Sundry Photography

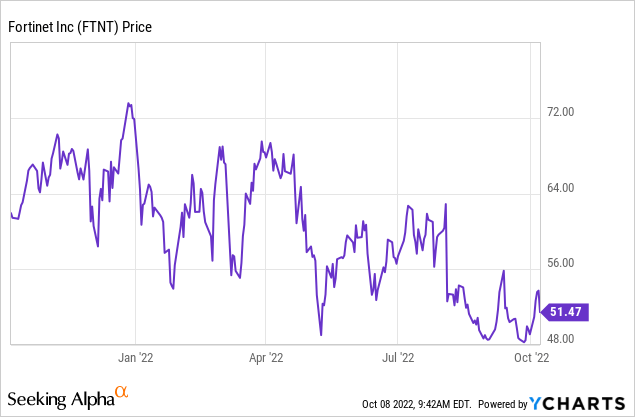

Fortinet (NASDAQ:FTNT) reported good Q2 results in early August and with the stock remaining down ~20% heading into the company’s Q3 earnings report in early November, this presents a good buying opportunity.

Management continues to believe the demand environment remains healthy (per recent commentary) and the recent Uber security breach highlights the ongoing need for IT security investment.

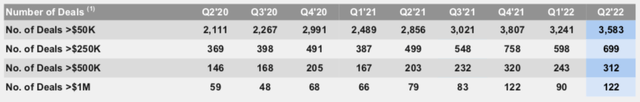

FTNT has also performed well as they move further upmarket and close larger deals, which tend to be more recurring and stickier. And in a challenging macro environment, focusing efforts on gaining market share with larger enterprises can help provide a more resilient revenue growth.

With FTNT reporting their next earnings release on November 2, investors should look to position themselves for this update. Despite the company reporting a good Q2 during a challenging macro environment, the stock remains down around 20% since then.

However, I believe the company will report a strong Q3 and given the increased scrutiny around cyber security, I believe long-term investors will be rewarded for holding through this volatility.

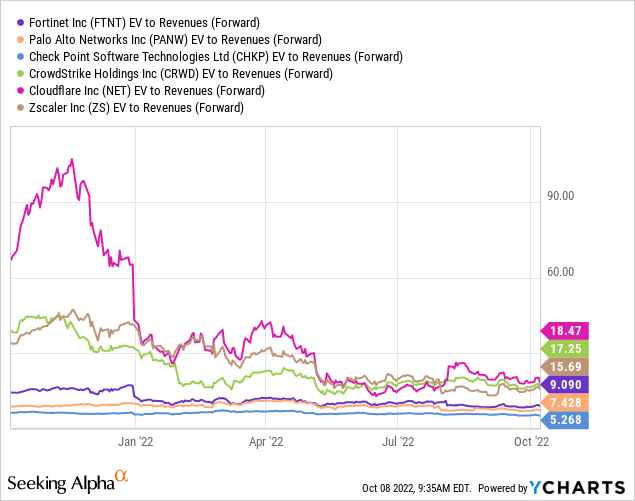

With a Rule of 40 score standing at 56-57 for the full-year, FTNT is clearly operating with healthy financials. The stock is currently trading at 9x forward revenue, but given the strong demand seen throughout the IT security landscape, revenue growth likely remains above 25% for the next few years.

Financial Review and Guidance

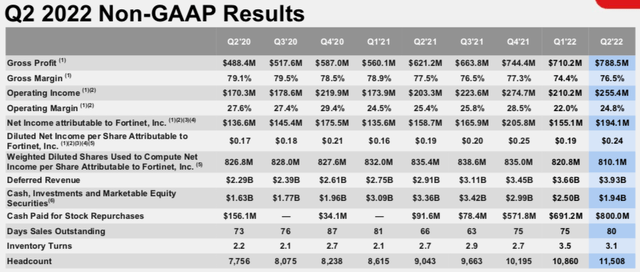

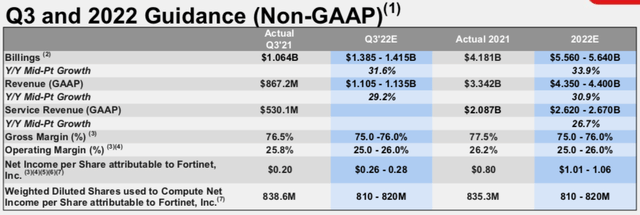

Briefly reviewing Q2 earnings, FTNT revenue growth of 29% yoy to $1.03 billion, close to consensus estimates. Product revenue continues to be an area of strength as many companies continue to place IT security investments near the top of their list.

