NanoStockk/iStock via Getty Images

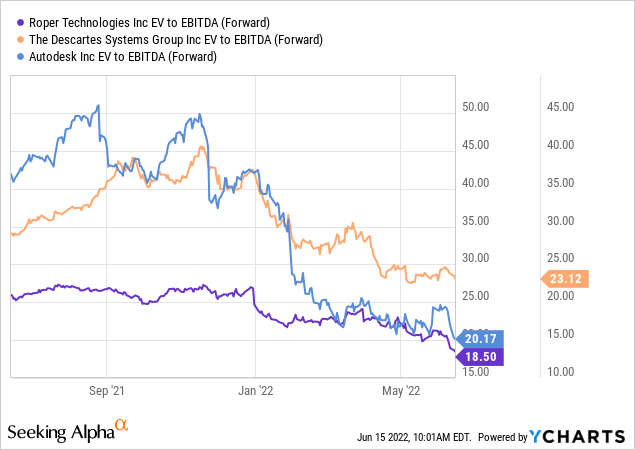

Roper Technologies’ (NYSE:ROP) industrial-facing businesses have driven its growth trajectory in recent years, but the company is turning a new page with its recent divestitures. With its latest move to dispose of a majority stake in sixteen businesses within its industrial portfolio, the company should see significantly reduced cyclicality going forward, as well as improved capex/working capital intensity. In effect, ROP moves another step closer to becoming a tech-focused company. While the transaction looks set to be dilutive near term, the additional financial capacity (after-tax proceeds will raise their total M&A capacity to +$7bn) opens up long-term capital deployment options, allowing ROP to capitalize on its robust M&A pipeline or ramp up capital returns (likely via buybacks) in the coming years. As ROP’s transformation into a tech-focused company gains further traction, I expect the stock to re-rate toward peers such as Descartes Systems (DSGX) and Autodesk (ADSK) over time.

Latest Divestment Represents the Final Step in Roper’s Transformation Story

ROP has announced a formal agreement to dispose of a majority stake in a group of its industrial-focused businesses to Clayton, Dubilier & Rice (CD&R) for upfront pre-tax proceeds of ~$2.6bn. The assets set for divestment include the Process Tech segment (AMOT, CCC, Cornell, FTI, Metrix, PAC, Roper Pump, Viatran) and the Measurement & Analytical Solutions segment (Alpha, Dynisco, Hansen, Hardy, Logitech, Struers, Technology, and Uson). While CD&R will have majority control, ROP will retain a ~49% minority interest in the new entity and expects additional proceeds from a future exit. The deal has likely been in the works for some time – recall that in late 2021, Bloomberg had first reported that ROP was looking to divest its Process Technologies unit at a valuation of ~$3bn. In essence, this suggests a strategic sale had been in the works for some time, and given the modest valuation markdown (despite the YTD market selloff), this is in no way a forced sale. Per the accompanying press release, the transaction is expected to close by the year-end.

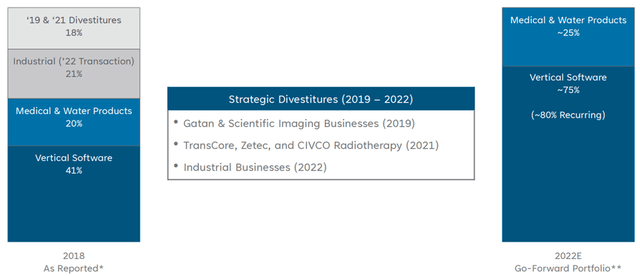

In the meantime, the divested businesses will be accounted for under “discontinued operations” until the deal is closed toward end-2022, after which income from its stake will be reported under “minority interest.” Given the divested businesses generated a sizeable ~$940m of revenue and ~$260m of EBITDA in 2021, the P&L impact could distort YoY comparables in the coming quarters and will need to be adjusted accordingly. The makeup of ROP’s portfolio will also be significantly different post-deal, comprising a 75/25 split between vertical software and medical & wastewater products. While smaller, the remainco will offer investors a higher quality, recurring revenue stream across both segments of the portfolio as well as an improved growth profile (+6% vs. the prior +2-3% organic growth).

Unlocking ~$3.3bn in Potential Pre-Tax Proceeds but Transaction is Net Dilutive

At first glance, $2.6bn in pre-tax proceeds for a 51% stake in a portfolio that generated $260m of EBITDA last year is a major positive – it nets out to an implied ~20x trailing multiple, in line with valuations for best-in-class software names like Adobe (ADBE) and Ansys (ANSS). That said, the subsequent 8-K filing indicates a more complex accretion/dilution analysis is needed. Per the disclosed deal terms, ROP’s assets will be moved into a new entity into which CD&R will make a cash payment of $826m for a 51% equity ownership. This nets to an equity valuation of ~$1.6bn for the combined entity. In addition to the $826m injection, the entity will issue $1.95bn of debt, from which ROP will receive a cash dividend of ~$1.75bn. Coupled with ROP’s 49% equity interest worth ~$784m, this amounts to potential proceeds of up to ~$3.3bn pre-tax. So relative to the ~$320m in EBITDA guided for this year, the implied transaction multiple is likely closer to ~11x EV/EBITDA – a wide discount to the current ~19x ROP trading multiple.

|

USD’ M |

|

|

CD&R pays for 51% equity ownership |

826 |

|

(+) ROP Dividends from Leverage |

1,775 |

|

(+) Implied equity value of 49% stake in CD&R-owned entity |

784 |

|

= Total pre-tax cash to ROP |

3,385 |

|

(/) EBITDA |

320 |

|

= Pre-Tax EV/EBITDA |

10.6x |

Source: Author, Roper Disclosures

The Transformation from Cyclical Industrial to High-Margin Tech is Taking Shape

The divestment to CD&R marks a significant milestone for ROP, with software now moving to an ~75% contribution on a pro forma basis and officially moving ROP’s GICS classification to “Software & Services.” The writing has been on the wall for some time now, starting with CEO Neil Hunn’s string of divestitures to date – these include Scientific Imaging (~$225m), Gatan (~$925m), Zetec (~$350m), TransCore (~$2.7bn), and CIVCO Radiotherapy (~$120m). With former Danaher (DHR) CEO Tom Joyce also joining the Board last year, ROP’s intent was clear – for context, Joyce played a key role in executing the tax-efficient spin-off of Fortive (FTV), accelerating the company’s pivot toward life sciences (away from the cyclical industrial business).

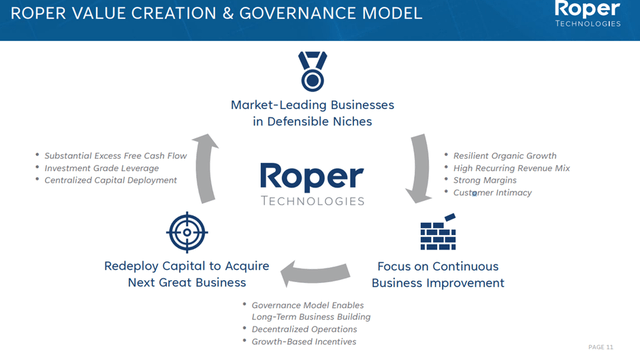

Strategically, the divestitures go a long way toward smoothing out ROP’s earnings stream. In addition, the remainco will benefit from a higher-margin, higher recurring revenue profile as well as reduced capex intensity and working capital needs. While ROP will suffer some near-term dilution in the meantime, the increased balance sheet flexibility with the after-tax proceeds from the sale introduces long-term capital deployment optionality – particularly useful given the YTD market weakness. More accretive acquisitions should continue to pivot ROP toward a higher-growth, recurring revenue profile, while accelerated buybacks present a nice tailwind to the EPS trajectory.

Near-Term Dilution vs. Long-Term Capital Deployment Optionality

ROP’s decision to divest 51% of its legacy Industrial businesses for $2.6bn to CD&R is a net positive for the long-term transformation story, in my view. That said, ROP’s 49% residual stake in the levered CD&R-owned entity post-transaction and the below-par realized EV/EBITDA multiple imply a near-term dilutive outcome. Yet, the influx of after-tax cash proceeds from the sale will further support ROP’s long-term capital deployment targets, facilitating the pivot toward a higher quality, recurring revenue profile as well as accelerated buybacks down the line. At the current valuation discount to peers such as Descartes and Autodesk, the market is likely undervaluing the quality of Roper’s remainco (comprising attractive SaaS and network-based businesses) as well as its >100% FCF conversion rates.

Be the first to comment