company is continuing to guide for relative strength and performance in its portfolio.

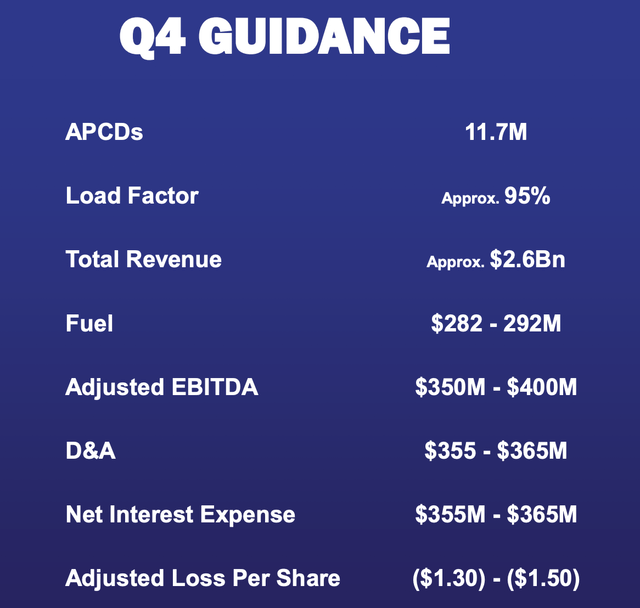

Royal Caribbean Investor Presentation

The company is expecting a just over 10% revenue decline to $2.6 billion. The company still has 11.7 million APCDs and a 95% load factor meaning slightly lower revenue than the most recent quarter, to be expected for a lower cruise season. The company’s fuel expenses are expected to be manageable and the company is still going to earn substantial EBITDA.

However, it’s worth noting the company’s interest expenditures will have a strong impact on its business hurting its earnings.

Thesis Risk

The largest risks to our thesis are continued black-swam events such as COVID-19, rising interest rates, and a global recession. COVID-19 can result in global shutdowns of cruise ships substantially impacting the business. Cruise ships are known to be a place where disease can spread rapidly, much more rapidly than at the home.

Rising interest rates are another risk. The company has almost $20 billion in long-term debt and $1.4 billion in annual interest obligations. Debt grew and was more expensive during the pandemic, and the company now has more long-term debt than its market capitalization. Lastly, a global recession could also hurt volume substantially impacting the company’s growth plans.

Investment Recommendation

Royal Caribbean substantially expanded its long-term debt during the pandemic. The company added billions in new debt as it had massive new losses during the pandemic and running a cruise line operator is a massive and expensive operation. Future pandemic black swam events could significantly hurt the company’s business.

However, the company is working on recovering its business. It has strong EBITDA to cover interest expenses and, by 2025, the company is expecting double-digit EPS. Assuming the company can clean up its balance sheet over the upcoming years, we see the potential for substantial double-digit returns. That is likely given the company’s guidance.

Let us know your thoughts in the comments below.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment