asbe

Rose’s Income Garden – RIG

Staying green, nice and green, thank you Mr. Market allowing RIG to be a winner in 2022.

December Performance

Most everyone had hopes for a Santa Claus rally which did not happen. December was not pleasing and this is what did happen:

(SPY) fell -5.69%

The Dow was down -4%

Nasdaq even more at -9%.

RIG fell -1.84%

The full year saw Dow down -8.8%, S&P – 19.4% and the poor Nasdaq -33.1%. Ouch!

RIG was up 2.83% to outperform SPY by +20.98% to end the year.

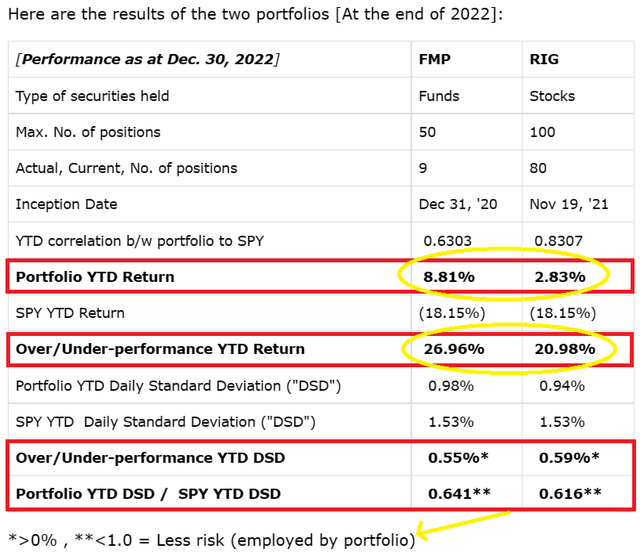

Below you can see the FY 2022 results of Macro Trading Factory‘s (“MTF”) two (and only two!) portfolios – Funds Macro Portfolio (“FMP”) and Rose’s Income Garden (“RIG”).

2022 Performance FMP and RIG (Macro Trading Factory / The Macro Teller)

December Dividend Income

The RIG income was up 5.5% from December 2021 and for the full year up 28.8%. The huge rise was primarily from the shipping stocks which are not expected to offer as large dividends in 2023.

41 out of 80 companies/ or ~51% of the portfolio paid; as expected along with getting 12 raises. The stocks with the raise have the information in bold in the chart and comments. Note there are 4 high yield companies that pay monthly are noted as such in the comments too. The 2 industrial sector shipping stocks offer varied dividend payments which were lower and mentioned. Even though lower it was not disappointing as they were still very high payments and welcome.

The chart below uses the following abbreviations:

Date Rec’d = Date payment received.

Div/sh = Dividend per share paid / received.

Yearly $ Div = Current 2022 yearly estimated known dividend payment.

Div % Yield = dividend yield calculated using the current shown price and yearly known dividend.

Curr Price is for the end of the day market price Dec 31st.

|

Stock |

2022 |

div/sh |

Yearly |

Div% |

Other Dividend |

Current |

|

|

Ticker |

Name |

date |

$ Div |

Yield |

Comments |

Price |

|

|

(PFLT) |

PennantPark Float |

1 |

0.095 |

1.14 |

10.38% |

Monthly Pay |

10.98 |

|

(ENB) |

Enbridge |

1 |

0.649 |

2.61 |

6.68% |

Canada exch rate |

39.1 |

|

(V) |

Visa |

1 |

0.45 |

1.8 |

0.87% |

Raise from .375 |

207.76 |

|

(WEC) |

WEC Energy |

1 |

0.7275 |

2.91 |

3.10% |

93.76 |

|

|

(SLRC) |

SLR Investment |

1 |

0.1367 |

1.64 |

11.79% |

Monthly Pay |

13.91 |

|

(CMI) |

Cummins |

1 |

1.57 |

6.28 |

2.59% |

242.29 |

|

|

(MAC) |

Macerich |

2 |

0.17 |

0.6 |

5.33% |

Raise from .15 |

11.26 |

|

(LYB) |

LyondellBasell |

5 |

1.19 |

4.76 |

5.73% |

excludes spec pay |

83.03 |

|

(SO) |

Southern Co |

6 |

0.68 |

2.7 |

3.78% |

71.41 |

|

|

(JNJ) |

Johnson & Johnson |

6 |

1.13 |

4.52 |

2.56% |

176.65 |

|

|

(ZIM) |

ZIM Integrated Shipg |

7 |

2.95 |

27.55 |

160.27% |

varies/25% tax |

17.19 |

|

(AMGN) |

Amgen |

8 |

1.94 |

7.76 |

2.95% |

262.64 |

|

|

(XOM) |

Exxon Mobil |

9 |

0.91 |

3.55 |

3.22% |

Raise from .88 |

110.3 |

|

(TGT) |

Target |

10 |

1.08 |

4.32 |

2.90% |

149.04 |

|

|

(WBA) |

Walgreens BA |

12 |

0.48 |

1.915 |

5.13% |

37.36 |

|

|

(SBLK) |

Star Bulk Carriers |

12 |

1.2 |

6.5 |

33.80% |

varies: was 1.65 |

19.23 |

|

(DNP) |

DNP Select Inc Fund |

12 |

0.065 |

0.78 |

6.93% |

Monthly Pay |

11.25 |

|

(CVX) |

Chevron |

12 |

1.42 |

5.68 |

3.16% |

raise due next |

179.49 |

|

(PTMN) |

Portman Ridge |

13 |

0.67 |

2.68 |

11.65% |

Raise from .63 |

23 |

|

(MGEE) |

MGE Energy |

15 |

0.4075 |

1.63 |

2.32% |

70.4 |

|

|

(HSY) |

Hershey |

15 |

1.036 |

4.144 |

1.79% |

231.57 |

|

|

(TAP) |

Molson Coors Brew |

15 |

0.38 |

1.52 |

2.95% |

51.52 |

|

|

(HD) |

Home Depot |

15 |

1.9 |

7.6 |

2.41% |

raise due next |

315.86 |

|

STWD bd |

Starwood bond |

15 |

2.375 |

4.75 |

4.90% |

bond pays 2x/yr |

97 |

|

(MCD) |

McDonald’s |

15 |

1.52 |

5.66 |

2.15% |

Raise from 1.38 |

263.53 |

|

(GOLD) |

Barrick Gold |

15 |

0.1 |

0.6 |

3.49% |

17.18 |

|

|

(VTRS) |

Viatris |

16 |

0.12 |

0.48 |

4.31% |

raise due next |

11.13 |

|

(DUK) |

Duke |

16 |

1.005 |

4.02 |

3.90% |

102.99 |

|

|

(SHEL) |

Shell plc |

19 |

0.5 |

1.98 |

3.48% |

56.95 |

|

|

(D) |

Dominion Energy |

20 |

0.6675 |

2.67 |

4.35% |

raise due next |

61.32 |

|

(TRTN) |

Triton |

22 |

0.7 |

2.65 |

3.85% |

Raise from 0.65 |

68.78 |

|

(NEM) |

Newmont Mining |

29 |

0.55 |

2.2 |

4.66% |

47.2 |

|

|

(UNP) |

Union Pacific |

29 |

1.3 |

5.2 |

2.51% |

207.07 |

|

|

(ARCC) |

Ares Capital |

29 |

0.48 |

1.8 |

9.75% |

Raise from 0.43 |

18.47 |

|

ARCC/S |

Special Ares Cap |

29 |

0.03 |

3c Spec =51c total |

|||

|

(AVGO) |

Broadcom |

30 |

4.6 |

16.9 |

3.02% |

Raise from 4.1 |

559.13 |

|

(KHC) |

Kraft Heinz Co |

30 |

0.4 |

1.6 |

3.93% |

no change |

40.71 |

|

(LMT) |

Lockheed Martin |

23 |

3 |

11.4 |

2.34% |

Raise from 2.80 |

486.49 |

|

(TCPC) |

BlackRock TCP Cap |

30 |

0.32 |

1.2 |

9.27% |

Raise from 0.30 |

12.94 |

|

(SPG) |

Simon Prop Grp |

30 |

1.8 |

7 |

5.96% |

Raise from 1.75 |

117.48 |

|

(NMFC) |

New Mountain Fin |

30 |

0.32 |

1.2 |

9.70% |

Raise from 0.30 |

12.37 |

|

(ARDC) |

Ares Dynamic Fund |

30 |

0.1025 |

1.23 |

10.61% |

Monthly Pay |

11.59 |

Raises: 12

Visa (V) – 20% raise

Financial tech credit card servicer was founded in 1958 and headquartered in San Francisco, CA. S&P credit rating of AA- with 15 years of consecutive rising dividend payments. The low yield must accompany a nice large dividend growth rate which happened.

Macerich (MAC) – 13.3% raise

Retail REIT / real estate investment trust headquartered in Santa Monica, CA of successful quality regional shopping malls. No credit rating available. This is the first raise since it cut from retail problems during covid. This is a recovery work in progress that will most likely take a few more years.

Exxon (XOM) – 3.4% raise

Oil and gas integrated energy company operating in up and down stream and chemical segments. It was founded in 1870 and is headquartered in Irving, TX. S&P credit rating of AA- and has 40 years of consecutive rising dividend payments.

Portman Ridge Finance (PTMN) – 6.3% raise

Business development company, “BDC”, that offers loans of a broad range to numerous company types in almost all sectors. It is headquartered in New York, NY.

McDonald’s (MCD) – 10.1% raise

Consumer Staple/cyclical restaurant franchise company founded in 1940 and is headquartered in Chicago, IL. S&P BBB+ credit rating with 47 years of consecutive rising dividend payments.

Triton (TRTN) – 9.2% raise

Industrial sector company for leasing of containers for transportation companies internationally. S&P BBB- credit rating and has 7 years of consecutive rising dividend payments.

Ares Capital (ARCC) – 18.6% raise

The raise includes the regular and special payment. It is a business development company “BDC” that offers a broad range of loans to middle market companies in many sectors. S&P BBB- credit rating.

Broadcom (AVGO) – 12.2% raise

Technology semiconductor company incorporated in 2018 and headquartered in San Jose, CA. S&P BBB- credit rating with 12 years of consecutive rising dividend payments.

Lockheed Martin (LMT) – 7.1% raise

International security and aerospace company operating also in defensive type systems, missiles, and space operations. S&P credit rating of A- and has 19 years of consecutive rising dividend payments.

Blackrock TCP Capital (TCPC) – 1.6% raise

Business development company, “BDC”, that offers a broad range of loans to a varied broad spectrum market preferring those that desire an equity ownership stake. The dividend was cut in 2020 and is now getting a restart upwards with no promises. Headquartered in Santa Monica, CA.

Simon Property Group (SPG) – 2.8% raise

Retail real estate investment company “REIT” that owns internationally premier shopping and entertainment property. Headquartered in Indianapolis, IN. Its dividend was cut in 2020 due to covid retail issues. This is the 3rd raise for 2022 which = 9.1% total increase from $1.65 to start the year. More raises are suggested for 2023.

New Mountain Finance (NMFC) – 1.6% raise

Business development company, “BDC”, that offers a broad range of loans to a middle defensive high growth type market and seeks high ownership in its portfolio companies. Headquartered in New York, NY. The dividend was cut in 2020 and is showing positive signs for it to rise once again.

There are 11 companies with a dividend yield near or 7% or more including the monthly payers PFLT, SLRC, DNP, and ARDC. They all have been reliable with ARDC having raised its payment in August. This month was a nice surprise as some of the BDCs did raise dividends; always a big hoorah when it happens!

Future Income

Future income yield is estimated to continue near or above ~5% as 2023 begins with the final tally far away. The yield is still quite nice and welcomed even with a rising portfolio value, shipping stocks with unreliable lower income and more cash. The RIG yield goal is a minimum of 4% which is still being met, but I do admit I prefer nearer to 5%. Once the cash is utilized it will provide more income too. I see 2023 as exciting, interesting and an investment challenge that I am looking forward to and happy to pursue.

December Transactions

Sold – 2

Kraft Heinz Co.

(KHC) is a consumer defensive packaged food company that merged Kraft with Heinz in 2015. It is headquartered in Pittsburgh, PA and has a current S&P credit rating of BBB-. It is paying a 4% nice yield when the price is $40, which seems to be hitting a peak. It tested my patience for too long and with interest rates rising and not seeing rising earnings or dividends it became a drag to keep in the portfolio. Kraft was a legacy stock obtained years ago as a spinoff from owning shares of Philip Morris (PM). This is one I pretty much had high hopes for as Warren Buffet owns it. I know now he is not exactly one to copy for every stock, and I find I disagree with some of his choices such as this one, so I gave it the ole heave ho, which means “Good-bye!”

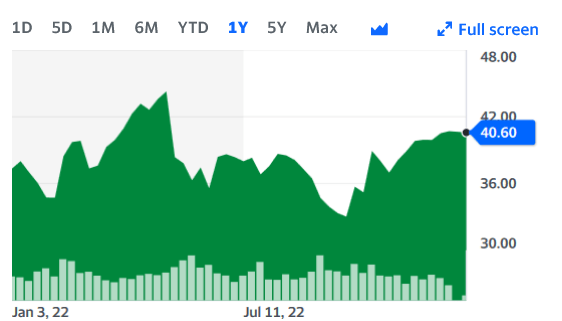

The chart below from Yahoo Finance shows its price movement for 2022.

Price Movement KHC for 2022 YF (Yahoo Finance Dec 31, 2022)

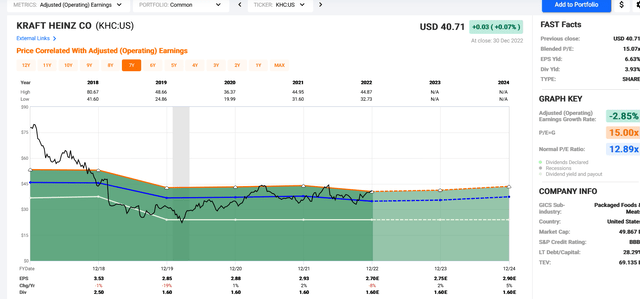

FAST Graph for KHC

The following colors/ lines on the chart represent the following:

Black line = price

White line = dividend

Orange line = Graham average of usually 15 P/E “price/earnings” for most stocks.

Blue line = Normal P/E

Dashed or dotted lines are estimates only.

Green Area represents earnings.

KHC operating earnings FG Dec 31, 2022 (FAST Graphs Chuck Carnevale)

Relatively flat 2% earnings for 2023, a bit more for 2024, but no expected dividend raise, which is not what I want for a dividend growth portfolio.

Note the normal P/E shown is 12.89x and it is selling at 15.07x.

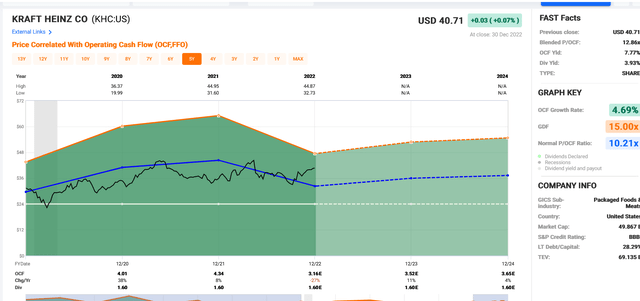

Cash Flows

This next chart shows “OCF” / operating cash flows, which took a huge dip in 2022, and will not recover for many years. However, the flat level for the dividend does look safe.

FG Cash Flows for KHC FAST Graphs (FAST Graph Chuck Carnevale Dec 31, 2022)

Surprisingly, the price is above the normal (blue line) P/OCF ratio of 10.18x and sits at 12.74x. Normally for the last few years the price travels below the blue line, and for some reason it now seems overpriced so I sold.

Ontrak, Inc. Preferred – (OTRKP)

This is a healthcare artificial intelligence company that was incorporated in 2003 and is headquartered in Henderson, NV. It lingered nicely at a fair price level and did just take an awful turn down quickly. This investment for some reason I thought would turn around, but I was totally blind with hope. I did get one payment in Q1, so it was not a total loss for income, but a disaster as an investment.

Price for OTRKP for 2020-2022 (Yahoo Finance Dec 31, 2022)

The positive view is that I did not have a large amount, but it still hurts to reveal and even mention this horrible investment. I should have cut and run a long time before December. I will not look back, but now you know my worst investment of 2022. Ouch!

The great news is that RIG is diversified and can and will handle bad investment results, but I hate it when it happens. I will not wait this long again to sell and plan to have a better exit plan for any investment. There were no add ons in December, as I am waiting for 2023 to use the 12.6% cash reserve.

Summary and Conclusion

The goal of RIG is first and foremost income with retaining value very important too. Quality high credit rated and safe value line companies comprise the majority of the common stock and investments in it.

The Rose portfolio/ RIG continues to outperform SPY by double digits, has a 5% dividend income yield along with 12.6% cash.

The WTB/ Want To Buy/ list is current for all RIG positions with a “Buy under price” and “Strong Buy” prices, along with desired yield listed. The non-RIG stock picks also have those price targets and some DGR statistics, along with current 52 week high and low prices shown which are on continuous evaluation for purchasing if not by me, but perhaps for subscribers. I enjoy watching, evaluating and the hunt for great stocks to own as an ongoing pursuit for investing happiness.

For more information about MTF please see the last bullet point at the beginning of the article.

Happy Investing to All!

Be the first to comment