Grafissimo/iStock via Getty Images

This article is part of a series that provides an ongoing analysis of the changes made to Chase Coleman’s Tiger Global Management 13F stock portfolio on a quarterly basis. It is based on Tiger Global’s regulatory 13F Form filed on 2/14/2022. Please visit our Tracking Chase Coleman’s Tiger Global Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves in Q3 2021.

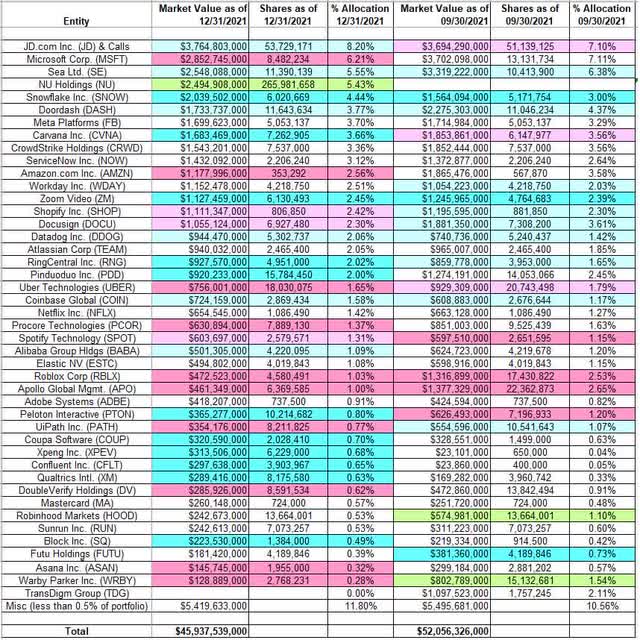

Chase Coleman’s 13F portfolio value decreased ~12% from $52.06B to $45.94B. Recent 13F reports have shown 100+ positions. 43 of those are significantly large (more than 0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are JD.com, Microsoft Corporation, Sea Limited, NU Holdings, and Snowflake. Together, they add up to ~30% of the entire 13F portfolio.

Prior to founding Tiger Global Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide “tiger cub”. To know more about Julian Robertson and his legendary Tiger Management, check out Julian Robertson: A Tiger in the Land of Bulls and Bears.

New Stakes:

NU Holdings (NU): NU had an IPO in December. Shares started trading at ~$12 and currently goes for $6.54. Tiger Global’s position is a large (top five) 5.43% portfolio stake.

Note: Tiger Global has a 7.63% ownership stake in NU Holdings.

Stake Disposals:

TransDigm Group (TDG): TDG was a 2.11% of the portfolio position. It was first purchased in Q4 2016 at prices between $245 and $289. H1 2017 saw the position built up to a large ~9% portfolio stake (4M shares) at prices between $210 and $272. The two quarters through Q3 2018 had seen a ~35% selling at prices between $301 and $373 while next quarter saw a ~12% stake increase. There was a ~15% trimming in Q1 2020. The disposal this quarter was at prices between ~$553 and ~$685. The stock is now at ~$624.

Note: TDG has seen a previous round-trip in the portfolio.

Stake Increases:

JD.com (JD) & Calls: JD was a ~5M share position first purchased in Q4 2014 at prices between $23.50 and $27. The next two quarters saw the position built up to a huge ~70M share position (~25% of the 13F portfolio at the time) at prices between $24 and $38. H2 2018 had also seen a ~42% increase at prices between $19.25 and $39.50. It is their largest 13F position at 8.20% of the portfolio (53.73M shares). The stock is now at ~$48. There was a minor ~5% increase This quarter.

Sea Limited (SE): The 5.55% position in SE had seen consistent buying since Q2 2018 when around 6M shares were purchased at prices between $10.25 and $16.50. Q4 2019 saw a ~40% selling at prices between $26.70 and $40.25. Last five quarters have seen a ~35% stake increase at prices between ~$155 and ~$358. The stock is now at ~$91.

Note: Tiger Global’s ownership stake in Sea Limited is ~6% of business.

Snowflake Inc. (SNOW): The 4.44% SNOW stake was built over the last five quarters at prices between ~$206 and ~$392 and it currently goes for ~$180.

DoorDash (DASH): DASH is a 3.77% of the portfolio stake. They had an IPO in December. Shares started trading at ~$190 and currently goes for ~$87. The stake was built in H1 2021 at prices between ~$125 and ~$206. Last two quarters have seen minor increases.

Carvana (CVNA): CVNA is a 3.66% portfolio position purchased in Q1 2019 at prices between $30 and $60 and increased by ~38% next quarter at prices between $58 and $75. Q3 2019 saw another ~75% stake increase at prices between $58 and $85. Q1 2020 also saw a ~22% stake increase. This quarter saw another ~18% stake increase at prices between ~$204 and ~$303. The stock is now at ~$114.

Note: Tiger Global has a 8.5% ownership stake in Carvana.

Zoom Video (ZM): The 2.45% ZM stake had seen a ~50% stake increase over Q2 & Q3 2020 at prices between ~$114 and ~$501. Next quarter saw a ~20% selling at prices between ~$337 and ~$568 while the last four quarters saw a huge build-up (~425% stake increase) at prices between ~$184 and ~$559. The stock is now well below that range at ~$98.

Datadog, Inc. (DDOG): DDOG is a ~2% position built in H1 2020 at prices between ~$29 and ~$90 and it is now at ~$127 Last three quarters have seen a ~12% stake increase.

RingCentral, Inc. (RNG): RNG is a ~2% of the portfolio position purchased in Q1 2019 at prices between $78.50 and $112 and increased by ~120% next quarter at prices between $103 and $125. That was followed with a ~18% further increase last quarter. The stock currently trades at ~$103. There was a ~25% stake increase this quarter at prices between ~$178 and ~$282.

Note: Tiger Global has a ~6% ownership stake in the business.

Pinduoduo Inc. (PDD): PDD is a ~2% position that saw a ~175% stake increase in Q4 2019 at prices between $31.25 and $43.50. Q3 2020 saw another ~135% stake increase at prices between ~$74 and ~$97. The stock is now at $32.13. This quarter saw a ~12% stake increase.

Coinbase Global (COIN): Coinbase had an IPO in April 2021. Coinbase started trading at ~$328 and currently goes for ~$160. Tiger Global’s 1.58% position goes back to a funding round in 2018 when the valuation was ~$8B. This is compared to current valuation of ~$35B. Last two quarters have seen minor increases.

Alibaba Group Holding (BABA): BABA is a ~1% portfolio stake established in Q3 2016 at prices between $78.50 and $109. The position had since wavered. Q3 2019 saw a ~80% stake increase at prices between $154 and $183 while next quarter there was a ~55% selling at prices between $162 and $216. Q1 2020 saw a ~28% stake increase at prices between ~$175 and ~$230. The stock currently trades at ~$87. There was a marginal increase this quarter.

Peloton Interactive (PTON): PTON is a 0.80% of the portfolio position purchased in Q1 2020 at prices between $19.50 and $33.50. Next quarter saw a ~28% stake increase at prices between $26.75 and $58.50. There was another ~45% stake increase in Q3 2020 at prices between ~$59 and ~$101. There was a ~12% further increase in Q2 2021 while last quarter saw a ~18% trimming. It currently trades at ~$21. This quarter also saw a minor ~4% increase.

Block Inc. (SQ), Coupa Software (COUP), Confluent, Inc. (CFLT), Qualtrics International (XM), and Xpeng Inc. (XPEV): These very small (less than ~1% of the portfolio each) stakes were increased this quarter.

Stake Decreases:

Microsoft Corporation (MSFT): MSFT is currently the largest position at 6.21% of the portfolio. It was established in Q4 2016 at prices between $57 and $63 and increased by ~400% in Q2 2017 at prices between $65 and $72. Q1 2018 also saw a ~38% stake increase at prices between $85 and $97. Q4 2019 saw a ~30% selling at prices between $135 and $159 while in Q1 2021 there was a ~15% stake increase at prices between ~$212 and ~$240. This quarter saw a ~35% selling at prices between ~$282 and ~$343. The stock is now at ~$280.

Amazon.com, Inc. (AMZN): AMZN is a fairly large 2.56% of the portfolio stake. The position was established in Q2 & Q3 2015 at prices between $370 and $540. Q1 2016 had seen a two-thirds reduction at prices between $482 and $676. The following quarter saw a ~40% increase at prices between $586 and $728. There was a ~38% selling in Q4 2018 at prices between $1344 and $2013. Q4 2019 and Q1 2020 had seen another ~22% reduction at prices between ~$1700 and ~$2170. There was a ~38% selling this quarter at prices between ~$3190 and ~$3696. The stock is now at ~$2911.

Note: AMZN has seen a previous round-trip in the portfolio. A 1M share stake purchased in 2010 in the low-100s price range was disposed in Q1 2014 in the high-300s realizing huge gains.

DocuSign (DOCU) and Shopify (SHOP): The 2.30% DOCU stake was built over the three quarters through Q2 2021 at prices between ~$180 and ~$310 and the stock currently trades well below that range at ~$75. The 2.42% SHOP position was built at prices between ~$885 and ~$1643 and it is now at ~$544. Last two quarters have seen only minor adjustments in both these stakes.

Uber Technologies (UBER): The 1.65% of the portfolio UBER stake goes back to funding rounds in 2015. UBER started trading at $41.50 and is currently at $30.76. Q4 2019 saw a ~225% stake increase at prices between $26 and $33.75. There was a ~55% selling next quarter at prices between ~$15 and ~$41 while Q3 2020 saw a similar increase at prices between $29.50 and $38. There was a ~80% further increase next quarter at prices between ~$33.50 and ~$55 while in Q1 2021 there was a ~25% reduction at prices between ~$48 and ~$63. This quarter also saw a ~13% trimming.

Procore Technologies (PCOR) and DoubleVerify Holdings (DV): Procore and DoubleVerify had IPOs last quarter. Procore started trading at ~$88 and currently goes for $52.25. Tiger Global’s position goes back to a funding round in 2018 when it was valued at ~$3B. The stake saw a ~17% trimming this quarter. DoubleVerify started trading at ~$36 and currently trades at $21.83. Tiger Global’s investment goes back to a funding round last year. There was a ~38% selling this quarter at prices between ~$30 and ~$40.

Note: They own ~6% of Procore Technologies (PCOR) and 5.42% of DoubleVerify Holdings (DV).

Spotify Technology (SPOT): Spotify is a venture capital investment that became part of their 13F portfolio following its IPO in Q2 2018. SPOT started trading at ~$150 and it is currently well below that price at ~$124. Q1 2019 saw a ~36% selling at prices between $109 and $151 and that was followed with another ~50% selling next quarter at prices between $122 and $150. The three quarters through Q1 2020 had seen another one-third reduction at prices between ~$110 and ~$160. Q2 2020 saw a ~16% stake increase at prices between ~$122 and ~$268. Last quarter saw a similar reduction at prices between ~$205 and ~$276. The stake is now at 1.31% of the portfolio. This quarter saw a minor ~3% trimming.

Roblox Corp. (RBLX): RBLX had an IPO in March. Shares started trading at ~$70 and currently goes for $39.24. Tiger Global’s position goes back to a Series F funding round in 2018 when the valuation was ~$2.5B. This is compared to current valuation of around 10-times that. The position was reduced by ~90% over the last three quarters to a ~1% portfolio stake at prices between ~$64 and ~$135.

Apollo Global Management (APO): APO is a ~1% portfolio position first purchased in Q1 2017 at prices between $19.50 and $24.50 and increased by ~40% the following quarter at prices between $24 and $28.50. The stock is now at ~$63. Last three quarters have seen a ~80% selling at prices between ~$47 and ~$80.

UiPath (PATH): UiPath had an IPO in April 2021. UiPath shares started trading at ~$69 and currently goes for $26.21. Tiger Global’s stake goes back to a funding round in 2020. The valuation at the time was ~$10B and the current valuation is ~$14B. This quarter saw a ~22% selling at prices between ~$40 and ~$58.

Warby Parker (WRBY): WRBY had a Direct Public Offering last September. Shares started trading at ~$54 and currently goes for $24.37. Tiger Global had participated in all their funding rounds after leading the Series A in 2011. This quarter saw the stake reduced by ~80% to a very small 0.28% of the portfolio position at prices between ~$43 and ~$59.

