gesrey

RIG = Rose’s Income Garden

Rose’s Income Garden (“RIG”) is a defensive income-quality value-built portfolio with 88 stocks coming from all 11 sectors. RIG contains mostly investment-grade common stock but also has high yield (“HY”) business development companies (“BDCs”) and real estate investments. The goal is to maintain 50% of the income from defensive sectors/ stocks and to keep a minimum dividend income yield of 4% or more.

August

August was a red month for the market and the major indexes with most all down as follows:

NASDAQ -7.5%

SPY -4.9%

DOW -4%

with RIG -4%

Year To Date to the end of August

Year to Date “YTD” lots of red and the markets still down as follows:

NASDAQ -26.5%

DOW -14.9%

S&P -16.8%

with RIG, however, holding steady near even, but down – 0.87%.

“FMP” or Funds Macro Portfolio run by The Macro Teller was up, yes up 4.25% for August.

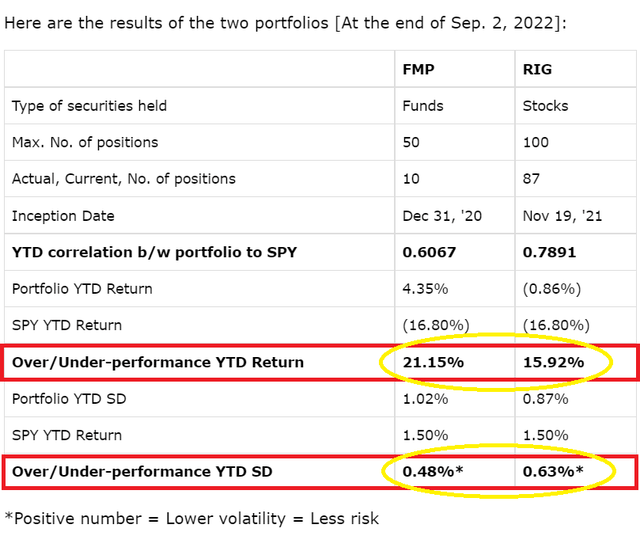

Both RIG and FMP are found at The Macro Trading Factory with the goal to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Including the last days of August at market close Sept 2nd.

FMP and RIG metrics (Macro Trading Factory)

Market Sectors

8 out of 11 sectors are in bear territory.

The 3 winners are energy leading the pack, then utilities, some commodities and at close to even is healthcare. Happily for Rose and RIG with a goal of 50% income coming from defensive sectors, it would seem that goal has helped with holding value near even. I now wish I had a larger stake in energy, however glad for what is owned.

The worst performing sector is communications/ telecoms- perhaps a revival is in their future, but right now all is looking rather grim for this particular sector.

RIG Portfolio Income/August Dividends

22 companies paid, of which 5 pay monthly, and there were 2 raises. The stock ticker is in bold for the raisers along with discussion in the comments.

The chart below uses the following abbreviations:

Date Rec’d = Date payment received

Div/sh = Dividend per share paid.

Yearly $ Div = Current yearly estimated known dividend payment

Div % Yield = dividend yield calculated using the current shown price and yearly known dividend

Curr Price is for the end of the day market price Sept 2nd.

|

Date |

Div / |

$ Yearly |

Div % |

Other Dividend |

Curr |

|

|

Ticker |

Rec’d |

share |

Dividend |

Yield |

Comments |

Price |

|

(PFLT) |

1 |

0.095 |

1.14 |

9.52% |

Monthly Pay |

11.97 |

|

(BMY) |

1 |

0.54 |

2.16 |

3.15% |

68.61 |

|

|

(CVS) |

1 |

0.55 |

2.2 |

2.21% |

99.44 |

|

|

(T) |

1 |

0.2775 |

1.11 |

6.46% |

17.19 |

|

|

(VZ) |

1 |

0.64 |

2.56 |

6.20% |

raise due next |

41.3 |

|

(SLRC) |

2 |

0.1367 |

1.64 |

11.01% |

Monthly Pay |

14.9 |

|

(GD) |

5 |

1.26 |

5.04 |

2.24% |

224.88 |

|

|

(VOD) |

5 |

0.4725 |

0.992 |

7.58% |

pays 2x year |

13.08 |

|

(MA) |

9 |

0.49 |

1.96 |

0.61% |

322.56 |

|

|

(DNP) |

10 |

0.065 |

0.78 |

6.90% |

Monthly Pay |

11.31 |

|

(DLNG.PA) |

12 |

0.5625 |

2.25 |

9.34% |

Fixed Preferred |

24.1 |

|

(CEQP.PR) |

11 |

0.2111 |

0.8444 |

3.11% |

Fixed Preferred |

27.11 |

|

(OHI) |

15 |

0.67 |

2.68 |

8.30% |

32.28 |

|

|

(MTBCP) |

15 |

0.2292 |

2.75 |

10.28% |

Monthly Pay-fixed |

26.75 |

|

(ABBV) |

15 |

1.41 |

5.64 |

4.14% |

136.28 |

|

|

(NNN) |

15 |

0.55 |

2.20 |

4.9% |

Raise from .53 |

44.6 |

|

(RITM.PD) |

15 |

0.4375 |

1.75 |

8.32% |

name was NRZ-d |

21.04 |

|

(NYCB) |

18 |

0.17 |

0.68 |

6.97% |

9.76 |

|

|

(BTI) |

22 |

0.68 |

2.98 |

7.51% |

Varies w Exchange Rate |

39.66 |

|

(DAC) |

29 |

0.75 |

3 |

4.46% |

67.31 |

|

|

(SBRA) |

30 |

0.3 |

1.2 |

8.13% |

14.76 |

|

|

(ARDC) |

30 |

0.1025 |

1.23 |

9.55% |

Raise from .095 monthly |

12.88 |

Raises – 2

National Retail Properties

NNN is a triple net real estate company headquartered in Orlando, FL. It owns ~3100 properties in 48 states with lease terms averaging 10.7 years with escalator clauses. Its largest sector rental group is 5% to convenience stores. Other well known and quality names include: Mr. Car Wash, Camping World, LA Fitness, Taco Bell, Arby’s, and more. Yahoo Analysts have a $49.69 target price on the shares. Its 5 year dividend growth rate is 3.4%, but it has slowed the last 2 years to ~2.1%. This last 2c/quarter raise was a welcome 3.8%. With the current yield of 4.9% it meets the goal expectation of an 8% total return for real estate sector holdings.

Ares Dynamic Credit Allocation Fund

ARDC, is a monthly payer and raised the dividend .005c which is ~5.2%. It is pleasing and raises confidence and hopes for it to continue. A bit more information for this is under monthly payers.

Monthly Payers

The 5 shown above are discussed in a June article here, but here is a shorter quick list:

BDCs / business development companies

– PFLT: PennantPark Floating Rate Capital primarily invests in the US; headquartered in FL.

– SLRC: SLR Investment Corp generally issues short term loans; headquartered in NY.

Closed End Funds

– DNP: Duff and Phelps Select Income is primarily utility focused; headquartered in Chicago, IL. It is complex with dividend paying; for tax purposes it sometimes involves paying back capital.

– ARDC: Ares Dynamic Credit Allocation Fund: short term bond focus in Europe; headquartered in CA. Yahoo Finance analysts have a strong buy on it. My personal view is its at fair value with its new 9.5% yield.

Preferred shares

– MTBCP: Care Cloud Inc. preferred has already passed its call date which has a call price of $25. The company has a new preferred share MTBCO with a lower rate and is converting debt to this new preferred as it raises cash. This is the only August transaction as mentioned next.

Transaction – 1 Sell

MTBCP last month had its price hit $27, which caused me to issue a Trading Alert “TA” in Macro Trading Factory. The next 3 dividends of $0.2292 have been announced. The call price is $25; therefore the most income one can achieve is 0.69 if it is not called. To break even a sell price of ~$25.69 would be needed. It’s a gamble to own at its current price of $26.70. The $27.00 sale price was a gift of another $1.00+ over the current call statistics.

If the price were to fall again to $25 or so, it might be a better gamble. I still watch it, but don’t own any.

Summary and Conclusion

The Rose portfolio/ RIG continues to rise primarily up and over value and falls on bad red days to at or near even value. It has a 5.3% dividend income yield along with 5.6% cash.

RIG has 88 stocks with the top 21 of portfolio value being just a part of the 43 total defensive names in it. The July article here reveals the names of the 21 beginning with the top 10 and then the next 11. If more is desired to know about RIG or the funds in FMP with its strategy, they are shown in real time 24/7 at MTF with prices paid, valuations, up to date statistics and more.

RIG does contain quality low debt/high credit rated companies and the goal is to continue to stay with that. The search continues for more of those and a “WTB” /want to buy list of Non-RIG stocks is available for subscribers to follow. Buy under prices and a deep value buy price is provided for those as well as all stocks in RIG.

The search is always ongoing for RIG candidates and the goals and specifics include the following:

– quality rated dividend-paying stock.

– undervalued, but can be at fair value for extra quality.

– low debt/great high credit rating.

– pay out and cash flows to easily cover the dividend along with a rising dividend growth rate.

– defensive in nature with products or services I understand and can easily follow.

The market is still too volatile and weak to consider adding new positions currently, however the WTB list will always be waiting for when the right time comes. Cash should be king and therefore my actions are very much in line with preserving it and collecting dividends, currently at ~5.6% in RIG. With an established quality dividend portfolio like RIG, I am confident it will ride the valuation roller coaster while the dividends/income continue to flow in as expected using the quality expectations and goal/s mentioned.

Happy Investing to all.

Be the first to comment