Vanit Janthra/iStock via Getty Images

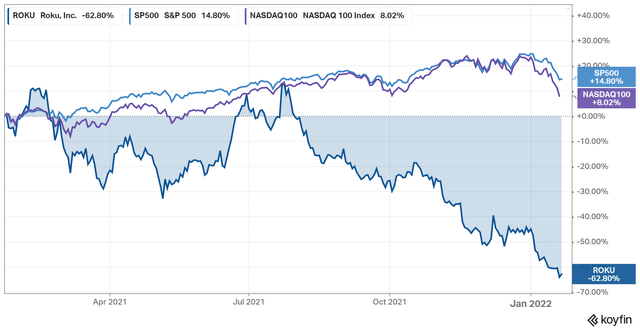

With the technology carnage over the past three months, Roku’s (ROKU) stock price has been slashed by half and then a fair bit more. While investors in this space would be feeling a little nauseous from the destruction of value, and there may be further to go on this drop, one can find truth and a logical baseline amidst the fundamentals of each company.

With this article, I’d like to string together a few facts and interpretations that support a bull thesis. I think there’s immense compounding potential going forward for the stock from the current price, and I’d like to explain my reasoning. The Abstract Portfolio is long ROKU.

Premise

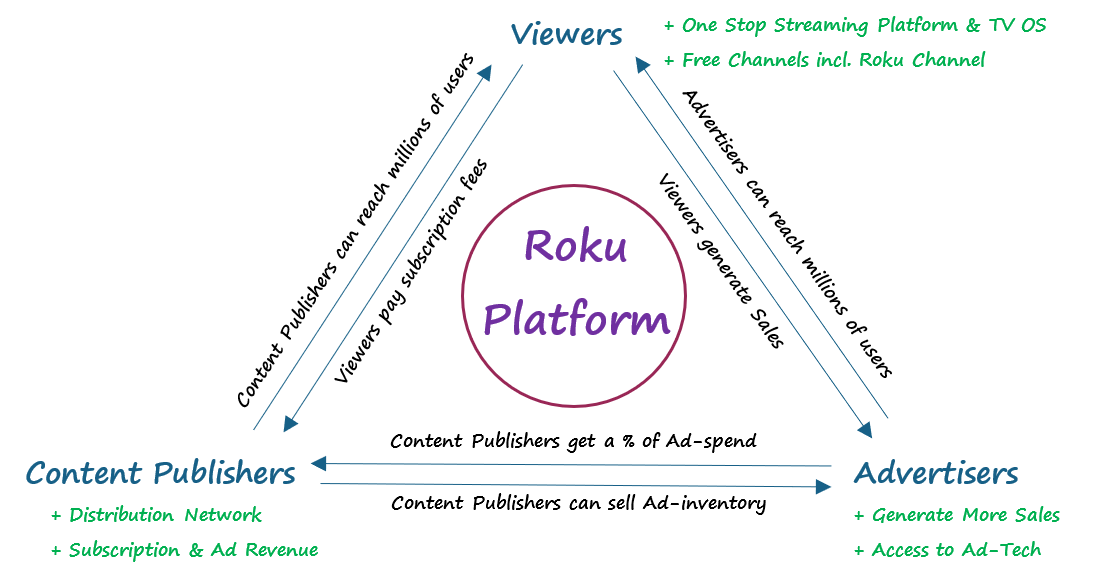

Let’s recap. Roku is a television media platform. That platform has various stakeholders and the company’s business model is designed to deliver value to all those stakeholders through interconnecting relationships.

Author

There are three categories of stakeholders:

- Content Publishers (like Netflix, HBOMax, Peacock, and even Roku via The Roku Channel)

- Advertisers

- Viewers

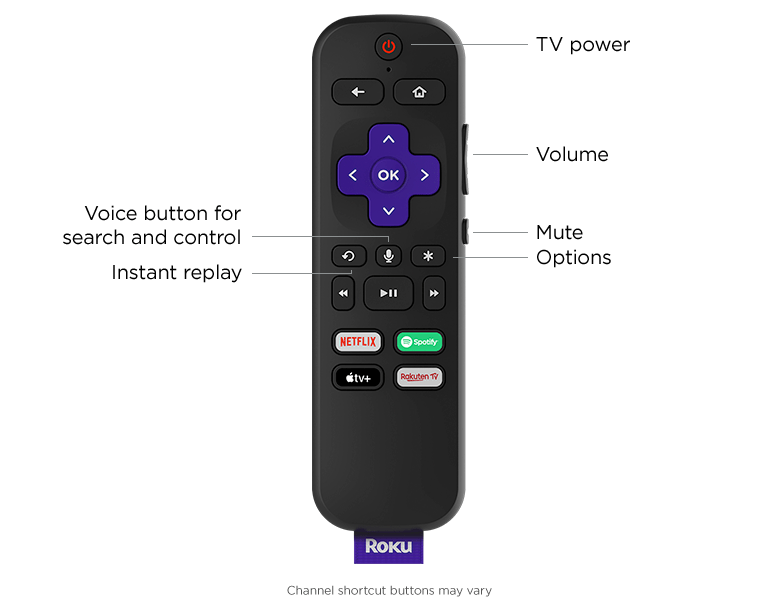

Then there’s Roku itself – that hosts the platform that enables the above relationships and then packages it through an Operating System. This OS is onboarded to TVs via streaming players or it comes preinstalled in original equipment manufacturer televisions that have existing partnerships with Roku.

Roku generates revenues through “Player” sales (hardware) and “Platform Revenue.” The latter comprises of a variety of monetization streams; though the two key ones to note are AVOD (Advertising-supported Video On Demand) and SVOD (Subscription-Video-On-Demand). AVOD includes channels like Peacock and The Roku Channel. While SVOD includes pure subscription channels like Netflix. The company has deals in place with these media giants that have various terms, lengths, and contract conditions. It’s particularly worth explaining how AVOD revenues work as it’s important to my bull thesis. For video advertising, which is understandably significant, there are two styles of deals for publishers:

- Roku Sales Rep Program: A qualifying AVOD publisher can share all of its ad inventory to Roku, which Roku then monetizes and returns the publisher a share of the proceeds.

- Inventory Split agreement: An AVOD publisher can share 30% of its inventory with Roku which keeps 100% of the proceeds from this split. The publisher keeps 100% of the proceeds generated from the other 70%.

More can be found on the Roku Distribution Agreement, and Video Advertising pages.

Then there’s a host of advertising outside such terms as well, such as banner ads, sponsoring buttons on the Roku remote, home screen promotion of a channel, etc.

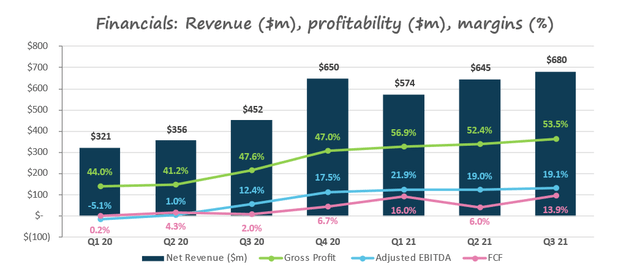

As of Q3 2021, Roku grew sales 50% YoY to $680m for the quarter, with 56.4m active accounts, a 54% gross margin, and about 10% on a Free Cash Flow margin on an LTM basis.

Competitive Conditions

An obvious bear case thesis is that Amazon and Google have their respective operating platforms, TV OEM deals, and stick-things to plug into your dumb TVs to make them smart. With these cash flow generative giants, Roku has some giant bulldozers as competitors. How does one make sense of this?

Naturally, the pandemic put the world on a television buying spree where millions of new viewers also onboarded streaming devices like Roku players and Amazon Fire Sticks. In 2021, that market opportunity for streaming devices became further saturated and Roku accounts didn’t grow all that much.

The question to me amidst slowing account growth conditions is not whether Roku can keep expanding accounts at a high pace, but the monetization they can pull from their existing viewership base while holding market share. For the world, and the US for a large part, has already got their Smart TVs, Roku Devices, Fire Sticks, Apple TVs, and streaming devices. There simply isn’t that much to go off to expand further, as this is not an unlimited market. Importantly, Netflix’s (NFLX) last earnings results alluded to something important – the streaming opportunity on a customer count basis is greatly saturating. It seems like we’re at the tail end of the adoption curve for streaming across all developed markets. Those developed markets, and notably the US, are also high-value markets where the average consumer contributes significantly more in dollar terms to streaming businesses vs. Asia or Africa.

To illustrate the saturation and evolving market share figures of Roku, I did some digging for alternative data and research.

Based on viewership activity on televisions, the following data presents some interesting insights:

| Global Market Share of TV viewing activity by Platform | 2021 | 2020 |

| Roku | 31.1% | 32.2% |

| Amazon Fire TV | 16.8% | 20.0% |

| Samsung | 12.2% | 9.4% |

| LG | 6.4% | 4.4% |

| Android TV | 5.9% | 5.4% |

| PlayStation | 5.4% | 6.1% |

Data Source: Conviva State of Streaming Q3 2021

The above data was taken from Conviva, an analytics company that produces a report every quarter on streaming data.

So a few key inferences. Streaming sticks didn’t do particularly well in 2021. The world is predominantly moving toward Smart TVs now because they come preinstalled with an OS already that supports streaming channels (makes sense). Why buy another device when it’s all in one? Old school OEMs like Samsung and LG gained market share with their own OS attempts, Amazon surprisingly lost market share, and Roku held market share. The logical forecast from here is for Roku to continue holding market share at about 30%. On a geographical basis, the US didn’t generate that much more of a streaming shift in 2021 vs. 2020, while Asia and Europe caught up at a higher rate last year. Samsung, LG, and Android TV have been doing well in these geographies.

To add some further color to geographical differences, Roku in the US was more dominant vs. internationally with a 39% viewership share. On a global basis, the lack of share acquisition isn’t ideal as we all like perpetual customer growth, though Roku’s ability to hold share is not the worst thing in the world. It has certainly executed above Amazon and Google which has been notably late to the game.

That begs the question: If the customer base doesn’t meaningfully expand, what is going to drive growth for Roku in the coming years?

State Of The Market Opportunity, And Why Roku Won’t Suffer Netflix’s Fate

Advertising. In particular, US advertising.

One would think every market participant would have moved to Connected TV platforms at an overwhelming level already, but it appears that advertisers, as with every new media platform in history, lag in spending with ad dollars. Facebook/Meta (FB) has hung around the 250 million monthly active user mark in US & Canada for three years, but it still keeps growing North America revenues at 15%-20%+ YoY normalized. The simple answer is that advertisers and marketers take ages to allocate resources to social media and that secular growth transition is still taking place. To add, it’s also because Facebook can allocate ad spend incrementally better across time on the back of its large and rich data garden to get marketers better results. The more ad dollars are allocated, the more data is generated across the user base, and Facebook gets smarter in pulling impressions and conversions. If one studies the Roku business model, it’s playing a very similar game. Accounts, data, advertisers, and programmatic ad spend.

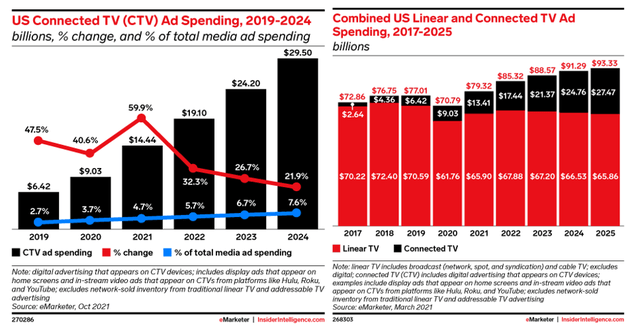

One might also infer that linear television or broadcasting advertisers, who’ve been hung up on Nielsen ratings and the old system forever, would be slow to switch. Here are a few interesting charts on Connected TV advertising spend in the US by e-Marketer.

Note that the charts above were published on different dates in 2021 so there are some slight discrepancies as data and forecasts were updated.

2021 was a banner year for Connected TV Adverting spending, but the category still only makes up <5% of total media spend in the United States. Granted, there are discrepancies in monetization potential across different media platforms, but ask yourself: how much time do you spend on your Connected TV vs. other media channels? Surely it’s a little more than 5%.

When CTV Ad Spend is compared to Linear TV Ad Spend, we’re still just scratching the tip of the iceberg. Super Bowl ads and live broadcast advertising will perhaps still be spent in the old way for some time, but when all television will be streamed, why won’t a lot of that ad spending on television also be allocated to streaming platforms?

E-Marketer has historically been conservative on CTV ad spend growth and is still projecting 32.3% YoY for 2022. This is above their forecasts for social media spend, and it appears logical that the transition to CTV ad spend will take several years to complete.

Roku, with 39% US viewership share, and after applying a 30% take rate on CTV Ad Spend, seems excellently positioned to capture this secular trend. Roku should be growing faster than other media platforms, and with a longer growth runway. Meanwhile, the company is actively building the walled data garden across its tens of millions of accounts, and like Facebook, is getting smarter at advertising technology. With compounding data comes compounding intelligence and a better value proposition for advertisers who choose Roku to produce results. Roku’s internal blogs on their ad-tech platform, OneView, all show technical strength and growth.

Last quarter, TV streaming impressions delivered through OneView more than doubled, increasing by 141% YoY. Nearly all agency holding companies now use OneView, and its appeal extends from established, blue chip brands such as Lexus, to direct-to-consumer brands like Lovevery, who use it to produce performance outcomes.

Source: Roku Blog

Advertising is also why Roku is not going to suffer Netflix’s fate. Netflix has been a pioneer in the streaming space and deserves all the credit in the world for changing the television entertainment game. However, it’s intrinsically tied to the subscription model that’s tied to customer bases that are saturated now. Unless the company lets on advertisements and starts actively getting greedy on monetization, we’re in the game for slow growth. AVOD will likely grow a lot faster than SVOD in the coming years and we’re in for clearly distinct performance trajectories for the two categories.

Roku is not Netflix. It’s becoming increasingly clear that content excellence and content investments are competing away profits for participants. It therefore logically follows that content aggregators and platforms like Roku should benefit from the richness of streaming. They effectively have added toll gates between publishers and your eyeballs. With Roku estimating access to 150m people, they surely have a lot of toll gates.

The Roku Channel’s Strategic Importance

The company’s original content and AVOD channel, the Roku Channel, aims to fulfil two very important strategic initiatives in my view:

- To differentiate the Roku OS from other operating systems. The Roku Channel is free and building its own brand as a high-quality channel for both original and licensed content. It also provides a reason for customers to continue purchasing Roku devices.

- To increase the AVOD revenue take rate for Roku.

The second point I made is a subtle one that explains why the company is allocating substantial resources to the Roku Channel. By default, by serving a different content publisher with an ad sharing or inventory sharing agreement, Roku only takes a percentage of the proceeds generated (e.g., 30% on inventory sharing). With The Roku Channel, they’d take 100% of the proceeds for 100% of the ad inventory. It’s in the company’s best financial interest to max out The Roku Channel to differentiate the brand as well as exercise its pricing power as the No. 1 American CTV platform to keep raking in revenues and compounding data. They were once content-neutral, and now they’re not by choosing to compete for engagement with some other content publishers. While it’s tricky maintaining relationships with those content publishers, Roku does have the strategic upper hand because of their dominant access to households in the US. Not being on Roku is not an option for any streaming service. Monopolistic behavior, although unsavory, is very good from an investment standpoint. If Roku Channel gains outpaced traction, Roku’s Platform (AVOD specific) revenue will outpace the industry due to the increase in ad revenue take rates.

Key Metrics and Financials

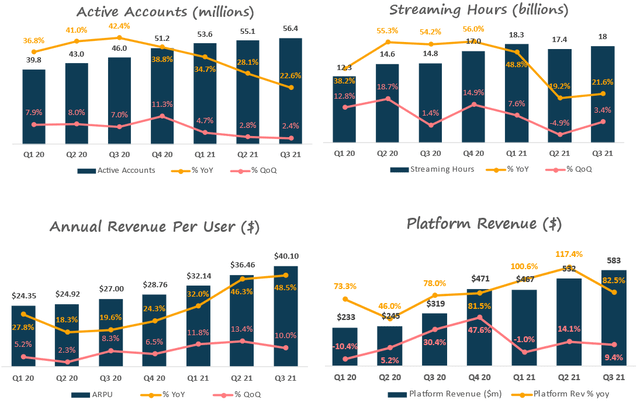

The above charts show Key Performance Indicators and how they’ve trended in recent quarters. If there’s one key takeaway from this analysis, it’s that Roku is an ARPU (Annual Revenue Per User) expansion story. A large portion of that expansion should be advertising-driven. The above data clarify this trend as ARPU has outgrown active account growth substantially.

Roku grew total revenues >51% YoY, with “Platform Revenue” growing +82% YoY and “Player Revenue” at -26% YoY. Roku mentioned that they intend to protect consumers from high inflation and excess supply chain costs and are thus operating on negative gross margins for player sales. This is not a negative in my book, as player sales are simply a way to onboard users that will contribute to platform revenue later – the real cash cow. Customer acquisition (or maintenance) should continue to be a priority as it drives long-term sustenance.

Platform Revenues are gross margin accretive while Player Revenues are gross margin dilutive. I expect the former to outpace growth compared to the latter. Within the Platform Gross Margin, advertising revenues are accretive, and Roku Channel costs are dilutive. These factors have resulted in a flattened gross margin over the past few quarters. Should ad revenues outpace everything and the supply chain return to more efficient operations, then we could see expansion. Should Roku ramp up investments in original programming for the Roku Channel, we could see some contraction. Then again, Roku Channel can be a mega ad-revenue generator so the net effect could be fine. I’d peg the gross margin at 60-65%-plus normalized after a few quarters. I, for one, don’t expect supply chain issues to last forever and the excess retail spending we saw in mid-2021 shows trends towards moderation. I highly doubt that Player Sales will be sold at a negative gross margin for too long.

If one’s hung up on profitability in these times, Roku does have it with a 10% Last-Twelve-Months (LTM) Free Cash Flow margin. With the opportunity ahead, this is a secondary condition to my thesis due to the long growth runway and sales expansion potential. It’s still all about growth.

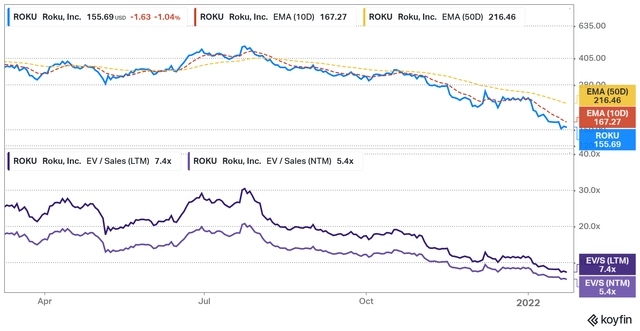

Valuation (Vs. Google, Meta, And Other Social Media)

It’s reasonable to hold the view that Roku’s most relevant valuation multiples are those with a Sales or Gross Profit denominator given their growth. Here’s a quick table on growth, gross profits, and FY 22 sales multiples for ROKU and other advertising dominant platforms.

| Ticker | Name | Gross Margin % (LTM) | FY 2022E YoY% Sales Growth | FY 2022E EV/Sales |

| ROKU | Roku | 52.4% | 35.6% | 5.13x |

| TWTR | 64.3% | 20.8% | 4.24x | |

| SNAP | Snap | 54.8% | 38.1% | 9.07x |

| GOOG | Alphabet | 56.5% | 17.3% | 5.43x |

| FB | Meta Platforms | 80.9% | 19.0% | 5.81x |

Source: Data from Koyfin, Captured 25th January 2021

Let’s make sense of this data.

Roku is likely to grow at elevated rates, for a longer time period, in a differentiated and faster-growing Connected TV Ad Spend market, and is yet trading at a discount on just 1-year forward multiples vs. mature ad-driven businesses.

One doesn’t have to believe in higher-valuation paradigms or Cathie Wood to see the value here. One doesn’t even have to believe in internal innovation, although the company has shown plenty of signs of first moves, sound strategic vision, and pioneering consumer tech under Anthony Wood’s excellent leadership. With baseline assumptions of Roku simply holding its current market share, and by even ignoring the entire international opportunity, the stock looks undervalued to my eyes. I can see ROKU heading back up to $300 or more in two years, even if the valuation paradigm remains at current levels after the recent tech carnage.

Look further into the future on FY2024 multiples and the discrepancy in valuations across the businesses above will be substantially higher due to the differing growth rates. Of course, there continue to be risks associated as with any investment, and I’ve listed some below.

Risks

- Macro: As an ad-tech business, Roku is macro cyclical partially, despite operating in a secular growth opportunity. A bad economy means lower advertising spending and lower than usual revenue growth.

- Competition: Amazon, Google, Samsung, and the lot can take market share against Roku.

- Renewal of content/ad deals are shaky: Roku continues to pick fights and sees some tension with content publishers that will have to renew their deals down the road – (HBO Max, YouTube TV, etc.).

- Roku Channel engagement falls: Lower Roku Channel engagement means lower advertising take rates – this applies some pressure to platform revenue growth. There’s always an argument for not needing another channel, although this one is free.

- Systemic: The whole system rerates to even lower valuation paradigms from here. Expect ROKU to continue to be susceptible to strong drawdowns and higher volatility as we’ve seen already. It’s almost a signature feature if one considers historical price action.

Ending Notes

Roku is the No. 1 CTV platform in the United States and has mostly held its market share globally over the past few quarters. While the streaming customer base is saturated and the majority of consumers have switched to some Smart OS or another already, there are underrated avenues for excess revenue growth going forward. Particularly, the advertising opportunity on Connected TV is still in its early innings with several years ahead of secular growth ahead at high compounding rates. Roku is a clear beneficiary of this trend and has built the infrastructure to make the most of it. It’s therefore an Annual Revenue Per User (ARPU) expansion story, not a customer/subscriber base expansion story like Netflix. With a leading market position, improving ad tech intelligence, a faster compounding trajectory, stronger tailwinds vs. other ad media, and a long growth runway, ROKU is still trading at a discount to mature ad-company valuation multiples like Alphabet and Meta. ROKU is an easy BUY at current levels.

Be the first to comment