Justin Sullivan

Shares of Roku (NASDAQ:ROKU) are down more than 70% YTD and valuation has been violently compressed to just 2.6x 2023 revenue in a rising interest environment. While the stock continues to attract dip buyers who see the current valuation as a favorable setup for improving macro in the future, I continue to remain bearish on the prospects of the company as revenue growth has significantly diminished and management doesn’t seem to have a viable path to profitability. Some might argue Roku is a long-term beneficiary of the secular trend towards CTV advertising, but there are a number of fundamental reasons why the company may not benefit as much as digital ad platform The Trade Desk (TTD) (analysis here).

The positives

To be fair, let’s first discuss the positives, as not everything is perfectly black or white in the investment world. Roku is a dominant streaming platform with over 60 million households and has successfully competed against Amazon (AMZN) and Google (GOOG). As a demand aggregator of streaming, Roku is in a power position to secure a standard 30% of ad inventory from most AVOD (Advertising-based Video On Demand) channels that wish to appear on the Roku operating system. With a user-friendly interface, Roku is also able to monetize ad spaces on its homepage and charge a premium for a quick button on the Roku remote. Aside from being just a platform, Roku has been actively investing in its Roku Channel, where it controls 100% of ad inventory. While international expansion is still early, management is confident about monetization when the user base begins to scale.

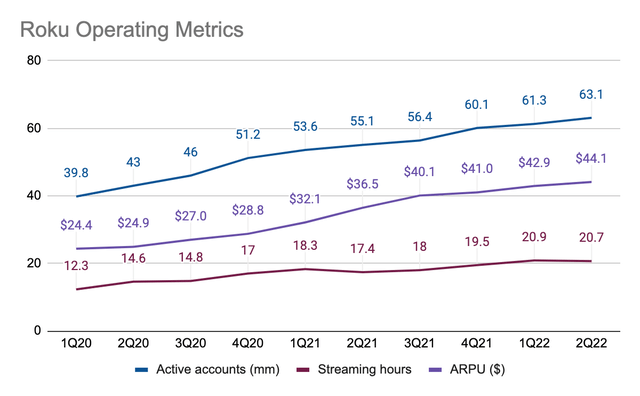

In 1H22, Roku added 3 million active accounts and quarterly streaming hours were comfortably above 20 billion (vs. 18/17 billion in 1Q21/2Q21) despite consumers might want to spend more time outside. Average daily hours per account of 3.8/3.6 in Q1/Q2 also didn’t experience a material slowdown vs. levels seen during the pandemic, indicating some stickiness of the service. While user growth may not be as strong as during Covid, ARPU saw meaningful expansions by growing 34% / 21% YoY in Q1/Q2. Total revenue in the first half of 2022 increased 23% YoY on a very strong 80% increase in 1H21. Big picture, there’s no question that consumers continue to find Roku relevant in a post-Covid environment.

The negatives

When a company provides a rosy outlook for its future, results will usually have to meet expectations just to keep the stock price from falling. In Q1, Roku forecasted 2022 revenue growth of 35% to reach $3.7 billion and adjusted EBITDA of $150 million for a 4% adj. EBITDA margin. While the projected bottom line was a bit of a disappointment, the 35% annual growth on top of the exceptional 55% growth in 2021 was an enviable feat relative to the vast majority of tech companies that saw their growth rates fall off a cliff thus far in 2022.

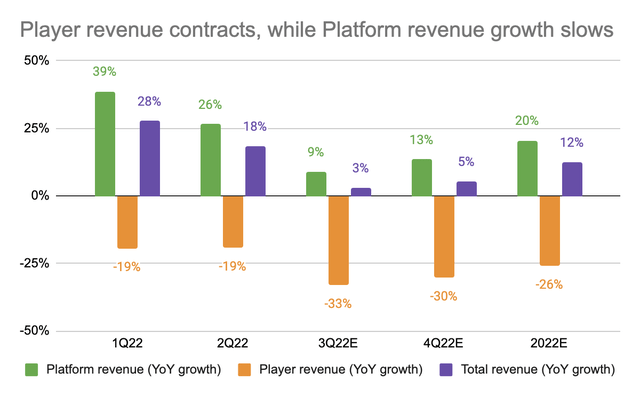

Unfortunately, Roku reported 18% top-line growth in Q2 (vs. +25% consensus) and guided Q3 revenue of $700 million (+3%) which was 22% below consensus while adj. EBITDA was expected to be -$75 million. Worse yet, management canceled 2022 full year guidance citing macro reasons and weakness in the scatter market where advertisers can easily turn off their campaigns in just a click. The market now expects just 12% 2022 top-line growth vs. +35% touted by management at the beginning of the year. This of course has been a major downer on the stock.

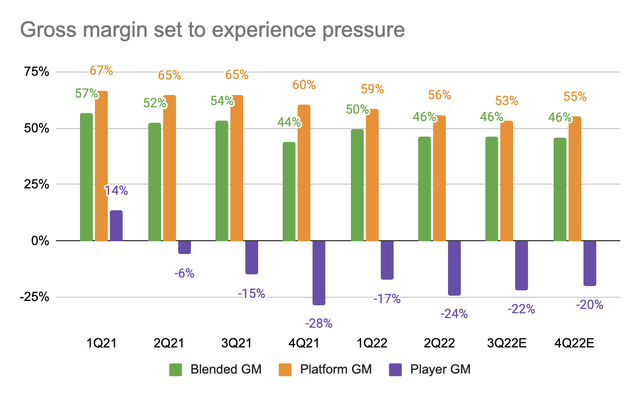

From a margin standpoint, Roku decided that it will continue absorbing negative Player margins to drive new accounts. This strategy is a problem considering the loss-making Player business has created an average 12% delta between the higher Platform gross margin and blended gross margin over the last 5 quarters. What’s more concerning is that Platform gross margin has been trending negatively due to higher mix of video advertising (lower margin) vs. media & entertainment (higher margin) per management. Suppose Player margin is to improve by 2 points in Q3 and Q4, blended gross margin may stabilize at 46%, but still compares poorly to 2021 levels.

Revenue and margins aside, a major question that every Roku investor must answer is whether the company still has a robust business model in a post-Covid environment. My biggest issue with Roku’s model is that future account growth must rely on hardware sales, which is an uphill as the majority of TV demand was pulled forward during the pandemic as Roku expects 2022 total TV sales in the US to be below 2019 levels. TV sales usually have a much longer cycle, as consumers don’t just switch TVs every 1-2 years.

Now that everyone seems to be overpaying for food, rent and gas, is buying a new smart TV really on top of the list? With over 60 million US households already using Roku (~46% market share), how many more active accounts can be added when there are plenty of alternatives from Samsung to Vizio? International markets may be the next leg of growth, but what are the chances that Roku TVs outsell Android TVs, Samsung and LG in countries like Germany and the UK? However, inaccurate my guesstimates may be, they don’t look too optimistic.

Why I remain bearish on the stock

Roku’s 2022 revenue trajectory is well understood, and I have no issue with the notion that most of the negativity has been priced into the stock. For investors who remain bullish on Roku, a recession in 2023 is now a major wildcard, as advertising budgets are highly sensitive to economic cycles. The question now becomes: what multiple does Roku deserve if future growth again comes up short and margins trend lower in a recession? The business generates no profits, so the P/S ratio is arguably the most relevant metric. Based on 2023/24 estimates, the Street seems somewhat hopeful that revenue will return to better growth at +17%/+25% for a forward P/S of 2.6x/2x. Given Roku already pulled its 2022 guidance, trying to forecast 2023 revenue has become a highly murky exercise, and my view is that multiples may experience further compression to 1-2x ($27 to $53 assuming 2023 revenue estimates remain intact) in a recessionary environment (Google’s P/S fell to 2x during the GFC). As attractive as Roku’s valuation may be today, I continue to see more risks than rewards.

Be the first to comment