Billings during the quarter grew 36% yoy and was similar to the past few quarters. In general, billings are a good indicator of future revenue growth, so the consistent 36% yoy growth seems to be a positive indicator of ongoing strength in underlying business demand.

Not surprisingly and similar to recent trends, non-GAAP gross margin continues to remain healthy at 76.5%. While there have been some pressures in gross margin over recent quarters, FTNT, like many other companies, benefitted from lower expenses during the global pandemic. As these expenses start to come back, we should start to see gross margins begin to normalize.

Another important factor is the company’s recent strength in larger deals. During a more challenging macro environment, larger deals tend to be more recurring and stickier. With FTNT now having 122 deals >$1 million, I believe the company’s ongoing march up market will prove to be an area of strength and provide more resilience to their revenue.

And the trend is not only being seen with the very large deals. Even when looking at deals >$50k, FTNT reported 3,583 during Q2, which is up around 700 yoy. Again, the larger the deal size, the more likely that revenue stream is to be sticky.

On top of that, management continues to remain confident in their pipeline activities, including strong demand signals within Europe. Despite the ongoing macro environment challenges, management continues to talk about strong demand trends manifesting into a strong pipeline build.

But saying that and we have said this the last several quarters because there is not only a question of macro question going forward in terms of visibility of demand, there is also this belief or concern that there has been a pull-forward of deals into the current periods. For the last – I haven’t gone back to look, but at least two, probably three or four quarters, we have said our pipeline has been accelerating on a going forward basis. And if it was pulled forward, we should see that in our pipeline demand and we are not. And then the other additional comment we made in this last quarter was about EMEA and saying that EMEA got off to a very good start in the third quarter and that the pipeline demand there is very good, because people are very much concerned about the EMEA macro with the war in Ukraine and those kinds of things being top of mind.

Guidance for Q3 includes revenue growth of 29% yoy, which would reflect a similar revenue growth as Q2, despite the continued challenging macro environment. Additionally, gross margin guidance of 75-76% and operating margin guidance of 25-26% would be fairly consistent with recent trends.

At a recent investment conference, FTNT had talked about the supply chain remaining dynamic, though they are still seeing demand outstrip supply.

I think the one thing about supply chain, it remains a dynamic situation could change on a daily basis. We have given some guidance in terms of what we think our backlog will be by the end of the year and in terms of it being around or possibly exceeding $500 million. We ended the second quarter at $350 million. So that would be an average of $150 million a quarter for the next two quarters. Backlog grew $72 million in the second quarter. So I would say that while things haven’t gotten better, they haven’t necessarily gotten worse. And we are still seeing demand outstripping supply.

In my opinion, many companies have provided a conservative and beatable guidance for the upcoming quarter given the many questions around the uncertain macro environment. And with the company continuing to believe demand is greater than supply and that things have not gotten any worse, I believe there could be some upside to the company’s Q3 guidance.

And in recent weeks, Uber (UBER) suffered a security breach, which again highlights the importance for companies to have strong network security protocols. Even after many years of heightened investment in network security, we constantly see news of security breaches. As these breaches are likely to continue, companies will constantly need to spend more in IT security, providing a long-term growth tailwind for FTNT, even during a more challenging macro-economic environment.

Valuation

While the company’s Q2 earnings report was pretty good, the stock has since pulled back nearly 20%. Factors such as higher interest rates and continued uncertainty around the macro factors have weighed on the market, and investors continue to punish stocks with higher valuations.

Nevertheless, I believe this intra-quarter pullback provides a great buying opportunity ahead of FTNT’s upcoming Q3 report in early November. With expectations remaining uncertain, the strong demand environment for IT security highlighted by the recent security breach at Uber could drive some upside to the quarter.

The chart above does a great job demonstrating how forward revenue multiples across the IT security landscape have significantly pulled back over the past year. Admittedly, valuations seemed very stretched in late 2021 and given the rising interest rates, it should not be a surprise to see these high-valuation companies come under pressure.

However, FTNT continues to provide good value relative to their financial performance. With revenue growth guidance for the year at 31% and operating margin guidance of 25-26%, the company is clearly overachieving on the Rule of 40 score.

Yes, their current 9x forward revenue multiple is a bit rich relative to the overall market, but FTNT competes in the IT security market, which remains at the top of every CEO’s mind. The macro environment does make visibility a little more complicated, but management continues to believe the demand trends remain strong and this is supported by billings growth of 36% yoy for the past few quarters.

For now, I believe investors should use this pullback as an opportunity to position themselves for the upcoming Q3 quarter. If FTNT is able to report a nice beat and raise, I believe the stock could move higher and back towards the $60 level seen prior to Q2 earnings.

Be the first to comment