piranka/E+ via Getty Images

We are approaching the release of Q4 Financial results for Clearfield, Inc. (NASDAQ:CLFD), a fibre broadband company with a fourteen-year profitability track record and a top and bottom line trending upwards for the last five years. It is the right time to shine some more light on this company that falls into the sweet spot of a US federal government funding initiative of $65 billion to increase countrywide connectivity. Against a weak market, CLFD has been delivering record-breaking results, all pre-federal financing incentives. It has a small market cap of $1.689 billion and a stock price of $121.00. However, the company appears to be overvalued, with a high price-to-earnings ratio of 41.91. Over the last year, the company has delivered 124.94% returns to investors.

One Year Stock Trend (SeekingAlpha.com)

The ability to consistently deliver profitable results, irrespective of the economic climate, is crucial during these economically uncertain times. The company has beaten EPS expectations over the last five consecutive years, and this past year we have seen EPS increase by 150% to reach $2.89. Although the current stock price is well above the analyst target estimate of $115.67, we have seen the price heavily fluctuate over the last few months. I believe there is still a lot of upside potential if we look at the enormous backlog in sales, the company’s position to benefit from government connectivity funding initiatives in the future and the new international vertical acquisition that will continue to expand its control over its products locally and abroad. Therefore investors may want to take a bullish stance on this company.

Company Overview

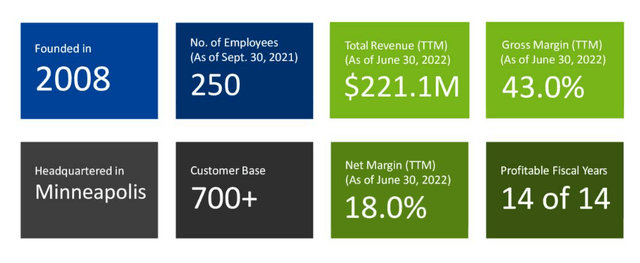

CLFD was previously known as APA Enterprises, Inc., until 2008, when it underwent structural changes and a clear focus on telecommunications. It is a well-established company founded in 1979 in Minnesota. The company operates in the USA and internationally, manufacturing, marketing and selling connectivity, fibre management, and protection products. It is a leader in the broadband industry focused on community broadband solutions for Tier 1, 2 and 3 telecommunication markets locally and internationally with over 500 customers. However, the majority of revenue comes from a few key customers. It focuses on rural and community access, which is also a key area of the government’s connectivity plan

Company Overview (Investor Presentation 2022)

Over the years, the CLFD business has benefited from the massive demand for high-speed broadband from individuals to large companies. CLFD targets four main market sectors, fibre to the home (FTTH), business services, wireless and multi-housing units (MDU/ MTU).

Target Segments (Investor Presentation)

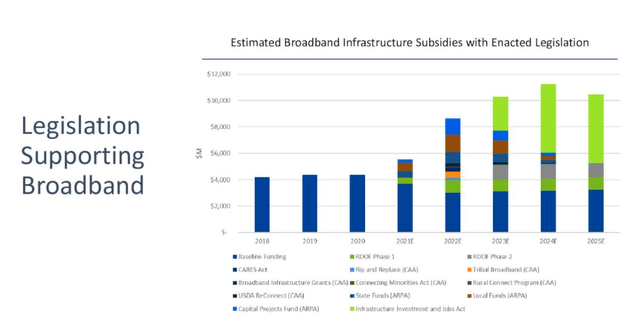

Frontier and Windstream, Tier 2 telecom service providers, are two examples of CLFD’s primary customers. It also works with smaller customers, municipalities, and cable and telco providers. The graph below gives an idea of the legislative support that helps to build and manage the fibre solutions the company is providing.

Legislative Incentives (Investor Presentation 2022)

Most recently, the company acquired Nestor, a fibre optic cable manufacturer in Finland, allowing them to integrate their solutions further to meet consumer demands. The company has also created a StreetSmart fibre hand-off box, a critical connectivity point between the handover from the wireless operator to the fibre provider. Modern technology creates more complex and overlapping networks, requiring highly skilled technicians to deploy solutions. Its plug-in and play-like solution, CLFD, has made it easier to deploy and overcome the shortage of highly skilled labour problem.

Finance and Valuation

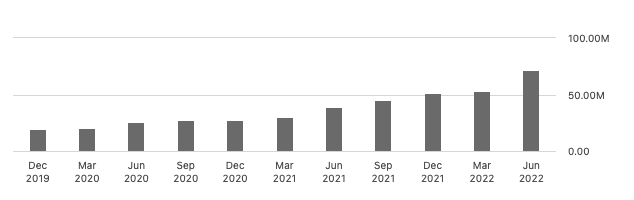

CLFD has a strong and long history of providing solid top and bottom-line performance. We can see a quarterly upward trend in total revenue since 2019 in the graph below. However, net sales in its smaller international market were down year on year by 16%. There is an increasing demand for high-speed broadband. The company sees record-breaking numbers in its sales backlog, a 16% increase to $157 million.

Quarterly Revenue (SeekingAlpha.com)

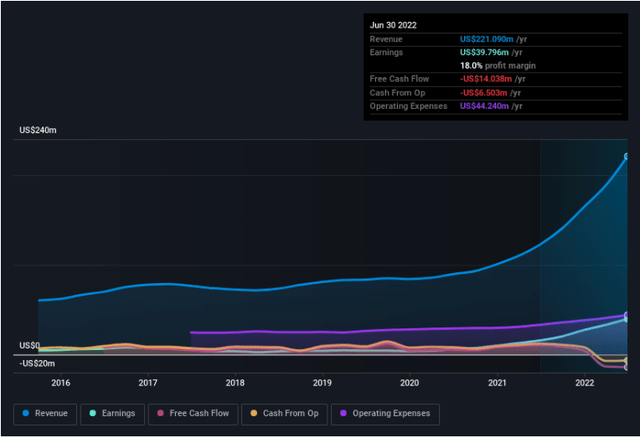

The EBIT margin has increased over the last year from 16% to 23% and the expectation for revenue is to continue on its upward trend.

Annual Top and Bottomline Performance (Simplywall.st)

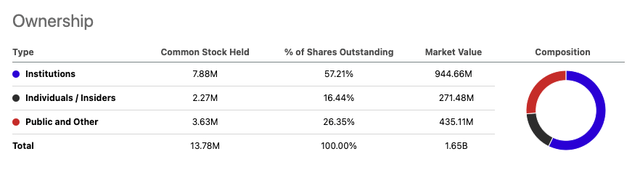

CLFD used $16 million in credit facilities for the Nestor acquisition of $23 million. As it stands, the company has no debt and a high backlog in sales. We should be wary that the company had a negative leveraged cash flow of $2.4 million this last quarter, although this was much smaller than the first quarter in which it had a negative cash flow of $16.2 million. Furthermore, the company falls into a long-term investment plan by the USA to provide affordable connectivity across the country. We can be confident that the company will be shareholder aligned regarding its decision-making if we look at the sheer number of insiders that own shares, a total of 16.44%, a total of $271.48 million of the market value.

Breakdown of Ownership (SeekingAlpha.com)

Lastly, the management team have raised their expectations for the full fiscal year to around $245 million in net sales, which would be more or less 73% growth yearly.

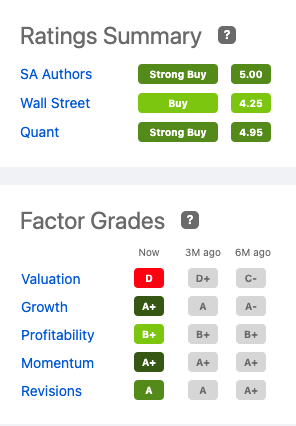

Analysts have mixed reviews of the stock. The target price is well under the current stock price. However, it is still considered noteworthy that analysts have made a buy and recent upgrades in the last month. On Seeking Alpha’s Quant Rating, we can see that the company scores highly on all factors besides its current valuation.

Seeking Alpha Quant Rating (SeekingAlpha.com)

Risk

The industry is highly competitive and quickly changing, and the pace of technology has and could disrupt the existence of essential technologies today. The entrance of new technologies into the market can soon turn other products obsolete and impact the company’s performance. Furthermore, most of CLFD’s income is from a small number of large customers. Any changes or losses regarding crucial customers could significantly impact the company’s performance. The company has also had a record cost increase, especially in metals connected to the solutions. It has been affected by inflation throughout the industry. A significant part of the cost structure is not within the control of the current business and, therefore, could continue to impact margins negatively.

Final Thoughts

It is undeniable that CLFD has seen some impressive growth numbers, especially over the last year. The company is in a market that plays a critical role in the success of the economy by providing individuals and businesses connectivity. The goal to create faster and more affordable broadband guarantees CLFD with the company in addition to financial incentives to meet the demand. Although the value of the share has increased significantly over the last year, with the importance of the industry, the international growth potential and the positioning that CLFD has in the market, there is still potential for a lot more upside. This large and well-established company is positioned in the right place at the right time. For this reason, investors may want to take a bullish stance on this company.

Be the first to comment