Timon Schneider

Investment Thesis: Rogers Communications (NYSE:RCI) could continue to see pressure the longer uncertainty surrounding the Shaw deal persists.

In a previous article back in July, I made the argument that Rogers Communications could see some upside following previous consolidation.

My reason for making this argument was an improvement in churn rates across the business along with a rebound in earnings.

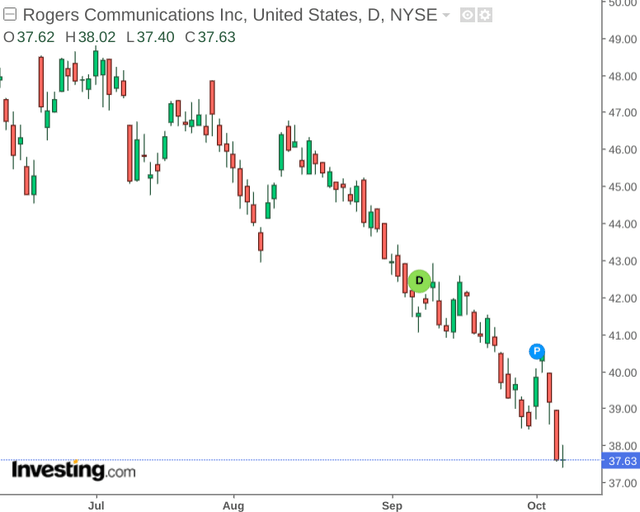

However, the stock has continued to see a decline – down by nearly 20% since my last article:

The purpose of this article is to assess why the stock has continued to decline, and whether Rogers Communications could see renewed upside from here.

Performance

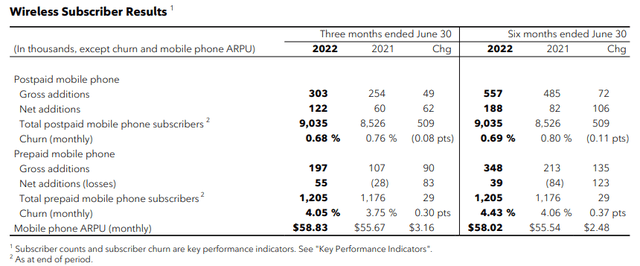

After my last article, it is notable that postpaid wireless churn continued to decrease for Q2 2022 and the total postpaid mobile phone subscribers continued to see an increase.

Moreover, while churn across the prepaid segment saw an increase – monthly ARPU (or average revenue per user) saw growth from the same quarter last year:

Rogers Communications: Second Quarter 2022 Results

Additionally, adjusted diluted earnings per share saw growth from $1.54 for the six months ended June 30, 2021 to $1.81 for the six months ended this year.

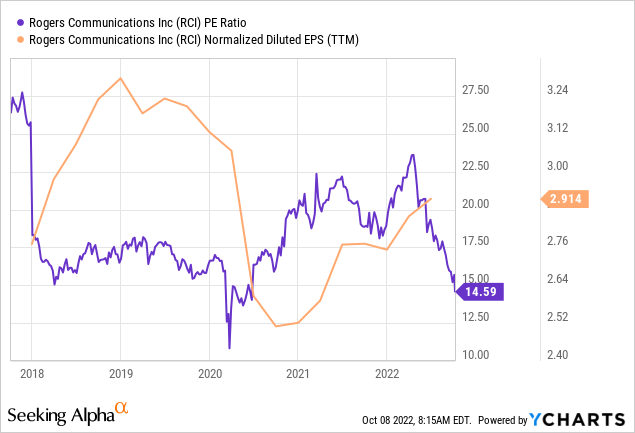

ycharts.com

We can see that in the context of a five-year period – the P/E ratio has descended near levels last seen in 2020 – while earnings per share has been recovering, albeit still below pre-2020 levels.

In terms of the company’s cash position – one concern among investors could be whether the company can conserve sufficient cash to ride out a potential drop in demand due to higher prices.

When looking at the company’s quick ratio (as calculated by cash and cash equivalents plus accounts receivable all over total current liabilities), we can see that the ratio has risen slightly from December 2021 to June 2022 – indicating that the company has been conserving cash to meet its current liabilities – although seeing growth towards 1 or above would be ideal as it would indicate that Rogers would have more than sufficient liquid reserves to meet its current liabilities.

| December 2021 | June 2022 | |

| Cash and cash equivalents | 715 | 665 |

| Accounts receivable | 3847 | 3621 |

| Total current liabilities | 8619 | 7529 |

| Quick ratio | 0.53 | 0.57 |

Source: Figures sourced from Rogers Communications Second Quarter 2022 Results. Figures (except quick ratio) in millions of Canadian dollars. Quick ratio calculated by author.

Looking Forward

However, in spite of respectable performance – the stock appears to have been dragged down by broader macroeconomic concerns with respect to inflation as well as continued regulatory hurdles with respect to the Freedom Mobile sale to Quebecor (OTCPK:QBCRF).

According to Canada’s competition watchdog, the sale of Freedom Mobile to Quebecor would not be sufficient to satisfy antitrust concerns surrounding the proposed purchase of Shaw Communications (SJR) by Rogers.

In this regard, I take the view that in spite of respectable performance by Rogers Communications in its own right – we could see the stock continue to come under short-term pressure until such time that the trajectory of this deal becomes more clear.

Moreover, with uncertainty continuing to surround the deal – it is also noteworthy that competitors BCE (BCE) and Telus (TU) have been outperforming Rogers to date as there is a perception that these rivals have been more focused on their core business while Rogers has had to grapple with the regulatory challenges posed by the Shaw deal.

From this point of view – a continued delay of regulatory approval could continue to place pressure on Rogers Communications going forward – even if KPIs across its core business continue to remain strong.

Conclusion

To conclude, Rogers Communications has seen significant downside over the past few months – and the delay in regulatory approval for the purchase of Shaw seems to have been a significant driver of this.

My overall view is that while the stock might see some potential for a rebound if earnings continue to improve and churn rates continue to decline – the more likely scenario is that the stock could continue to see pressure the longer uncertainty surrounding the Shaw deal persists.

Be the first to comment