Asana, Inc. (ASAN): The minutely small 0.32% of the portfolio stake in ASAN was reduced substantially this quarter.

Kept Steady:

Meta Platforms (FB) previously Facebook: The 3.70% FB stake was established in Q4 2016 at prices between $115 and $132. The buying continued through Q2 2019 at prices up to ~$200. Q4 2019 saw a ~25% selling at prices between $175 and $208. The three quarters through Q2 2021 had seen another ~42% selling at prices between ~$246 and ~$356. The stock currently trades at ~$188.

Note: Facebook has seen a previous roundtrip in the portfolio. A pre-IPO investment of ~54M shares was sold out by Q4 2012. The trade generated over $1B in profits.

CrowdStrike Holdings (CRWD): CRWD is a 3.36% of the portfolio stake established in Q2 2020 at prices between ~$55 and ~$105. Q3 2020 saw a ~50% stake increase at prices between ~$97 and ~$144. The stock currently trades at ~$191.

ServiceNow, Inc. (NOW): NOW is a 3.12% of the portfolio position that saw a stake doubling in Q3 2020 at prices between ~$402 and ~$500. The two quarters through Q1 2021 had seen another ~45% stake increase at prices between ~$475 and ~$595. The stock currently trades at ~$512.

Workday, Inc. (WDAY): WDAY is a 2.51% of the portfolio stake built in 2020 at prices between ~$114 and ~$258 and the stock currently trades at ~$225. There was a minor ~2% stake increase last quarter.

Atlassian Corp. plc (TEAM): TEAM is a ~2% portfolio stake that saw a ~150% stake increase in Q4 2019 at prices between $108 and $133. There was a ~85% stake increase in Q3 2020 at prices between ~$161 and ~$197. The stock currently trades at ~$246.

Netflix, Inc. (NFLX): NFLX is a frequently traded stock in Tiger Global’s portfolio. It has seen multiple roundtrips since 2011. The bulk of the current 1.42% of the portfolio position was purchased in Q3 2017 at prices between $146 and $189. The stake has wavered. Q4 2019 saw a ~30% selling at prices between $267 and $337. Q4 2020 saw another one-third selling at prices between ~$471 and ~$554. The stock currently trades at ~$340.

Elastic N.V. (ESTC): The 1.08% ESTC stake was primarily purchased in Q4 2019 at prices between $61 and $87 and the stock is currently at ~$72.

Robinhood Markets (HOOD): HOOD had an IPO last July. Shares started trading at ~$35 and currently goes for ~$11. Tiger Global participated in funding rounds last year and their stake is at 0.53% of the portfolio.

Futu Holdings (FUTU): FUTU is a small 0.39% of the portfolio stake purchased in Q1 2021 at prices between ~$49 and ~$191 and the stock currently trades below that range at $25.74. There was a ~20% stake increase last quarter at prices between ~$86 and ~$162.

Adobe Inc. (ADBE), Mastercard Inc. (MA), and Sunrun Inc. (RUN): These very small (less than ~1% of the portfolio each) stakes were kept steady this quarter.

Note 1: Although the relative sizes as a percentage of the portfolio are very small, it is significant that they own substantial ownership stakes in the following businesses: 1Life Healthcare (ONEM), 8×8, Inc. (EGHT), AltC Acquisition (ALCC), Blend Labs (BLND), Dingdong (DDL), Just Eat Takeaway.com (GRUB), Katapult Holdings (KPLT), Logistics Innovation (LITT), Missfresh (MF), Sumo Logic (SUMO), TaskUs (TASK), TCV Acquisition (TCVA), VTEX (VTEX), and Yatsen Holding (YSG).

Note 2: In July 2018, it was reported that Tiger Global has taken a ~$1B stake in Softbank (OTCPK:SFTBY). The stock was at ~$20 (split-adjusted) at the time and currently trades at $18.63.

Below is a spreadsheet that shows the changes to Chase Coleman’s Tiger Global Holdings 13F portfolio holdings as of Q4 2021:

Chase Coleman – Tiger Global’s Q4 2021 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Tiger Global’s 13F filings for Q3 2021 and Q4 2021.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment