esvetleishaya/iStock via Getty Images

Dear readers/followers,

I’m going to be taking a look at Rogers Corporation (NYSE:ROG) (not communications) here, a business in the materials/chemical space that was fairly recently slated to merge with DuPont (DD), but fell over 50% after a proposed merger completely fell through, sending the stock down 50% in a matter of short days. Despite the overreaction/reaction, the stock still hasn’t materially recovered, and the visibility for what we can make of the company at today’s prices and trends is low.

Let’s see what is going for us here, and why it’s worth looking at Rogers even after this M&A obviously did not work.

What is Rogers Corporation?

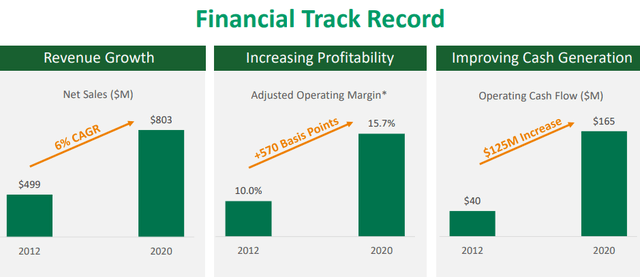

First off, Rogers isn’t a dividend-paying business. It has never paid a dividend, not in over 20 years’ worth of business. If we look at trends leading up to the share price offer from DuPont however, the company has delivered impressive outperformance, beating the market with an 11% annualized RoR, or 650% total in around 17 years prior to being close to being sold (more if you held and sold before the deal fell through).

ROG IR (ROG IR)

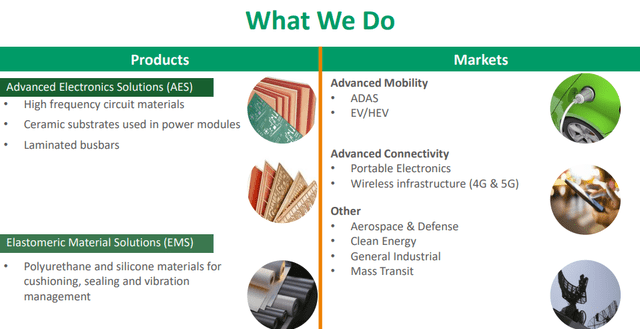

The company’s core business centers around two segments – Advanced Electronic Solutions and Elastomeric Material Solutions. The company operates R&D Centers across the US, and its strategy is based on synergistic M&As as well as organic growth aside from predicted operational excellence.

Rogers is a net beneficiary of the ongoing electrification trends and advanced driver assistance system as well as increased use of smartphones and advanced telecommunication systems. In addition, company output/products are being used in general industrial, aerospace and defense, mass transit, clean energy, and connected devices.

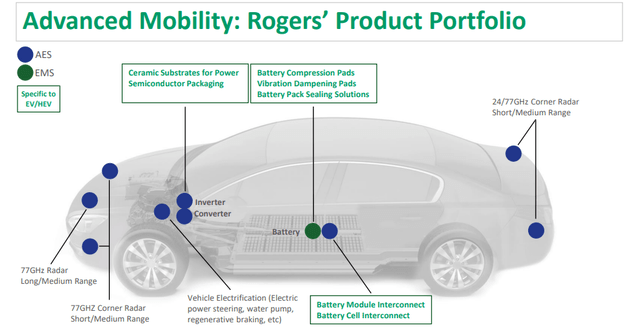

The company sees the potential to essentially double its sales revenues over a coming 5-year period based on the current EV/HEV and ADAS trends. This is not just company analytics and forecasts, but third-party analytics, which forecast relevant market growth rates compounding at 25% over the next 5 years, or 15% for ADAS.

ROG IR (ROG IR)

The Merger with Dupont was supposed to synergize this with the combined operations of the two companies resulting in shareholder value – that is the merger that now did not happen.

Operations are split into:

- AES (Advanced Operating Electronics), which designs, develops, manufactures, and sells circuit materials, ceramic substrate materials, busbars, and cooling solutions for applications in EV/HEV as well as other segments, such as wireless infrastructure, mass transit, clean energy, and wired infrastructure. AES products are sold globally, and trade names for the company’s products include curamik® , ROLINX® , RO4000® Series, RO3000® Series, RT/duroid® , CLTE Series® , TMM® , AD Series®, and many others. These products are hard for anyone not “in the space” to understand. Curamik, for instance, is a series of metalized ceramic substrates used in applications such as solar, or any industry that requires customizable substrate design. The company produces and manufactures these in USA, Germany, Belgium, Hungary, and China.

- EMS (Elastomeric Material Solutions) works with engineered materials for a wide application and target market. These include polyurethane and silicone materials used in cushioning, gasketing and sealing, and vibration management applications for EV/HEV, general industrial, portable electronics, automotive, mass transit, aerospace and defense. They also include basic consumer applications such as footwear, flexwear and other industrial areas, such as cable shielding and protection, vibration management, cushioning, and other areas. Trade names for company materials include but are not limited to PORON® , BISCO® , DeWAL® , ARLON® , eSorba® , Griswold® , XRD® , Silicone Engineering and R/bak®. Poron, for instance, is an impact-dampening foam that’s used in medicinal and orthopedic areas, featuring open cells that “freeze” when put under stress and spread the impact over a larger area. Being thinner than conventional impact-dampening materials and with better qualities, they are among the market leaders here.

So, now you know what the company does. The company researches designs and manufactures these crucial materials, and they sell to customers in NA and EMEA. Around 3,400 customers across the world buy company products, and no single customer accounted for more than 10% of overall sales – though there are customer concentrations in the semiconductor sector. In short, if the semi-sector goes up and down, there’s a relatively high correlation from Rogers here to that movement.

ROG IR (ROG IR)

The company competes with other engineered materials manufacturers. Generally speaking, there’s a very high degree of specialization in these segments, which makes specific peers hard to find. Some that I was able to identify are Photronics (PLAB), Corning (GLW), and Coherent (COHR). While Corning is larger, the company isn’t in exactly the same areas either.

Sales tend to be short-term purchase orders made with traditional deposits. The company has little control over cancellations, and orders may be canceled without any sort of massive penalty. While from time to time Rogers operates with a significant backlog, unlike businesses like Airbus (OTCPK:EADSY), Rogers’ backlog is not at all the same as theirs in terms of a long-term indicator of sales.

Input comes in the form of copper, polymers, fiberglass materials, ceramics, silver, polyol, isocyanates, PE materials, silicone, and rubber. Some of these are sourced through limited-source suppliers, but some are available across the board from many different vendors.

ROG IR (ROG IR)

The most and the 2022 results for the company were quite solid. A positive 2Q22 was made possible through sales in EV/HEV, defense, and portable electronics. Despite ongoing Supply Challenges, the company delivered solid gross margins of nearly 35% (down from 38.2%) and improved net income margins of 7.1%, up 40 bps compared to 1Q21.

So, the company managed positive top-line results due to higher demand – but margins, most of them, showed a decline due to raw material and supply chain constraints. The company did manage to cut SG&A which positively impacted GAAP operating margins and contributed to positive GAAP earnings increase on a per diluted share basis.

The company did receive a one-time termination fee totaling $162.5M, but given the drop in share price, that’s a drop in the bucket.

3Q22 came in only yesterday, and while they were lower than 2Q22, they did confirm the overall stability of the business, with the company generating EPS of above $1.10 for the quarter, even if GM for the quarter declined to south of 32% along with the net income margin. Most of these headwinds continue to be a product of overall macro, and these will likely remain for as long as the current situation remains pressured as it is. Margins weren’t just impacted by macro, but by underutilization charges due to a more unfavorable sales mix, which the company is addressing by adjusting capacity levels.

SG&A decreased even further due to lower employee-related costs and fees. So on a high level, it was a quarter that proved to the market that the company can generate substantial levels of sales, but that the current environment is delivering continuing blows to the company’s bottom line as Rogers adapts to the current market. Its mix, which includes manufacturing in China, also isn’t perfectly adapted to the current macro, and we’re likely to see continued pressure for the foreseeable future.

These pressures in 3Q22 do little to impact the overall long-term targets and potentials for the company though – and the current cash/equivalent position of $236.5 does not yet include the termination fee by DuPont, which will come in 4Q22. The fee alone represents more than 5x the quarterly CapEx from the company, as a comparison, so for Rogers, this isn’t a small payment at all, but one that will increase its cash position by more than 50%.

In the end, Rogers is a solid business in its own right. It’s in a very “now” sort of segment, with a patent and product portfolio that holds its own in any, and even in this market.

ROG IR (ROG IR)

While I don’t expect 2022 to bring a material sort of GAAP EPS growth to the table, I do expect results to be better than COVID-19 affected 2019-2020, and beyond 2022, I see the company starting to grow its earnings again on the back of very strong trends in their respective end markets, be they EV, mobile devices, defense or any of the other areas the company is active in.

Because from a high level, while Rogers isn’t the highest-revenue sort of business, it’s still a company that takes annual revenues of close to a billion dollars and puts those through around a 30-38% GM, to an operating margin that’s close to 15-18% and has managed to grow those earnings over time.

Those are the tell-tales of a working organization/business that’s attractive, and that’s what DuPont saw – even if their suggestion was to grossly overpay for that organization.

Let’s see the valuation we can view the company as being fairer at.

Rogers Valuation

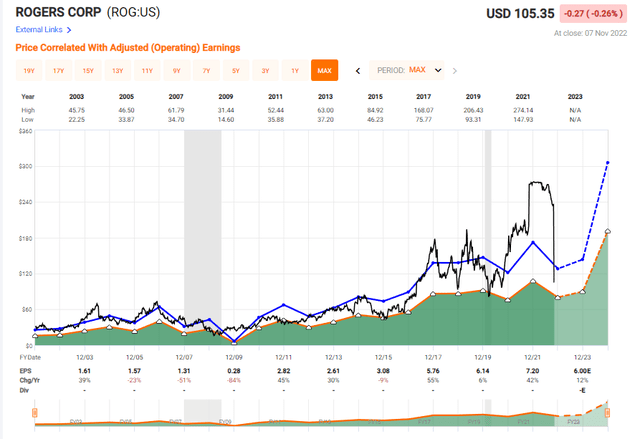

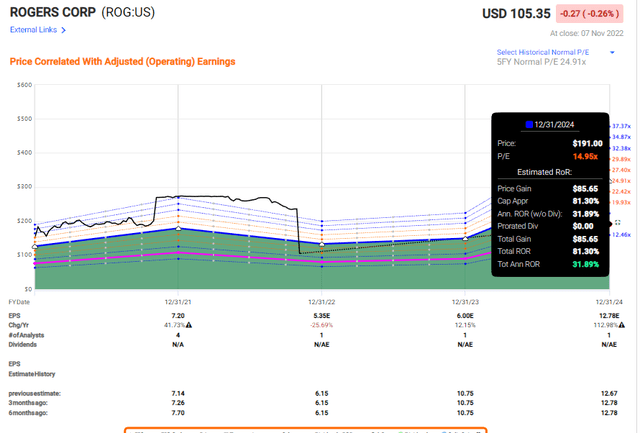

Despite an overall massive drop in valuation, it can be clearly stated that the company is still at a premium here. After a 50% drop, the company is still trading at an 18.7x P/E compared to a 23-24x normalized P/E premium on a 20-year basis.

Rogers Valuation (F.A.S.T graphs)

Now, this premium as you can see is fairly well-established over time. We should view it as fairly reasonable for the growth that this company can deliver, at least potentially. Forecast accuracy isn’t great – 33% negative miss ratio for a 1-2 year basis with a 10-20% MoE, but it’s not terrible either. There are indications that the company’s expected earnings are pretty indicative of where things may end up. Analysts haven’t made a more than 15% forecast error for over 10 years here.

And if, dear readers, we do forecast the company at anything close to its premium, the expected RoR even without a dividend, becomes fairly interesting. You can even begin at a 15x forward P/E, and based on that 15x P/E, you’re making almost 81.3% total RoR in less than 3 years.

ROG upside (F.A.S.T Graphs)

That potential upside goes up all the way to 200% though, if the company’s 24-25x P/E premium holds, and the company’s EPS estimates materialize. That’s a 67% annualized RoR until 2023E.

So the range is around 31-67% annualized, depending on what you look at. I don’t think anyone would argue that Rogers Corporation is worth less than 15x P/E, given where it is and what it does.

Rogers Corporation is very underfollowed by analysts. There’s only one analyst following the company following the merger announcement, and that one still has the PT from the merger – meaning at this time, we really can’t focus on what analysts say about the company. The last non-merger-impacted PTs call the company a “BUY” with a $244/share PT.

I view such targets for Rogers as ridiculous.

Setting a conservative price target is absolutely necessary for a company with this overall size, no yield, and no credit rating – which Rogers does not have.

For that reason, I would heavily discount Rogers Corporation to a modest 15x P/E normalized, which puts the target at around $150/share for the long term. This incorporates a decent upside for the next 3 years of where the company might go as a stand-alone business. But expect that normalization to truly take some time.

If you, however, are willing to wait and forgo some dividends that do not exist here, you might discover that Rogers has the ability to generate market-beating sort of performance with triple-digit RoRs over extended periods of time.

While this isn’t the sort of opportunity that I typically jump on, it’s one that’s up my “speculative” alley, which is how I’m considering allocating here. Maybe a starter position of 0.2% for the longer term.

The reason for my positive consideration is that the company, as I see it, is worth a lot more than the market is currently putting it. I understand the market sentiment, with a bit of negativity following the deal falling through.

But frankly, that deal was too expensive and outsized by half. DuPont (DD) shareholders like myself can thank their lucky stars that it didn’t actually go through, because 35-45x P/E is not a fair valuation for Rogers corporation.

However, I’m happy to initiate my coverage here with the following thesis on Rogers.

Thesis

My thesis for Rogers is as follows:

- This is an undervalued play following a failed merger with DuPont, in specialty materials and engineered components/substrates for various attractive end uses and industries. This sort of company typically deserves a premium – and if the company had had size, a credit rating, and yield, it would have deserved more.

- As it stands, I’m willing to give the company a 15x normalized P/E as an introductory price target. This comes to a PT of $150/share.

- I, therefore, start out here with a bit of a speculative “BUY” rating, one that I believe warrants your attention. Still, be aware of the drawbacks of Rogers, because it lacks some things you might want.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment