adventtr/iStock via Getty Images

RIG

Rose’s Income Garden (“RIG”) is a defensive income-quality value-built portfolio with 89 stocks residing in all 11 sectors and is a part of the service The Macro Trading Factory, a macro-driven service, led by The Macro Teller and RoseNose. The service offers two portfolios: “Funds Macro Portfolio” and “Rose’s Income Garden”; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

RIG contains mostly investment-grade common stock but also has high yield (“HY”) business development companies (“BDCs”) and real estate investments. The goal is to maintain 50% of the income from defensive sectors/ stocks and to keep a minimum dividend income yield of 4%, which is now 5.3% for June.

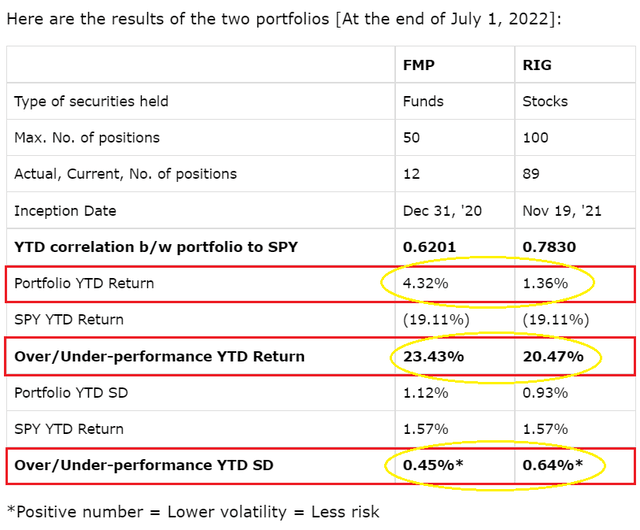

The chart below is for both RIG and FMP which includes July 1st.

Each of the portfolios, span across all sectors, offer a hassle-free, easy to understand and execute investing solution.

RIG and FMP Returns H1 2022 (The Macro Teller at MTF)

The Stock Market – Half 1

Worst first half since 1970 for the stock market and some indexes listed:

S&P -21%

Dow -14.4%

Nasdaq -30%

Individual stocks lost and some as much as -50%

Some sectors that did poorly: Semiconductors down -36%, Consumer Discretionary down-32%.

The sectors of consumer staples, utilities lost the least being down ~5% followed by energy, healthcare and commodities lower by ~6%.

RIG +0.3%

Yes, RIG was up 0.3% on June 30th not including Friday, July 1st in a very emotional and volatile market which is still behaving in that manner.

June alone

June was the worst month, not the usual May, it saw most all of the major indices suffer ~6-8% losses, including RIG. Even energy gave back 17% of its quite phenomenal annual gain along with Bitcoin (BTC-USD) down ~32% and crude oil had its first price drop ytd. RIG ended green, perhaps only by a small amount, but it was positive.

Quarter 2

Q2 had energy, commodities and healthcare winning with the least losses of ~6%. To repeat, June was the worst month of Q2, with it being a terrible annoying, gut-wrenching, icky month for most all investors to finish out and end the quarter. NASDAQ was the weakest, being down -22%, and all of the other indices suffered double-digit declines. RIG was up and green to end Q2 and, yes, even half 1.

Rig Portfolio Value/ Return

A bit of history for RIG on Jan: 1st it was up 5.21% with dividends from inception in November 2021. This also presents for Half 1 2022. The chart below constructed by The Macro Teller, with an accountant background, presents RIG and compares it to SPY. These returns are easily found under the performance tab in the service Macro Trading Factory where it resides:

RIG Portfolio 2022 Returns MTF (Macro Trading Factory)

Total return is 1.35% YTD, year to date, including July 1st with SPY down 19.11%. Dividends are included for both. Total overall over performance of RIG over SPY is 20.46%. Standard deviation and Sharpe ratio are good and the lower number is better.

FMP

The chart below shows the separately run FMP, Funds Macro Portfolio as compared to SPY and is beating it by 23.43%. Congrats TMT! Statistics for FMP are also shown above and at MTF. Remember that it uses funds in an easy care non intensive manner.

Funds Macro Portfolio 2022 Returns (The Macro Trading Factory Service)

RIG Portfolio Income

June is a Joy for dividends.

46 companies paid with 2 extra special payments; 5 pay monthly. The 6 raises have the stock ticker listed in bold print and some discussion follows the chart.

The chart below reveals the payments by date received with abbreviations used as follows:

Div/ sh = Dividend per share paid.

Yearly $ Div = Current yearly estimated known dividend payment

Div % Yield = dividend yield calculated using the current shown price and yearly suggested dividend

Current $ Price is for the end of the day market price July 5th.

| 2022 | div/sh | Yearly | Div% | Other Dividend | Current | |

| Ticker | date | $ Div | Yield | Comments | Price $ | |

| (PFLT) | 1 | 0.095 | 1.14 | 9.82% | Monthly Pay | 11.61 |

| (ENB) | 1 | 0.676 | 2.71 | 6.66% | 40.69 | |

| (V) | 1 | 0.375 | 1.5 | 0.76% | 197.6 | |

| (WEC) | 1 | 0.7275 | 2.91 | 2.96% | 98.3 | |

| (SLRC) | 2 | 0.1367 | 1.64 | 11.07% | Monthly Pay | 14.81 |

| (CMI) | 2 | 1.45 | 5.8 | 3.03% | 191.62 | |

| (MAC) | 3 | 0.15 | 0.6 | 6.55% | 9.16 | |

| (SO) | 6 | 0.66 | 2.7 | 3.84% | 70.33 | |

| (PTMN) | 7 | 0.63 | 2.52 | 10.64% | 23.68 | |

| (JNJ) | 7 | 1.06 | 4.45 | 2.53% | 176.02 | |

| (ZIM) | 8 | 2.85 | 19.85 | 47.52% | varies+25% for tax | 41.77 |

| (AMGN) | 8 | 1.94 | 7.76 | 3.18% | 243.95 | |

| (DAC) | 9 | 0.75 | 3 | 5.04% | 59.49 | |

| (CVX) | 10 | 1.42 | 5.68 | 4.04% | 140.62 | |

| (TGT) | 10 | 0.9 | 3.6 | 2.51% | Sept raise to 1.08 | 143.34 |

| (XOM) | 10 | 0.88 | 3.52 | 4.20% | 83.72 | |

| (DNP) | 10 | 0.065 | 0.78 | 7.18% | Monthly Pay | 10.86 |

| (WBA) | 10 | 0.4775 | 1.91 | 5.01% | 38.11 | |

| (MMM) | 13 | 1.49 | 5.96 | 4.69% | 127.19 | |

| (LYB) | 13 | 1.19 | 9.9 | 11.84% | Raise from 1.13 | 83.63 |

| LYB/ S | 13 | 5.2 | $5.2 Special = $6.39 | |||

| (MGEE) | 15 | 0.3875 | 1.6 | 2.12% | 75.45 | |

| (HSY) | 15 | 0.901 | 3.61 | 1.67% | raise due in Sept | 216.37 |

| (AEM) | 15 | 0.4 | 1.6 | 3.58% | 44.66 | |

| (TAP) | 15 | 0.38 | 1.52 | 2.78% | 54.72 | |

| (MTBCP) | 15 | 0.2292 | 2.75 | 10.42% | Monthly Pay | 26.38 |

| (GOLD) | 15 | 0.2 | 0.6 | 3.49% | Raise from 0.1 | 17.18 |

| (HD) | 16 | 1.9 | 7.6 | 2.72% | 279.82 | |

| (SBLK) | 16 | 1.65 | 6.6 | 29.46% | Varies/ last $2 | 22.4 |

| (VTRS) | 16 | 0.12 | 0.48 | 4.65% | 10.32 | |

| (DUK) | 16 | 0.985 | 4.01 | 3.81% | raise due in Sept | 105.23 |

| (NEM) | 16 | 0.55 | 2.2 | 3.74% | 58.89 | |

| (KGC) | 16 | 0.03 | 0.12 | 3.64% | 3.3 | |

| (D) | 21 | 0.6675 | 2.67 | 3.40% | 78.59 | |

| (MCD) | 21 | 1.38 | 5.52 | 2.20% | 250.6 | |

| (TRTN) | 23 | 0.65 | 2.6 | 5.05% | 51.5 | |

| (KHC) | 24 | 0.4 | 1.6 | 4.24% | 37.71 | |

| (LMT) | 24 | 2.8 | 11.2 | 2.74% | 409.03 | |

| (SHEL) | 27 | 0.5 | 1.98 | 4.12% | Raise from 0.48 | 48.08 |

| (ARCC) | 30 | 0.42 | 1.8 | 9.77% | 18.43 | |

| ARCC/S | 30 | 0.03 | 3c Special = 45c total | |||

| (AVGO) | 30 | 4.1 | 16.4 | 3.50% | 468.63 | |

| (NMFC) | 30 | 0.3 | 1.2 | 9.88% | 12.14 | |

| (UNP) | 30 | 1.3 | 4.98 | 2.39% | Raise from 1.18 | 208.56 |

| (TCPC) | 30 | 0.3 | 1.2 | 9.51% | 12.62 | |

| (SPG) | 30 | 1.7 | 6.7 | 6.96% | Raise from 1.65 | 96.32 |

| (PEP) | 30 | 1.15 | 4.53 | 2.72% | Raise from 1.075 | 166.84 |

| (ARDC) | 30 | 0.0975 | 1.17 | 9.66% | Monthly Pay | 12.11 |

The Raises-6

LyondellBasell NV

LyondellBasell NV (LYB) is a commodity producer of mostly chemicals operating internationally with operations based in Houston TX and a BBB credit rating. It has paid rising dividends for 12 years with a raise from $1.13 to $1.19 along with a special payment of $5.20 to = $6.39 paid on the 13th. The stock price has dropped recently and has a fabulous yield of 5.4% on the suggested yearly payment of $4.76 (special not included).

Barrick Gold

Barrick Gold (GOLD) is an international gold and copper miner with a BBB S&P credit rating headquartered in Canada. It raised the dividend 100% from 10c to 20c, but no real idea if that will continue. I show the yearly dividend at 50c, but it could be more.

Shell plc

Shell plc (SHEL) was known previously as Royal Dutch Shell was founded in 1907. It has merged its operations into the new name operating out of London, UK. It is an international energy and petrochemical company with and AA- S&P credit rating.

Union Pacific

Union Pacific (UNP) railroad operates out of Omaha NE and has an “A-” S&P credit rating. It has been in business since 1862 with now 16 years of rising dividends. This raise was given early, as it was not due until November. It gave 2 raises in 2021, so this is again, indeed, a wonderful surprise. The nice dividend raises, 5 yr DGR of 12.9% and yield of 2.4%, it is a very pleasant stock to own. If anyone cares it has a Chowder # of 15.3 and could be time to consider buying more.

Simon Property Group

Simon Property Group (SPG) is one of the largest retail real estate investment trusts that specializes in quality premier shopping and dining properties in North America, Asia and Europe along with an “A-” S&P credit rating. It experienced difficulties during the covid-19 closings, cut its dividend and is playing catch up with it. This is the 2nd raise within 1 year and now has a very attractive 7% yield.

PepsiCo

PepsiCo (PEP) was founded in 1898 in Purchase, NY and has become known worldwide for its non alcoholic beverages and convenience snack foods. It has an “A+” S&P credit rating. It pays on an interesting schedule for the months of January, March, June and September and has done so for 50 years raising it each time.

Monthly payers- 5

PFLT – PennantPark Floating Rate Capital

“BDC” Business Development Company is high yield, currently ~ 9.6%. It rarely changes the payment amount or the date.

SLRC – SLR Investment Corp. – New purchase from May transactions section article.

DNP – Duff & Phelps Select Income Fund

“CEF” Closed End Fund primarily invested in utilities/ bonds with yield now ~7.2%.

MTBCP – CareCloud (MTBC) preferred

Healthcare technology preferred issue has a 10.2% yield. It reveals the most recent payment dates 3 at a time. Shares in smallish batches have been called at $25; none currently. I most likely will own it for the remainder of the announced dividend payments this year with only 2 left. I watch carefully for another call date or more announced dividend pay dates.

ARDC – Ares Dynamic Credit Allocation Fund – New purchase as mentioned in May transactions: CEF- fixed income mutual fund invested in bonds of generally short duration loans. Dividend paid on the last day of the month. Trading Alert “TA” to buy for RIG was given in MTF service on May 12th here and also June 6th here.

1 Trim and 5 Add-Ons

Trim-1

Trim AT&T (T) and add to Medical Properties Trust (MPW) for income replacement. Trading Alert June 6th here for MTF service.

ARDC – Added more and already mentioned above under monthly payers.

MPW – Medical Properties Trust is a real estate investment trust that owns hospitals and medical office buildings internationally using net leases. It beat earnings hugely Q1 with next earnings to be reported July 27th. It has 9 years of rising dividends, a BB+ S&P credit rating, and 4.2% 5yr DGR along with a very high yield of 7.4%. I consider it a healthcare defensive payer for my 50% income goal.

KEN – Kenon Ltd is a holding company operating in Israel, but based in Singapore under the name Ansonia holdings. It has no K1 tax form and does not remove any foreign tax. Its largest holding is a utility, but it has a smaller position in ZIM shipping. Pay day is July 5th for its nice distribution of $10.25. However, the price has now more than compensated for that distribution. It along with other shipping companies are now offering excellent buy in prices if you can be patient and see its future opportunities. However, it pays at various times and amounts, so it provides very unreliable timing for income. My experience is a yearly minimum yield of ~7%.

(NRZ.PD) – New Residential Investment Corporation is a mortgage real estate investment trust that specializes in loans and mortgage backed securities. The common shares have been very volatile and the preferred are a bit less risky and I added more at a lower price. It pays $1.75 or 43.75c quarterly mid month of February, May, August and November. TA in MTF on June 23rd here. The yield is 8.1% at the current price of $21.56. The common has announced a name change to Rithm Capital and the preferred might also see it, but not sure of the when or if any of that will happen.

(DLNG.PA) – Dynagas LNG is a shipping company headquartered in Greece. These preferred shares pay $2.25 yearly / 56.25c quarterly quarterly mid month during February, May, August and November. Yield is 9.6% at the price now of $23.45. The suggestion was first offered for RIG in MTF April 13th and again at a lower price to add on June 24th here.

Summary and Conclusion

The 50% income goal from defensive sectors and stocks continues to be met. The defensive investments comprise 43 stocks or ~50% of the 89 stock portfolio. The remainder or 46 stocks consist of the non-defensive sectors and as June payments show contribute quite gigantic dividend/bonus payments to skew the 50% defensive goal, but I do know it will not continue as such.

I look for quality low debt/high credit rated companies and review those in RIG often and now provide a nice “WTB,” or want to buy, price list for all of the 89 stocks along with a Non-RIG list for subscribers to follow.

The search is always ongoing for RIG candidates and the goals and specifics I want include the following:

– quality rated dividend-paying stock.

– undervalued, but can be at fair value for extra quality ratings.

– low debt/great high credit rating.

– pay out and cash flows to easily cover the dividend along with a rising dividend growth rate.

– defensive in nature with products or services I understand and can easily follow.

The market is still too volatile and weak to consider adding new positions currently, but my list will always be waiting for the right time. Cash should be king and therefore my actions are very much in line with preserving it, currently at ~4.3% in RIG. With an established quality dividend portfolio like RIG, I am confident it will ride the valuation roller coaster while the dividends/income continue to flow in as expected using the quality expectations and goal/s mentioned.

Happy Investing to all.

Be the first to comment