Justin Sullivan

Investment Thesis

Roku (NASDAQ:ROKU) had one of the worst earnings reports as it missed its revenue guidance for a 3rd time in the last 4 quarters and guided for a 22% lower revenue in Q3 as compared to the expectations. I’m going to explain why Roku’s business is experiencing massive volatility, what my issue with management is and if I’m adding shares to my Roku position.

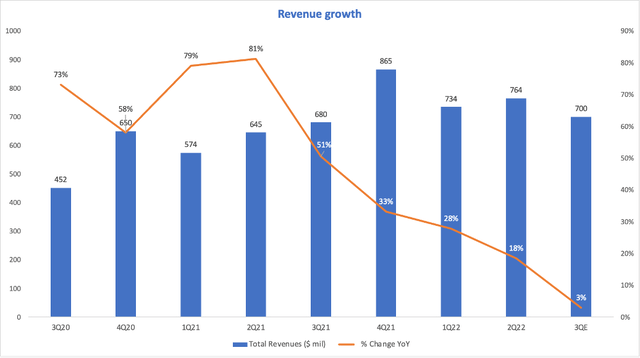

Revenue – growth is gone for now

I’m going to start with the most important aspect for a growth company, its revenue. Unfortunately, the growth rate for Roku’s revenue collapsed with revenue only growing 18% in Q2, in conjunction with a modest 3% (YoY) growth forecasted for Q3.

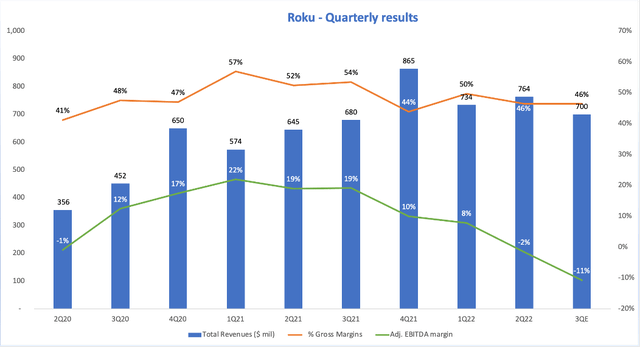

Moreover, the margins for the second quarter unsurprisingly are all trending downwards with adjusted EBITDA being negative for the first time since the second quarter of 2020:

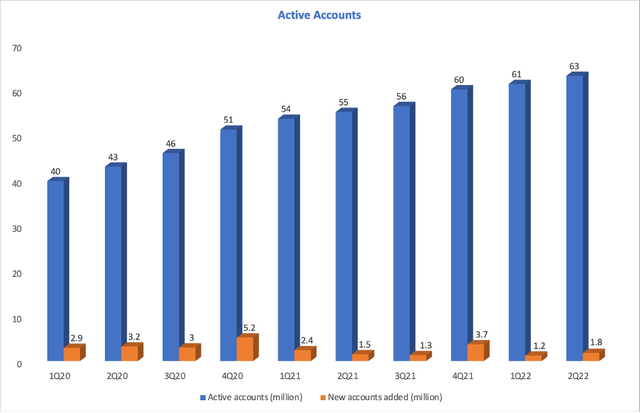

However, the biggest letdown from the earnings report is the massive 22% revenue guidance cut for Q3, from $902 million to only $700 million. Could this massive slowdown in the business be because of Roku’s platform or is it perhaps the competition from Google, Apple or Amazon that’s catching up? But before going into that, there are a couple of things that actually went well for Roku this quarter, starting with Active Users. Surprisingly, the company delivered on its active users with around 1.8 million users added in Q2, which proves the company’s ability to resist in face of tough competition.

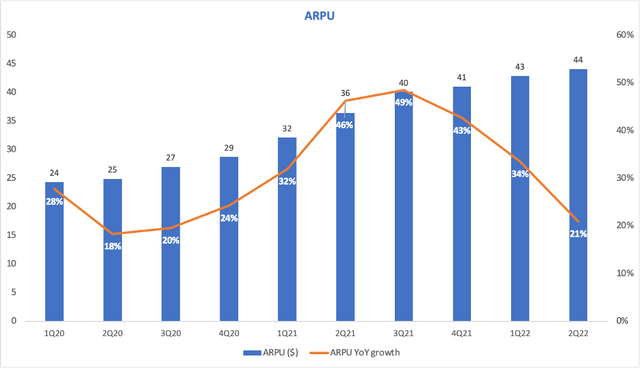

Moreover, the (ARPU) (average revenue per user) increased 21% YoY, sitting around $44.

Lastly, Roku maintained its position as the number one selling TV OS in the US and the number one TV streaming platform in the world, but also in the US, Canada and Mexico by hours streamed. Additionally, it launched the Shoppable Ads feature, which allows users to buy a product straight from their TV:

Operating segments

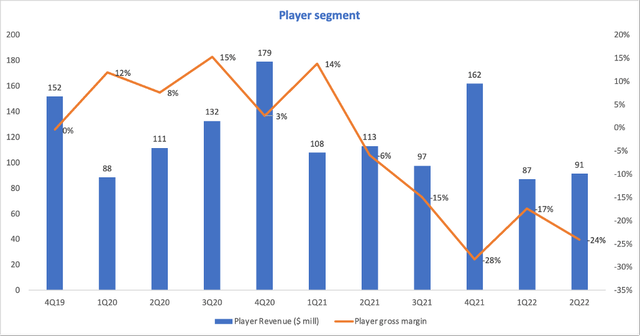

Next up, to identify why Roku’s results were so bad, let’s look at Roku’s operating segments: firstly, we have the player segment that continues to be highly affected by the inflation pressures and yielded a negative 24% gross margin for Roku. This is a continuation of the trend seen in the last couple of quarters so that’s not materially impactful for the overall results.

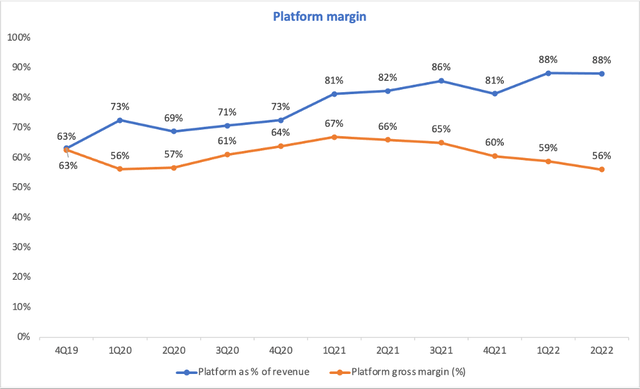

What is impactful is the Platform segment, which represents almost 90% of Roku’s revenue. However, in spite of a 26% YoY revenue growth, the gross margin deteriorated for the Platform segment:

“The growth was lower than expected as many marketers abruptly reduced or paused advertising spend in the ad scatter market during the latter half of Q2.” – Roku’s (CEO)

This is the main reason why Roku’s results were bad. And you must be thinking what is the ad scatter market? The advertising process is split into 2 categories: upfront spending – big budgets that are usually committed in advance in an event that happens yearly. This quarter, Roku surpassed $1 billion in upfront commitments for 2022 the first time ever so the upfront spending is still solid for Roku. On the other hand, there’s the scatter spending, which is the airtime that is sold closer to the actual air date and is not necessarily targeted to a particular demographic. And we actually got confirmation that Roku’s advertising activity is indeed very volatile:

“We are seeing advertisers worried about a possible recession, and we’re seeing them reduce their spend in places that are easy for them to turn off and turn back on. The scatter market, which is an important source of ad revenue for Roku is an easy market for advertisers to turn off and turn back on.” – Roku’s CEO

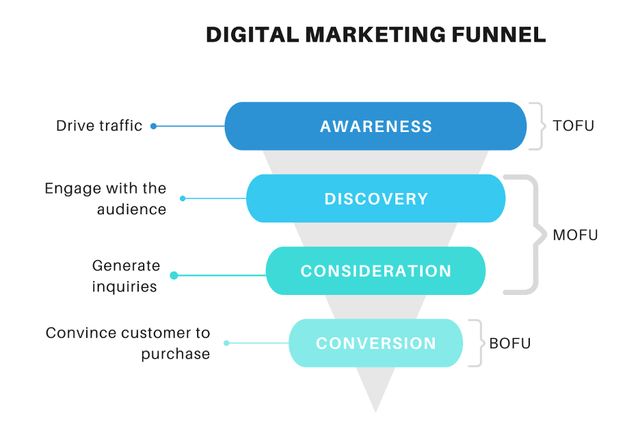

Moreover, according to a survey by research company Advertiser Perceptions 47% of advertisers in the U.S. say they made in-quarter pauses on ad spending on TV streaming, 44% on digital video, and 42% on legacy pay TV. The reason why Roku is affected severely is that marketers put a pause on spending mainly on media channels aimed at awareness and brand building, what’s known as the upper portion of the marketing funnel, which is exactly where Roku is the active thanks to their strong first-party data:

“As brands shift focus from growth at all costs to profitability in these inflationary times, being able to reach current and past customers across channels will be paramount.” – VP of Advertiser Perceptions

My issue with Roku’s management

While I don’t have a problem with the volatile macroeconomic environment from the CTV space, what I do have a problem with is management’s inability to see it coming or to communicate it to their shareholders. Roku’s management missed their own revenue estimates by 5% and cut their guidance 22% and it’s the third time out of the last 4 quarters when they miss their own revenue guidance. At this time, it seems like the management is just as surprised as we are that their business is volatile. For an experienced management team like Roku’s, this is definitely a letdown.

Original content – a threat for Roku’s margins?

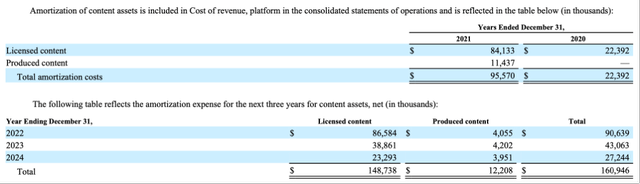

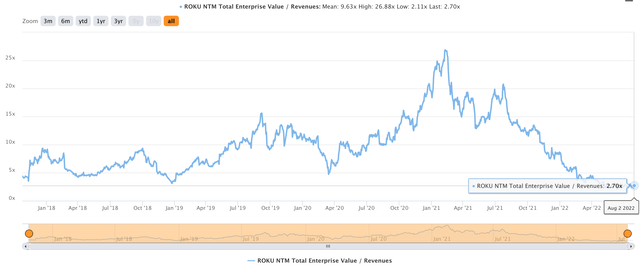

By now you probably know that Roku entered the viciously competitive space of content creation. This snapshot from its 2021 yearly report shows how the company expected around $90 million in amortization expenses from licensed and produced content for the full year 2022.

However, in the Q2 report, the company revealed that it already amortized more than $100 million for the first half of 2022. This is a massive deviation from its plan and it shows that Roku might be forced to spend more on capital investments than it initially expected. This is yet another crucial aspect about Roku’s business as the licensing of content will only put more pressure on Roku’s margins:

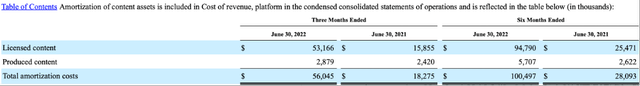

Lastly, another important aspect is the company’s ability to generate free cash flow. Roku finds itself again in the negative (FCF) territory because of factors as increased inventories and an increase in content assets spending (spending that is expensed and it’s different from the portion included in the capital expenditures):

Valuation

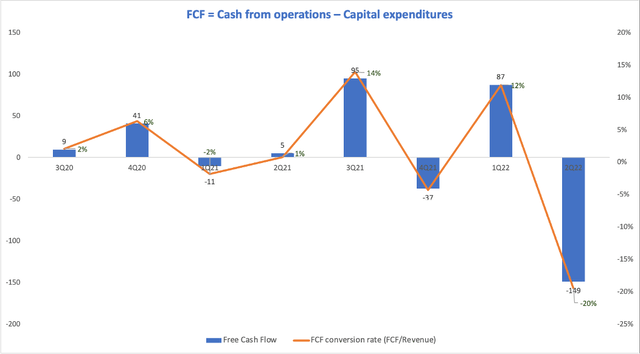

While the stock price is around its March 2020 low, the company is now ~ 50% cheaper than it was back then in terms of the Enterprise value / (NTM) Revenue and it is now the cheapest that it has ever been:

However, the negative operating margins, in conjunction with the negative FCF show that Roku is probably spending more than it anticipated on original content in a period when the business is slowing and even if the stock is cheaper, the risk with investing in Roku’s shares is now higher than it was in March 2020. Moreover, another important aspect is that headwinds are expected in the ad market throughout the year, which makes Roku’s estimates for revenue and operating margins to be really difficult to estimate. As a consequence, I wouldn’t try and predict the revenue growth rate for more than 1-2 quarters in advance.

Risks

As we’ve seen recently, there are many risks involved with Roku’s stock. Starting from the broad-market multiples compression to the specific volatility from the ad sector, all these might hurt the stock price severely in the short-term. Moreover, another leg down is possible in the market as a result of difficult macroeconomic conditions so the risk involved with investing in a high beta stock is much more elevated than usual.

Technical Analysis

What the stock will probably do is sit around the $65 support for a while, at least until another earnings report is published. Even after the vicious rally that it had during the last couple of days, I believe that it will come back down, especially if another leg down happens in the broader market. We saw the same pattern after 4Q21 earnings report, when the company cut its EBITDA guidance severely, the stock rallied ~30% and then lost it all:

So even though the FOMO might be strong with this one, I am not giving up yet. In other words, I believe the stock will be dead money in the next couple of months so I’m in no hurry of adding to my position as there might still be more downside coming.

Final Thoughts

I do like Roku’s business model and I believe they’re the front runner in the CTV advertising space. However, I am keeping the stock as a very small % of my portfolio with no intention of adding until I see a substantial change in the company’s execution. I don’t like the way Roku’s management dealt with the slowdown and I would rather miss on the next 20%-25% run on the upside and buy confidently than to catch a falling knife.

Be the first to comment